I got a Tesla for the price of a used Honda Civic

How to turn panic into profit in the upside-down Tesla market

I just bought the cheapest 2020 Tesla Model X in the entire country.

Believe it or not, this car was worth more than $100,000 brand new. Since then, it has depreciated about $80,000 in value. Let that sink in for a second. That is an $80,000 loss for a car with Gullwing doors, a 300-mile range, air suspension, $5,000 rims, heated seats, and the ability to drive itself.

When I had the opportunity to buy this six-figure, clean title, one-owner car for just $23,000 (for a net cost of just $14,490 after tax write-offs), how could I say no? But I’ll be honest: after driving this around for the last few days and crunching the numbers, I’ve decided something: I am never buying a brand-new Tesla ever again.

What is happening in the used car market right now is absolutely insane, and if you are smart with your money, you too can take advantage of it.

Join 39,000 others who are mastering their money. If you want to be the first to know when I find deals like this, make sure you’re subscribed. I send out deep dives like this every Monday:

A Quick Note on Closing the Year Strong

Speaking of taking advantage of end-of-year opportunities, this mindset doesn’t just apply to buying cars. It applies to how you run your business. A lot of people wait until January to “get serious,” but the smartest business owners I know are executing right now. If you have 2025 projects sitting on a backlog, do not drag them into 2026.

This is why you should use Upwork Business Plus to bring in top freelancers in hours – not weeks – to knock out launches and clean up backlogs before the New Year. No long-term commitments. Just high-impact talent. And right now, they have an offer that’s basically free money for business owners:

Spend $1,000, get $500 back in Upwork credit. That is effectively a 50% ROI on the talent you need.

But the offer ends strictly on 12/31/2025. Get the help you need, get the credit, and enter 2026 with momentum.

Click here to claim your $500 Upwork credit.

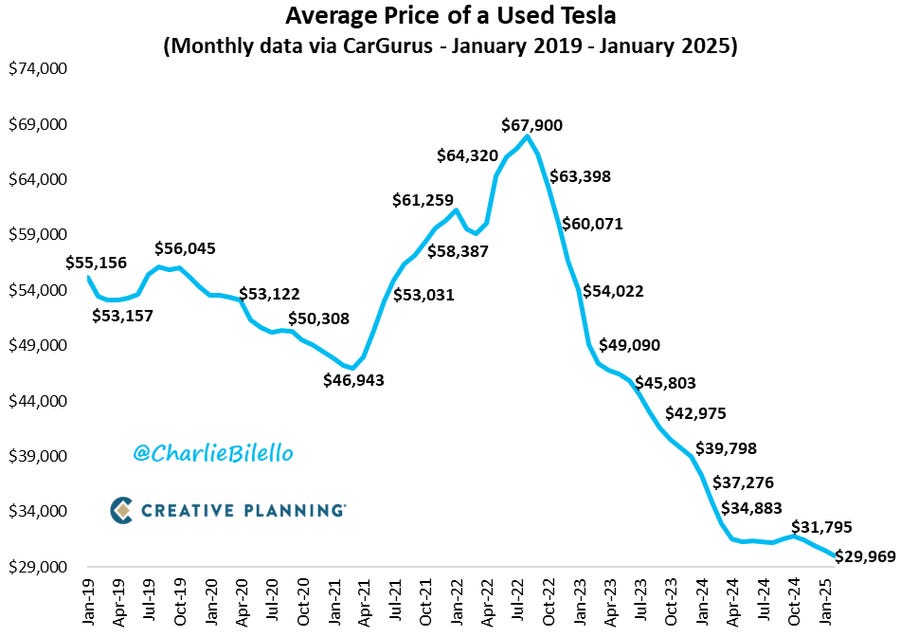

The Great EV Crash: Why values are plummeting

Alright, back to the car. Let’s address the elephant in the room. For the last few years, EV values have been plummeting.

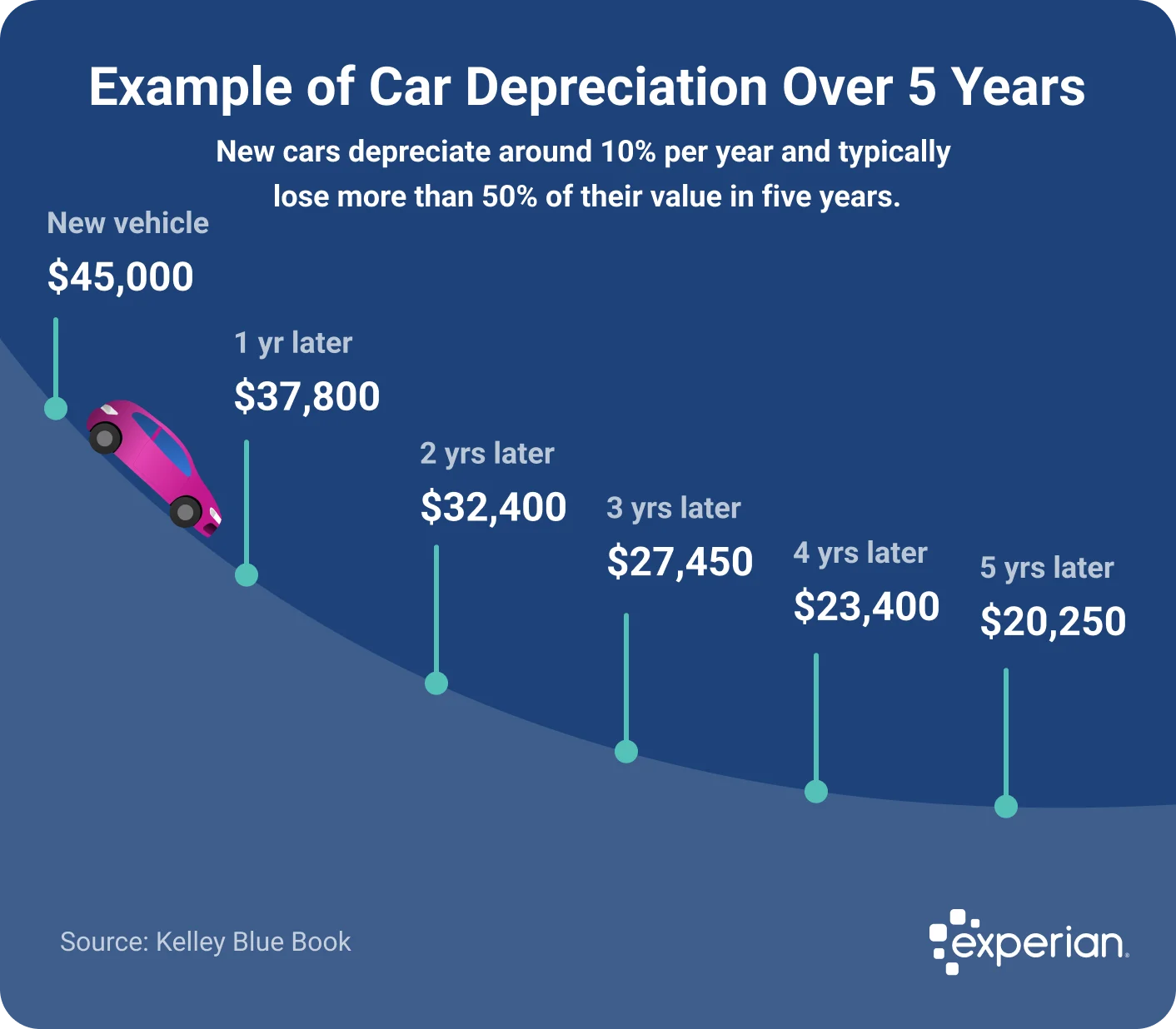

If you buy a standard gas car, it is common knowledge that you lose about 20% of the value the moment you drive it off the lot.

But Teslas are depreciating way worse, with some figures showing they drop 3x faster than any other brand. Why is this happening? It comes down to five specific factors that have created the perfect storm for buyers like me (and potentially you).

1. Tech Obsolescence

Think of it this way: Teslas are like the iPhones of cars.

EV technology changes extremely fast. By the time you take delivery of your new car, the chances are that a slightly better tech has just been announced. It could be better range, a new battery, or a competitor offering more features for less.

Within a year or two, your “cutting edge” car starts to feel outdated. While Tesla does send over-the-air updates, software cannot fix hardware. You can’t download better cameras or faster charging ports.

2. The Subsidy Trap

EVs have been heavily subsidized by tax incentives. Until recently, you could get a $7,500 tax rebate (or more) on a new vehicle.

This created a weird market dynamic:

You could order a brand new $50,000 car

Get $7,500 back from the Feds

Another $7,500 from the state

And potentially more depending on your trade-in.

Suddenly, a new car cost $35,000. It made no sense to buy a used one for $40,000 when a new one was cheaper. Consequently, used prices had to fall off a cliff to compete.

3. Battery Anxiety

Buyers are terrified of battery life. The more you drive and charge an EV, the more the battery degrades.

Take my 2019 Model 3 as an example. When I bought it, it had a range of 240 miles. Now I can only charge it to a maximum of 190 miles. And that’s on paper – when I go fast with the AC on, that 190 reduces to 130 miles in practice, forcing extra charging stops and wasting time. That degradation scares off second-hand buyers, and that drives down prices even more. (The Model X, with an extra 70 miles on it, goes a much longer way)

4. The Price Cut War

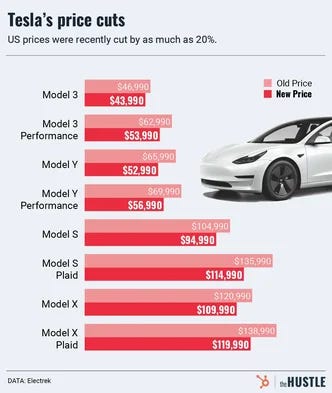

This is the biggest factor: Tesla aggressively cut prices on new cars to boost sales, which instantly destroyed the resale value of used ones.

My new Model X was over $100,000 in 2020 ($125,000 adjusted for inflation). Recently, you could pick up a new one for just $88,000. The Model S Plaid used to be $150,000; now it’s $95,000. When the price of the new product drops, the price of the used product crashes.

5. Keyman Risk

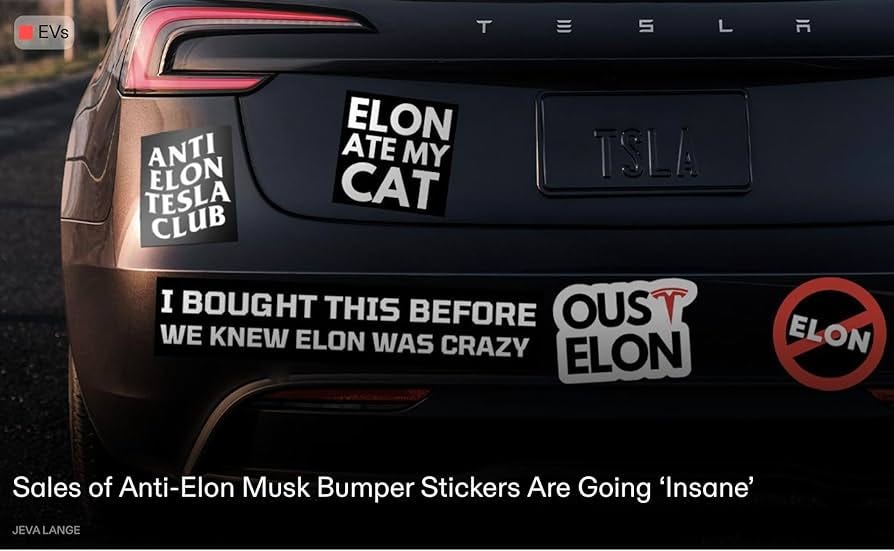

Finally, controversy surrounding Elon Musk has affected the resale value. I see the bumper stickers in certain cities – some people simply don’t want to be associated with the brand right now.

Combined with a flood of used Teslas hitting the market (thanks to Hertz selling off their fleet and early adopters upgrading), supply is high, and demand is shaky.

I want to hear from you: Does the battery degradation or the “Elon factor” stop you from buying a Tesla, or is the price drop enough to make you ignore it?

The Hidden Variable: Hardware 3 vs. Hardware 4

There is one more massive differentiator I didn’t pay attention to until I started shopping: HW3 vs. HW4.

Every Tesla is basically a giant computer. Pre-2023, cars were equipped with HW3. I have this in my Model 3. I bought Full Self Driving (FSD) for it, and I have to confess, I never used it. It was glitchy, slow, and upset everyone driving behind me.

In late 2023, Tesla started shipping HW4. It’s smoother, has better camera resolution, and is “future-proofed.”

This creates a split market. You can see two identical 2023 cars with totally different prices (sometimes a $6,000 difference!) just because one has the new chip. And with rumors of HW5 coming in 2027, buying “new” tech today guarantees you’ll be owning “old” tech tomorrow.

The Math Behind the “Free” Car

So, why did I buy this specific car?

This Model X belonged to my good friend, Jeremy (Financial Education). He bought it new, took great care of it, and was about to trade it into CarMax because he bought a new Model X. CarMax offered him a lowball trade-in value. I stepped in and said, “I’ll take it right now for that price.”

The Price: $23,000.

Market Value: Similar models are selling online for closer to $30,000.

Because I bought it at effectively wholesale price, and because the car is at the bottom of its depreciation curve, my assumption is that I won’t lose a dime on depreciation over the next few years. Also, buying this Model X has made my life much easier in another way – it has a lot of extra space in the boot that makes lugging around equipment way more convenient compared to the compact Model 3 which had so little storage space.

But it gets better.

The Section 179 Tax Hack

Here is why this purchase was a financial no-brainer: Because the Model X has a Gross Vehicle Weight Rating (GVWR) of more than 6,000 pounds, it qualifies for the Section 179 Deduction.

This tax code allows business owners to write off the entire cost of qualifying equipment (like this car) in the year it is placed in service, provided it is used exclusively for my business.

Purchase Price: $23,000

Tax Bracket: 37% (Federal)

Tax Savings: ~$8,510

Net Cost to Me: $14,490.

On top of that, because this was a private party transaction in Las Vegas, there was no sales tax on the vehicle price. I paid registration, and that was it.

I am getting a Model X for the price of a used Honda Civic.

The Verdict: Should You Buy a Used Tesla?

I’ll be honest: at these prices, it seems like a no-brainer.

Mechanically, they are flawless. They drive great. The Supercharger network is second to none. Sure, the build quality isn’t perfect, and my 2020 model lacks the blind-spot cameras and phone-key features of the newer ones. But who cares?

You are buying a car for 50-60% less than it cost new just a few years ago.

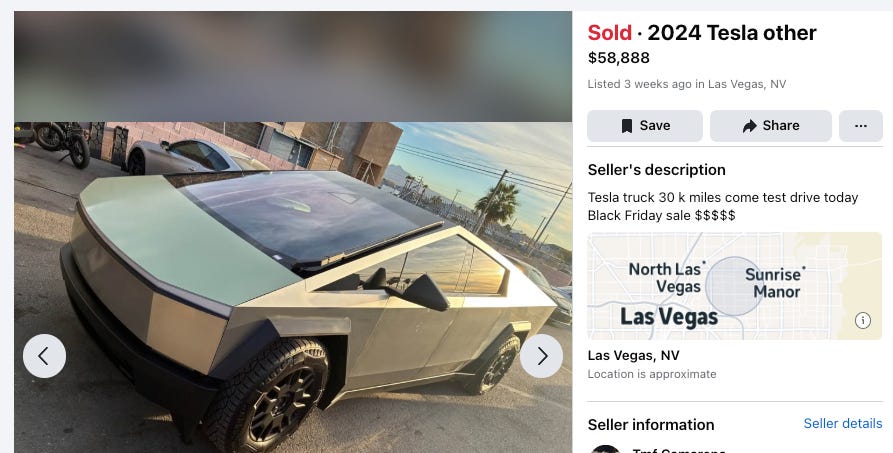

A $110,000 Model S for $50,000. Model 3s for $20k. A one-year-old Cybertruck for $40,000 off.

If I have learned anything from this, it’s this: Do not buy a new Tesla after the tax rebates go away. Unless you truly don’t care about money or the tax incentives are so massive that it wipes out the depreciation, it’s a losing game.

Buy a clean, private-party used car that is 2-5 years old. Let the first owner take the $80,000 hit. Then, drive it guilt-free.

Electric vehicles hold a charge well, but they don’t hold value.

Thanks for reading! If you found value in this breakdown, please like this post and share it with someone currently looking for a car. It might save them $50,000, and they’ll remember you for it:

Don’t forget to check out today’s sponsor! See you next time, Graham.

I bought a brand new Tesla Model Y in Las Vegas in 2024 for several reasons: EV incentives, the warranty, 2% financing for 72 months, the ability to charge at home, and lower insurance premiums compared to other cars.

Before that, I was driving a nearly paid-off Toyota Corolla. It was a solid, well-built, and relatively cheap car, but gas prices and car insurance were getting expensive. More importantly, it didn’t drive itself, and I’ve always hated driving—so switching to a Tesla felt like a no-brainer.

I ended up paying a few hundred dollars more per month, but in exchange, I got to drive a futuristic car that handles most of the driving for me.

I was initially uneasy about buying a brand-new car because I knew Tesla tends to drop prices significantly shortly after release. However, I’ve had very few problems with it, and I’m glad everything has been covered under warranty. A couple of months ago, the battery died, and Tesla replaced it for free with no hassle.

I don’t fully understand the difference between Hardware 3 and Hardware 4, but I believe Full Self-Driving (FSD) works better and processes faster on Hardware 4.

I don't understand how people are still buying brand new cars. They think financing/leasing makes more sense in that moment because they're emptying their pocket less, but in the end they wasted so much money. Great move on the Tesla!