All the world's a stage: Volatility Theater and how investors should react

How tariffs, Fed rates, Gold Cards – and investors like you – rock the market

Today’s issue is brought to you by Helium Mobile.

When it comes to personal finance, small changes can lead to big savings—and your phone bill is a great place to start. The average person spends $144 a month on mobile service. With Helium Mobile, that cost could drop to zero.

Their free plan includes 3GB of data, 100 minutes of talk, and 300 texts—no credit card or contract required. I use it as a second line through an eSIM, which I can switch to anytime I’m in a spot with bad service. It’s a reliable backup that costs nothing. If you need more than the free plan offers, Helium also has an unlimited plan for just $30 a month. They even have bonus programs with redeemable rewards!

To try it out, go to their site and enter my code: GRAHAM. Whether you want to cut your bill or just have a backup option, Helium Mobile is a smart move—and it’s completely free to start.

The Global Financial Crisis struck the world in 2008. Just four years later, another crisis was looming over Europe. The Euro was barely a decade old, but it looked like it might collapse. The sovereign debt crisis in 2012 was triggered by the 2008 recession.

Banks in European countries like Greece, Italy, and Spain struggled to meet their debt obligations. So governments bought more bonds to stabilize the banks, which made investors nervous. Governments raised rates to compensate investors for their risk. This made the debt even harder to manage. Eventually, people were fearing that Southern European countries would default on their debt and were planning to bail out and take all their money to Northern Europe. Investor confidence hit a low.

Then, Mario Draghi, President of the European Central Bank (ECB), turned things around with just one sentence. In a speech meant to revive confidence, he said:

Within our mandate, the ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be enough.

His speech implied that the ECB was ready to buy unlimited bonds to support failing countries and intervene wherever necessary. After the speech, investor confidence began to rise and the European situation stabilized. But here’s the thing – the ECB never did anything. They didn’t reveal a concrete plan or policy change, announce a bond-buying program, or provide aid. They just set the expectation that the ECB would act decisively if necessary. That expectation alone changed the market.

This is a perfect example of volatility theater. What moves markets more than the underlying economy is the expectation of how the economy will move, and the players who understand this can perform in a way that moves markets. Right now, expectations are shaping the market – tariffs, Fed Rates, Gold Cards, Tax Cuts – but in very unpredictable ways. Here’s how you can get to the bottom of what’s going on to figure out how to invest your money.

Act I: Tariff Games

I wrote about tariffs recently. The situation is so volatile that by the time I make a video or write an article, things have changed – tariffs are announced, deadlines are set, and they are revoked at the last minute, only to be announced again. For businesses trying to plan ahead, this causes intense uncertainty, and the market hates uncertainty. This could be why the market entered correction territory recently. Some see this as Trump trying to “intentionally crash the market.” When he was asked point-blank whether he anticipates a recession, he said that we prioritize quarterly plans while countries like China have 100 year plans, and that short term upheavals might be necessary to bring wealth back to America.

The government is framing tariffs as leverage to negotiate better trade deals, and to revive domestic industries. But the underlying incentive could be to create controlled chaos to move markets. This chaos can be used to pressure trading partners because global markets are so tightly connected, and it can also be framed as decisive action.

In the long term, everyone agrees that tariffs are bad. According to the Boston Federal Reserve, new tariffs could add at least 0.5 percentage points to core PCE inflation. Earlier tariffs contributed up to 2.2 points. This makes the job harder for another entity which is also involved in this theater…

Act II: The Fed’s “Wait and Watch” strategy

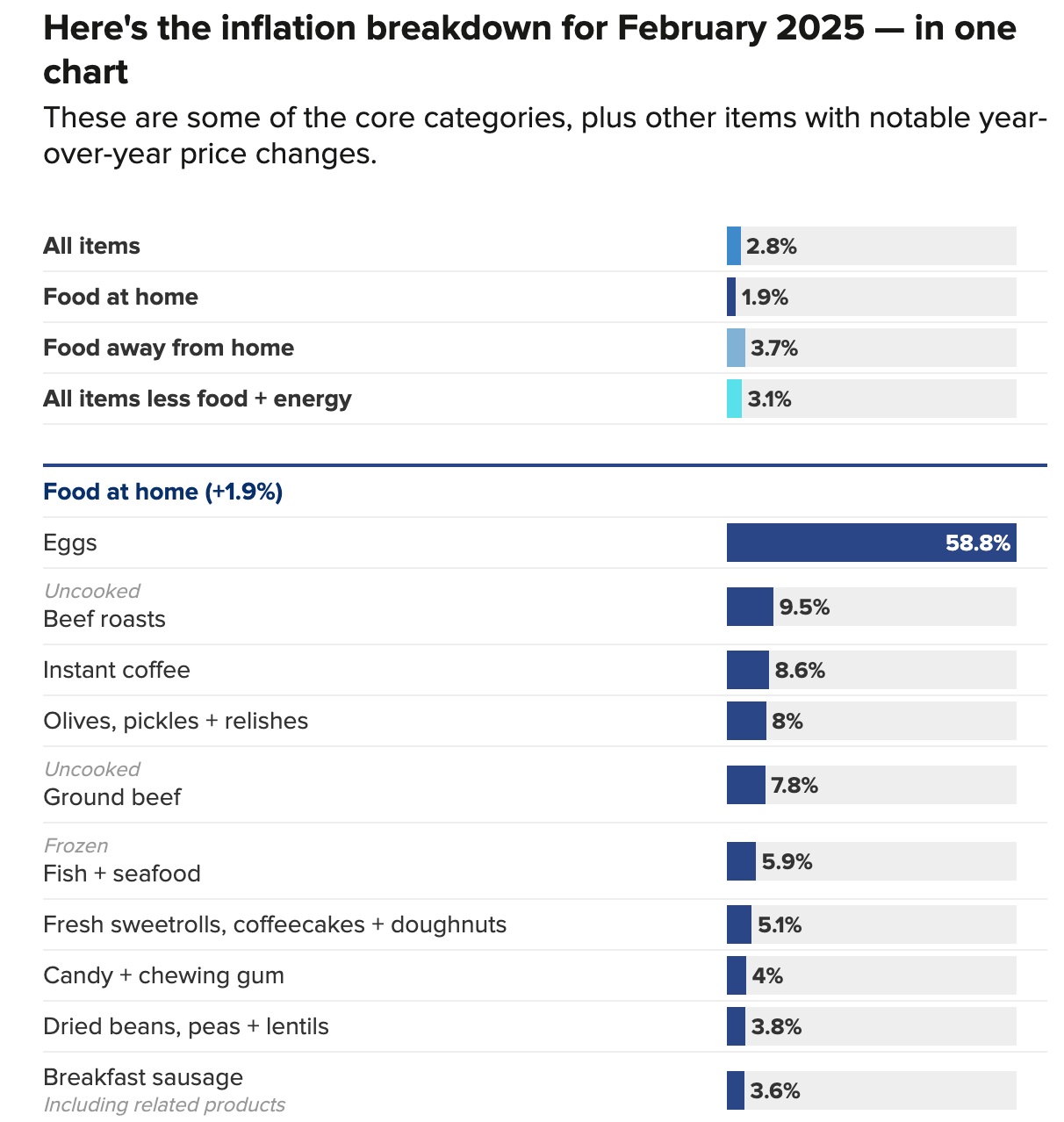

Jerome Powell cares about only one thing – to bring inflation under 2% a year. And the data came in that prices are up 2.8% since last year, and core CPI dropped from 3.3% to 3.1%. That’s good news, but it’s still above the 2% target, and the Fed is going to delay cutting rates till they hit their target.

On the surface, their stated goal is to wait for more data before making a move. But the Fed’s job is like the European Central Bank’s (arguably even more important). It doesn’t just need to do the right thing, but also give consumers and investors the confidence that it’s doing the rational thing to maintain credibility. If the public gets the impression that the Fed has lost control of the economy or is making random decisions or is being politically influenced, then they might panic.

So the Fed needs to use the right language and timing to not just communicate what’s going on, but also to shape investor psychology. “Forward guidance” is as powerful a policy tool as interest rates, which is why investors cling to every press release.

The Gold Card and the Vanishing Tax

Some experts say that what President Trump really cares about is not the stock market, but the bond market, because it’s an indicator of whether America is still a healthy place to invest in. National debt is still a huge issue, and the government seems to be using all sorts of strategies to cut spending and meet the trillions of dollars worth of national debt that is due next year.

But one of the more creative and bizarre ideas is the Gold Card. Trump announced that anybody willing to pay $5 million would get a direct US citizenship. If a million people buy this Visa, it would bring in $5 Trillion in income to the US government, and if 10 million people bought it, that number would go up to $50 Trillion, enough to pay off the national debt in full with $15 Trillion left. That sounds great – on paper.

The reality is that there less than 9 million people in the world with a net worth of more than $5 million and a large number of them already live in the US. There’s also the question – if you already have a net worth of $5 million, would you want to move to the US? What would tempt you? Maybe if you had $30 million in your bank account, then this offer makes sense. But there are just 376,000 people outside the US who qualify, and even if 10% of them bought the Gold Card, that would still bring in only $185 billion in revenue. That’s a lot of money, but it isn’t going to pay off no national debt.

There’s the other thing that’s being making headlines recently: Income Tax Cuts. Under the new proposal, income tax would be eliminated for anyone earning under $150,000, and this would provide financial relief to middle-class Americans. But this would cost the US government over $1 Trillion annually – and if the Gold Card Visa works, its benefits would be offset by the Income Tax Cuts. It’s also doubtful that something like this would go through Congress without any dilutions. The idea is that other initiatives like cutting government spending would create new sources of government revenue, but until this happens, I’d say don’t bet on it.

So if these are such long shots, why are they getting so much press? Well, for one it’s campaign friendly and creative – it creates the impression that the government is taking care of the working-class American and bringing in revenue through other sources, following through on its campaign promises. And don’t get me wrong, I’d really really like this to work. But the numbers just don’t add up. It’s more of a narrative tool at the moment.

The plot twist: Investors are part of the cast too

Once you’re aware of this “theater”, you begin to see it everywhere. What businesses say matter as much as what they do. The Fed’s press release can carry as much power as its rate hikes and cuts. Tariffs may never go into effect, but the scare induced by them can cause volatility in the market. It’s tempting to view this theater as something done to you as an investor – but you’re a participant in this too.

Here are two situations:

The risk-free (bond) rate is 1%, and risky assets promise a 6% return.

The risk-free rate is 5%, and risky assets promise a 10% return.

In which case are investors more likely to invest in risky assets?

In the first case, it turns out. Though the difference between risky and risk-free assets is 5% in both cases, investors perceive the risky option as “non-risky” in one situation more than the other. How investors perceive the market influences when they buy and sell, and their perception ultimately leads to volatility in the market.

Why this theater exists – and what to do

Here’s the thing: This isn’t a conspiracy. It’s just a system of incentives.

The government needs to look decisive and informed.

Central banks need to preserve credibility.

Investors need reassurance.

Everyone’s playing their part because nobody wants to break the illusion that they’ve got the situation under control. But if you really want to invest long-term, you need to look at the historical data and the underlying economy. Instead of reacting to every theatrical move, stick to what works. Regardless of market conditions, these are the strategies that have persisted over the long term:

Dollar cost averaging

Diversification

Buying and holding for the long term

That’s what I do, and that’s what I’d suggest for informed investors.

If you found this mental model useful, share this with a friend who needs to see it. Hit like if you enjoyed reading, it really helps the newsletter grow!

Hi Graham! I'm Corban, a 19-year-old realtor in Rochester, New York. Hearing how you got your license at 18 inspired me to get mine recently. I rewatched your video explaining how you got your first sale and you mentioned holding an open house every Sunday. I'm just curious -- how did you do this without having any listings yet? Were you at open houses for the other agents in your office? The brokerage I work for is very small so we don't have open houses as often. Do you have any recommendations for how I can really put myself in front of potential clients? Thank you for the continued advice and inspiration!

-Corban V.

(corbantvogler@gmail.com)