Your personal experiences with money make up maybe 0.00000001% of what’s happened in the world, but maybe 80% of how you think the world works.

- Morgan Housel in “The Psychology of Money”

Imagine that you’re a graduate fresh out of college with a job in hand, in March 2020, and you’ve been learning about investing. Then the COVID crash happens, you think “this is the time to be greedy when others are fearful”, and you invest. A year passes, and your money has multiplied by 2x! “I was right”, you think. “Long term investing always wins.”

Now consider another situation - You’re 50 years old and you believe in long-term investing, and you put all your money into the real estate market which just doesn’t seem to go down. But the year is 2007. When the market crashes in 2008, you don’t mind initially - but then you see it go down further year after year… And retirement is nearing. Would you hold on?

This is why the time you begin investing and your personal experiences inform so much of your investing decisions across life - no matter how many charts, tables, and data you are given, seeing your portfolio go down beats all these. Guess what - my own career and investing journey started right before the 2008 financial crisis, and today I’ll tell you why it’s so relevant to what’s happening in the market and how you can hold your head amidst the chaos.

Investing in 2008

When I started my career as a real estate agent after graduating high school, it was at the peak of the housing market bubble. We know how steep that crash was - they even made a movie about it that made Michael Burry a household name - but at that time, before the crash, this is how it looked:

The market just kept going higher, housing was booming, and nobody could do any wrong. Consider the story of Casey Serin, who got started by reading Robert Kiyosaki’s “Rich Dad Poor Dad” and flipped a house to make $30,000 in profit. This convinced him that buying properties in spite of negative cash flow was a good idea and he built up $2 Million in debt - But he couldn’t pay it back (And how did he deal with it? He started a blog that talked about how he was escaping his creditors’ calls).

His story wasn’t unique. Just days after I started working, Lehman Brothers, one of the largest banks in the business, went bankrupt and I started seeing my coworkers leaving as they couldn’t get any business. My company started hiring foreclosure experts - and even with home offers as low as 30 cents on the dollar, people couldn’t afford to buy, because the economy had crashed. 10% of the US was unemployed.

Each year after that just got worse, and we only started recovering in 2012 - The drop was so bad that, adjusting for inflation, home prices today are barely above the 2008 level. And that’s the climate in which I started investing. But what about someone who started investing in 2020?

Unrealistic Expectations

The market tanked in 2020 - and it could have gotten a lot worse, but the Fed bailed us out. Don’t believe me? Check the dates: The market plunged 30% in 3 days and bottomed on March 20th, and the Fed announced its plan on March 23rd. Under these new conditions, the Federal Reserve would inject money into the economy by purchasing treasuries and mortgage-backed securities, along with a $2 TRILLION stimulus package to re-invigorate investor confidence. If they hadn’t, we might have been in a much worse place today, sure. But there were side effects.

Every amateur investor sitting at home joined the party on Robinhood - Over 13 million users, many in their 20s and 30s, took advantage of increased volatility, zero commission fees, and a bull market that showed no signs of stopping… Not to mention the raging crypto market and increases in home prices. Hedge funds got short squeezed. Retail investors had the last laugh. Dave Portnoy thought he was a day trading genius and called Warren Buffett “washed up”.

Everything investors touched turned to gold - until now. Now that the Fed has started pulling out support to deal with record-high inflation, we’re seeing demand slowing down and that’s impacting the market. We’ve lost almost all the gains since the start of the COVID pandemic!

So what’s in store? What does the bear market actually mean for your money?

Bear markets till now

A bear market is defined as a 20% decline from the market top. They’re not as rare as you think - in fact, it would be more surprising if we went for a long time without seeing one. We’ve had 26 bear markets since 1928, about once in 3.5 years on average (list of bear markets).

But the two important questions are:

How bad can it get?

How long will it last?

The average bear market sees a decline of 35% over 289 days. But declines don’t occur in averages. If we take a look at how bear markets have behaved in the past, the most likely scenarios are markets dropping 20-40% from the peak and lasting 1 to 1.5 years.

The largest drawdowns that we have ever seen were during The Great Depression in 1928 when the market dropped more than 90%, and the Financial Crisis of 2008-09 when it dropped 51%. These are the worst-case scenarios that pop up in our minds the most readily, but as this excellent analysis by Ecoinometrics shows, recessions have mostly lasted for 100 days to a year with a drawdown of less than 20% in most cases, and it’s very rare that we see something worse.

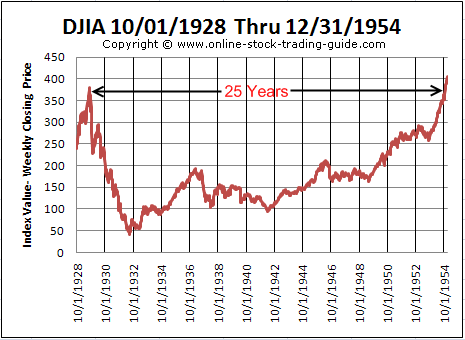

But even if it does get worse, take a look at this:

The market technically took 25 years to break even after the Great Depression but accounting for deflation and dividends, investors would have broken even in about 4.5 years.

Source: Online Stock Trading Guide One of the longest recessions we’ve had was in 1937 - lasting close to 4 years. But the market rally that began after that led to a 15-year bull run.

Tech stocks lost 78% in the 2000 dot-com bubble. The Invesco QQQ Tech ETF bottomed at $21.67 in 2002, but even after this year’s correction, it is now at $281 - that’s 1300% growth in 20 years!

Of course, just because something hasn’t happened in the past doesn’t mean it can’t happen in the future, but the chances are reduced. The market is tough now - There’s no denying it. High inflation is eating into incomes leaving little for investing. Millennial millionaires are delaying purchases because of higher borrowing costs. More than a third of all US employees are living paycheck to paycheck because of record-high inflation.

So how do you handle a situation like this? How do you keep your cool and not get emotional when the market keeps getting worse?

A plan for tough times

Here’s what I’ve learned from my unhealthy obsession with all things investing in the past 14 years. Consider this a checklist to refer to when the panic kicks in.

There will always be reasons to not invest but stick to your plan. I started buying real estate in 2011, when the market was already down 50% and I was closing properties at 20% of their appraised value a few years prior. I was told to wait because of the “shadow inventory” that was going to flood the market which would further reduce prices. But I went ahead anyway… the shadow inventory never came, and the market picked up. Most warnings for implosions never come to pass.

Investing is not a game - It’s supposed to be boring, and if you’re having fun watching your portfolio go up and down, trying to beat the market average, ask yourself if it’s a calculated risk or gambling.

Overconfidence destroys returns. Sometimes the lesser you know the better, and the people who do the best over the long run are those who buy and hold a broad market Index Fund.

“Buying the dip” is very tricky - It might always dip further and the absolute bottom happens only during investor capitulation, when everyone thinks the economy is doomed. Make sure you don’t go all-in on a hunch and blow out cash that can be used to buy into opportunities.

Practice good financial habits at all times, not just during a crisis. This is the classic case of “I’ll eat those extra calories and burn them down by going on a run later” - Better to eat in moderation instead of waiting for the day you’ll jog.

Time in the market beats timing the market. Half of the index's strongest days last year occurred in a bear market. 34% of the market's best days happened in the first two days of a bull market (before you could sense it.) If you missed just the 10 strongest days and tried to time the market, the returns in difference would be 12%! Better to buy and sit tight.

And as always, when you ask me…

See you next week with another deep-dive!

Graham I didn't know you had this! I've been following you on youtube but started disliking the format (I understand thats how YT algorithm works), so I'm glad to have found this through Ecoinmetrics.

Amazing newsletter!