Housing is the biggest expense for most people. But in the U.S, housing affordability is now at its worst level in more than three decades. Inventory has dried up, mortgage rates have doubled, and for most people, the question isn’t “Where should I live?” It’s whether they can even afford to move.

The housing problem was one of the major issues that Donald Trump focused on during his campaign. Now, the President has unveiled a proposal that aims to pull off what every administration before this has struggled to do (including his previous term): Make homes more affordable. The proposal relies on three reforms:

Cutting federal regulations

Relaxing building codes

Unlocking government-owned land for development

If this works, it could lead to the construction of as many as 4 million new homes and a shot at home affordability.

But how realistic is this plan? Could it actually make a difference? Let’s dive in.

The Housing Market Is Broken—and Everyone Feels It

To understand the reforms, we first need to understand how we got here. The 2008 financial crisis was a major correction that led to a crash in housing prices. It reset the whole economy and it also enabled a lot of people to enter the housing market – like me – who otherwise had no shot at elevated prices. But the crisis also caused homebuilders to pull back hard. Construction has never returned to pre-crash levels, even 17 years later.

That created a long-term underbuilding problem that’s only gotten worse with time. COVID threw fuel on the fire: mortgage rates dropped to historic lows, home prices soared, and millions of people locked in rates they now can’t afford to give up. This is what economists call the lock-in effect. Homeowners who locked in 2–3% rates during the pandemic aren’t listing their homes—because moving today would lead to a 50%+ jump in monthly payments.

Meanwhile, builders face rising material costs, labor shortages, and zoning headaches that make it virtually impossible to profit from “affordable” housing. So they don’t build it.

Here’s where we stand:

76% of Americans say housing affordability is a growing problem

Builders are still producing fewer homes than in 2006 because affordable homes are unprofitable to construct

People remain locked in place because mortgage rates are close to 7% and it’s too expensive to move

Trump’s new plan comes in the middle of all this.

Trump’s Plan to Cut Housing Costs

The new plan hinges on three strategies, and the third one is likely to make the biggest impact:

1. Loosen building codes

Federal mortgage programs currently require new homes to meet specific energy-efficiency standards. While these upgrades save money over time, they add upfront cost—up to $31,000 per home, according to the National Association of Home Builders. This includes higher-efficiency appliances, HVAC systems, insulation, and more. I’m all for energy efficiency and a big fan of anything that’ll improve it. But the truth is that when the government makes it mandatory, instead of encouraging voluntary adoption, costs start adding up.

Even if you support sustainability (which I do), there’s no denying that these requirements raise prices—especially when they’re blanket mandates instead of optional incentives. Trump’s proposal suggests revisiting these mandates to reduce upfront costs for buyers.

2. Cut regulations

According to NAHB data, regulations account for:

23.8% of the cost of a single-family home

40.6% of the cost of a multifamily unit

These come from federal, state, and local layers of red tape: zoning, permitting delays, environmental reviews, and more. Trump’s team argues that even though many land-use decisions are local, the federal government can help by reducing regulatory burdens on financing, permitting, and approval processes for affordable developments.

But the catch is that some of Trump’s other policies, like tariffs on Canadian lumber or immigration crackdowns, could actually increase building costs—so these changes may cancel each other out.

3. Build on federal land

The government owns 28% of all land in the U.S. As per the proposal, a task force would be put together to identify “surplus” federal land that could be leased or transferred to local governments for housing development.

The American Enterprise Institute estimates this could unlock 3–4 million new homes, especially in states like Nevada, Arizona, and Utah. But there’s a problem. Most of this land is remote, lacks infrastructure, and wouldn’t make sense for large-scale housing. According to the Wall Street Journal, only 7.3% of federal land overlaps with existing cities. That means most of the usable land is already constrained by other issues—like local zoning laws, access to utilities, or conservation status. While the government assures that the proposed changes won’t affect National Parks, it also raises the question about how effective these changes will actually be.

Even If It Works, It’ll Take Years

Let’s say this plan does pass. What then? Builders typically plan projects 12–24 months in advance. Even under perfect conditions, it would take 2–3 years before any new supply meaningfully hits the market. In the meantime, affordability may improve in a different way: not from falling prices, but from falling mortgage rates.

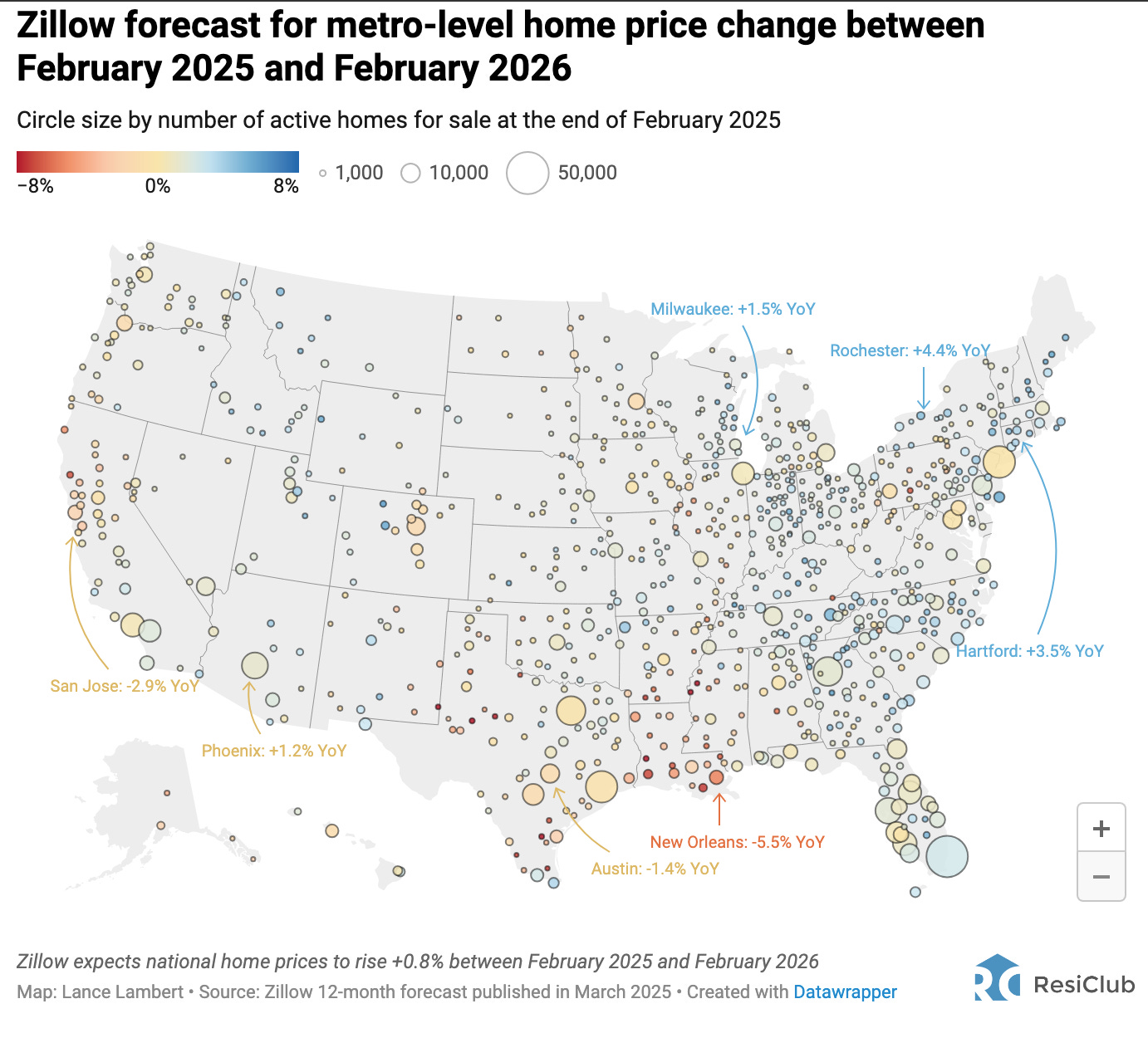

Right now, many economists—including those at Zillow—believe home prices will rise just 0.8% in the next year. But if mortgage rates continue to decline due to economic uncertainty or rate cuts, the monthly payment becomes more manageable—even if prices don’t move.

For example:

A $500,000 loan at 7% works out to $3,300/month

But a $500,000 loan at 3.5% breaks down to $2,200/month

That’s a 33% drop in monthly cost, with no change in home price. This is why lower rates can improve affordability more than price cuts alone, especially during recessions.

What will work, what might not

Here’s where I’ll be honest. This plan has interesting components, and some parts could help. But it’s not enough. We’re facing a shortage of 2.5 to 7.2 million homes, according to Realtor.com’s chief economist. While deregulation might address the immediate pains, it doesn’t address the core issue: People don’t want to move, and builders can’t make a profit on affordable homes.

Here are three ideas I think could have a more immediate impact:

Mortgage portability: Let buyers carry their current low mortgage rate to their next home, removing the lock-in effect. If I could move my mortgage from one home to another, I’d be much more willing to sell – and I’m not even looking to move at the moment.

Faster permitting: Cut red tape at the local level to speed up construction timelines. This could be a much more effective exercise than DOGE.

Raise the capital gains exclusion: Make it easier for sellers to cash out and move without a massive tax bill (e.g., raise it from $500K to $1M for married couples).

These kinds of incentives wouldn’t just help current homeowners. The inventory that’s freed up would reduce prices for buyers as well. If you work in the government, please use my ideas. The portable mortgage alone could make a big difference (And if you know someone who should read this, share this post with them):

Final Thoughts

Look, politics aside, the truth is this: no one policy will solve the housing crisis. But increasing supply, removing artificial barriers, and improving the flow of housing stock is a step in the right direction.

The danger is in overpromising. Building on federal land sounds great until you realize most of it will have nowhere near the impact that jobs, infrastructure, or demand can create. Cutting energy standards won’t solve the affordability gap either, when mortgage rates have more than doubled. But by combining these ideas, we might be able to thaw the frozen market: loosen regulations where it makes sense, build smartly near existing cities, introduce portable mortgages, and give people a reason to move.

In the meantime, don’t hold your breath for $200K homes in LA or New York. But if mortgage rates fall and policies shift, we could see affordability improve – if not in the form of prices, at least in mortgage payments. That’s what actually matters.

That’s all for this week! I’ll see you next week with a different story. If you enjoyed reading, please like and share with a friend.

I totally disagree with your premise that anything the Orange Mafia Boss does will be helpful!! Nobody lives near those federal lands - end of story !!! Try again! Maybe you could donate $10 million to Habitat?????

Mortgage rates aren't likely to come down much, and even then it'll take an economic recession. So a more likely "lower rate future" would be more like a $480,000 at 30 yrs at 5.25% giving a $2650 monthly payment. Not quite as high as at present, but hardly a margin. (And with a 4% decline of house value.)