What’s up Graham, it’s guys here :-) If you want to join 24,900+ smart investors and never miss an update on the market, hit the subscribe button below. It only takes a second and is completely free.

In the early 1900s, the coal mining industry experienced a meteoric rise due to its widespread use in manufacturing iron, the popularity of steam engines, and the expansion of railways. Energy from coal was relatively cheap and played a key role in the industrial revolution as it ensured that power production was no longer dependent on forces of nature (wind/water) and could be clustered near cities that were just starting to industrialize.

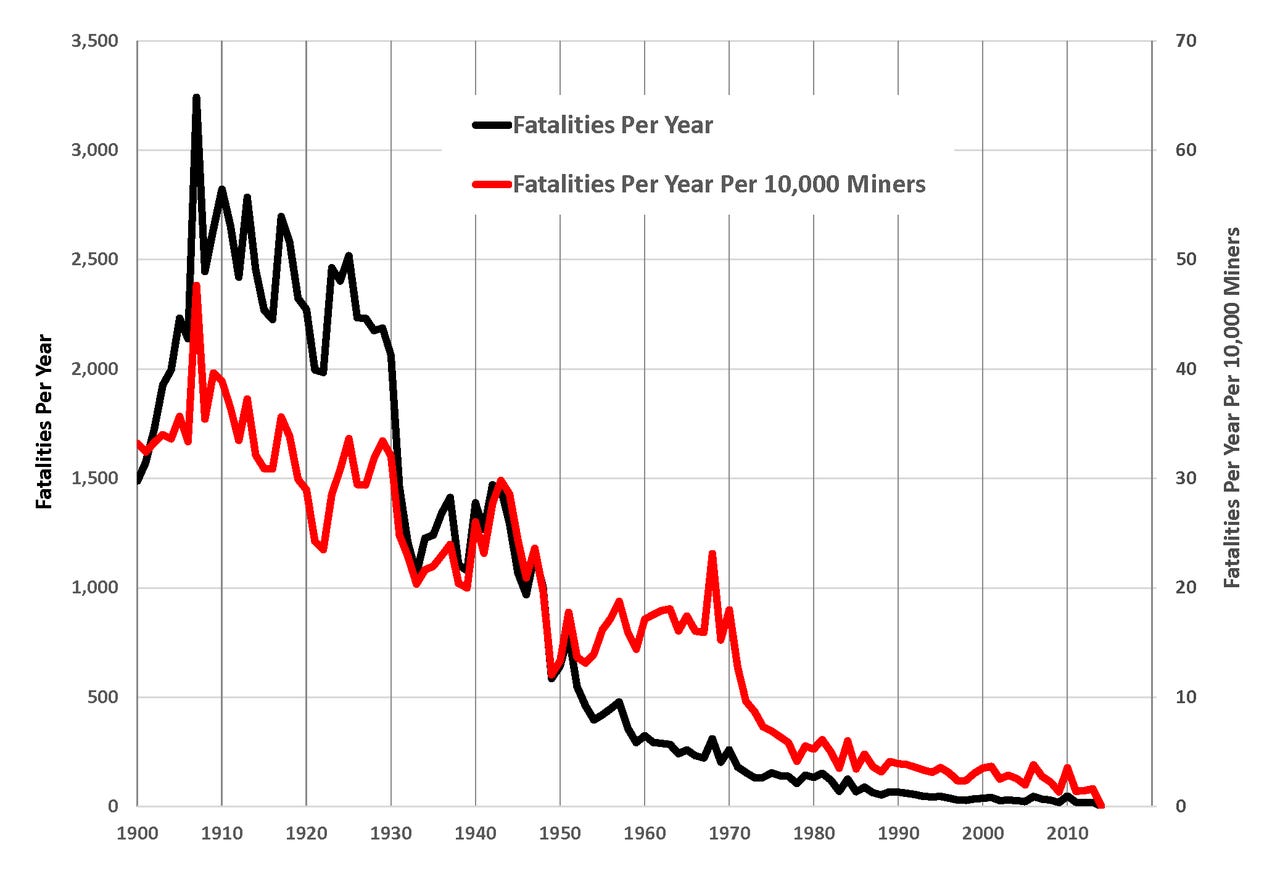

There was a major issue in mining: it was a risky endeavor for the workers. Between 1900 and 1910, the fatality rate for coal miners peaked at nearly 5000 workers every year! One of the contributing risk factors was carbon monoxide buildup in the mines. Even at very low levels, Carbon Monoxide can be fatal, while at higher levels, it can catch fire, presenting an additional hazard.

In 1896, a Scottish engineer, John Scott Haldane was tasked with finding a solution to the Carbon Monoxide problem in the mines. His answer? A canary, the tiny yellow songbird. Haldane found that canaries were much more sensitive to Carbon Monoxide and would alert the miners even at very low levels of buildup.

For decades since then, miners would take canaries down the coal shafts to alert them about the poisonous gas while the miners did their work. If the carbon monoxide levels reached uncomfortable levels, the canaries would stop singing, providing the miners enough time to evacuate the shaft.

Since then, we have developed modern devices for detecting carbon monoxide and the use of canaries has gradually been phased out. However, the phrase ‘canary in a coal mine’ persists, as a reference to the utility of the songbird to predict and avert disasters.

There is no doubt that there is tremendous uncertainty in the current economic landscape. Both Goldman Sachs and JP Morgan expect a recession as the Fed keeps raising interest rates in a tight labor market. Now, analyst predictions are one thing, but being prudent investors, we need to keep an eye out on how the various cogs in the economic machine are functioning. Crucially, canaries in a few specific markets have stopped singing and it’s time we take notice.

So this week, let’s take a look at how two key areas, the used car market, and home rental prices are on the decline, why this is a reflection of the overall economic environment, and what you should do to prepare for the storm.

Sudden Brake

In case you missed it, the used car market has been on an absolute roll in the past few years. As an asset class, used cars outperformed the stock market in 2020-2022 and they outperformed the housing market by a factor of two! In fact, in February 2022, 80% of new cars were selling above MSRP.

The primary contribution to the used car crisis was made by the chip shortage caused by the COVID crisis. A modern car requires thousands of semiconductors to properly function and in the wake of the COVID crisis, manufacturers started prioritizing consumer electronics resulting in a shortage of new cars. The low-interest rate environment further helped sellers boost sales, as many consumers often only looked at the monthly payment. With creative sellers providing auto loans of up to 144 months, the immediate purchasing power increased which drove prices higher.

However, this is starting to change.

In the wake of these loans, car repos started to explode with the Consumer Financial Protection Bureau coming on record to say that loans that originated in 2021 and 2022 are starting to show higher delinquency rates compared to previous years. Even CARMAX, generally regarded as a fairly stable business model has had its stock fall by nearly 60%, indicating trouble for the entire industry. Their CEO even came out to say that consumers are prioritizing spending differently as inflation made cars less affordable and rising interest rates led to tougher financing situations.

The sudden reverse shift (:-)) in the car market has led to a few key changes. First, loan requirements have started to get a lot stricter. Wells Fargo began to see signs that their borrowers were falling behind and moved fast to tighten underwriting standards, which caused auto loan origination to plummet 40%. Second, we are also starting to see vehicles get cheaper with prices dropping nearly 20% from their peak and continuing to fall nearly 2-4% every month.

However, the auto industry isn’t the only canary that has stopped its song. The music from the rental market is starting to fade as well.

Rental Decline

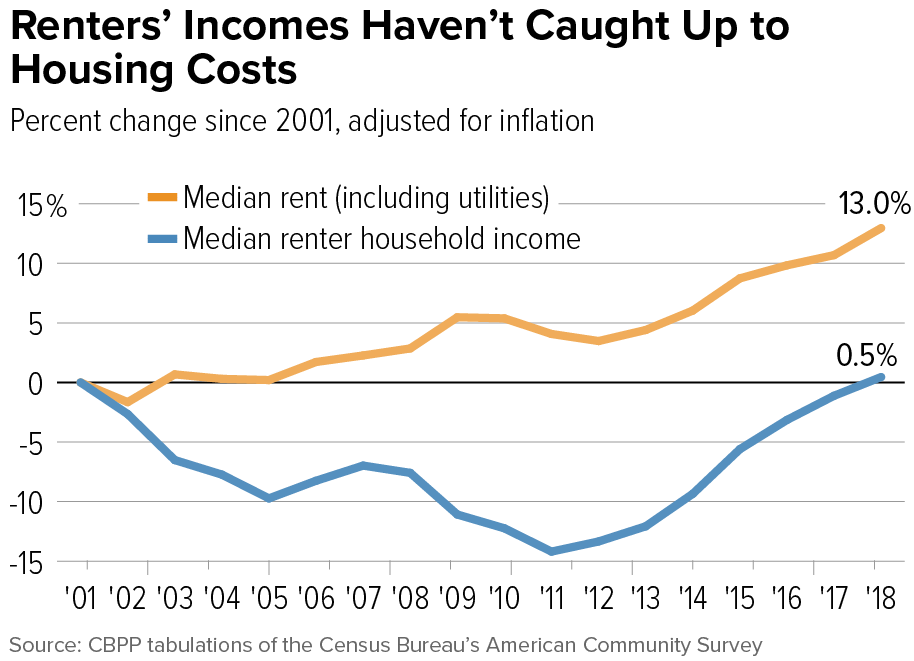

The rental market has been on a meteoric rise since the early 2000s and despite the 2008 crisis, the median rent has grown at a rate that far outpaces the growth of household income. It is hard to pinpoint a single reason for the rise in rent as it is a combination of a host of factors such as fewer affordable units in the market, increased demand for rentals since 2008, landlord expenses increasing due to property taxes/repairs, and finally, home prices going through the roof. The pandemic further exacerbated this as demand for homes skyrocketed when people started working from home. The median rent crossed more than $2,000 in May 2022 from the pre-pandemic levels of $1,600.

However, there has been a slight reversal in this trend recently. Month over month, in the third quarter of 2022, asking rents declined by 0.4% with rent.com slowing a higher decline of ~2.48%. With migrations slowing and occupancy rates falling, rental demand is becoming negative for the first time in 30 years. A former Fannie Mae economist wrote that rents might actually see a real decline in dollar amounts in 2023.

There is a bill under consideration by Congress that would take a wrecking ball to the plans of large-scale institutional investors. The Stop Wall Street Landlords Act of 2022 is aimed at discouraging large investors from purchasing property, by disallowing interest payments to be deducted as an expense and eliminating any claims to depreciation that would offset their taxable income. Although in the long run it does kind of make sense to curtail large companies from buying up single-family homes, right now the bill is limited to anyone who holds more than $100 Million worth of assets.

Testing Times

The silence from the canaries in the auto and rental market does point to testing times for the economy. As intended, the Fed’s rate hikes are dampening the appetite for credit, which is reducing overall demand. In the near future, we can expect the price for used cars to decline, but before you pull the trigger on that dream vehicle, do keep in mind the 20/4/10 rule. Essentially, you should be able to afford a 20% downpayment on a 4-year loan, and you spend no more than 10% of your monthly income on transportation.

On the rental front, we can certainly expect a decline, however, it’s unlikely that we are going to return to pre-pandemic levels anytime soon. Rental prices often show a lag because of lease durations, so keep an eye out for any deals in your neighborhood. It looks like we might be in the worst part of the rate hike cycle - companies are starting to cut forecasts and lay off staff, but the Fed isn’t ready to put the brakes on the rate hikes just yet. So, keep an emergency fund ready and stay employed and you should be able to ride out this storm.

Stay safe, stay invested and I will see you guys next week - Graham Stephan.

A lot of effort and research went into making this article, so if you found it insightful, please help me out by clicking the like button and sharing this article.

Thank you!

Thanks Graham!