Bad decisions made with good intentions are still bad decisions.

- James C. Collins, author of “Good to Great”

Celsius has been in the news a lot of late, and not for the right reasons. Though I’m going to dive into the complete story, the gist of it can be summed up in just two tweets.

This is something I avoided talking about for a long time, because when Celsius disabled withdrawals and locked away more than $11 Billion in assets, my money was caught in there as well - and there’s a chance that I might never see that money again.

This is the story of how a company that started out as the little guy’s alternative to the “Big Bad Banks” became an investor’s nightmare. It’s also the story of what may be in store for the crypto landscape, and how you should keep your money safe. Let’s get started.

The Celsius Pitch

Alex Mashinsky founded Celsius upon two stories:

The banks are stealing the little guy’s money

Celsius is the answer - High rewards for little to no risk

Let’s unpack that a little to understand how banks work. Celsius claimed that banks did not share the profits they made with their depositors. For example, a bank that pays its depositors 2% and lends out money at 4% is making 2%… But that’s not a great business model, is it? Instead, banks maintain only a small portion of their depositors’ money, sometimes less than 10%, called a fractional reserve. This lets them leverage their deposits 10x and multiply their returns.

It’s ok for banks to use leverage because their investments are usually diversified and even if one fails, the others would make up for it (unless you consider the 2008 crash where they put all their eggs in one basket, but I digress). But on this point, Alex was right: depositors got a very little piece of the pie.

At the same time, banks came with certain advantages, like FDIC and SIPC insurance. Even if the banks collapsed, you wouldn’t lose your money as an investor. But we’ll come back to that later.

What Alex was proposing was that investors could earn 16-18% yield from their crypto assets without taking on any extra risk (as he says in this argument with Peter Schiff that would come back to haunt him later). But how exactly was Celsius generating its yield?

Celsius’s business model

The idea was simple - You could deposit your cryptocurrencies in Celsius, or you could also borrow money against any of 40 different cryptocurrencies. If you staked your cryptocurrencies using the EARN feature, Celsius would lend out the tokens to borrowers who would generate yield on the loan and pay back Celsius. Celsius would then share the profits, ranging anywhere from 1% to 12% with their users. That’s neat, isn’t it? Not quite.

Though Celsius wasn’t the only exchange to do it - Binance, Nexo, Anchor, and other firms also offer yield on staked tokens - the yields that Celsius was offering might have stretched it a bit too much. The high yields meant that Celsius was paying out nearly as much money as it was making - nearly 80% - and even if there was a slight fluctuation in the market, it could lead to a liquidity crisis. (Covered in detail in Coffeezilla’s excellent video).

There’s also the issue that by accepting deposits and lending money, Celsius was technically doing what the “evil banks” were doing, but nobody cared as long as the yield was flowing in.

Well, the first sign that it started unravelling was when the SEC started restricting the operations of Celsius and other DeFi firms on the basis that they were engaged in trading securities and allowing only accredited investors to invest (basically, like a hedge fund). In normal circumstances, crypto would not be considered a security, but because of the high yields and lending activities, the SEC wanted a closer look - Especially because the customers were not insured. Of course, Celsius denied all allegations…

ETH staking

The second source of the problem was the way staking was handled. Celsius accepted ETH and staked it in two ways:

By directly staking it to get staked ETH (stETH)

By pooling deposits and staking it through Lido

Though the technicalities are different, the result is the same: Once the ETH is staked, it is locked in for a certain period of time, and the stETH cannot be swapped back for ETH immediately. ETH and stETH have a 1:1 peg (for practical purposes). The stETH is like an IOU while your ETH earns yield… But Celsius lets you stake even your stETH and borrow against it! This led to Celsius having a highly leveraged position in stETH which it was lending to multiple projects.

At the same time, to prevent a liquidity crisis, Celsius came up with a bright idea - They gave customers the option of taking CEL, Celsius’s own token that guaranteed higher rewards if you took payment in CEL instead of crypto.

It would be like saying: “You can either make 10% interest…or, I’ll give you 15% if you just take this token that we create. It might go up or down in value…but, it doesn’t cost us anything extra.” This went well for a few months, but when the crypto crash started, stETH depegged from ETH and there was a panic as customers scrambled to withdraw their tokens. Even this might have been possible to handle if not for….

Unforced errors: Stakehound and BadgerDAO

Two other disasters struck Celsius.

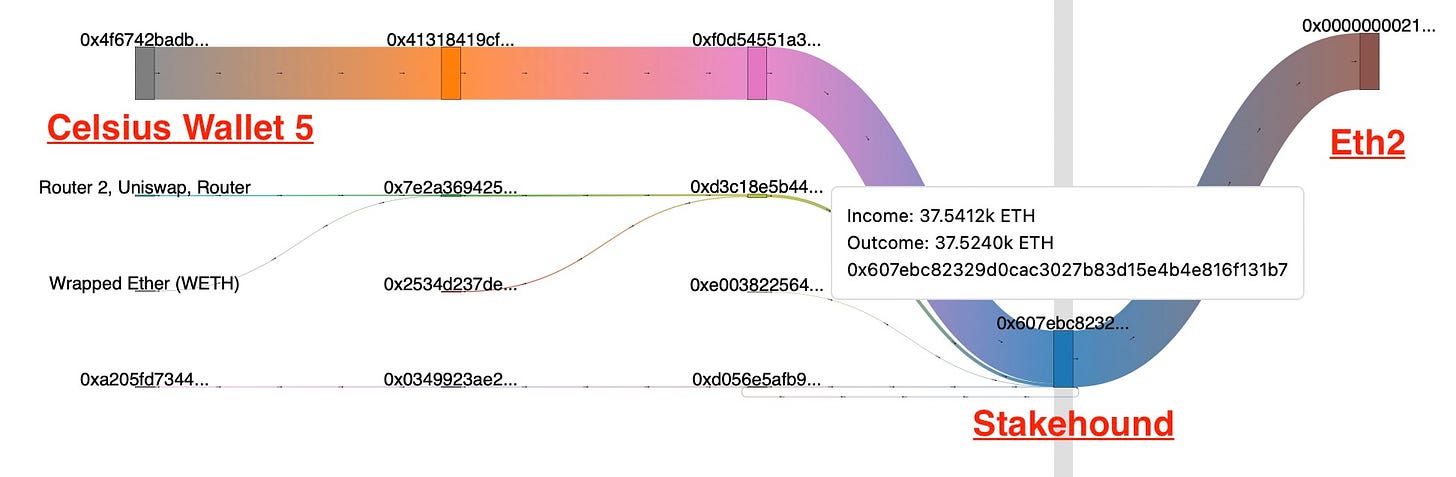

Celsius was one of the biggest holders of the Stakehound stETH coin - they deposited more than 35k ETH in a single deposit - which they had used their customers’ deposit to obtain:

Stakehound lost the keys to the account making the holders of Stakehound stETH bagholders - And Celsius lost more than $30M in the process. This might have just been bad luck. But the second one was just unbelievable.

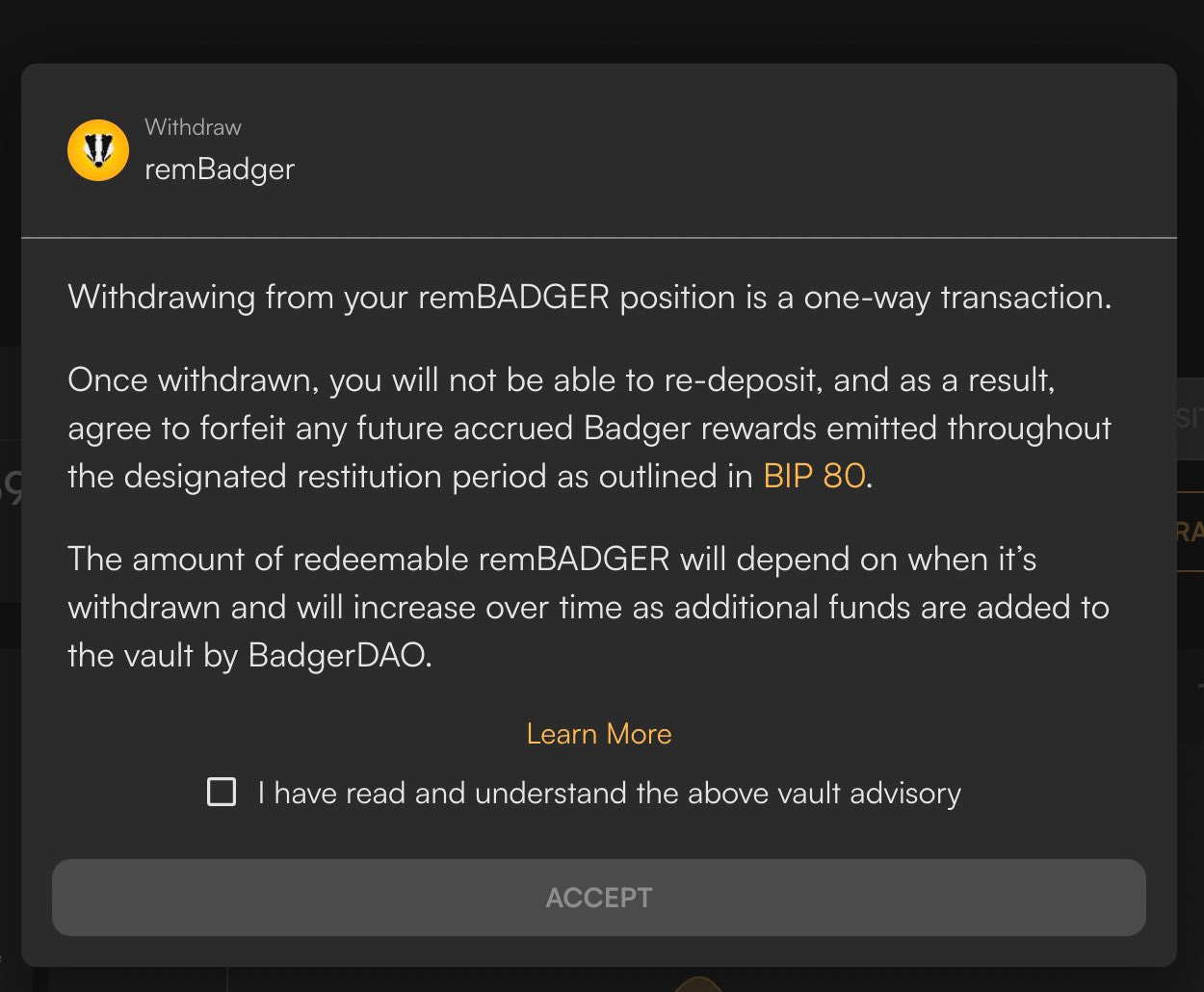

BadgerDAO was another company that Celsius had invested in, and it was hacked to the tune of $120M - But to Celsius’s good luck, BadgerDAO minted remBadger tokens which would reimburse Celsius over the next year just if the tokens were held on to. The problem was, Celsius withdrew its tokens accidentally. This was in spite of the warning screen shown below that made it clear that this was not a reversible transaction. And they lost more than $54 Million because of a human error.

These losses seriously affected their liquidity. After that, it was only a matter of time before the FUD started kicking in, and the CEL token started dropping steeply in value, as users started withdrawing their assets as fast as they could. Ironically, this was CEO Alex Mashinsky’s (now famous) tweet on the day before Celsius froze withdrawals.

The Wild West returns?

So in spite of all the mockery that banks are subjected to by the crypto community, it’s critical to understand that banks went through the same cycle as crypto. Bank runs are as old as the history of banking themself, going back to the 15th and 16th century. But after the stock crash of 1929, bank runs became a serious problem in the US with one bank run triggering a feedback loop that caused bank runs in many states. And since currency was not fully centralized, there wasn’t much the State could do.

This was why FDIC and SIPC came into being - To insure the depositors’ money in case the bank went bust, and they have played a critical role in protecting citizens’ money since then, even during the 2007-08 financial crisis.

At least in the physical cash era, runs were slow because of the lengthy queues at the bank - Digital FUD spreads within a matter of hours, and contagion can spread fast. As skeptical as we might be of regulation, once our money is at risk, we wish the SEC had stepped in sooner - There’s no question that regulations might make crypto less lucrative, but they will also make it a safer space to invest in and they’re highly necessary.

What about Celsius? If you look at the fine print, you’ll know that the users of Celsius are technically loaning their money as unsecured creditors, and they could be the last in line to get their money back, but hey, when’s the last time you read the fine print? Even as I write this, there are fears that Celsius might be preparing for bankruptcy, and news of Blockfi, 3AC, Finblox, and other firms being in trouble is cropping up in the media.

What you should do

I know I keep saying “Buy the dip”, but this is not the kind of dip I’m talking about. At any given time, 3-7% of my portfolio is invested in crypto, and I never hold more than 20% of that on a single platform. With all of them, I am prepared to see the value go to zero.

Will Celsius get back up on its feet? It’s hard to say at this point, and I really hope it does for the sake of its depositors, but even if they do manage to find the funding required to maintain their liquidity, their credibility has taken a severe beating and it’s hard to see them return to where they were.

“Not your key, not your crypto”

That’s definitely something you should keep in mind when you enter this area. Since the time I entered crypto, I’ve been aware that it’s a very high-risk, high-reward venture and I have only invested as much as I am willing to lose. I get nervous when I see millennials refer to crypto as their retirement plan… this is a highly volatile market, and not something you should count as your fallback option. Always know what you are getting into and only invest what you are willing to lose.

See you next week with another deep dive!

Such a interesting article. Keep going Graham 💪

Excellent work Graham.