End of an era

A 166 year old bank fades away silently

What’s up Graham, it’s guys here :-) If it’s your first time here, hit the subscribe button below to join 36,900+ smart investors and never miss an update on the market again. It only takes a second and is completely free.

It ain’t what you don’t know that gets you into trouble.

It’s what you know for sure that just ain’t so.

– Mark Twain

Have you heard of the parable of the boiling frog? A frog that is plopped into hot water will immediately leap out because the change in temperature is glaring. But if the same frog is placed in a vessel of tepid water that is slowly warmed, it passes into a drowsy stupor. As it nods off in its little frog sauna, it gets cooked alive without realizing the danger of the temperature increase.

No frogs were harmed in the making of this story. This parable is not true either. But it makes the point that slow-moving problems are much more difficult to catch – nobody can predict the straw that breaks the camel’s back. Sometimes a crisis happens overnight – an incident occurs that turns the world upside down, bringing a new world order into existence. But there are other crises that occur over decades that can catch us off guard. This is what happened with Credit Suisse.

166 years after its founding, after surviving two world wars, multiple financial crises, and being a pillar of the global financial system, Credit Suisse was taken over by its competitor UBS yesterday. How did this happen? And what does it mean for your financial strategy? Let’s take a look at the complete story.

A history of scandal

Last week, we covered the fall of Silicon Valley Bank which was the go-to bank for tech entrepreneurs and Venture Capital, and a mainstay of the valley for 40 years. SVB collapsed because interest rates went against what they had expected, and bad risk management plus a bank run ended things overnight. But things were different with Credit Suisse. With over $1.5 Trillion under management at the end of 2021, more than 50,000 employees, a designation as one of the “systemically important financial institutions of 2023”, and a strong balance sheet, liquidity was not Credit Suisse’s problem. In fact, it was considered “too big to fail”.

But it did have a host of other issues, including questionable practices, bad business models, and repeated failure in communication which led to erosion in every bank’s chief asset – trust. For instance, in 2017, Credit Suisse agreed to pay a $5.3 Billion Fine for over-valuing mortgage backed securities during the 2008 Great Financial Crisis, which resulted in “the loss of billions of dollars of wealth and took a painful toll on the lives of ordinary Americans.” In fact, the settlement announced that the bank “knew it was peddling investments containing loans that were likely to fail” and did it anyway. That’s just the beginning.

In 2009, they forfeited $536 million for violating the International Emergency Economic Powers act.

By 2014, they plead guilty to assisting US Taxpayers in filing false returns and paid another $2.6 Billion in fines.

In 2017, they paid $500 million for wire fraud relating to “Tuna fishing”.

In 2019, they were caught spying on their own top executives, resulting in the forced resignation of their CEO.

In 2021, they lost $4.7 billion after Archegos defrauded its clients.

A massive leak in 2022 showed that Credit Suisse’s clientele included individuals from highly powerful and questionable backgrounds.

They have been found guilty for money laundering in 2022.

And finally, before the year ended, they paid $500 million to settle a mortgage fine.

Whew, that’s quite the list. When Saudi National Bank who owned 9.8% stake in Credit Suisse were asked if they would buy more stock, they said “Absolutely Not.” This was apparently for regulatory reasons, but the firm nature of the reply added fuel to an already fraught situation, and caused their shares to slide further. But what’s happening today, is something over and above all these reasons, and here’s what you need to know about it.

Stress Test

At the end of 2022, the CEO of Credit Suisse set off a chain reaction when he made a statement that the bank “was at a critical moment”, and tried to reassure employees to not confuse the day-to-day stock price with the firm’s strong capital base and liquidity position. Why would he need to make a statement like this?

Credit Suisse’s stock had declined by over 90% in the last decade, and they were undertaking a major restructuring to return the company to profitability. They needed capital to do this, and the CEO was trying to boost the bank’s image. But some saw this as a last-ditch effort to stay afloat before going down, like what happened with Lehman Brothers. To add to this, Credit Suisse’s problematic financials were coming to the fore.

A bank’s credit-worthiness is not determined by its investment performance and its public perception alone. It must pass something called a “Stress Test”. The Federal Reserve imagines adverse scenarios – wars, natural disasters, a combination of high unemployment and high inflation – and projects whether banks have enough capital to pull through in all adverse scenarios. Sometimes, banks barely pull through, failing in the present but with a tap on the head to introduce corrective measures. Deutsch Bank and Santander, for example, have failed the stress test on multiple occasions. Ironically, SVB might have given red flags in a stress test, but did not meet the capital requirements for an annual stress test, so it wasn’t caught in time.

Should US banks be more strictly regulated at the cost of difficulty of doing business? Is there a better solution? Let me know what you feel.

Credit Suisse too was among this lot. After this, Yahoo dug into Credit Suisse’s financials and discovered that the Tier 2 capital fell short of regulatory requirement – and all hell broke loose. Critics warned about their path moving forward, declining revenue, and dwindling returns that could have a significant impact on the entire market, which, only ended up getting worse. Investors ran for the doors. Throughout 2022, customers of Credit Suisse withdrew billions from the bank….” contributing to the bank’s biggest annual loss since the financial crisis in 2008.”

In its 2023 stress test, the Federal reserve flagged the bank as prone to both global market shock and counterparty default – with connections around the world. And finally, hitting the nail in the coffin – On March 14th, the bank said that it had found material weaknesses in its financial reporting over the past two years because of ineffective internal controls. Essentially, these could be material misstatements of account balances or disclosures and when one of the world’s largest banks says this, a lot of their customers began to panic.

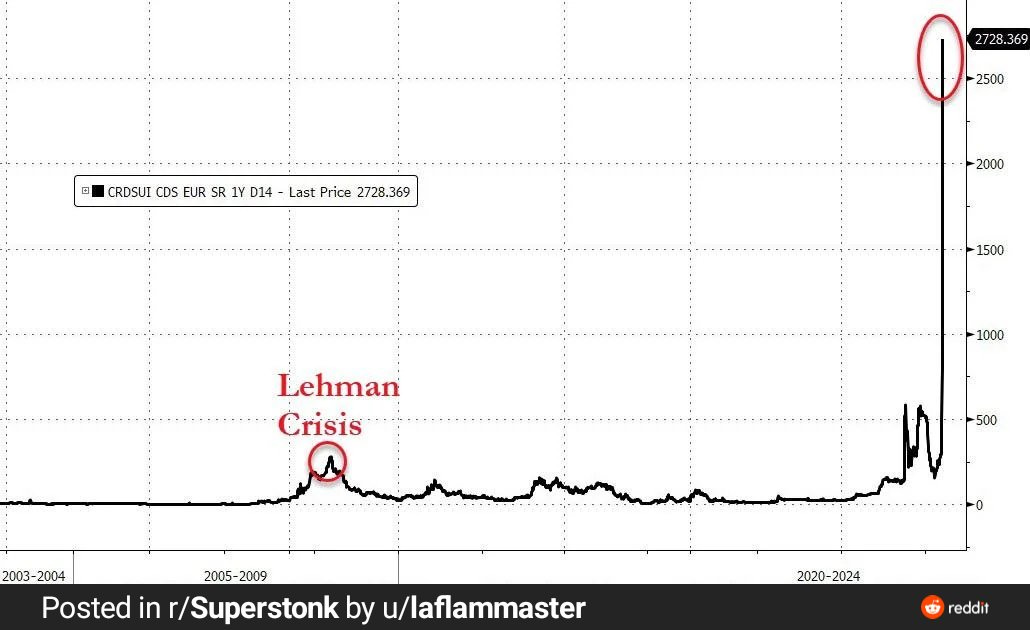

This began to show up in their Credit Default Swaps.

Credit Default Swaps

If you’re a movie aficionado, you’ve already come across this term in the movie “The Big Short.” The concept is pretty simple: Anytime a bank issues a loan, they have the option to purchase a “Credit Default Swap”, which acts like insurance in the event the borrower does not pay back the loan. In this case, one bank is able to transfer their risk to another bank for a small fee, and that second bank then ends up taking on all the risk. The second bank can afford to pay back the first bank because they are collecting premiums from many different banks (diversification) and they also have the rights to the underlying investments of the first bank (collateral).

However, sometimes a bank issues too many credit default swaps, and they don’t have the assets on hand to cover the insurance payouts. Then they would be potentially forced to raise a huge amount of cash to offset those losses, and if they can’t, the bank would go under. This is what happened during the 2008 financial crisis, where banks like Lehman brothers collapsed from a lack of capital once they couldn’t pay for non-performing loans. The concern became that history is repeating itself – with a slight twist.

Credit Suisse was one of the biggest buyers of US home loans during the 2008 financial crisis. Now, customers were withdrawing money at a rate not seen in more than a decade, and the cost of their Credit Default Swaps had skyrocketed – because people were betting on the bank’s demise and wanted to cash out on the insurance when things went south.

What next?

Within 24 hours of Credit Suisse facing financial difficulty, the Swiss National Bank said that they would provide liquidity if needed, even though they “believe the bank to still be well capitalized.” Essentially, they promised to backstop losses for the time being, until hopefully, the bank can regain profitability. All of this was done as a way to calm the markets, knowing that if consumers have confidence in the banking system, they won’t all rush for the exits, at the exact same time – and that won’t spread throughout the rest of the economy.

Despite this, the situation devolved into Credit Suisse’s competitor UBS taking it over yesterday at an extremely low price that left a very small amount to be distributed among shareholders of the bank (Matt Levine wrote an excellent piece on the details of the deal). On the other hand, this deal might be beneficial to the depositors because UBS has the liquidity and capital necessary to handle Credit Suisse’s assets while also having a strong and reputed brand.

All this leads me to believe that despite the reassuring headlines, there is a risk that these large banks could be in trouble, and customers should absolutely diversify their holdings. Make sure you’re under the FDIC limit, and understand that panic might create some good buying opportunities if you’re a long term investor. Personally, I’m using this as a chance to dollar-cost-average at slightly lower prices but you could also just ask ChatGPT – because, it correctly predicted that the market was going to crash on March 15th. Coincidence?

Hours of effort and research went into making this ten-minute read. If you found it insightful, please help me out by clicking the like button and sharing this article.

No, they should just be allowed to fail when they fail and stop making the middle class bail out the banks.

I think when you hit a bakers dozen on Fraud etc charges as a bank that might ring a few alarms.