Welcome to the premium edition of Graham’s newsletter! Graham’s newsletter is now reader-supported and this article is one of the many perks paid subscribers have access to.

Let’s start with a paradox. Every time Apple pays dividends, it makes headlines, because one of its largest payouts is to the coffers of Warren Buffett’s Berkshire Hathaway. This year, the payout was $214 Million! In 2023 alone, Berkshire Hathaway is expected to make $5.7 Billion just in dividend payments. Buffett has also sung the praise of dividend-paying stocks in the past.

An investment in Berkshire Hathaway would have beaten any other investment on the planet over a number of timeframes. And yet… Berkshire Hathaway has never paid a dividend in its 50+ years. So the question is: Do dividends say something about the quality of the company? Why does Buffett favor dividend-payers while not paying a dividend himself? Most important of all: Can you make money by investing in dividend stocks?

In this article, I’ll be diving deep into the mechanics of dividends, the pros and cons of dividend investing, and what you should keep in mind before you invest. I’ll also be discussing my own dividend portfolio and how it’s performing, in detail.

Why are dividends paid?

The basis of owning shares in any company is that it entitles you to a portion of their profits. Companies can choose to return this profit to their stakeholders in a few different ways:

By reinvesting capital into the growth of the business

Acquisition of other businesses

Repurchasing shares of shareholders

Distributing cash as dividends

Which direction a company takes is dependent on both the opportunities it has and its stage in its lifecycle. Growth companies that focus on technology or disruption, or companies that see scope to expand typically reinvest capital. In the long run, this could make the business more competitive and increase the value of the stock. Companies that have a vision for the future and a lot of capital reserves could also acquire other companies that align with their vision.

Buybacks can be great, but they are also controversial, because of the perception that it only enriches executives. This isn’t really true though – with no other viable opportunities, if a company is trading for lesser than its intrinsic value, buying back shares could add value to all shareholders. That brings us to dividends.

Dividends are the simplest option of the lot – The company just returns a portion of the cash to its shareholders and lets them decide what to do with the money. Dividend payers are usually mature and stable companies that have predictable cash flow. The dividend amount is a percentage of the share price, called the “Yield”, and a stable yield year-over-year is seen as an indicator of financial stability.

Dividend investing is one of the easiest ways to generate passive income, and reinvesting dividends can be a powerful way to compound your investments. But others argue that dividends just show a lack of ideas on the company’s part. Let’s dive into both the pros and cons.

The psychological advantage

The biggest advantage of dividends is that you get payouts in cash without having to sell any of your shares. Some argue that this is just an illusion because the money that the company takes to pay out dividends is capital it could have reinvested to grow the stock price. But consider the following scenario:

The company is mature and stable, and has no new markets to expand into.

There are no attractive acquisition opportunities.

The stock is valued fairly or overvalued.

In such cases, forcible reinvestment or share buybacks could be a bad decision – by redistributing profits as dividends, the company is letting its shareholders manage their money for themselves. Assuming you have dividend payers in your portfolio, you can collect the dividends and reinvest them among your holdings as you see fit.

But the bigger advantage might be psychological: If you’re a true value investor, you might have paranoia about selling your shares. After all, the standard advice is to “buy-and-hold”, and even if you really need the cash, you might be anxious about selling a stock you know is doing well. Dividends alleviate this fear by taking away the need to sell and giving you ready cash to spend. The fewer major investing decisions you need to make, the fewer mistakes you are likely to make, and dividends outsource the decision-making to the companies.

But that still leaves the question: Are the returns of dividend stocks better?

Dividends vs The S&P 500

One of the biggest advantages of dividends is predictability. A company cannot control its stock price, but it can control the amount set aside for dividend payments – and it generally remains stable or trends upward. For a stable or mature company, the dividend payout is a means of signaling financial stability, so such stocks could lead to predictable cash flow (more on where to look for these later).

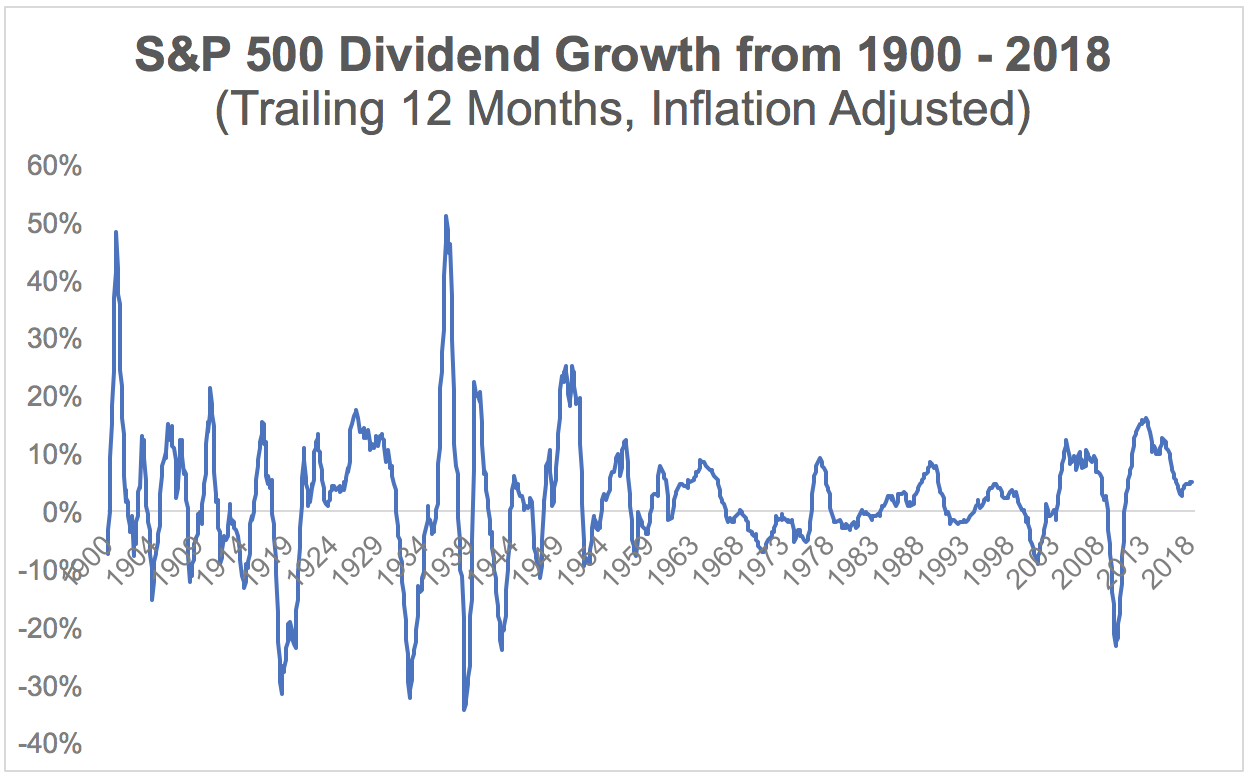

As evidence to back this up, let’s look at how dividend payments have compared over the last century: From 1900 to 2018, dividend payments remained fairly constant, and had an average variance of just 10% during market downturns.

But the S&P 500 had much higher volatility in the same period. If predictability and consistency in cash-flow are your priorities, then lower volatility goes a long way. Don’t get me wrong – long-term investing is the wiser course of action to build lasting wealth, but it might not be a source of cash for you to tap into for a long time. Dividend-paying companies on the other hand are larger, more mature, and prioritize stability – so they could be a better choice for regular cashflow.

The larger cash reserves of stable companies mean that dividend payments take a smaller hit and sometimes increase during recessions at a time when other companies struggle to stay afloat. According to Simply Safe Dividends, dividends paid to investors increased in three recessions, with a 46% jump during the recession following World War II.

Finally, dividends accounted for 54% of market returns during times when inflation was above 5% – and dividend stocks have been shown to provide a comparable return to the overall market. Though they might not be the stocks that benefit the most from bull runs, dividend stocks also do not decline the most during a crash.

But there are good reasons for people to argue against dividend investing as well. You need to be aware of those…

The Dark Side of Dividends

The biggest problems with dividends have to do with dividend policy and payouts: Dividends are predictable and generally stable, but they are not guaranteed in any way. If the cash-flow of a company is threatened, they might suspend dividend payouts till the situation improves.

Dividend yields are also meaningless when the stock price itself declines – a 5% yield would lose you money when the stock itself declines by 30%, and that has happened on multiple occasions. 3M lost more than 55% of its value in the last 5 years making their 5.6% yield worthless. There’s always a chance that stock prices could bounce back, but these situations cancel out the consistency advantage of dividends.

Taxes are also a tricky area when it comes to dividends. If you’re single and make less than $41,000 a year or married making less than $83,000 a year and receive what’s called a qualified dividend – there’s absolutely no tax on this profit. Beyond this amount, some dividend income is classified as “long-term capital gains”, which is much lesser than what you’d pay on your income.

But if you start making more money, dividends give you less control over your taxes. When it comes to stock price appreciation, you pay taxes only when you sell, and the amount that you save is reinvested and compounded over years – this can add up to large amounts. But dividends are taxed immediately on payout, and if your income increases, the taxes could go to 20% or higher. Dividends are also taxed twice, first on the corporate level as profit, and then at your end. It’s a “waste” of money for both the company and you if there are better opportunities to invest.

And then there’s also the argument that dividends really have no financial edge – that it’s purely psychological. No value is created or destroyed in the process of paying out dividends, and all it does is save you the decision-making about selling the stock. Instead of getting a 5% yield, you might have gotten a 5% yield if the capital had been invested efficiently.

Despite all this, I lean towards holding some portion of my portfolio in dividend stocks. Here’s how I’ve allocated my money and how you can figure out the amount of dividend income you need to live comfortably: