The Largest Wealth Transfer Just Started

Making sense of "the everything sell-off"

“You make most of your money in a bear market, you just don’t realize it at the time.”

- Shelby Davis

Here’s the deal: Things don’t look too rosy right now. So far, in 2022, the Nasdaq has plunged into a bear market dropping more than 25%, the S&P 500 is down 18%, hundreds of stocks are trading at their all-time-lows, the economy has begun to shrink, inflation is at the highest it has been in the last 40 years, and a recession is likely on the horizon!

Phew! That was a lot of bad news in just one line! But what most people don’t realize is that beneath all the bad news lies one of the best opportunities to build wealth quicker than any other recent time! In this issue, I will break it all down backed up with actual studies, statistics, and history so that you can see firsthand just how important these next few months will be.

The Everything Sell-Off

Remember the good times when we had the “everything rally”, where even my random stock picking monkey was able to outperform the S&P 500 and made 40% in a year? Well, it looks like those times are long gone and we have the opposite of that, in what’s being dubbed the “everything sell-off”.

Before we go into how to make your investment plays, it’s important to understand what’s going on in the market right now. The recent decline is caused mainly due to 3 factors.

a. Inflation

No surprises here - inflation has been running rampant throughout the economy over the past 1 year. Wages increased while demand soared, so businesses had to staff up quickly to fulfill the orders, leading to increasing prices. The price rise was so fast that inflation hit a 40-year-high. Although it could have been managed, where things went horribly, horribly wrong was how the Fed just considered inflation to be transitory.

b. Increasing Interest Rates

It’s important to note that high inflation on its own is not enough to cause everything to begin selling off (In reality, some inflation is good for the economy). The Fed’s response to inflation by increasing the interest rates is what’s causing the current sell-off. We saw a 25 basis point rate hike in March, a 50 basis point rate hike in May, and several more rate hikes planned throughout the rest of the year.

The impact of high-interest rates is that the stock market starts to look less appealing as there are safer high return investments available in the form of Bonds and T-Bills, mortgages cost more to borrow, and businesses have to pay a higher overhead. All of this leads to less disposable income that can be put back into the market.

c. Uncertainty

Right now, there’s a concern that companies are beginning to lay off their workers (Robinhood, Rocket Mortgage, and a bunch of other established startups have already started their layoffs).

Combine this with the uncertainty of an upcoming recession, the Russia-Ukraine war, and rate hikes, and we have the perfect recipe for an extended bear market.

Stock Market, Crypto, and Real Estate

We’ll start with the stock market which recently saw its worst drop since 2020. The Nasdaq is down over 25%, the S&P 500 is down 18% and even the Dow Jones is down more than 10%! Morgan Stanley went so far as to say that the S&P 500 bottom is still another 700 points away. Another concerning tidbit for the backtest enthusiasts is that

“In the previous 10 instances when stocks endured deep losses in the first four months of a year, six saw the market extend its declines through December, and only two saw gains exceeding 10%” - Morgan Stanley

However, the stock market losses are pretty tame when compared to the bloodbath in the Cryptocurrency market.

40% of bitcoin investors are now underwater - CNBC

It’s important to understand what’s going on in the crypto market because throughout the last year, Bitcoin was often seen as a hedge against inflation. But as we have seen this year, it seems to have no correlation with inflation and it’s been following the same trajectory as tech. In other words, when interest rates increase, investors take a less risky approach moving money into safer, less volatile assets causing the crypto market to take a significant hit.

Finally, this brings us to Real Estate where it’s looking slightly better for home buyers. The immediate impact of the Fed raising its rates was that the 30-year mortgages have increased to their highest point since 2009. But buyers are looking on the bright side - The inventory in the market is beginning to improve, potentially decreasing the sky-high asking prices.

For the first time in what seems like forever, sellers are beginning to drop their asking prices and more than a dozen cities have seen a decrease in real estate prices.

Wealth Transfer

When you see massive declines in the market, it’s important to not get affected emotionally and look at them objectively to see what’s going to happen. If we look at the past bear markets, we can see that there are a lot of opportunities right now!

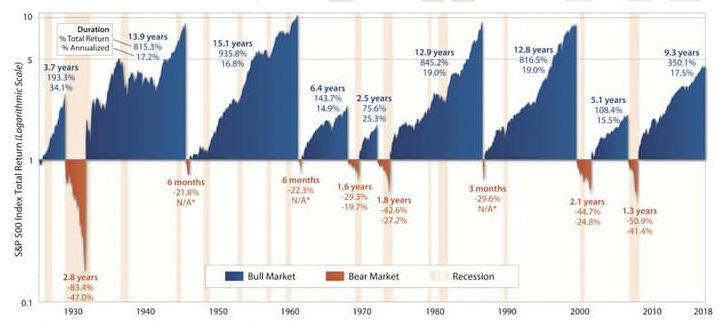

But it’s easy to point to the historical data and say that - on average the bear market lasts just under 1.4 years with a max loss of 41%.

All the crashes are unique in their own way. In 2020, the markets fell 34% in a single month before bouncing back up, in the shortest bear market in history. Prior to that, markets fell 56% over 1.5 years throughout the Great Recession and it took more than 4 years just to break even. This also applies to the Dot-com crash where tech stocks plunged 78% and it took more than a decade for most of them to recover.

But amidst all the doom and gloom is where the real returns are made. The worst thing that you can do right now is to stop your investments or liquidate the investments with the hope of getting in on the bottom. There is a reason I say the same thing over and over again - The best thing to do is to never deviate from your plan during periods of turbulence.

The fact is, if you buy consistently, regardless of where the market is trading with the intention of holding for the next 10-20 years, you would have never lost money!

In general, people panic about their portfolios and dread seeing a bear market. But now is the time to buy at a discount because unless you aren’t a few years from retirement, any drops should be seen as a gift.

After all, what if I had told you that you should invest right after the dot-com bubble when investors thought that tech stocks were done for? Or buying real estate during the 2009 collapse was one of the best plays you could have done in the last decade? Each of the past recessions has provided a unique opportunity that would make patient and consistent investors a lot of money!

In each of these market crashes, it could be argued that “this time is different” and indeed it’s different. No two bear markets are ever going to be the same - I have no idea when the stocks will begin to bounce back nor am I trying to time the bottom. But, I have the feeling that looking back at this, we would end up seeing it as one of the best buying opportunities.

This is exactly what I said at the lowest point of the market on March 20th, 2020 and that is what I will say here again! I stick with the core principles that have worked for over a hundred years and believe that this will be the best opportunity for one of the greatest wealth transfers of recent time. As Warrant Buffet says

“The stock market is a device for transferring money from the impatient to the patient.”

See you next week with another deep dive!

If you enjoyed this piece, smash that like button and share it! Thank you.

This newsletter is great, thanks Graham!

Really enjoyed the newsletter! Your writing is very clear and easy to understand! Thank you!!