What’s up Graham, it’s guys here :-) If it’s your first time here, hit the subscribe button below to join 40,000+ smart investors and never miss an update on the market again. It only takes a second.

Arthur Ragland Momand was a newspaper illustrator, and his name is forgotten today: I wouldn’t have found it either if I hadn’t gone digging behind the story of what he created. While Arthur himself didn’t attain great popularity, he started to work on a comic strip in 1913 about a funny little family of social climbers, the McGinises. The parents, daughter, and maid in the family struggle to match the lifestyle of their neighbors who are never shown in the comic but mentioned by name: The Joneses.

The name of the comic strip was “Keeping Up with the Joneses”, a phrase that has become synonymous with living a life of comparison and status anxiety. The comic struck a chord back in 1913 when it was released and people were struggling to match up to their wealthy neighbors. 110 years later, we’re still not far off – in fact, the problem has intensified!

A recent survey revealed that $2.2 million is the magic number to be considered wealthy. This staggering amount can buy you five median-priced houses, 62 Tesla Model 3s, or 425,531 Big Macs from McDonald's. On one hand, the $2.2 million sum might be more attainable than you think – but it might also not be necessary to live a life of fulfillment in which you feel rich.

So let’s dive into exactly how much money it takes to get “rich”, how to build wealth, and how to make it last a lifetime. Finally, we’ll see what wealth means beyond monetary figures and delve into what it truly means to feel rich.

The Income Threshold

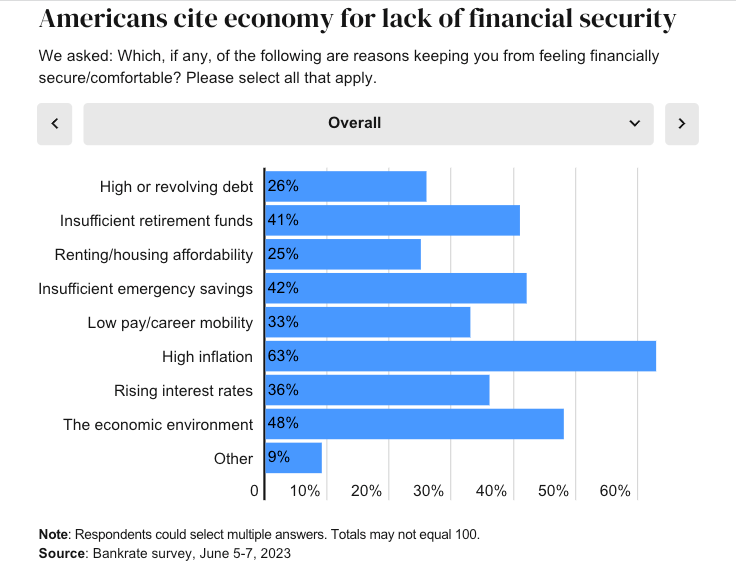

What’s the average amount of money you need to ‘feel’ wealthy? According to BankRate, it takes a staggering average annual income of $483,000 to be considered rich and achieve financial freedom, while $233,000 is the amount needed just to feel secure and comfortable with finances. 3 in 5 Americans feel financially insecure, and even high-earners fall into this category. Americans earning between $80,000 and $100,000 annually report feeling the most financial pressure due to inflation, the economy, and rising interest rates.

Surprisingly, the more money people earn, the more they need to feel financially secure. The survey shows that individuals making $80,000 would require $208,000 per year to feel secure, while those earning $100,000 would need $341,000. To feel “rich”, those numbers go even higher, with 25% even saying they’d need to make over a million dollars a year. Objectively speaking, this is just: BS.

Of course, $2.2 Million is a lot of money, especially when the median US net worth is around $122,000. A starting investment of that magnitude can get you $55,000–$90,000 a year in just investment returns, without ever having to work a job, step foot in an office, or deal with an over-bearing boss. This would definitely give you the status of “wealthy.” But is it necessary to hit that milestone to feel rich? Of course not.

YMMV

Although $2.2 million may seem like an enormous sum, how far it can go depends on your context. For example, the cost of living plays a crucial role. Living in an expensive state like New York significantly reduces the purchasing power of this sum compared to a state like Mississippi. A $2.2 million budget in New York is equivalent to roughly $1,892,000, while in Mississippi, it translates to $2,552,000. That’s a $660,000 spread depending on where you live!

The same applies to the cost of housing, with square foot prices varying significantly across locations. For instance, in Los Angeles, the average price per square foot is $715, whereas, in Little Rock, Arkansas, it is only $137, which is 80% less expensive. This really goes to show you that, depending on where you live, money takes on a different meaning, and spending $500,000 on a house could get you two widely different outcomes:

Charles Schwab also found that in Denver, Colorado, $2.3 Million is how much you’d need to feel rich. But if you’re in San Francisco, that amount skyrockets to $5.5 Million.

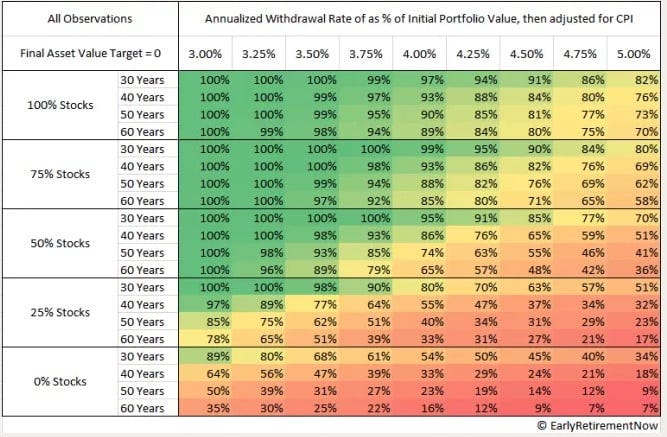

Slow and steady

Another thing to consider is not just how much money you have but, how long it will last you. As I mentioned earlier, $2.2 million invested should be able to safely generate an income between $55,000 and $90,000 per year, depending on where it’s invested, for the rest of your life without you ever having to worry about running out. This works on what’s known as “The 4% Rule,” which - as you would expect - suggests that you could spend 4% of your total portfolio on an annual basis. That’s an incredible income.

In fact, that’s enough to basically earn what the average American makes in a year, without having to actually work and, at a lower tax bracket than actually earning a wage. I’d call that a success. But feeling “rich” earning between $55,000 to $90,000 annually doesn’t quite cut it – according to surveys, apparently. While this income level is significant, surveys indicate that it falls short of what people consider "rich."

Like, a report from YouGov found that people felt that someone earning $90,000 a year was “neither rich, nor poor.” And earning $100,000 or more per year became the crossing point where 56% of people surveyed felt like that would make them “rich.” But in terms of how much you actually need to feel “wealthy,” it depends on how much money you already have.

When surveyed, 92% of people earning between $90,000 and $150,000 per year either felt “neither poor, nor rich” or straight up just “poor.” In fact, throughout all income brackets under $150,000, less than 10% of them felt rich. This was the same result when they surveyed people earning $40,000 per year as it was for people earning over $100,000 per year – despite how much they make, 90% don’t feel like they make enough to consider themselves rich.

Now, this also applies to net worth: According to the investment bank UBS, only 28% of people with $1 million to $5 million in assets considered themselves wealthy and, even when you ask people with more than $5 million in assets, only 3-in-5 thought that they were wealthy. So how does hitting these million-dollar milestones compare with feeling rich?

Keeping up with the Joneses

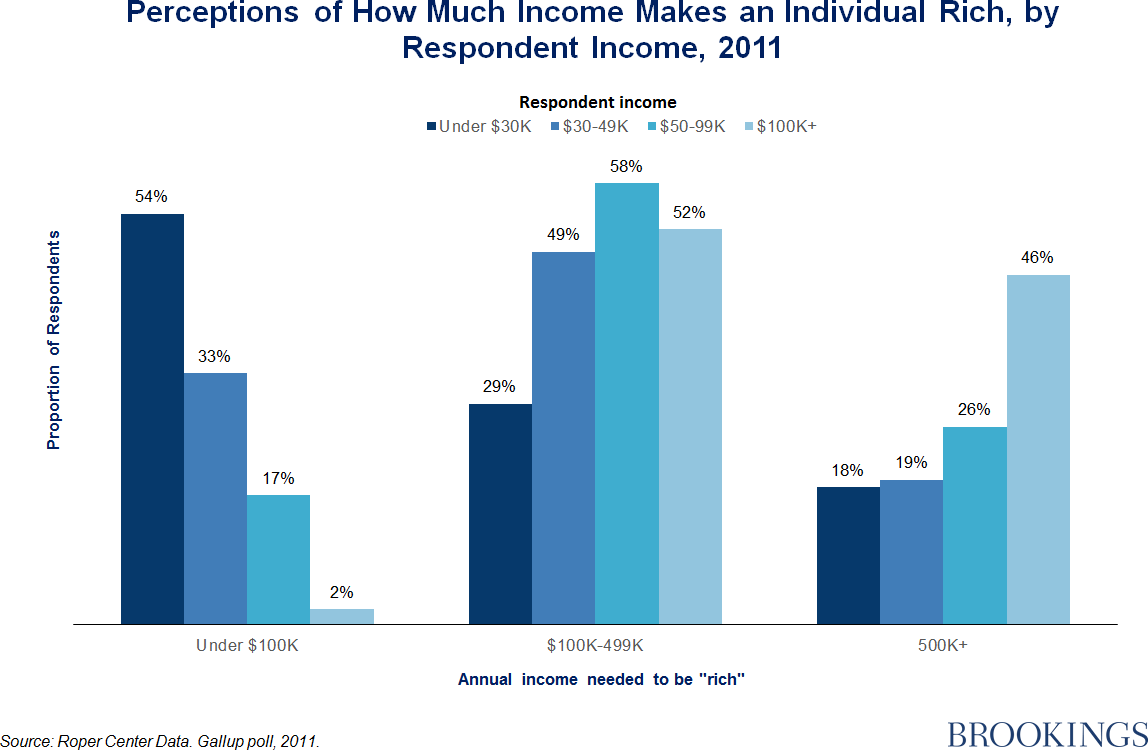

Yes, we’re back to that again. In terms of “feeling rich”, the truth is, we always compare our income to those who are doing better than us. For example, almost half the people earning $30,000-$49,000 per year felt that making $100,000-$500,000 per year would make them rich. But those earning over $100,000 per year felt differently – half of them felt like they’d need to make more than $500,000 per year to consider themselves “rich.”

The more money you make, the higher the bar, and the more you need to make to think of yourself as “Rich.” If you’re earning $50,000 per year right now, chances are, $100,000 per year is rich. Then if you earn $100,000 per year, $250,000 per year is rich. If you earn $250,000, $500,000 is rich. And so on.

The Wall Street Journal even goes so far as to say that “rich is always going to be double what you already make.” Wealth might in the end be a concept to be pursued, not possessed and overall, it’s found that every individual’s benchmark for wealth increases in proportion to their current net worth.

The Hedonic Treadmill theory suggests that regardless of significant life changes, one's baseline happiness eventually returns to a normal level. As income increases, expectations rise accordingly, leading to a perpetual pursuit of more. Furthermore, as individuals make more money, they tend to surround themselves with people who share a similar income level. When you’re making $200,000 per year, you’re living in an area where everyone else makes $200,000 per year, and all of your friends make $200,000 per year, you suddenly don’t feel as wealthy as you once did. Consequently, the feeling of wealth diminishes as the new income becomes the new normal.

Studies support these findings, indicating that even millionaires believe they need approximately $7 million to feel wealthy – and that was back in 2011. “Feeling Rich” is not about hitting a certain dollar amount, or achieving a certain income per year. Even though you might feel a temporary boost from reaching certain milestones, it’s not going to last – and you’re naturally going to seek out the next goal. Despite that, hitting your $2.2 Million milestone could still be possible. Here’s how you could go about it:

A numbers game

All of this, at the core, just comes down to a simple numbers game: How much money can you save, how much can you earn from your investments and, how long are you willing to wait?

By consistently investing $1,000 per month with an 8% average return after inflation, it would take approximately 34 years to reach $2.2 million. Increasing the monthly investment to $2,000 or $3,000 would shorten the time frame to 26 and 21 years, respectively.

“Just invest $2000 per month!” is a lot easier said than done, but consider that the average American is spending $18,000 per year on non-essential purchases and only 32% of Americans are saving money in a 401k, which would often result in a tax-savings of 22-24%. Almost one-third of the food you buy goes to waste, and, categories like dining out, alcohol, and credit card interest are the highest ticket items that could most easily be cut back.

This doesn’t automatically get you an extra $2,000 per month. Although, once you begin:

Itemizing your expenses

Saving the difference

Taking advantage of retirement accounts

Working to increase your income

It becomes more doable over time, and once your investments gain momentum, it’s just about waiting for the power of compounding to kick in. To accelerate this further, you could increase your salary and skills over time, work a side hustle, or rent out rooms to lower your cost of living. Pretty soon, that extra $1000 per month is going to be a lot more achievable.

20 to 35 years might seem like a long time, but if you’re in your 20s or 30s, you’ll eventually be 60 someday – and it’s better to be sitting on a multi-million dollar nest egg by starting from wherever you are today rather than focusing on instant gratification and regretting it later.

Where true freedom lies

In terms of “actually” being wealthy – I hate to be a downer – but $2.2 million might not be enough to get you there. Instead, the investment you might need to make could be in some aspect that money can’t quite buy. For example, 62% say that “true wealth” comes from healthy relationships with loved ones – and that comes with intentional, consistent effort and attention. There’s no substitute.

1000 Americans were surveyed on what mattered to them in life, and things like:

Fulfilling experiences with family and friends

Good health

Career flexibility

Work-life balance

All ranked higher than net-worth and earnings. Even when it came to money, around 70% said that not stressing about money was more important than the actual amount.

Charles Schwab also found the same thing: They reported that having a fulfilling personal life, enjoying experiences, being generous, and having balance all took precedence over making more money.

In my experience too, true wealth comes from having control over your time.

The person who makes $100,000 per year with all the free time in the world is way “wealthier” than the person who makes $500,000 per year working 90 hours per week. Sure, the former might not make as much but, when you consider your options, the person with the time has more choice.

Feeling “rich” is a state of mind not characterized by numbers, but rather by your own gratitude for appreciating what you have, with the time to enjoy it. This very much goes in line with the saying: wherever you go, there you are.

If you’re a person who feels rich on $50,000 per year, you’ll feel just as rich at $250,000 per year. And if you feel poor making $250,000 per year…I guarantee you’ll still feel just as poor making $1 million per year.

$2.2 million is enough money that pretty much anyone can retire from, and live a very comfortable life almost anywhere in the world. But in terms of thinking how much you’d need to feel wealthy, I’d say that true wealth really comes from stepping back and seeing the bigger picture. Just having a roof over your head and food on the table makes you rich in the eyes of someone else who has neither.

Stay safe, stay invested, and I’ll see you next week – Graham Stephan.

If you liked this article, you can forward it to one person who might find it useful :)

Disclaimer: This is not financial advice. This information is intended to supplement your knowledge in the field of investing and personal finance. Please do your own research carefully.

I find that people think they will save a higher % of income when they are older and get pay raises - but the best time is to save a crazy high % early when you have no wife, kids, house, responsibility and can let compound interest do it's work!

Love the article. Thank you.

Thank you for this article Graham :)