What’s up you guys, it’s Graham here! If you want to join 17,900+ smart investors and never miss an update on the market, hit the subscribe button below. It only takes a second and it’s completely free.

I recently learned that the semiconductor fabrication process involves three round trips across the world totaling nearly 25,000 miles! The globalized assembly line is the reality for not only technologically complex stuff like silicon chips but even everyday items such as shoes and clothing. Several iconic American brands have now offshored their manufacturing process; for example, almost all Nike shoes and Levi’s clothing are made outside the United States.

Distributing the manufacturing process across the globe has helped organizations reduce costs, and generate a competitive advantage by gaining access to new workforce demographics, and right now, we are the largest goods importer in the world.

The opening up of global trade not only increased American imports but has also made us one of the most prolific exporters. Several ‘American’ companies do most of their business outside the United States. For example, more than 75% of Intel’s business and half of Facebook’s revenue generation is outside the United States. Even companies like McDonald’s, Apple, and Tesla do a substantial portion of their business overseas. The globalized economy has made it easier for American companies to access markets overseas, while also creating new jobs and bringing down costs.

But all of this comes with a catch. More than ever, our economy is now plugged into the global market and is susceptible to crises across the world. For example, back in 2012, the flooding in Thailand increased the price of hard drives back home, and more recently, we saw how the chip shortage caused car prices to increase by nearly 40%.

We often try to predict black swan events within the country and how that could change the direction of our economy. But, in the era of international supply chains, our way of life is now vulnerable to issues from the other side of the world as well. The geo-political scenario right now is quite complicated with the Russia-Ukraine crisis, global inflation, and China’s stumbling economy. A catastrophe in any of these could lead to a domino effect that can cripple the global economy. So this week, let’s do a deep dive into the critical global issues right now and how they can affect the US economy and consequently your investments back home.

Crisis in Europe

The European Union (EU) is one of our biggest trading partners and right now they are going through a serious crisis due to the Russia-Ukraine war. In addition to the tremendous humanitarian suffering inflicted on the Ukrainian people, the invasion threatens to disrupt global semiconductor production as 90% of our semiconductor grade Neon comes from Ukraine, while 35% of Palladium is sourced from Russia. Ukraine also plays a key role in global food security as it is a major wheat producer and exports more than 50% of the global sunflower oil supply.

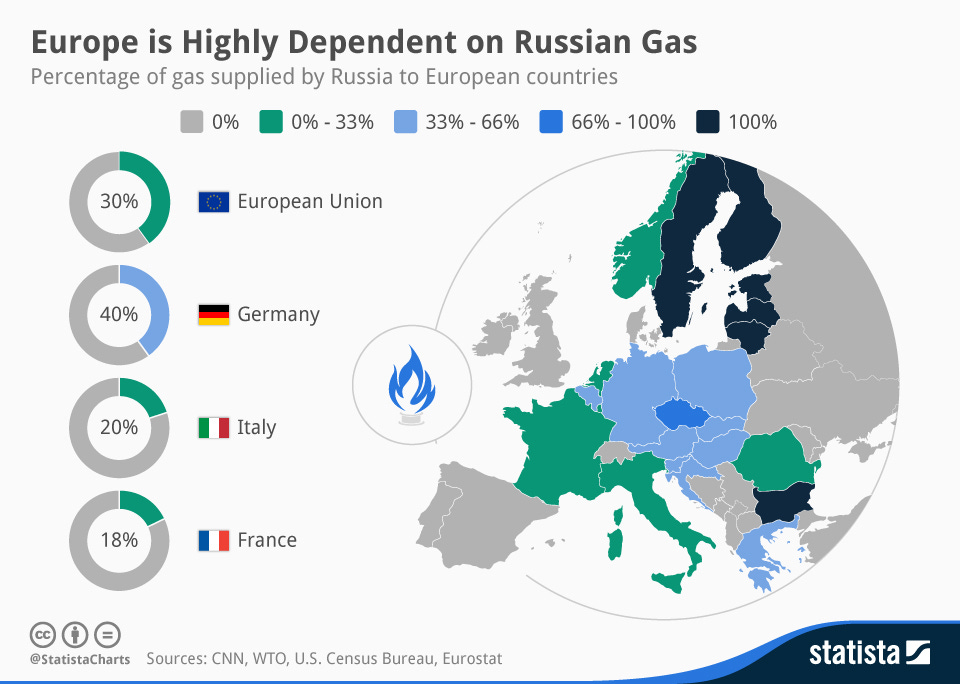

However, the biggest economic casualty of the crisis is energy security. The EU is one of the biggest consumers of Russian petroleum products with 40% of its energy being supplied from there. In an effort to thwart the invasion, the EU and US have banned the import of Russian oil, while also imposing crippling economic sanctions on the country. Responding in kind, Russia reduced the supply of petroleum products and just recently announced that they are shutting off the natural gas supply to the EU until the sanctions are lifted. With an approaching winter, EU leaders are now scrambling to secure the natural gas supply used to keep homes warm.

The most immediate impact of the energy crisis is skyrocketing inflation across the EU since petroleum and natural gas make up a large segment of the consumer price index. Several critical businesses have been hit hard by the rising energy bills and many are on the verge of shutdown. Goldman Sachs now predicts that inflation in the UK could cross a whopping 22% and other countries, which depend on natural gas for heating are also feeling the pinch. Energy bills have skyrocketed across the EU with protests, strikes, and energy bill boycotts starting in different countries and it is unclear whether these protests will change the policy approach towards Russia.

With the situation in Ukraine unresolved right now, the upcoming winter looks grim for the EU economy. However, Europe is not the only region facing an issue right now. There is another crisis developing in the east.

Wounded Dragon

China, the world’s second-largest economy is responsible for 28% of the global manufacturing output and they are at risk of complete financial collapse due to 3 confounding factors.

Zero Covid Policy - Since the beginning of the covid crisis, China has followed a strict zero covid policy, i.e no tolerance for the spread of Covid. Right now, they enforce authoritarian lockdowns, maintain tight regulations, and pretty much do anything in their power to prevent the population from becoming infected. There have been several dystopian videos and news headlines about the shutdowns and just yesterday, citizens were stopped from evacuating during an earthquake due to the lockdown.

Crumbling real estate - As I covered in depth in my newsletter last month, excessive speculation, corruption, and a lack of oversight has led to a real estate crisis in China with many developers filing for bankruptcy, the most popular one being Evergrande. Real estate drives about a third of China’s economic activity and housing accounts for nearly 70% of household wealth. As the number of incomplete projects grew, protests have broken out in several parts of China. The crisis has further spread to the banks which lend most of their money to real estate developers leaving the system vulnerable to bank runs.

Slowing production - The combined effects of zero covid policies and the real estate crisis are likely to result in slowing production and fewer exports from China to the USA. China is also likely to fall far short of its annual growth target of 5.5% as its export growth recently fell to nearly 7%, well short of analyst expectations.

Ripple effects back home

While these international issues undoubtedly affect our economy, it is further complicated by homegrown factors as well. In particular, the Fed is raising interest rates at a slightly faster pace than the rest of the world to fight inflation. In times of international crisis, people hold the US dollar as a safe store of value, and as a result, the demand for USD has increased, resulting in the dollar index reaching a two-decade high. The Euro has fallen below the value of the US dollar for the first time in 20 years and it is becoming increasingly expensive for other countries to trade in US dollars.

Production and supply issues can have cascading effects back home as we saw from the semiconductor crisis increasing car prices. Even without a supply chain disruption, a recession in the EU or China will undoubtedly result in fewer US exports, less international investment, and fewer profits for American businesses. We are also likely to see more countries producing critical items ‘in-house’ to avoid future shortages. The recent CHIPS bill, focusing on enhancing semiconductor production back home is likely a step towards this.

In general, the global crises have resulted in increasing inflation pretty much everywhere, resulting in households having to pay more for goods and services. This results in less money to spend on things other than bare necessities, which is driving down, production and growth globally. Two of Europe’s largest economies are already showing signs of recession and businesses in the UK are struggling due to rising energy costs. There are also recession fears back home with a heavily inverted yield curve, high inflation, and low unemployment, all of which have historically always heralded a recession.

Hunkering down for the storm

The global economic outlook looks bleak right now with pretty much every major economy under the shadow of recession. Realistically, it is likely that both the US and EU will experience near-zero growth in the future. A reduction in demand is desperately needed to bring down inflation right now and a spell of low economic growth might be the key to that. For us individual investors, at the moment, it is best to reduce expenses, keep a diligent budget, stay employed and continue investing. In the meantime, let’s keep an eye out for global issues and hope that conditions will improve for everyone.

Sidenote

This is my first attempt at covering economic issues on a global scale and a lot of effort went into researching international news, so do let me know what you guys think. Further, it is impossible for me to address every issue, so notify me if I have missed out on any key events. What do you think will be the biggest global crisis in the next few months? Let me know in the comments!

See you next week with another deep-dive!

These newsletters are so good!! Keep it up

Great article! Well written and very informative. Thank you for your hard work!