Gold Fever

Why investors are flocking back to the oldest form of money

Look, it’s no surprise that I’ve been a huge advocate of doing anything you can right now to cut back, lower expenses, and save as much money as you can.

When it comes to saving money and finding less-expensive alternatives - our sponsor, Helium Mobile is there to help.

Helium Mobile is a new phone carrier with plans that actually PAY YOU to use them. You could potentially cut your cell phone bill to $0 per month with their free plan offering 3 GB of data, 100 minutes of voice, and 300 texts – no credit card required. If you find yourself needing MORE, they have other options like an unlimited plan for $30 per month, all with no contracts…

They’re also actively expanding their coverage. I love this because Helium Mobile gives me a no-cost second line on my existing phone through an eSim. Anytime I’m in a location without good cell service - I can easily switch over (again, all for free).

So if you want to try it out, even just as a FREE option for extra coverage, feel free to sign up. Use the code GRAHAM to get $10 in Cloud Points for Gift Cards. You can also refer your friends, and if they sign up – you’ll each get $10 worth of cloud points. It’s a win-win. Enjoy!

Download for iOS | Download for Android

Read till the end on this one, because I’m announcing something…

In 1933, at the height of the Great Depression, the U.S. government minted 445,500 twenty-dollar gold coins called “Double Eagles.” Just before they were released into circulation, President Franklin D. Roosevelt signed Executive Order 6102 banning private ownership of gold. The order was controversial. Many saw it as a breach of trust and the government going back on an earlier promise. But the U.S Government didn’t have a choice, because they needed gold bullion to keep the Federal Reserve afloat. Gold was confiscated from people at a time when they were all turning to it as the last safe resort.

Meanwhile, this also led to almost all of the Double Eagles being melted down. Only a handful survived – less than 20 – and today, just one is legally owned by a private citizen. The “Weitzman specimen” as it’s called, was sold in 2021 for a record $18.9 million, making it the most expensive coin ever sold.

That tiny golden coin is a symbol of that time of scarcity, fear, and value – everything that gold is connected with. A century later, the same dynamic is playing out with people turning to gold once more. This time, it’s on a global scale.

The dollar is weakening. Investors are once again turning to gold in this time of uncertainty, with gold notching 55 record highs over the last 12 months, and it’s up nearly 30% year-to-date. Some analysts are even forecasting that gold could hit $5,000 an ounce.

What’s driving the gold frenzy? Should you hold gold? And how much?

Gold vs. the Dollar: A chaotic history

What’s the ideal currency? It’s something that fulfills some conditions – it needs to be rare, durable, valuable, portable, divisible, etc. For thousands of years, gold has served as money because it ticks so many of these boxes. Especially rarity. It’s estimated that if all the gold in the world was mined, it would fit inside a 23 meter cube.

The U.S formalized gold’s role with the Coinage act of 1792 creating gold and silver coinage. Later, under the “gold standard act,” dollars could be redeemed for gold. With the U.S still being a rising power, the backing of gold gave the dollar credibility. People trusted banks knowing that their notes could be exchanged for gold at any time. Then it collapsed.

During the Great Depression, people panicked. Demand for physical gold started soaring and this became a problem because people started pulling gold out of the banks at an alarming rate. The government was in a fix – to revive the economy, they needed money, but to print money they needed gold bullion to back at least 40% of the money in circulation. This is what prompted Roosevelt’s controversial ban (which did stimulate the economy and arguably fix the depression).

The pegging to gold was still intact – after World War II, the U.S dollar became the world’s reserve currency because it was pegged to gold. But after the Vietnam War, the U.S was burdened by debt and abandoned the gold standard completely in 1971 turning the dollar into a fiat (paper) currency. As the Market Sentiment blog writes, the dollar has lost over 85% of its purchasing power since then, while gold prices have risen approximately 85-fold.

Gold has retained its purchasing power surprisingly well. In 1906, an ounce of gold would buy you 690 hot dogs, and more than a hundred years later, in 1924, it would still get you 675 hot dogs (what

calls the “Frankfurter Index”). But the question is: Why is it surging now?

Safe Haven in volatile times

Today, gold isn’t just beating inflation. It’s outperforming stocks. While trillions have been wiped from stock markets in 2025, gold continues setting new records. There are several forces at work here:

Fears of the dollar being unstable: The U.S. dollar recently fell to a three-year low. There are concerns of political instability, and the Federal Reserve is under pressure with Jerome Powell being called “a major loser.”

Central Bank Buying: Central banks bought more than 1,000 metric tons of gold a year in 2022 and 2023, with 2024 on track to break records again.

Geopolitical Tensions: Escalating tensions with China and fears of a trade war have added to the uncertainty.

In times of uncertainty, gold acts as a “fear hedge” for investors like us. It’s been around for a long time, and when faith in governments wavers, people want to trust in something a little more tangible. But how do Gold and Stocks move against each other? Is Gold a hedge against the stock market’s crash?

Gold vs. Stocks

During times of crisis, gold has served as a shock absorber:

Stocks fell 30% during Black Monday, Gold barely moved.

During the Dot-Com Crash, the S&P 500 declined 44% and Gold fell only 12%.

During the Covid crash, gold dipped only 0.86%.

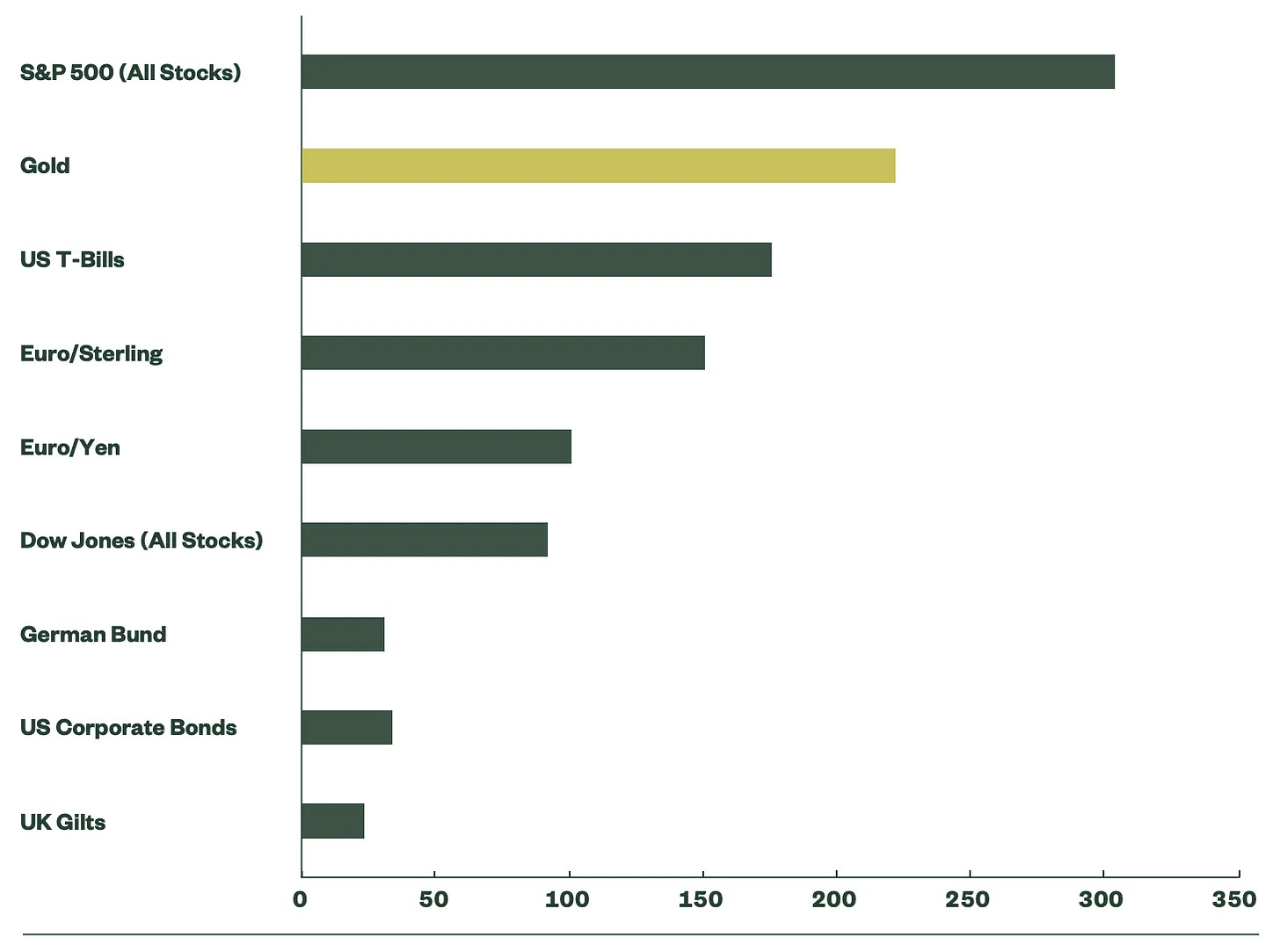

Gold has outperformed U.S. bonds, commodities, and global equities over the past 20 years, and has increased at an annualized rate of 8.3%. Also, gold is one of the most liquid assets, with a daily trading volume that’s only exceeded by the S&P 500.

However, over longer periods, gold’s performance is less impressive. From 1980 to 2023, gold delivered just 3.2% annual returns—barely keeping up with inflation—while stocks averaged 11.7%.

Moreover, gold is not a perfect hedge against stocks or bonds. Their long-term correlation is zero, meaning gold doesn’t move in the opposite direction as stocks, but more or less in a disconnected way.

Is it a good time to buy?

Experts see a bright future for gold. Jeffery Gundlach believes it could reach $4,000 per ounce and Goldman Sachs suggests $4,500 is possible in an extreme-risk scenario. Rob McEwen sees potential for $5,000 per ounce.

But here’s the thing – the recent surge could be driven by institutional buying sprees and short-term fear, instead of fundamentals. After sharp rallies, gold has historically gone through long flat periods. As to whether it’s a good time to buy, here’s what I found interesting: The Gold to S&P 500 ratio. This can be an indicator for not just when to buy gold, but also when stocks are undervalued.

The ratio tracks how many ounces of gold are needed to purchase the S&P 500 index. The higher the ratio, the more valuable stocks become. When it takes more than 2 ounces of gold to purchase the S&P500, the market is overvalued, and when it takes less than 1, it’s undervalued. The indicator has been higher than 2 for quite some time now… and analysts believe that if the current trend continues, it might go higher.

How gold fits into your Investment Portfolio

In my view, gold should be treated as a hedge against fear. It’s not a replacement for traditional investing. Most financial models recommend limiting gold to 10-15% of your portfolio. If you decide to invest, there are two ways to invest: Through physical bullion that comes with storage and insurance requirements, or via ETFs like GLD which provides liquidity while charging fees for the same.

My emphasis is on diversification. My portfolio includes cash, treasuries, U.S stocks, international stocks, real estate, Bitcoin ETFs… and potentially a small allocation to gold though I’m not a big fan. I’m more of an aggressive investor with a long-term horizon focusing on the stock market, so gold isn’t of much interest to me except as a hedge against extremes.

But remember, if you do decide to invest in gold, the goal isn't to "bet" everything on it but protect against worst-case scenarios while staying invested across asset classes.

Gold is not a magical bullet. In times of economic fear, it feels safe. But its real strength is in its ability to hold value over a long period of time, not grow it.

Like that single Double Eagle coin, gold’s appeal is as a symbol of the eternal. It is less about making fortunes overnight and more about safeguarding wealth in an unstable world where investors seek something real to hold onto.

That’s it for today. If you found that useful, please share it with a friend (hitting “restack” lets more people see it) and drop a comment with your thoughts. I’ll see you again next week! Don’t forget to check out today’s sponsor, Helium Mobile.

Also, an announcement: I am now available for a one-on-one consultancy call with a few slots opening on a first-come-first-serve basis. I’ve had the privilege of working with incredible people through my consulting calls, and the feedback has been amazing. Many have shared how these sessions provided clear actionable strategies and a fresh perspective on their projects — from growing their YouTube channels to figuring out business & real-estate deals.

It’s been incredibly rewarding to see these successes, and I’m excited to continue helping more people achieve their goals. If you’re interested, fill out the Google Form to get started. I look forward to connecting with you!

*sigh* People really need to read The Bitcoin Standard. Or Lyn Alden's Broken Money. Or really any book that covers the principles of sound money. Watch the YT video "What is the problem?" by Joe Bryan. None of this costs a lot of time or money to do.

Good luck out there.