The Greenland Gambit

Crisis averted or just the beginning?

For the last week, the financial world was held hostage over the most unexpected chokepoint: Greenland. We were looking at a potential trade war with Europe, threats of military escalation in the Arctic, and a February 1st deadline that would send gold prices shooting up.

Then, in less than 24 hours, the narrative flipped.

President Trump has officially ruled out military action and announced that the tariffs on our European allies have been suspended. The reason is that a new framework for a future deal regarding Greenland has been arrived at. It isn’t over yet. It’s just on pause – for now.

If you are feeling dizzy, you aren’t alone. The markets just went from pricing in a trade disaster to hitting a relief rally in the span of a single trading session.

What’s the reason for this upheaval? Because this isn’t just about buying an island. It’s about:

The Arctic Cold War

AI and the control of 21st-century technology supply chains

A negotiation gamble. One that could secure American dominance if it pays off, and break the European alliance completely if it collapses.

But if you’ve been paying attention to the mechanics of negotiation rather than the headlines, this wasn’t chaos. It was a formula. Today, I’ll break down exactly what happened, why the Greenland Gambit is far from over, and what this means for your portfolio and investment strategy.

The GIUK Linchpin

Why was America willing to threaten a trade war with its oldest friends over an icy landmass? To answer that, let’s look at the map like a military strategist.

There is a concept in naval warfare known as the GIUK Gap (Greenland-Iceland-United Kingdom). This is the naval choke point in the North Atlantic. Historically, this gap is the only gateway for Russian submarines to enter the Atlantic Ocean via the Arctic, and threaten American/European shipping lanes or even the US East Coast. This chart is being posted non-stop, but it’s only part of the picture:

Currently, Greenland is a semi-autonomous territory of Denmark. While we maintain a presence there – specifically Thule Air Base, which houses roughly 150 American troops and critical missile-warning radar – it’s technically on Danish soil that we rent.

The argument from the White House is blunt: Renters don’t set the rules.

As the Arctic ice cap recedes due to changing weather patterns, new shipping lanes are opening up. Russia and China are aggressively expanding their “Ice Silk Road” ambitions. The U.S. position is that we cannot afford to rely on a European landlord to approve our security upgrades. If China builds infrastructure in Greenland (which they have attempted to do by bidding on airport projects), they bypass the GIUK choke point.

Acquiring Greenland isn’t about ego. It’s about cementing the unsinkable aircraft carrier of the North Atlantic. But there’s one more thing…

The Resource War: Chips, not ice

The second driver of this crisis is the one most relevant to your portfolio:

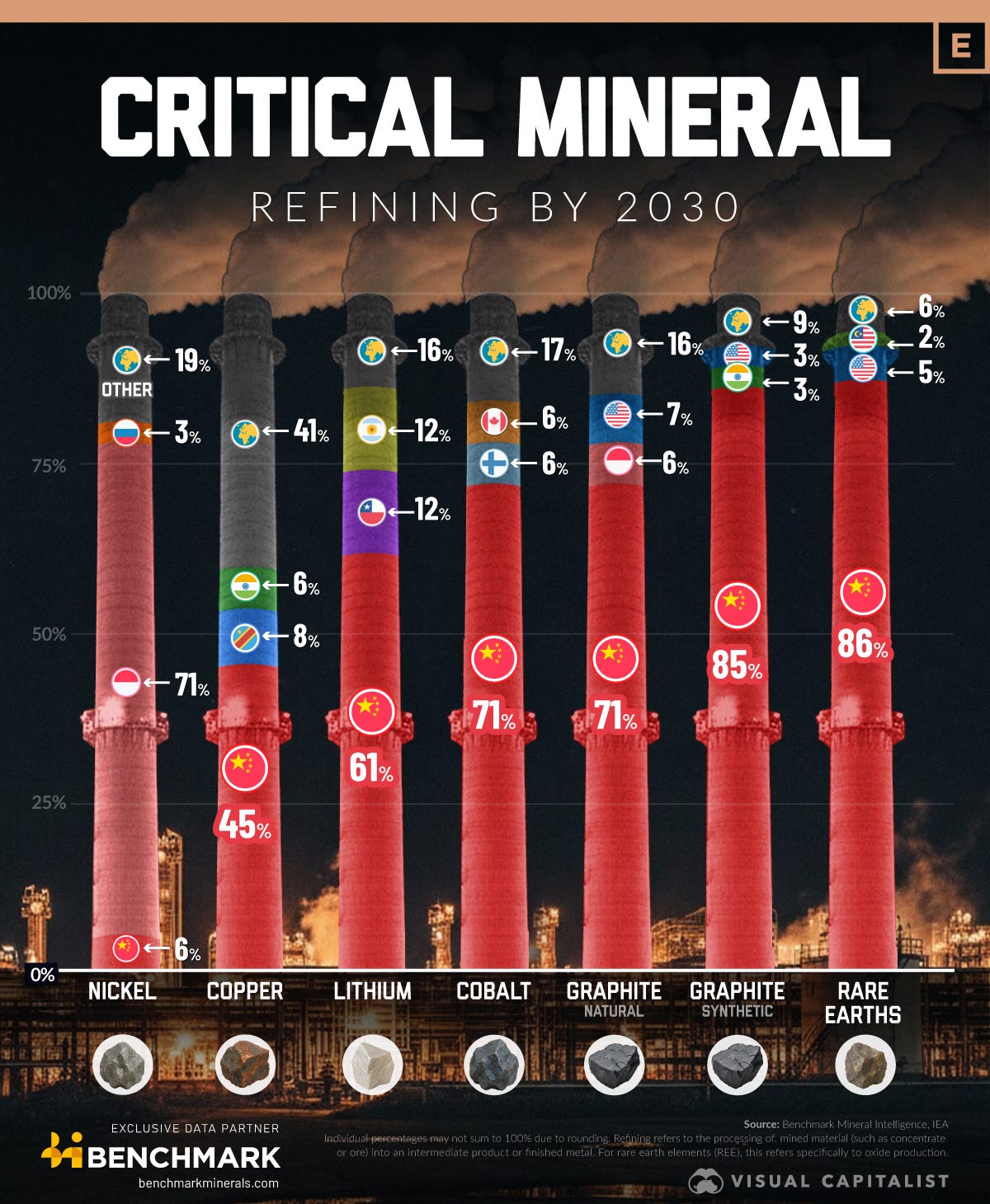

Rare Earth Minerals.

Rare earth minerals are indispensable for latest technology: batteries for Electric Vehicles, guidance systems in missiles, magnets used in wind turbines, and chips that process AI infrastructure. The US is betting big on AI with hundreds of billions of dollars in investment, and its crucial to control the infrastructure that bet is made on.

The media often simplifies this to “Greenland has minerals.” But that misses the point. The United States has minerals. We have rare earth deposits in California, Texas, and Wyoming. There are deposits in Canada and Australia. We don’t need to buy an island to find rocks. So, why is the White House risking a trade war for this specific territory? Because of a chemical variable that gives us an edge:

Processing Economics.

Most rare earth deposits in the world are mixed with Thorium, a radioactive byproduct. This is true for the US and China:

In the US: Thorium is a liability. You can’t sell it, so you must pay millions to treat it as nuclear waste. This Radioactivity Tax kills profit margins and is exactly why we shut down our biggest plants decades ago (Here’s how we lost the plot).

In China: They dominate 90% of global processing not just because they have the mines, but because they were willing to absorb environmental costs that the West refused to pay (Read the tragic story of dumping waste into Weikuang lake).

For decades, the West outsourced the processing of rare earths to China to keep costs low and environmental regulations easy. The result is that China controls the supply chain for the most crucial raw material of the 21st century economy.

Enter Greenland.

Greenland is home to the Kvanefjeld deposit, a geological anomaly that changes the math completely. It doesn’t just hold rare earths: it holds massive concentrations of Uranium Oxides.

This flips the economic equation. Instead of the radioactive byproduct being a waste you pay to hide, it becomes a fuel you can sell. By acquiring rights to this deposit, the US could sell the uranium to the nuclear industry to subsidize the cost of rare earth processing. It creates a “negative cost” structure that allows the West to finally undercut China’s prices without needing state subsidies.

By acquiring Greenland, the United States wouldn’t just be buying land. It would be buying mineral independence. It would secure a domestic supply chain for the next century of high-tech manufacturing, cutting China out of the loop.

The tariff threats set for February 1st weren't just about territory. They were a strategic lever to overturn local bans on uranium mining and unlock the only deposit on earth where the waste pays the bills. The US is essentially saying to Europe: “Help us secure this processing hub, or we all remain hostage to Chinese supply chains forever.”

Don’t Miss the Signal

The financial landscape is shifting faster than the headlines can keep up. That’s why I’m publishing this emergency issue today. My goal is to cut through the noise and give you the strategy you need to protect your wealth. Join our community of 39,000+ intelligent investors to stay ahead of the curve:

The Economic Trade Bazooka

On January 17th, President Trump accused European allies of deploying troops to Greenland for “purposes unknown.” In response, he announced a phased tariff plan.

It was to start with 10% on imports from Denmark, Norway, Sweden, France, Germany, the UK, the Netherlands, and Finland on Feb 1st. If a deal wasn’t reached by June 1st, that rate would have climbed to 25%. Europe in turn threatened retaliation with a “Trade Bazooka.”

Thankfully, this is on pause for now. But what happens if this plays out?

If something like this goes into effect, the stock market would feel the pain. A trade war with Europe is fundamentally different from a trade war with China. The economies are more integrated, and the goods are of higher value. If Europe retaliates, we aren’t looking at cheap plastic goods getting more expensive. We are looking at:

German Autos: A massive blow to the German industrial base, which is already struggling with energy costs.

French Luxury: LVMH and Kering rely heavily on the American consumer.

Pharmaceuticals: A huge portion of U.S. pharma imports come from Ireland and the continent.

When tariffs hit, companies face a binary choice: absorb the cost (crushing their profit margins and stock price) or pass it to you (increasing inflation). The largest companies would face the most disruption in their supply chains. Investors were pricing in this lose-lose scenario. The volatility in the S&P 500 wasn’t panic. It was a repricing of earnings expectations for Q1 and Q2 based on lower global trade volume.

I want to hear your thoughts: This is one of the most polarizing moves in modern trade history. Is this a stroke of “4D Chess” negotiation to secure America’s future, or a diplomatic disaster that will alienate our closest allies?

It’s only crazy until it happens

It is easy to dismiss the idea of buying a country as a relic of the 19th century. But history tells us that today’s absurdity is tomorrow’s strategic genius. The US went from being a country the size of Mexico in 1783 to the size of Europe today. How do you think it happened? The U.S. has a long history of solving geopolitical problems with a checkbook rather than a tank:

The attempt to buy Greenland isn’t an aberration. It’s a return to classic American expansionist strategy. The only difference is that in 2026, the stakes – and the price tag – are significantly higher.

The Trump Playbook: Anatomy of a Deal

If this feels like chaotic improvisation, there might actually be a method to this madness. According to analysis from The Kobeissi Letter, the current events follow a strict, 13-point negotiation algorithm that Trump has used repeatedly.

It operates on a cycle of Pressure → Panic → Relief. The stages are roughly:

The Threat: Announce a tariff or drastic measure (The Greenland Ultimatum).

The Double Down: While markets are closed on weekends, escalate the rhetoric to maximize Monday morning anxiety.

The Dip: Allow the market to sell off, creating pressure on the opposing side (Europe) to come to the table to save their own economies.

The Pivot: Signal that discussions are productive, causing markets to rally.

The Deal: settle for a compromise that looks like a victory (e.g., a 99-year lease of Greenland’s military bases rather than an outright purchase).

Where are we right now? At the time I started to write this article, we were at the dip. The threat had been made, the double-down happened over the weekend, and the markets were opening to volatility. Just as I was completing it, Trump ruled out using military force and suspended tariffs – and we moved on to the pivot, with markets bouncing back. Things are changing fast here, and I suggest you follow The Kobeissi Letter on X to track the developments as they happen:

The Three Scenarios: How Does This End?

Knowing the playbook is one thing, but knowing the endgame is another. Realistically, there are only three ways this standoff concludes.

The United States Buys Greenland Outright. In this scenario, the USA pays Denmark, Denmark signs the deal, Greenland gets transferred, and American flags go up. This is highly improbable because Denmark doesn’t “own” Greenland in a way that allows them to sell it. The people of Greenland would have to vote “Yes” to becoming American, which looks unlikely.

The Land Lease Compromise (Control Without Ownership). Trump’s demand that “we have to have it” doesn’t necessarily mean holding the deed. It means control. This scenario involves a 99-year lease, massive military expansion rights, and exclusive mining agreements. Think of it like living in a house where you have the keys, you pay the utilities, and you renovate the kitchen, but your name isn’t technically on the title.

The Nothing-Burger (Total Bluff). This entire event is a disguised negotiation tactic to apply pressure for something else entirely: perhaps better trade rates with the EU or increased NATO spending from Germany. Timelines get extended, tariffs get delayed, and the market moves on.

Option 2 looks most likely as it’s the path of least resistance. It allows Trump to claim a victory (”We secured the Arctic!”), it allows Denmark to save face (”We didn’t sell our citizens!”), and it keeps the shipping lanes open.

What This Means For Your Money

So, how do you trade a geopolitical crisis?

1. Watch the Safe Havens

Gold at $4,700 and Silver near $100 aren’t accidents. They are the market’s fear gauge. When the largest economy in the world (USA) threatens the second-largest economic bloc (EU), fiat currencies look less attractive. Investors are treating precious metals as insurance policies against a trade war spiral.

2. The Dollar Wobble

The U.S. dollar is usually the safe haven. But in this specific scenario, the U.S. is the source of the instability. This has caused a rare decoupling where the dollar weakens while gold rises. If the tariffs go into effect on February 1st, expect short-term pain for the dollar as European money moves to neutral assets.

3. Stay the Course

Despite the headlines, the Trump Playbook suggests a resolution is the goal, not permanent economic destruction. Panic selling your long-term index funds because of a diplomatic spat is usually a mistake. The market hates uncertainty, but once a deal is struck (or a lease signed), the relief rally tends to be violent and fast.

My Plan: What I Am Doing With My Money

With gold hitting all-time highs and the dollar selling off, it is tempting to try and time this trade. You might feel the urge to sell everything and wait for the dust to settle, or go “all in” on commodities.

I am doing neither.

My strategy remains exactly the same as it was before this news broke, and exactly the same as it will be after it passes. I am continuing to invest consistently into low-cost, broad-market index funds (like the S&P 500) and hold real estate for the long term.

Because if you look at history, geopolitical panic is almost always a buying opportunity, not a selling one. The market hates uncertainty, which is why we see this volatility now. But once a resolution is reached, whether it’s Option Two or Option Three, the market usually rallies on the certainty. Trying to time the market is a disaster too. If you panic sell now, you lock in losses and miss the recovery. As long as you have a diversified portfolio and a long horizon, these headlines are just noise.

Stay the course, keep buying the dip, and let the compounding do the heavy lifting.

The winners in the next 6 months will be those who recognize the difference between noise and signal. The noise is the political outrage. The signal is the strategic importance of the Arctic. Invest accordingly.

Found this analysis helpful? If you want to support independent financial journalism that digs deeper than the 24-hour news cycle, please like this post and share it with someone who needs to see the bigger picture.

Disclaimer: This post is for informational and educational purposes only. None of this should be interpreted as financial advice. Please do your own research carefully before investing.

Why can't We Use Somali Welfare Fraud Loot to Buy Greenland?

https://torrancestephensphd.substack.com/p/why-cant-we-use-somali-welfare-fraud

Hey Graham,

First, a personal note: A few years ago you used my image and name in a thumbnail claiming I was "refusing to work." This is factually incorrect and damaging to my professional prospects. I’d appreciate a correction. That framing doesn’t reflect the reality of my career or my work ethic.

Regarding Greenland: There is a sliver of truth to the "Thorium Trap," but you’re overstating Kvanefjeld’s importance while oversimplifying the geopolitical reality. The US interest is primarily about deep-water ports and AEGIS defense. Kvanefjeld doesn't smooth a supply chain if Greenland's government won't let us put a shovel in the ground.

Greenland's environmental sovereignty would not end as a U.S. territory. Under U.S. law, the rights of indigenous peoples in territories are a major legal pillar. The Inuit population has soundly and democratically rejected this idea. Moving the deposit into a U.S. zip code doesn't undermine them.

That said, securing the Kvanefjeld deposit under U.S. strength would be a boon to nuclear non-proliferation efforts, ensuring these high-grade materials are managed under Western safeguards rather than becoming a regional security liability vulnerable to adversarial "velvet glove" takeovers.