Buyer's remorse

The housing market is digging itself into a hole

What’s up Graham, it’s guys here :-) If you want to join 28,570+ smart investors and never miss an update on the market, hit the subscribe button below. It only takes a second and is completely free.

White Elephants are rare and majestic creatures. In Thailand, they are more than that: The power and majesty of the king are proportional to the number of White Elephants he owns. King Bhumibol Adulyadej from 1946 to 2016, for example, possessed 21 white elephants over his reign and was considered divine! Sometimes, the king would gift a white elephant if he wanted to honor the person. But secretly, everyone hoped they wouldn’t be on the receiving end.

Getting a white elephant was simultaneously a blessing and a curse. It was a symbol of high status and favor in the eyes of the king. But it was also an extremely expensive gift to maintain. The elephant had to be fed, watered, washed and kept in perfect health. Because the animals were sacred, they could not be put to work as beasts of labor. They could not be given away, and they were a financial burden. Recipients would regret getting the royal gift.

As the housing market is crashing with no signs of slowing down, I can’t help but wonder - Are people who bought a house in 2021 and 2022 experiencing similar feelings? 72% of recent homebuyers said they had regrets about their purchase, and 30% said that they rushed the decision. 36% of the buyers made an offer on the home without even seeing it in person. The cracks are starting to show…

Underwater

Housing is considered a generally safe investment because long-term trends are generally upward. You could buy a stock and be down 20% in a year, but that usually doesn’t happen with housing. But last year was different - We saw one of the most expensive housing markets, with people willing to pay exorbitant amounts to just get their hands on any house, and now that prices have started falling, it’s hurting the buyers. Mortgage payments relative to income are much higher than the 2013-18 average.

With housing prices falling, nearly 10% of homes purchased in the last 9 months are partially underwater on their loan. Usually, home equity would act as a buffer against delinquency because you could refinance or use home equity to get a credit line. But with housing prices falling, the home equity positions are smaller. 40% of homes bought this year have less than 10% equity left to tap, and there is a large percentage with negative equity too.

The ones with no money to put down would be the most impacted as we enter the seasonally slowest months. Let’s look at the market's seasonality to get a better grip on this.

Seasonal shifts

The markets may or may not be cyclical, but human behavior definitely is. Housing markets are usually the hottest in the period around spring to summer, and most sellers take their properties off the market during winter. The bottoms and peaks in historical housing prices coincide predictably with these times. The reason is simple: School season and holiday season. Moving house is a major life change, and people take a good school district into consideration when shifting, usually around May to August when schools are closed.

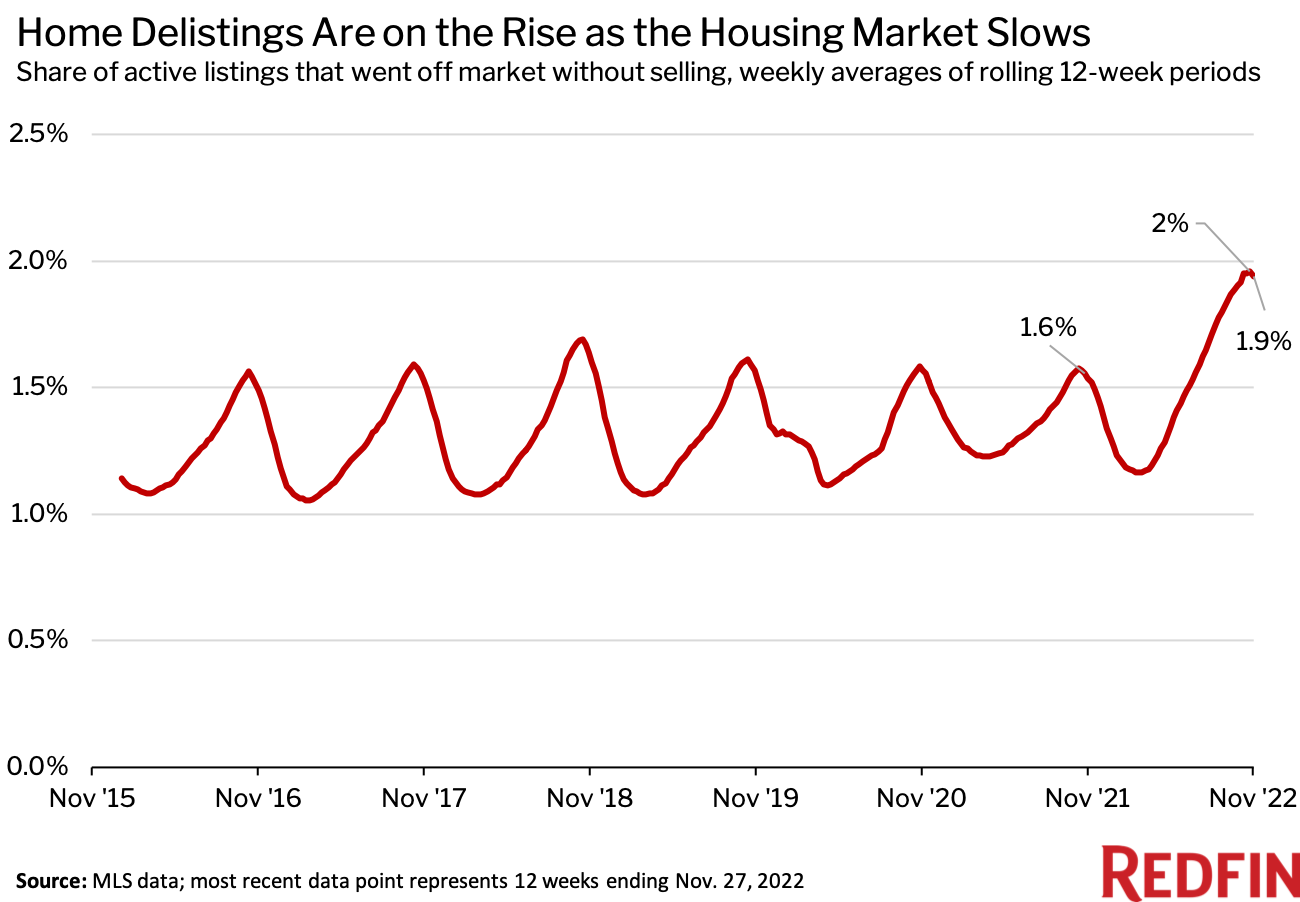

On the other hand, Winter is a difficult period to move house, and very few people want to move during Thanksgiving or Christmas - So these are usually the dullest months in the market. This time around, a terrible housing market combined with the seasonal dip has made the numbers look even worse. For example, Redfin data showed that 2% of homes were being taken down every week this November, which is twice the seasonally adjusted average. Weaker consumer spending and excess inventory have also led to a drop of 1% in national rents in November.

The worst affected parties due to this seasonal decline are probably the ones who can afford it the least…

FHA Loans and defaults

There are two ways to get a mortgage. One is the conventional route, which requires a higher down payment and a stronger credit score. The other route is to go for an FHA loan which allows you to put down as little as 3.5% in down payment without strict requirements such as a strong credit score. It enables many more people on the road to becoming a homeowner, but in a downward market, these borrowers are the first to get hit. Any decline in housing value puts them upside down on their loan almost immediately as their home equity begins to drop.

National housing prices have dropped by an average of 7.6% in Q3, the largest decline since 2009, and many new home buyers owe more on their loans than what the home is currently worth. In some locations like Colorado Springs, Honolulu, and Riverside, California, more than 20% of homes have limited or negative equity. Nearly two-thirds of FHA borrowers have less than 10% equity. If the market continues to fall, they are in a precarious position.

The good news is that delinquency rates are still historically the lowest they have ever been, and delinquency is mainly restricted to those with a credit score of 680 or below. With all that data, let’s look at what is coming in the year ahead…

Predictions for the new year

Redfin has collected data and insights from across the country and collated them into 12 predictions for 2023. Let’s just go over some of the most important ones that are likely to affect you as a home buyer or owner.

Home sales will fall to their lowest level since 2011. There will be a slow recovery in the second half of the year. With interest rates rising (and continuing to rise at least till mid-next year), sellers wouldn’t want to flip or refinance at a higher rate - Having locked in a good mortgage rate in the last two years, they will wait till the demand bounces back, leading to houses being taken off the market.

Mortgage rates will stabilize at around 6%. The mortgage industry is influenced by two factors: Supply-demand dynamics, and the Fed’s interest rates. If the Fed manages to bring inflation under control by 2023 and housing demand still remains low, mortgage rates will drop to incentivize buyers.

The US will avoid a wave of foreclosures as the mortgage rates were 3% or below when locked in, so payments will be sustainable. At the same time, the US will see a year-on-year decline in home prices for the first time in a decade.

What heats up first cools down first. The Midwest and Northeast areas were not as taken by the pandemic homebuying frenzy as the other regions, so they would hold up the best as other regions cool down.

The structure of American families will change, and the real estate market will change with it. Gen-Zers and Millennials will continue to rent indefinitely, split houses with roommates, stay in with family, or otherwise delay striking out on their own. With single-family homes not being attractive real estate, builders will focus on multi-family rentals.

Finally, the market will continue its seasonal journey and bottom out in the spring. IF the Fed eases up on rate hikes, the market will rebound at that point with demand and prices picking up again.

In light of all this information, does it look like there is an impending crash or an apocalyptic scenario? Frankly, no. If a 5% drop is the worst that we expect, most people are unlikely to even notice. On top of this, most people managed to lock in homes at rates that would make their payments sustainable at 3-3.5%. So while negative equity sounds scary on paper, for those planning to stay put and pay out their mortgage with a steady source of income, the current dip doesn’t mean much.

The real risk is if someone loses their job, has negative or limited equity in their house, and cannot manage payments anymore. But with only 1% of homes that took a mortgage in 2021 currently underwater, the risk of something like a 35% drop across the board like what we saw in 2008 is improbable, even if prices decline temporarily.

The areas which see a crash of 20-25% would probably be the ones that saw a euphoric rise during the pandemic. For others, this might even be turning into a buyers’ market that turns up opportunities for investment. As mortgage rates are bound to turn soon, shop around and use it to your advantage. I’m personally keeping some cash on the sidelines while I scout around for a commercial office or warehouse space.

For sellers, if you really want to get your property off your hands, you have to price it aggressively from day 1. If not, remember that the value of your property declines every additional day it’s on the market, and you’re probably just wasting your time.

So, stay safe, stay invested and I will see you guys next week - Graham Stephan.

A lot of effort and research went into making this article, so if you found it insightful, please help me out by clicking the like button and sharing this article.

Awesome post Stephen! Just to add my 2 cents here. I read that the home builder sentiment dropped for the 12 straight month but from what I’ve read it seems that it is the smallest drop on HMI index in past 6 months🧠

Man I love your analogies! The white elephant is a perfect way to describe the housing market. It's a huge honor to own a home but right now at least it is a huge burden. Thanks for sharing this, this is turning into one of my favorite Newsletters.