What’s Graham, it’s guys here :-) If you want to join 19,200+ smart investors and never miss an update on the market, hit the subscribe button below. It only takes a second and it’s completely free.

In the summer of 1975, across the country, there was a sudden drop in the number of people going to the beach. No, the reason wasn’t a Tsunami warning or a new study that showed how suntanning causes skin cancer, but, the blockbuster movie ‘Jaws’ had released in June. Now, the chances of being killed by a shark are extremely low (you have a higher chance of being killed while opening a champagne bottle), but having watched the movie , many viewers had an irrationally high fear of shark attacks and this is often considered as a classical example of recency bias.

Recency bias is a severe issue in long-term investing, with a study showing that 78% of Millennials are susceptible to it. When folks sell or buy assets based on the news cycle, it becomes a barrier to building wealth in the long term. This is particularly relevant for assets like real estate, which are an important vehicle toward generational wealth.

Now, pretty much everyone knows how unaffordable housing has become for our generation. Homeownership, a quintessential part of the American dream has been unattainable for many Millenials as they have the lowest homeownership compared to any other generation at a similar age. Housing affordability is also at the worst level since 1985; it now takes 35% of the median household income to make the mortgage payments on a median home.

It is in this context that I saw the recent news regarding a decline in the housing market. With nearly 63% of Americans hoping for a housing market crash, many are wondering whether this will finally be the opportunity that they are looking for. However, we should not get carried away by the headlines and instead should have a historic perspective of the housing market changes.

So, this week, let us take a closer look at the history of the housing market, its recent decline, and whether you should consider waiting for a further drop in prices before pulling the trigger on that purchase.

The Housing Boom

A nation of homeowners, of people who own a real share in their own land, is unconquerable- Franklin D. Roosevelt

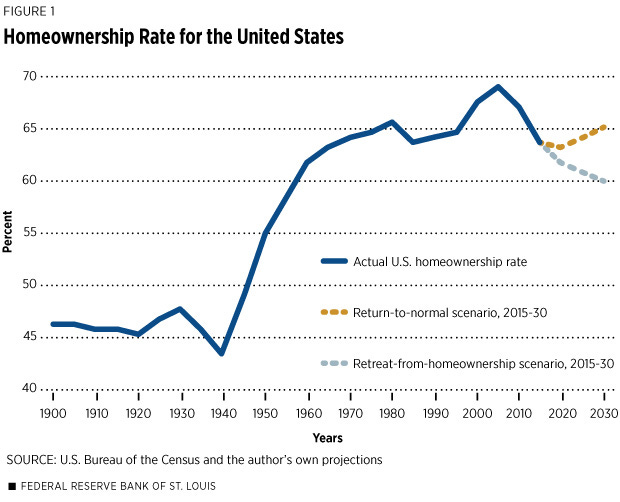

Picture this, you are in 1944; the country has gone through two world wars and a great depression that lasted ten years. Homeownership is at an all-time low of 43% (it is ~65% now), partly due to the ban on housing construction. The manufacturing industry, which provided two-thirds of the allied military equipment is grinding to a halt and 15 Million war-weary veterans have returned back home. How do you jumpstart the economy? The answer then was the Servicemen's Readjustment Act of 1944, commonly known as the G.I. Bill.

The G.I. bill proved to be one of the most consequential pieces of legislation as far as housing and the rise of suburbia is to be concerned. It provided low interest, zero downpayment mortgages with more favorable terms for new construction. Subsequently, many Americans left cities in large numbers and filled the suburbs as the white picket fence became etched into the American dream.

For some context on how easy the path to homeownership was, a newly made six-room house in suburbs cost around ~$5,000 with a monthly mortgage payment of ~$30 when the average annual income was around $3,000. The GI bill ended in 1956 and at the dawn of the ’60s, homeownership rates in the United States stood at ~60%.

Housing continued to be affordable till the early 2000’s when corporate greed and a slew of bad loans led to the 2008 subprime mortgage crisis. After the bust, housing regained its growth rate as institutional and international investors saw the housing market as a safe haven and poured money into it, which made homeownership unaffordable to many. Very recently, in the post covid housing boom, the Case-Shiller inflation-adjusted home price index has reached its past 2008 heights. However, in the past couple of months, the tides have started to turn.

Shifting Sands

Since the start of 2022, there’s been some talk about a housing market decline, and in July, we saw the largest monthly drop in housing prices in the last 11 years.

A report by Black Knight Research, which monitors the housing market shows that there are a few key aspects of the market that are on a downward trend

Mortgage refinances - Every single aspect of refinances fell to its lowest level ever reported in history. Additionally, home sales accounted for 64% of mortgage payments, which meant that more people are selling their homes rather than replacing them with a new mortgage.

Home prices - Home prices dropping in July is unusual for a summer, where it usually increases. Because of this, analysts believe that more corrections are likely as we move to neutral months.

Key markets hit - Some key markets, particularly the tech centers in California and Washington are experiencing a decline. San Jose experienced the largest decline so far, with nearly a 10% drop in the last 3 months. Note here that during the 2001 dot com bubble, San Jose was the fastest market to decline 10%.

Goldman Sachs now predicts that nearly 40% of markets will see a decline in 2023 and one in five sellers have already started to drop their asking price. One of the main reasons for the drop in demand is the decrease in affordability due to increasing mortgage rates. I recently posted an example regarding how bad things have gotten.

With the decreasing demand for due to high mortgage rates, banks have started bringing back no money down loans raising fears of a scenario that lead to the 2008 crisis.

2008-Redux?

Bank of America recently launched a pilot program for first-time home buyers to ‘achieve the American Dream of homeownership’ and help underserved neighborhoods. The loans are available in designated markets like Charlotte, Dallas, Detroit, etc. with no money down, no PMI, no closing costs, and no minimum credit score. Further, eligibility is entirely based on income and home location and the company will make a downpayment on behalf of the client up to $15,000! Many have raised concerns that this could lead to a 2008-like scenario of accumulation of bad loans. Remember, the 2004 relaxations in guidelines allowed agencies to issue riskier subprime loans which lead to unprecedented real estate growth caused by ‘Ninja loans’, which caused a mass wave of foreclosures.

However, a closer look at the documentation shows that the new program does not have many of the red flags that are associated with the 2008 crisis. Instead of indiscriminately giving out loans, the new program allows borrowers to use other metrics like income and employment history, timely rent, utility, and phone payments, etc.

Further, Bank of America has gone on record to say that “their loans are underwritten with substantial rigor to ensure performance throughout various market and economic cycles” - which means that they’ve built in a “margin of error” so that if the buyer loses their job, or experiences financial hardship, the home wouldn’t have a high risk of being foreclosed on. Finally, the fixed interest rates on these loans are likely to be higher due to their higher risk involved.

What Lies Ahead

Now, as much as we wish there was a crystal ball that can predict prices, the best we have now are analyst projections. Overall, it is unlikely that we will see a 2008-like crisis; the circumstances for that are not there at the moment. Moody’s Analytics believes that housing prices will shift between 0 to -5% year to year. As to what you can do in this timeline, if you qualify for one of these no downpayment loans, do check it out. However, most loans now have a high-interest rate, so shop around for mortgages and don’t get attached to a single property. Finally, only buy a home that you intend to keep for 7-10 years so that you can ride out any fluctuations.

Real estate is a topic that’s close to my heart and a lot of effort and research went into making this article. So, if you found it insightful, please help me out by clicking the like button and sharing this article. I am also curious to know what you guys think about the recent decline and the zero downpayment loans. Let me know your thoughts in the comments below!

I appreciate the deep dive into the data these posts contain. Thanks Graham!

Love the analogies you used in the article! Do you think Gen Z are likely to face a similar situation?