U.S. housing-market bubble could burst this year - AEI's Lachman

The Housing Boom May Be About to Go Bust - Bloomberg

Are we in another housing bubble? - The New York Times

We are coming across ever-increasing news articles and experts calling the current housing market situation a bubble that might burst any time. It looks more and more like we are going into another housing market crisis.

Despite many patiently waiting on the sidelines to purchase their first house, the mortgage rates have hit 4% for the first time since 2019, drastically reducing their purchasing power. Adding to this, housing prices are increasing by record numbers which put the homeownership dream outside the reach of many Americans.

It’s long overdue that we talk about what’s going on in the current housing market. Because, as both a homeowner and real estate investor, it’s shocking to see the current state of the market. We are about to see some fundamental changes to home affordability - and that is worth breaking down.

How did we reach one of the hottest housing markets of all time?

The current extraordinary market conditions were created by a variety of factors that happened at the exact same time.

March 2020 interest rate reduction - In an emergency move by the Fed against the Covid-19 crisis, they cut the interest rates to zero and launched a $700B QE program to stimulate the economy. This directly resulted in lower mortgage rates and higher purchasing power which meant that people could afford bigger homes for the same monthly payment.

Housing Supply - The Covid-19 shutdown caused a record low number of homes on the market. The severely reduced supply, in addition to the lowered interest rates, caused the left-over inventory to be bid to even higher values. Even though more than six million homes were sold in 2021 (the highest number since 2006), it was still well short of satisfying the demand.

Supply chain issues - Supply chain issues meant that housing materials took longer to arrive and when they did, they were considerably more expensive. Even as recently as last month, supply chain issues were causing new homes to be built without garage doors and gutters. There seems to be a huge backlog of uncompleted homes.

Labor shortage - According to the latest report by the Home Builders Institute, lack of skilled construction labor is one of the key factors that prevents improving housing inventory and affordability. It’s estimated that the construction industry would need 2.2 million new workers (!) over the next three years to satisfy the growing demand.

All of these factors occuring simultaneously caused the prices to skyrocket over the past two years. Even though none of the above issues are completely resolved, there are some fundamental changes occurring right now that could have an impact on the overall housing market in 2022.

Major changes in 2022

Inflation: Ahh, that magical thing that reduces the value of your money every year. I had made an in-depth video on inflation last week, but the TLDR is that with inflation recently clocking in at 7.5%, interest rates are going to go up!

Consider the simple example below of someone trying to buy a $500k house. Last year at 2.8% interest you had to pay $2054 per month. But given the current mortgage rates, you would have to pay a whopping 16% more per month for the same house. This comes at a time when people have lesser and lesser real income as prices of groceries, gas, and almost everything else have also gone up over the past year due to inflation.

The rising mortgage rates have caused the Mortgage Bankers Association to forecast that housing prices are bound to drop by around 2.5% by Q4’22.

But if you look a bit deeper, research suggests that mortgage rates are not inversely correlated with home prices. Robert Shiller (you know, the guy who invented the Shiller index), argues that there isn’t a tight fit between high mortgage rates and low home prices. He backed up this statement by the below chart which showcases that even though there are some short-term trends, in the long term housing prices show no relation with the interest rates.

While there are multiple theories as to why housing prices are not affected heavily by mortgage rates, the most intuitive one is that mortgage rates are pretty sticky. Once you lock in a low mortgage rate for 30 years, it’s unlikely that you will move to another house at a higher interest rate. Adding to this, even if the housing prices drop by a significant amount, as long as the homeowners can afford the monthly payment, they are unlikely to sell and actually realize that loss.

New Mortgage options: Both Fannie Mae and Freddie Mac have increased their loan limit by 18% for 2022. Now you can get a mortgage loan of up to $1 Million in high-cost-of-living cities. This was the largest increase on record dating back to 1970 and it directly indicates the lack of home affordability throughout some of the most expensive areas. This increase would now make it easier and cheaper for borrowers to buy a home.

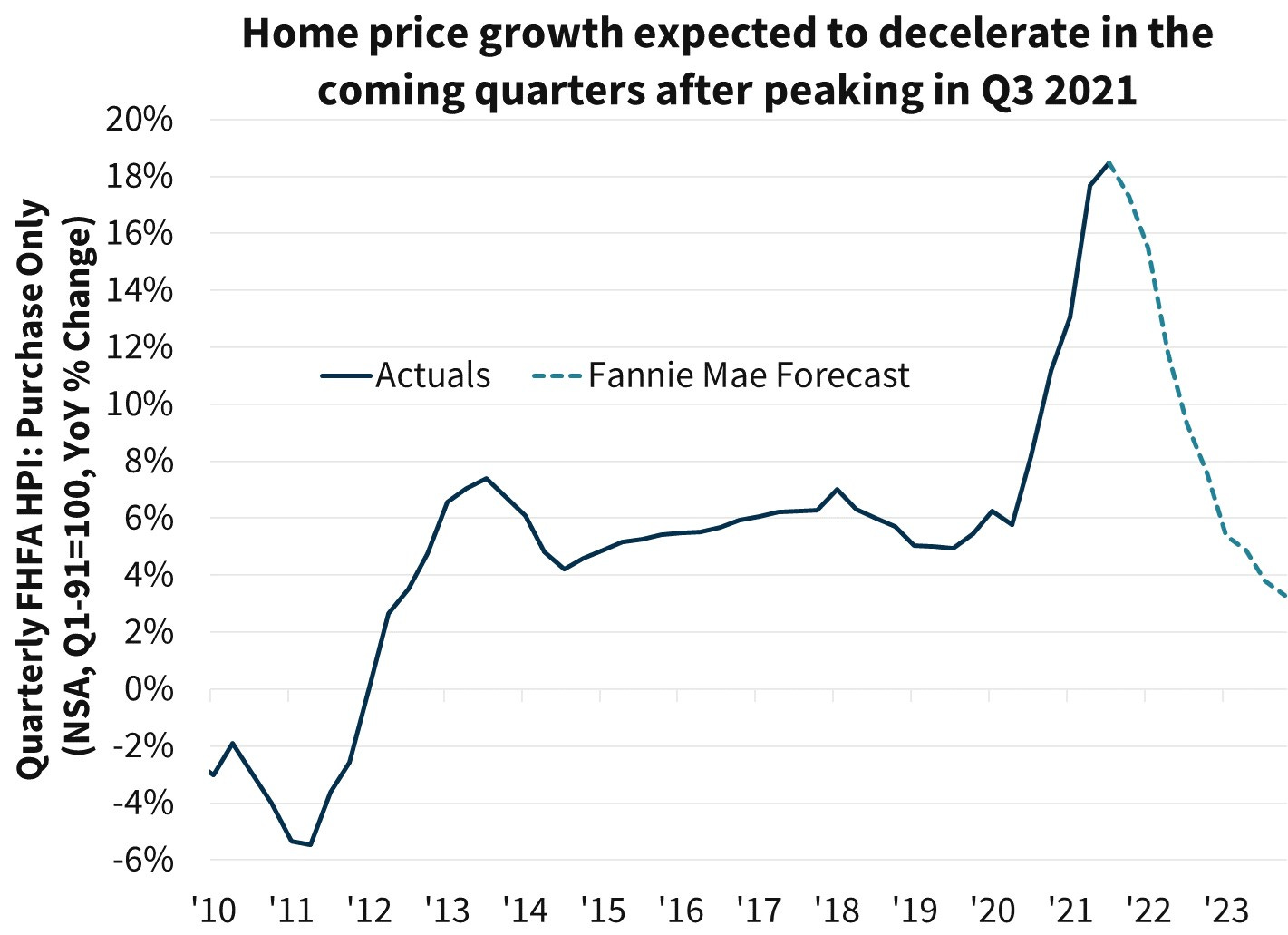

Forecasts are expecting the price rise to cool down: Mortgage giants Fannie Mae and Freddie Mac have warned that inflation is going to remain high and home price growth will continue for the foreseeable future. They have stated that it’s unclear whether the current shift in the housing market that we are witnessing is a passing trend or permanent change. They expect home prices to jump up by another 7.6% this year. The only silver lining to their report is that they do not expect the further increases to be like 2021 as the prices have appreciated so fast that any increment on this would have to be at a more sustainable pace.

The New Normal?

Even though there are some major structural changes happening in the market right now, the overall outlook for the housing market is more of the same in 2022! At the end of the day none of us have a crystal ball and we can’t predict what’s going to happen tomorrow accurately. The best we can do is to look at data and previous trends and make an informed decision.

If you are looking to buy a house, now is a good time as any as it does not seem like the prices or the mortgage rates are coming down anytime soon. Holding cash for a down payment for a long time while waiting for a reset is a definite no-no, given the current inflation rates. Even though Zillow is not the gold standard in real estate predictions (remember their Home-Flipping fiasco), their real-estate data is undeniably extensive - They are expecting an 11% increase in home prices in 2022.

Do your best to be patient and shop around, make yourself as strong of a buyer as possible, and then lock in a 30-year mortgage at the lowest rate you can find. Ultimately, the burden is going to fall on you to make sure you’re not getting ripped off. So, a little research absolutely goes a long way in getting the best deal.

Before you leave make sure that you smash that like button! (sorry, force of habit :P). But really, if you have any feedback on the article, if you agree or disagree with any statements - let me know, I read all the comments, and I do my best to always respond to as many of them as I can.

Graham the newsletter is awesome. TBH I kind of hate watching Youtube videos but go there to find information I can't find anywhere else. Being able to read your thoughts is much more convenient to me. Also, please include the links to the offers from you Youtube channel. A lot of times you tell us about an offer but my hands are busy and the I forget about it. If I can click the link after I read the article I am much more likely to take advantage of the offer.

Good read! Would be curious to see how the volume of sales has fluctuated compared to months supply.

BTW, possible typo at the end of New Mortgage Options? Seems odd that it would result in buying being more affordable and the text in parentheses seems like an editor's comment.