ICE AGE

The housing market is cooling as demand drops.

What’s up you guys, it’s Graham here! If you want to join 17,600+ smart investors and never miss an update on the market, hit the subscribe button below. It only takes a second and it’s completely free.

A recurring theme in conversations I have with my acquaintances is the difficulties they face with the housing market, and for good reason. The median asking rent for a single-family home has reached nearly $2,200 (up 37%) compared to last year and the average interest rate for 30-year mortgages went up from 3% to almost 5.5% in the last year.

However, recently there’s been some news about a decline in the housing market. The National Association of Realtors recently announced that we have entered a ‘housing recession’ and home sales have fallen substantially compared to last year.

Now, many of us who lived through the great recession tend to pigeonhole pretty much every negative news about the housing market to the 2008 subprime mortgage crisis. However, a closer look at the data reveals this: if 2008 was a sudden deep freeze, what is happening right now could be the beginning of an ice age; slower, but just as potent.

Housing contributes ~15% of the US GDP and is the major expense for most households, either through rent or mortgages. So, let’s do a deep dive into the recent news about the housing market, how we got here and what to expect in the near future so that you can make informed decisions regarding your biggest expense.

What’s on the News

Since 1980, housing prices have gone nothing but up, with the exception of the 2008 crisis. The incredible returns of the market have also attracted investments in the form of real estate investment trusts (or REITs) which are specific types of funds that invest in real estate securities. In fact, on a 20-year rolling period, REITs have outperformed S&P 500 in the last 10 years!

However, the red-hot housing market priced out many middle-class Americans as household income could not keep pace with the increasing cost of home ownership. The boom continued even after the covid crisis, as home prices rose nearly 19% in 2021, which was the biggest increase in the last 34 years.

However, all of that has changed recently. The national association of realtors reported that home sales fell nearly 6 percent in July, which is a 20% reduction compared to last year. Mortgage demand also fell to a 22-year low and mortgage applications are 18 percent lower in comparison to 2021. The negative sentiment has spread to institutional investors, as even Blackstone, one of the largest private buyers of home equity, recently declared that they are stopping purchases in select markets. Zillow has identified 123 markets that they believe will see a decline and Redfin noted that sellers are backing off, with many hesitant to sell below prices that they would have got during the post-Covid boom.

The anticipation of declining prices and lower demand for mortgages has left us thinking. Are we at the cusp of another 2008-like recession?

Reality Check

Now, the skyrocketing housing prices have left many Americans in the dust when it comes to home ownership, and many are hoping for a market correction. In fact, a recent survey by consumer affairs showed that 3 out of 5 Americans are hoping for a housing market crash so that they can purchase a new home! As much as we hope that we could wish a housing market crash into existence, it is unlikely that we will see one in the near future. There are a few key reasons for this

Demographics: With work from home increasing during the pandemic, many folks who owned homes are now looking for bigger places that contain offices so that they can work from home. Millennials in particular are in their prime earning years and are keen on home ownership with many waiting on the sidelines for a price drop.

Stricter lending: Lending standards have become stricter since 2008. The subprime crisis was caused by bad loans given out regardless of credit history or income documentation. Right now, most borrowers have stellar credit, and mortgage payments account for 3.8% of US disposable income, while back in 2007, it was nearly 7.2%.

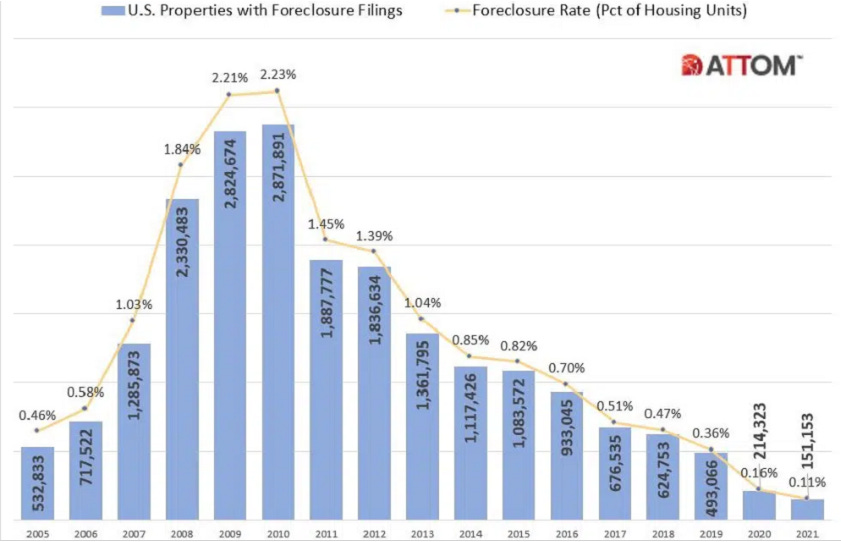

Muted foreclosures: Foreclosure activity has increased this year to nearly 200,000, but it is nowhere near the great recession, during which we saw millions of foreclosures.

What all this points to is that we are more likely to see a housing ‘cool-off’ rather than a recession. The federal reserve is still holding and buying Mortgage-backed securities, thus artificially propping up the market. Even Micheal Burry, who correctly predicted the 2008 crash says that doomsday scenarios are less likely to happen as the government can print its way out of a crisis.

Uncertainty Beckons

So, what can we expect in a housing ‘cool-off’? First, while nominal housing prices may increase, when we account for inflation, it is likely that the real prices will actually decrease. For example, if housing prices go up by 4.3 % as predicted by CoreLogic, and inflation holds steady at 8.5%, that means that real prices would have gone down by 4.2%.

Given how much the housing market went up by in 2021, some softening could be healthy to bring things back to normalcy and increase affordability. At the moment, the market scenario looks speculative, and I would only buy a property if I am planning to keep it for 7-10 years.

See you guys next week with another deep dive!

And force of habit - Smash that like button to help others find this newsletter.