Trying to grow your business without growing your overhead?

Smart founders are using Upwork to hire top freelance talent — without the bloated payroll.

From AI experts and developers to designers and marketers, Upwork gives you access to highly rated professionals across 10,000+ skill sets. You can browse reviews, work samples, and hire on your terms — hourly, flat rate, short-term, long-term.

No cost to join

Only pay for approved work

Scale fast, stay lean

If you’re looking to grow without burning budget, this is the move.

My most watched video clip recently isn’t about my investing wins, or how to buy a house, or about how the Fed Rates will impact your stock portfolio. It’s a clip of me titled “I Lost Huge Money on Robinhood.” It got 11 million views. But looking back, that entire video aged horribly, because since I made that clip, I’ve ended up losing even more money on it.

That got me looking through my other financial mishaps. It was a bitter pill to swallow, but here’s the deal: If I can help even just one person by talking about my mistakes openly, and if that one person is you, then examining my mistakes in public is worth it. I wouldn’t make these mistakes again now that I know about them, and if you’re on the same journey, you could learn from them.

In this issue, I cover:

My mistakes with the stock market

Why a car is a risky investment

Why you should get a really competent accountant

How much I lost in Bitcoin and Ethereum

My failed business

The Problem with Private Equity

A counter-intuitive lesson

I’ll also tell you what I’d do differently in each of these situations. Let’s get started.

My problem stock

Before 2020, most of my investment was in real estate. It was the field I knew, where I worked as a real estate agent day in and day out, and I had saved up a lot of money to be able to invest in the good deals I was finding through the course of my job. But after 2020, I had some excess cash, and a lot of stocks had fallen by 50 to 80%. I figured that this was a good time to buy individual stocks – like airlines, restaurants, cruise ships, oil – any field you could think of where I had no real expertise. I went in heavy thinking that the discount on the stock would make up for it.

And maybe it was beginners’ luck, but in the first few months, I was up 50-100% on most of my stock picks. That gave me a bit of confidence and in 2021, when the Robinhood stock IPO-ed, I thought “Jeez, this seems like a really good deal with all this money flowing into the market.” So with that momentum, I plunked down about $150,000 at $35 per share.

When the market dropped in 2022, nearly all of my stocks ended up crashing.

However, I didn’t reverse course. The more I looked at it, the Robinhood Stock looked more and more attractive to me for some reason. The cheaper it got, the more I bought. When it hit $20, I bought another 2,500 shares. When it hit $10, I bought even more. At the peak, I had over 7,000 shares of Robinhood at a cost basis of $28. The stock was such a bargain to me in my mind, and to reinforce my belief, screenshots of Robinhood were all people ever shared on my social media feed. But despite me personally liking the company, the stock price just kept going down, and I wasn’t immune to the anxiety of seeing a position keep dropping.

In mid-2022, I decided to sell every single one of my individual stocks for the sake of simplifying my investments – I wanted to rebalance and invest in just three index funds. This is still good advice for most people. In my case though, I was taking existing investments and redistributing them. What this meant was that I sold my entire investment in Robinhood stock at a loss of about 50%.

If you’ve been following the stock at all lately, it’s now trading at nearly $106. If I had just held on, I would have been up more than 250%! You know what’s worse? Even more recently, I nearly bought back my entire position when Robinhood was trading at $38 per share because I thought tariffs would have no impact on its ability to make money. But I couldn’t bring myself to do it because of how much I’d lost in the past – and it’s ended up tripling in the last 3 months.

This is just one investment. I’ve had other stocks that compensated by doing incredibly well, and it balances out in the big picture. But in the long term, I’d have been better off – and probably had more peace of mind – just consistently buying into an index fund from the very beginning, because the majority of stocks go to zero and it’s a very hard task to predict which ones will be the winners. Even if you pick the winners, just mistiming it due to panic like I did could lead to missed opportunities.

3 years ago, a person asked me for a portfolio update on my cars and start-up investments. I wanted to keep my word, but also some time to pass for the update to be meaningful. Now that it’s played out for some time, I’ll fill you in on how it went:

Driving off the road

Alright, to be fair, I couldn’t have predicted this one – My Tesla Roadster purchase.

In 2022, I did two things: I sold my Tesla Stock for $314 per share. And I used that money to buy a Tesla Roadster. It wasn’t an ordinary Roadster. It was a 1 of 26 Yellow Tesla Roadster with just 27,000 miles on the clock. Everything about the transaction made sense to me. I had already lost money on Robinhood that I could offset against my Tesla stock profits, and I could also use those profits to buy a Roadster.

In the long term, my bet was that the value of this car as a collectible would beat the stock. Here’s why:

The Roadster was the FIRST car from Tesla. It popularized the EV concept.

It’s the only car to be floating around in space.

There’s estimated to be less than 1,500 of these remaining.

Yellow is the rarest factory color.

On top of all this, if you look at other cars that have similar production numbers and historical significance, they’re all worth more than $250,000. I thought that the Tesla Roadster was on the way to be a future classic for sure and would make me more money.

I couldn’t have been more wrong. Within a few months of buying the car, Elon Musk purchased Twitter, started to become a little controversial, Tesla stocks began to fall… and all of a sudden, Tesla Roadsters started flooding the market. I hate to admit this, but at minimum, I’ve lost $30,000 on this car. To make things worse, I’ve driven it only 500 miles over 3 years (maybe), while also spending over $10,000 doing random fixes on a few internal pieces that wore out over time. All of this isn’t to say anything against the car – It’s a blast to drive and a really fun expenditure – but as an investment, it’s a sunk cost. Unless I sell it one day for $250,000 to $500,000, I’ll be taking a loss of $80 for every mile I’ve driven.

But every cloud has a silver lining I suppose – Tesla stock is 7% down from when I sold it, so I’d have lost that money either way if I had held on. By the way, since I don’t drive it enough, if anyone’s interested in making a serious offer to buy the car from me, email me at grahamstephanbusiness@gmail.com. Maybe this will be another Robinhood moment where the value will skyrocket as soon as I sell it, who knows?

Tax blunders

This next one is so stupid that I feel embarrassed even talking about it, but it’s something that applies to all of you.

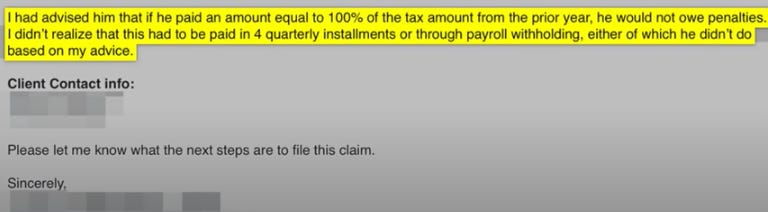

I started working with a new CPA in 2014. She seemed diligent, and fairly well-priced. For the first few years, she did an amazing job with my taxes and told me about different ways to optimize my income, and she even structured my LLCs. I had no issues. Once I started earning a higher income through YouTube videos though, I got the feeling that she didn’t quite know what she was doing. But I kept going because things seemed fine – until 2020.

My business took off that year. I was working 12-14 hour days, and my tax return was the last thing I wanted to worry about, so I let her handle everything without going through the fine print and this is where I messed up. She recommended I get a 6 month extension on my taxes that year to give her more time to file and I agreed. I asked her how much I had to pay the IRS, and she said I was already good and didn’t need to pay anything for another 6 months.

I didn’t think anything of it until a year later when I got hit with a $60,000 underpayment penalty from the IRS and the State of California for not paying my taxes on time. When I confronted her, she admitted that she made a mistake but that I’d have to pay it before I could get it reversed. So I did, but when I applied for the reversal, the State of California denied my request because they said an accountant’s error wasn’t “reasonable cause” for not paying taxes on time – though I had even submitted written evidence of our emails.

I filed an appeal and waited another 6 months. That too was denied. Instead of trying to recover this money through her errors and omissions insurance, I took the loss and let it go. It was my mistake for not paying closer attention. I changed accountants so that this would never happen again. Except… her mistakes didn’t end there.

The new accountant noticed that the older one had failed to file the proper election for my LLC, meaning that I would be double-taxed on nearly all of my income over the prior two years. I’m not exaggerating – this was a potentially seven-figure tax bill to the IRS – and thankfully, we made the cutoff just in time to get this reversed. If the new accountant hadn’t caught the mistake though, it would have been the biggest loss I’ve ever taken on money I’ve rightfully earned just because I missed some fine print on paperwork.

Here’s my word of advice: When it comes to your taxes, always make sure you’re paid up to date. Don’t skimp on accountants, get a second opinion, and if errors are made, do your best to file a correction as soon as possible.

Crypto fumbles

Since I started making content as a personal finance creator starting in 2016, I’ve personally used just about every investment platform in existence. I enjoy trying them out, for one, but also when I talk about something, I like to have used it myself. When it comes to cryptocurrency though, I wound up losing more than I’d like to admit.

For the last 8 years, I had bought a small amount of Bitcoin and Ethereum on a regular basis. It grew to about 2-3% of my portfolio and I let it sit, but when companies started offering a yield on Bitcoin and Ethereum, I figured I might as well try it out. I split my portfolio throughout several companies in varying amounts and started to earn 2-5% a year. At first, it was great. But when nearly all of them went belly-up all of a sudden, I lost about 3 Bitcoin and 50 Ethereum which got frozen on a number of platforms.

On the bright side (if you can call it that), Bitcoin was “only” worth about $20,000 back then. I invested an amount I was willing to lose, and it was only a portion of my crypto investments. When I see the price today though, and see how much it could have been worth, it stings. It’s more than $535,000. All of this could easily have been prevented by sticking to the phrase: “Not your keys, not your coins.” I repeated this slogan for years but willingly chose to flout it because I was playing it safe by spreading my investments. Apart from that, this is also the reason I’ve switched to buying a Bitcoin ETF more recently – that way, I don’t manage it myself and don’t have to worry about security leaks. If anything happens, Blackrock is to blame.

This next one though, is my biggest loss in a dollar amount: A failed business.

Most businesses fail

That’s just a fact of life. Still, the allure of building something from scratch and providing value to customers is very motivating. A few years ago, everyone in the YouTube space was starting a business and diversifying outside of their content brand: Alex Hormozi, Alex Becker, NELK, MrBeast, Logan Paul, you name it – everyone had a merch brand. YouTube grows extremely fast, but it’s also a very volatile business. It’s all attached to me and if I stop making content, it all grinds to a halt. So starting a business seemed like the way to go.

Talk about serendipity – right as I was thinking about this, someone approached me with a business idea. We’d be equal partners. After talking it through, we agreed to move forward. It made sense. The timing was right, it seemed like a win-win, and our roles were clearly defined. I would focus my time on content and promotion, which was my strong suit, and they would handle the back-end of the business which I didn’t have the time or energy for.

At first, it all seemed great. Soon though, I started to feel that maybe some things were being rushed. Maybe we could take it a little slower, or possibly adjust our expectations… and I wanted to pause for a bit. But here’s the thing – I was also working through some of my own issues at the time. I was so busy making videos that the voice in the back of my head said, “Maybe I’m too much of a control freak. Maybe this is the opportunity where I get to delegate and learn to trust the people I work with, instead of micromanaging and letting them do what they’re good at.” So I let them take the reigns fully.

However, less than 6 months later, it was apparent that we both had a very different vision for the business, and we wanted different things from the future. We cut ties amicably, and I was out of about $250,000 at that point – and we decided to stop because I wasn’t totally satisfied with our direction.

Sending that wire was a really difficult moment. It was a hard chapter to close. But I kept my word to the other person. If anyone is to blame, it’s me for not being as involved as I should have been and I take full responsibility for falling short. I did what I felt was the best outcome at the time, moving forward, because I didn’t want to be tied to something I didn’t stand behind wholeheartedly. Though there were no hard feelings, cutting such a big tie was an expensive lesson to learn.

The lesson I learnt was this: Unless you’re actively involved in every aspect of a business and spend all of your time and focus on growing it, it’s not worth pursuing. Since then, I’ve only worked with the opportunities that I’m willing to give my 100% attention to. But by then it was already too late for some other investments…

Private equity is tricky

I reserved this for the end, because this one’s still in progress. It’s too early to see how this plays out. But so far, Angel Investing in startup companies has been one of my biggest regrets. Here’s how this tends to happen: I get pitched all the time with startups, offering me a stake for some investment. At least a few dozen emails saying “invest in my business” every single month turn up my way. In the beginning, this was novel, and a few looked really promising, so I tossed in some money there to see how it goes.

But here’s the thing to keep in mind: Publicly traded stocks are liquid. You can buy and sell them almost at any time, because there’s always demand. The price may go up and down, but it’s very unlikely that your stock is frozen. Startup investments on the other hand are completely illiquid. They pay out only when they go public (or you find another buyer for your investment), and you have no say in how the company is run – you’re stuck with it for the long ride.

In the beginning of my private equity journey, I wound up investing in just over a dozen companies with a lot of potential (I thought). Five years later, I realized I’d have been much much better off just sticking to Index Funds. Unlike equity, I can’t even cash out, take a loss, and move on – I’m locked up – and of the one investment I could potentially sell, I’d need to take a 60% loss from its market value. So I might as well hang on to it and see how it does.

Running a business taught me that it’s hard – and more than 90% of startups fail. But this is just how private equity works. Most PE funds bet on multiple companies hoping for that one home run which makes up for the 20 strike-outs. But it’s a full-time, high-stress job, not something in which you could fire and forget. If I could do it all over again, I’d just stick with boring old index funds.

My last regret

Having said that, my last regret is this: Playing too safe.

Maybe you think I’m crazy for saying that, after listing all of the risks I took that didn’t pay off and wishing I had invested in Index Funds instead. I know it sounds counter-intuitive, but hear me out. All of these risks I took make up a very small part of my portfolio. With the rest of my money, I play extremely safe – maybe even too safe, because 25% of my money is in treasuries. When the market fell over tariffs, I could invest a big chunk of that money in the dip, but in the meantime, I was missing out on potential growth because I crave stability.

If there’s anything all these losses have taught me, it’s about how my own mind and emotions react to losses and profits when they actually happen. And I’ve discovered that I tend to play it a little too safe.

In my mind, I prepare for a worst-case scenario and work backwards. I imagine that I’m going to wake up one day when:

My income goes to $0

The market drops 50%

All of my real estate goes vacant

Unexpected bills come due

I can’t find a job ever again

I suffer from a catastrophic medical emergency

And all of this happens at the same time. I know this sounds stupid, but it feels good to know that if all of this does happen, my family and I will still be okay. And keeping that 25% on the sidelines earning only 4.5% helps me sleep better at night even though it’s me preparing for something completely irrational.

Playing it safe is a blessing in that sense – but it comes at the very expensive cost of giving up higher market returns in the long term. But maybe I could have felt just as safe with a 10% allocation to treasuries, so playing it “too safe” can backfire at times and be the irrational choice.

When I step back and look at the bigger picture, I realize I’m incredibly fortunate to even be in a position to take these risks. Even if some of them didn’t pan out, sharing what I’ve learned can hopefully help you avoid those same mistakes. Here’s the takeaway: Take a boring, slow and steady approach to investing. There are NO shortcuts. Index funds might make less upfront, but they compound in the long run. Pay attention to the paperwork and know where your money is going. And never make the same mistake twice.

This is a post I took a lot of effort to put together because it can help anybody who’s managing their money and trying to build wealth. If there’s a friend or family member who needs to see this, please share it! Hit like and subscribe, if you haven’t done so already:

If you read this far, let me know what you thought by commenting: Great | Good | Meh | Terrible at the bottom. I read every single comment and email reply.

I’ll see you next week! Don’t forget to check out our sponsor, Upwork.

Appreciate your directness and I guess we're all human

Great post, so transparent. Inspiring !