Michael Burry's Warning

A broken clock or a genius who is ahead of his time?

Michael Burry has once again issued ominous warnings about the stock market and its impending collapse. For those who don’t know him, Burry is famous for calling out the 2008 housing market bubble way before it happened, and his hedge fund ended up making a killing in the downturn. The prediction became so famous that they even made a movie about it (The Big Short).

Given his stature, I think it’s important to talk about his exact warnings, the data behind the predictions, and what it would mean for you! After all, Burry is the same person who warned us about the record-high inflation in 2021, the unsustainable price of Bitcoin just as it hit $69K, shorted Tesla at $1,200, and cautioned that the market was dancing on a “knife’s edge” last year.

The Warning

Michael Burry isn’t exactly the most “formal” when it comes to issuing his warnings. Rather than talking to a journalist or posting a video, he takes to Twitter where he posts his detailed research and then immediately deletes it.

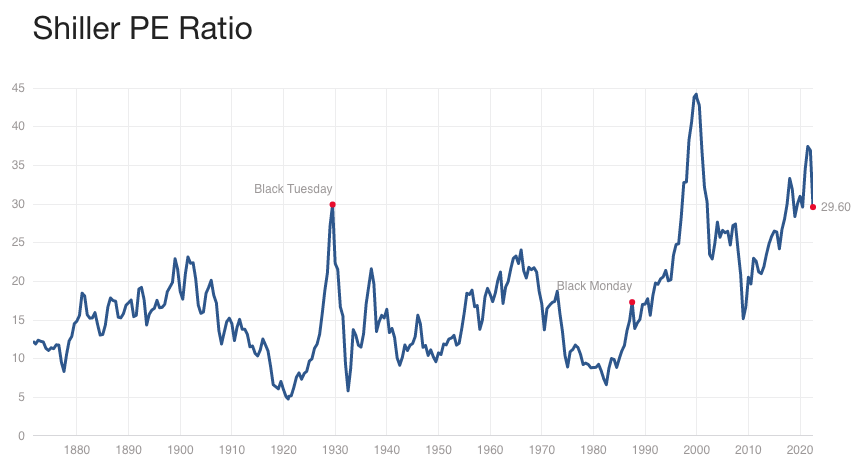

But, fear not - There is an archive account that reposts each and every one of his tweets. As expected, Burry is extremely bearish and states that each market crash generally bottoms out at a PE ratio that’s lower than the one that came before it. He predicts the Shiller PE ratio bottoming out at 16 - which would translate to the S&P 500 of 1862 - a massive 50% drop from the current prices.

How good are Michael Burry’s predictions?

If we take a look at the recent history, it does look like Michael Burry’s predictions are pretty much on point. The main issue with his predictions is that they tend to play out over 6 months to 2 years (something Burry himself admitted), making it extremely hard to time it right.

He became famous for seeing and shorting the 2008 housing market collapse before anyone else could. But it took more than 2 years to fully play out during which he was bleeding money every day. He also called out the astronomically high inflation rates in the U.S, 6 months before they began to increase and started getting covered by the media.

He also spoke about betting against Bitcoin, right as it hit its peak of nearly $69,000 - It subsequently fell 50% over the next few months. The cherry on top was him shorting Tesla at $1,200 following which the stock dumped to $900 (as of today, the stock is trading at $700).

One final warning he has given is that Americans could run out of savings by Sep to Dec ’22. The U.S Personal Savings has fallen to 2013 levels and with the current level of inflation and price rise for essentials, people might have to borrow just to stay afloat by the end of this year.

A Broken Clock?

Even though all of this sounds like horrible doom and gloom news, keep in mind that a lot of Michael Burry’s predictions are yet to come to fruition.

In 2019, he compared index funds to the Subprime CDOs of 2008 - stating that index funds were distorting the true valuation of the companies. But, since then, index funds have continued to remain a relatively solid investment.

In 2016, he predicted a financial meltdown and a World War 3 quoting (without giving any rationale/proof)

“I just did the math. Every bit of my logic is telling me the global financial system is going to collapse”

This is basically the equivalent of saying “just trust me, bro”. It’s more than 6 years since he made the prediction and the financial markets are chugging along just fine.

In 2017, he called for an imminent stock crash while the markets have gone on to rally another 55%.

Finally, in 2020, at the literal bottom of the Covid’19 crash, he warned of another selling stampede. If you had listened to him, you would have missed out on quite the rally.

This excellent analysis from Market Sentiment shows how much you would have made or lost out if you had listened to all of Burry’s predictions.

Even though I have immense respect for Michel Burry, part of me believes that if he makes enough predictions, eventually some of them are bound to come true. This is especially true when there’s no definitive time frame. It’s easy to say - “Oh, yeah.. I was just too early” or that some other factor prevented your prediction from coming true, all the while missing out on a market that might move way past your initial expectations.

I think the main focus for everyone here should be to simply stay employed and maximize your income so that if the market continues to drop, you will have the resources available to take advantage of a lower price.

It’s always best to be cautious in a market like this and prepare for the worst. At the same time, don’t tailor your investment strategy to a short-term trend that may or may not occur. Legendary investor Peter Lynch puts it across in the best way

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

See you next week with another deep dive!

p.s - The inspiration and a lot of research covered in this article were done by the YT channel New Money. Do check it out.

And force of habit - Smash that like button to help others find this newsletter.