What’s up Graham, it’s guys here :-) As we reach 20,000 subscribers, I want to ask you guys for a favor. Help me grow this community by sharing this newsletter with one person whom you think is missing out by not being a part of this community. It could be a loved one or a colleague who will appreciate our weekly updates and deep dives on everything related to finance and investing.

“Wake me up when September ends” - The Green Day classic might as well be about investors as historically, September is often the worst month for equity markets. This September has been particularly challenging as the S&P 500 dropped nearly 10% making this the worst month for stocks since the start of the pandemic.

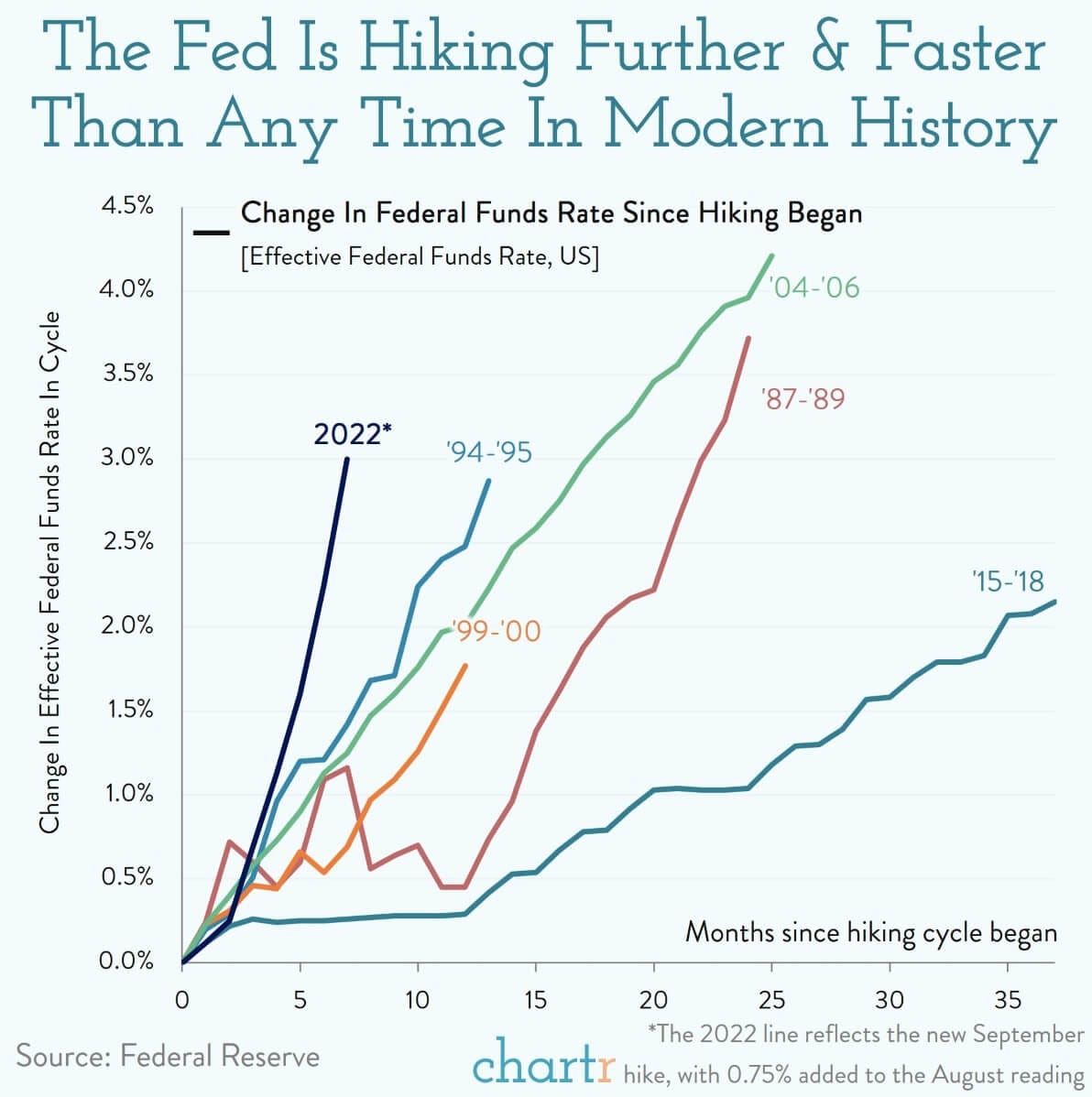

There appears to be no relief in sight as the Fed is raising interest rates at the fastest pace in modern history to try and bring down inflation.

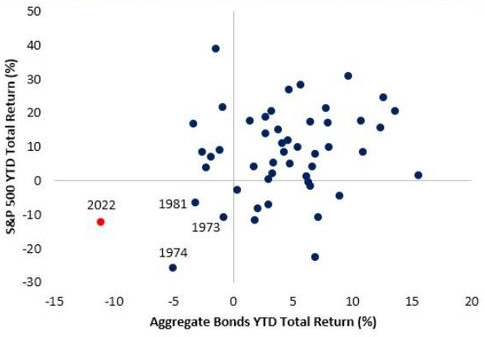

What makes the present situation even worse is the rout in the bond markets, which are supposed to be boring steady buffers against the volatilities of the stock market. The largest US bond fund, the $500 Billion Vanguard total bond market index is also down nearly 16% this year, its worst performance since the fund was created in 1986!

During the stock market crashes of 2008 and 2022, investors were able to seek refuge in the bond market. But a recent report by the Bespoke consulting group who analyzed the data on both stock and bond markets and found that there has never been a year where both markets have suffered such severe losses simultaneously.

Even with all the bad news, we are somewhat shielded from the rest of the world due to investors preferring the safety of the US dollar. Across the pond in the United Kingdom, the chancellor’s mini-budget was so badly received that pension funds reached the risk of insolvency and the Bank of England had to step in and resolve the crisis.

Let me fill you guys in on what I did last week.

How Much Money MrBeast Makes | The Full Story

Last week, I was lucky enough to get behind-the-scenes insight into how one of the most successful creators of all time manages his business. In a candid interview, MrBeast takes me through his journey from humble beginnings to becoming the highest-paid creator on YouTube.

There are a few specific things that I have noticed in folks who are incredibly successful: a tremendous passion for what they are doing, a near obsession with producing the highest quality work, and an ability to put in ungodly hours no matter how well they are doing. MrBeast describes himself as working pretty much every waking hour since he was 11 years old and tells me about how the walls in his studio are whiteboards to chart out thoughts any time inspiration strikes.

In this video, he gives me a tour of his studio, plans for future videos, and his latest venture: Feastable snacks and burgers. Most importantly, MrBeast talks about his work philosophy and why he puts in 12-hour days despite having an estimated $50 Million net worth, so make sure you watch this one!

Congress Wants To Ban Investing

A couple of weeks back, the New York Times published a jaw-dropping report on the stock trades from members of Congress. They found 3,700 trades that had a potential conflict of interest and found that several members had traded the stocks of companies that were directly under their investigation!

The report has caused widespread protests on both sides of the political aisle as the lawmakers under scrutiny consist of nearly the same number of Democrats and Republicans. Congress is now considering a ban on the trading of stocks by elected officials or amending the existing rules around reporting their trades. Currently, lawmakers are only required to report their trades within 30 days of the transaction.

In my second video this week, I discuss why such a law is desperately required and show how the investment portfolio of some lawmakers outperforms the S&P 500 regularly. The video also details some specific stock picks by members of congress that would make even Warren Buffett jealous, so check it out and let me know what you guys think.

I Have a Recommendation!

Check out the GRIT Capital newsletter.

GRIT is the #1 FREE finance newsletter on Substack – talking stocks, crypto, and investing. Run by a former $100MM portfolio manager Genevieve Roch-Decter. Her mission is to democratize access to stock market insights to the masses through her platform GRIT. She has +400,000 followers on social media and writes a daily newsletter to +65,000 investors - including hedge funds, billionaires, investment advisors, and retail investors.

This week, Genevieve writes about what's happening with the Pound, questionable decisions by the UK government, and the consequences of monetary policy error. Subscribe to read more!

So that’s it for my Sunday round-up. For the new folks here: In this newsletter, I give a quick recap of whatever you may have missed over the week on Sunday, and on Wednesday, I will be doing my deep-dive article on one of these topics.

See you next week with another bunch of exciting videos!

As always, like, share and subscribe :-)