Some news on the personal side…

I started a group recently called The Index which I’m very excited about. I’ve always wanted to join something like this but couldn’t find it, so I created it.

It’s a private group for people doing $10M+ in revenue or with investable assets, who want more out of life - not just financially, but in health, perspective, relationships, and purpose.

We meet in person each quarter and try to do something fun and unique together: off-roading, sports, adventures, great dinners, campfire conversations.

We talk through the kinds of challenges that are unique once you reach a certain place in life and chances are, someone in the group has faced that same challenge or has some connection that can help you through it.

Everyone in the group has built something meaningful and is still pushing forward. Low ego. High caliber.

Our next gathering is coming up in July, and we’ll likely cap the group at 25 people to keep things tight-knit.

So this feels like something you’d want to be part of, you can apply here:

National Debt is getting out of control. It’s approaching $37 Trillion, and it’s expected to increase by another $1 Trillion every three months. Interest payments recently hit an all-time high and investors are responding by “selling America.” In just the last month, we have seen interest rates shooting up, Bitcoin hitting an all-time high, and the entire financial system saw a credit-rating downgrade. This is something that hasn’t happened since the Great Financial Crisis.

This is going to affect every single person in America, and we really need to talk about what exactly is happening – not just for the short term, but looking at America’s future over the coming decades, for your children and the system that they will grow up in – so that we can start preparing for what’s coming.

Unsustainable Debt

Think of National Debt as the amount that a country has to keep borrowing from its future to pay for the present. According to veteran investor Ray Dalio, this number is growing more and more unsustainable by the day. When a country can’t sustain its debt, it has two choices: To default, or to print more money, and they always choose to print more money. So what’s the problem with printing more money?

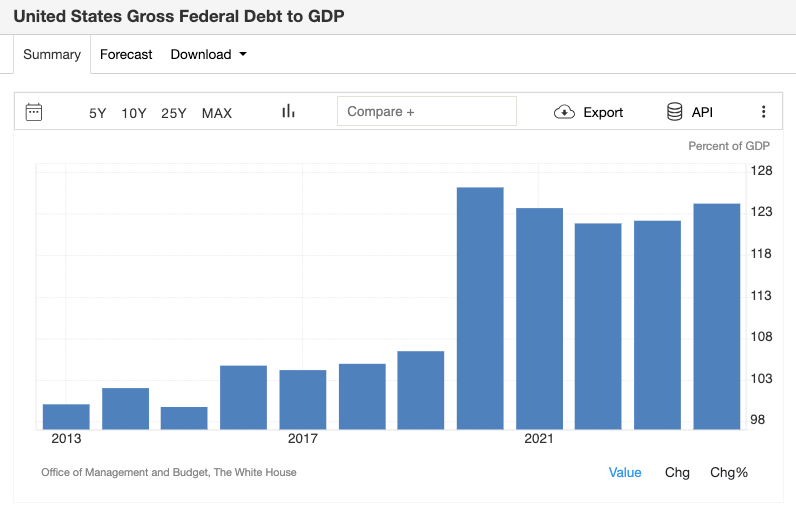

The debt-to-GDP ratio is at a 122%, and it’s consistently been high, meaning that we are spending and borrowing more than we are able to produce every single year. As government interest rates continue to rise, it recently hit a record high.

Three factors are causing a perfect storm that could lead to economic trouble – tariffs are causing external conflict, political divide is leading to an internal conflict, and rising debt is affecting the Fed’s monetary policy which is already struggling to control inflation.

The world order is breaking down. Because of an “America First” approach, we are moving away from a multilateral, cooperative world order which could foster more growth for everyone. This comes at the expense of long-term goodwill.

All of this is undermining the faith of the world in the US financial system.

Moody’s downgrade

Every country has a credit rating. It’s a measure of how likely the country is to repay its loans because they operate on “borrowed money” issued in the form of treasuries.

For a long time, the US was seen as a safe haven by other countries who bought huge amounts of US treasuries, because the dollar was the global reserve currency and the US also has a perfect track record of paying back their debts on time. But recently, the rating agency Moody’s downgraded US credit from AAA (negative) to AA1 (stable).

This is a big deal.

They pointed out that Congress has continuously failed to reduce the national debt and excessive borrowing. As government revenues remain flat and entitlement spending rises, they expect larger deficits which will drive debt and interest even higher – leading to a drop in performance. They project that by 2035, interest payments will make up 30% of the total budget – imagine that you as a person need $100,000 a year to survive and $30,000 is just the interest on money that you already owe. That’s insane.

The risk to the dollar

The US has never defaulted on its debt and probably never will – but this does suggest that the US will be forced to continue printing more money, and if fewer investors buy that debt, interest rates will begin to rise because:

Investors are piling into stocks because they are losing faith in treasuries. Then the rates have to go up to compensate them for that risk, and entice them back.

If inflation is causing prices and interest rates to spike, they are likely to keep rising, so investors think why lock in now?

Other countries like Japan are paying more on their own bonds, reducing the demand for US debt.

Tariffs could cause other countries to stop buying US treasuries, pushing the rates higher.

The credit downgrade is the most visible issue, but the bigger problem according to Ray Dalio is the devaluation of the dollar which could lead to dedollarization in the long run. Because other countries buy US treasuries, we need to pay less interest because there’s so much demand for it. But if they stop seeing the US as a safe option and begin to exit, then the US is left holding the bag. The head foreign exchange researcher at Deutsche bank even said that the damage has already been done, and the world is reassessing the narrative of the structural attractiveness of the dollar.

All is not lost – we do have ways to fight this back. The Fed is still a powerful institution and they stepped in saying that if things get bad, they can provide liquidity (an earlier post I wrote explains how the Euro crisis was resolved by a similar statement of confidence). The Fed is also buying billions in bonds and backstopping the market. But what about the root issue? This is where taxes matter.

What about taxes?

There’s no way to sugarcoat it. Debt is growing at a rapid rate and they’re printing more money to finance it, but that money has to come from somewhere. While cutting spending is nice, it isn’t enough. The only other source is tax revenue – but as more time goes on, the more unlikely this seems.

Especially when you look at the tax cuts. A bunch of tax reforms are coming in:

The revival of the 2017 tax act

A raise in the SALT ceiling

Tax cuts on tips and overtime work

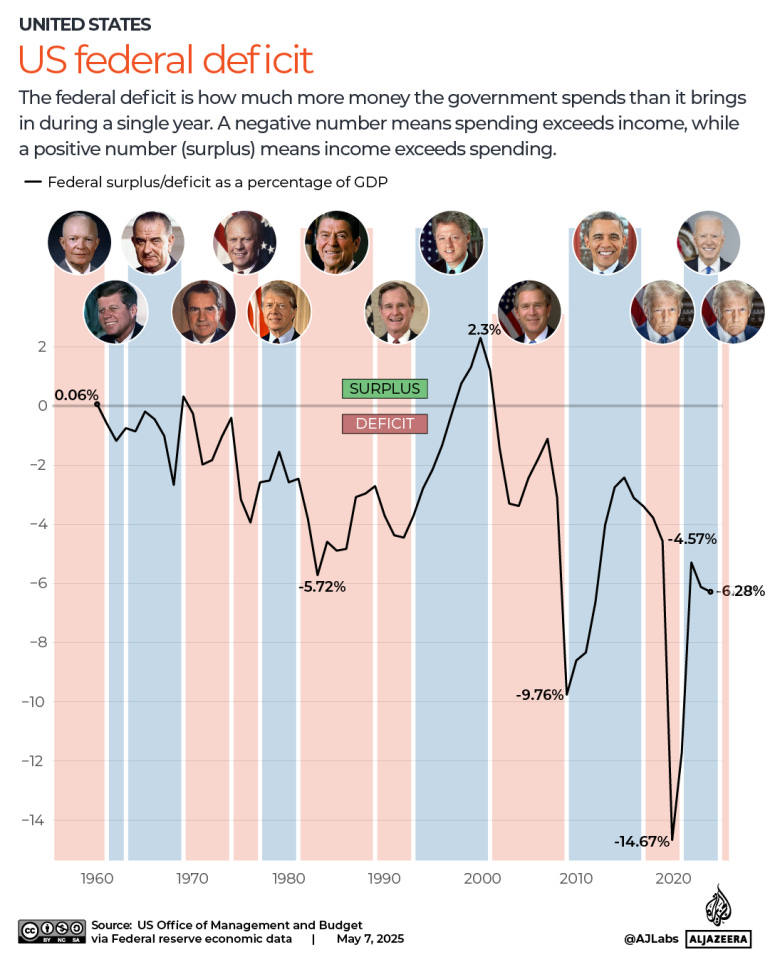

To pay for these tax cuts, there’s a proposal to raise the debt ceiling by another $4 Trillion. Over the next 10 years, $9 Trillion will be added to National Debt. This isn’t a Democrats vs Republicans issue. Both sides have operated at a deficit except under Bill Clinton who operated at a surplus.

42% of the national debt is held by private investors, like Warren Buffett. 20% is held by government agencies, 13% by the Federal reserve, and foreign investors hold the remaining 25% (a number that’s risen by 5x in the last 50 years!). As interest payments grow more than healthcare and defense spending, the dollar’s value will continue to go down – mortgage rates are back up at 7%, 30-year treasury yields are at 5%, and borrowing money will get way more expensive. If people lose faith in the US, rates will continue to rise to compensate for the risk, and prices of other assets will fall.

To be honest, I don’t see it getting better any time soon.

Will this tank the economy overnight? No. But over the next few decades, it’s something to keep in mind. You can expect the money printing and bailouts to continue for a very long time. But for the average person who wants to make the best of the situation, this is what I have to say:

Have an emergency fund, but don’t hold on to too much cash or stay out of the market for many years in a row.

Diversify your investments across many different assets. If one falls, the other ones tend to make up for it. For example, whenever the US CPI has topped 5%, gold has given an annual real return of 10.35% of average during a time when stocks had negative returns.

Ignore the negative news and keep buying in. In a 30 year period, missing just the best 10 days will cost you half the returns — the best thing is to buy, hold, and not panic sell.

Keep a steady income. The biggest risk to your investments is pausing or disrupting them because you don’t have a steady source of income.

Stay out of margin or leverage. If you’re borrowing money to invest in the stock market or anything short-term for that matter, you’re playing with fire.

If you need the money in the next 3 to 5 years, it’s probably not a good idea to invest it. Over the long term, the stock market has always bounced back, but there have been times where it took almost a decade to recover — so if you have plans on a shorter timeframe, keep this uncertainty in mind.

Paying attention to all of this gives you the best chance of coming out ahead.

That’s all for this week! I’ll see you next week with a different story. If you enjoyed reading, please like and share with a friend.

What I learned from COVID is that if that default is inevitable and you best reward your friends and punish your enemies while there is still some left.