New Normal

How investors are adapting to inflation and a rising dollar

What’s up Graham, it’s guys here :-) If you would like to join more than 21,500 members and never miss an update on the market, hit the subscribe button below. It only takes a second and it’s completely free.

Intelligence is the ability to adapt to change - Stephen Hawking

There is an enduring question in the fandom of nearly every sport. Who is the GOAT ( Greatest Of All Time)? There are tons of successful athletes: in fact, if someone plays at the highest level in any sport, then by definition they are successful.

Now, almost all successful athletes are gifted and extremely hard-working: most of them make the highlight reel at some point in their careers. It could be a last-second touchdown, a buzzer-beater, or even one-season domination (remember Linsanity?)

However, to truly stake a claim for being the GOAT, you need to dominate the game for an extended period of time. When season after season, you are the player to look out for. When millions of dollars are being poured into analyzing your weaknesses even as age catches up with your physique. Yet, after all this, you go out and turn around games single-handedly. The key here is that without exception, GOATs do one thing right whenever they face a new challenge.

They adapt.

We see this all the time in sports.

Tiger Woods substantially changed his playstyle after repeated back injuries to stage a miraculous comeback in 2019.

Magnus Carlsen started his career with a more aggressive playstyle that evolved to become a universal one.

Michael Jordan perfected the fadeaway later in his career.

Unsurprisingly, the ability to keep a keen eye on the changing environment and to adapt accordingly is extremely valuable in finance.

Amazon started as “Earth's Biggest Bookstore” and now most of its profits come from cloud services. Netflix started as a DVD rental but later pivoted to streaming. Marvel went bankrupt in 1996 as the comic book industry collapsed, but it reinvented itself and made the most successful movie franchise in history.

Right now, we are living through a fast-changing economic landscape the likes of which we have never seen before. In less than two years, inflation skyrocketed to 8%, the free money era ended, and mortgage rates went up by nearly 4%. If you weren’t following changes closely, it’s easy to feel like Captain Steve Rogers who woke up from cryogenically frozen ice.

In the changing dynamics of this new normal, strategies and investing methods that were useful in the era of free money have to be altered. So this week, let’s take a look at how the economic climate is changing, what investment funds and nations are doing to adapt to these changes, and how to position yourself to be successful.

Inflation Nation

Despite the Federal Reserve’s efforts to dampen prices, the latest inflation data came in at a significantly higher-than-expected 8.2%. More concerningly, core inflation, which excludes volatile food and energy prices was also up 6.6% from last year, making it the largest 12-month gain since 1982.

If there are two things that lost all their value from 2021 to 2022, they would be NFTs and the word ‘transitory’. Right now, we’ve had more than a year of > 6% inflation and the idea of ‘transitory inflation’ is truly dead and buried.

With prices continuing to increase throughout broad categories and the global turmoil showing no signs of waning, it is clear that conditions are not likely to improve in the immediate future. With an approaching winter in Europe, increasing energy prices could push inflation numbers up again.

The latest Federal Reserve meeting was surprisingly candid and gave a pretty clear indication of what lies ahead for us. The gist was simple: inflation is here to stay and the Fed will keep raising interest rates until it comes down.

Essentially if you were expecting inflation to reach pre-2020 levels in the next few months, you are in for a massive disappointment. Much like turning the knob on an oven, the effect of rate hikes on inflation will be felt slowly. Each rate hike will not make an impact on everyday prices for at least 6-12 months.

Most analysts now expect that inflation will reach its target level of 2% only by 2025. However, while we in the United States have to deal with inflation, other countries are dealing with a two-pronged problem: inflation and a rising dollar.

Dollar Crisis

There is something about economic cycles that needs to be understood. When times are good and folks are expecting stable economic growth, people make riskier investments. After all, when there is no foreseeable threat to your income, it’s alright to risk a small percentage of it in moonshots like emerging market stocks, cryptocurrency, or NFTs.

However, in times of crisis, like the one we are in right now, this strategy changes. In times of uncertainty, everyone wants to protect their capital. Then, there is no investment that is guaranteed to hold its value like the US Dollar.

Due to its stability, resilience, and global acceptance, every country in the world trades using the Dollar, and consequently, it is the de-facto reserve currency of the world.

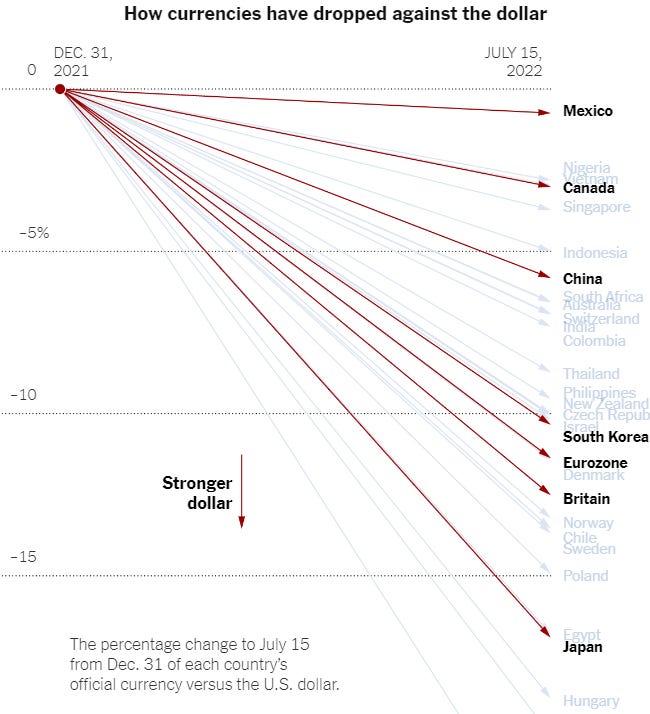

With countries looking for a place to park their money safely, everyone is buying up the dollar resulting in the US dollar rising in value compared to nearly every other currency in the world.

This presents a double whammy for folks living in other countries. First, their purchasing power has reduced due to inflation. Second, any American import will become more expensive since their currency has dropped in value compared to the US dollar.

Imagine you live in the UK. The 10% inflation means that your purchasing power has dropped by 10%. But because the British pound has lost value compared to the dollar, you have to pay even more to buy any American product.

When Apple released the iPhone 14 in the United States, the price was unchanged (compared to the iPhone 13) here but its price increased elsewhere.

Adapting strategy

As of now, there is a broad consensus among the Fed and other independent analysts. We are going to see an extended period of high inflation, below-trend economic growth, and a strong dollar. With this in mind, many institutions are changing their strategy.

Fund managers - Some of the largest money managers and funds are stockpiling cash. With the stock markets being the way they are, fund managers are taking a wait-and-see approach as a better deal might be just a few days away. Even Ray Dalio recently made a famous reversal in his approach to cash.

Homeowners - The housing sentiment index is at an all-time low and fewer people believe that now is a good time to buy. As housing prices decline and mortgage rates go up, many homeowners are choosing not to sell their assets at this time.

Foreign investors - With the rising dollar, foreign imports are becoming cheaper, which is making it difficult for American companies to compete with their foreign counterparts. Foreign investors looking to protect capital might move their assets to the US, while aggressive American companies will try and purchase assets abroad to take advantage of the strong dollar.

For the foreseeable future, we are likely to see increasing unemployment, so keep that six-month emergency fund handy. As plain as it sounds, the best thing for the average investor to do right now would be to stay employed and continue investing.

You can't go out and practice average on Wednesday, average on Thursday, okay on Friday and then expect to play well on Sunday - Tom Brady

Sidenote

Who is the GOAT investor? Do you go with consensus picks like Warren Buffet or is there a wildcard? Are you planning to change your investment strategy? Let me know in the comments below!

A lot of effort went into making this article, so if you found it insightful, please help me out by clicking the like button and sharing this article.

Love this newsletter!! Hope you keep doing it :) the pics and jokes made it so entertaining and learned so much too! Appreciate it :) you da best!!

GOAT Investor wildcard: Nancy Pelosi's husband.

Another great article. Thank you, Graham.

I would be curious to see a YouTube video / article about investing in franchise businesses sometime in the future if you are looking for topic ideas!