Perfect Credit Score

To 800 and Beyond!

Over the past 12 years of my investing journey, I have studied, analyzed, and researched every single aspect of building credit. My credit score now is above 800, a threshold many consider a ‘perfect score’.

When it comes to building wealth, investing, and leveraging your money, your credit score is easily the most important metric. It’s the adult version of a report card in terms of how well you handle your money. Having a great credit score means that you can get the lowest interest rates anytime you want!

Now whenever I use leverage, the interest rates are so low that it feels like I am getting free money! As an added perk, I am instantaneously approved for any credit card that I am interested in, which means more free stuff like the sign-up bonus - and who doesn’t like free stuff? :)

So in this deep dive, I will teach you exactly how to get that perfect credit score, totally free and in possibly much lesser time than it took me.

How do Credit Scores work?

Before you try to increase your credit score, it’s important to understand how it works and what parameters go into calculating your credit score.

Payment History: The single largest contributing factor to your credit score is your payment history. It just means that you pay your bill always on time as agreed. If you end up missing a payment, it could stay on your report for a whopping 7 years! But the good news is that, when it comes to paying off a credit card on time, it just means paying the minimum due amount (most of the time around ~$25-50) and not the full balance.

So, even in the worst-case scenario where you can’t pay off your credit card in full, just make the minimum payment and your credit score will stay intact. I HIGHLY recommend you set up an autopay for the minimum amount every single month so that you will never be late on a payment.

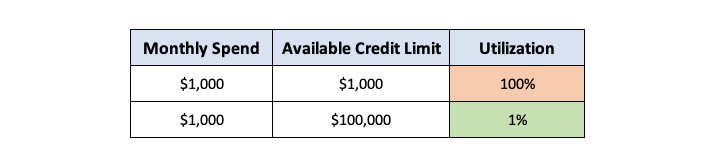

Amount Owed aka Utilization: This parameter evaluates how much credit you have available vs how much of it you are actually using. If you usually max out your card by going on a shopping spree, it will lower your credit score because you are seen as a riskier borrower.

One important thing to clarify here is that it’s not the dollar amount that you spend you should be concerned with, but the percentage of credit that you use. In the above example, in both cases, you are spending $1k, but when you have a higher credit limit, your utilization is much lower.

Average age: No, it’s not your age that the credit algorithm is worried about :P. It’s how long you have had your credit accounts open and in good standing. The longer your credit history, the more comfortable banks are in giving you loans

One key nuance that you should be aware here is that it’s the average age of credit history that’s considered and not the total age. For example, if you had just one credit card that you took 4 years back, then your average age would be four years, but if you got a new card recently, then your average age would drop to 2 years.

Types of Credit: This parameter evaluates whether you have multiple types of loans. It’s just to prove to the lenders that you are a financially independent adult who can handle a range of credit types including Credit Cards, Auto Loans, Mortgages, etc. One added benefit of having multiple types of credit is that your overall utilization would be on the lower side which again positively affects your score.

Credit Inquiries: Finally, the last 10% of your credit score is impacted by the number of times you apply for a new line of credit. This is shown as a ‘hard inquiry’ on your report. In general, the more hard inquiries you have, the lower your score will be. This is because lenders will be concerned that you are actively trying to seek multiple new loans and credit lines and you are seen as a potentially risky borrower. Personally, I am not so worried about the credit inquiries part as it only impacts the score temporarily (a few months at most).

How to get and review your Credit Score

“If you cannot measure it, you cannot improve it” - Lord Kelvin

Before we go trying to improve our score, we have to first know what our current Credit Score is. There are multiple websites that can help you here.

Annual Credit Report (you can check only once a year)

Pro tip - If any website ever ask you to pay for your Credit Report, just click out of it. There is no need to pay for information that’s freely available.

When you review the report, you can see which items can be improved, and usually, it’s going to be one of these (we will get into how to solve these shortly):

You don’t have enough credit - If you are relatively new to the credit world, you might not have had enough time to get a credit card and make on-time payments. Your credit score isn’t high just because there is not enough history on your account.

Late Payments - This is a big one. If you have a late payment, it’s going to stay on your report for 7 years & severely affect your credit score!

Collections - I am not going to lie. If you have an account in collection, it’s pretty bad. Collections occur when you are so late on a payment (usually more than 180 days) that the lender just gives up and sells the debt to a collection agency - you know, the folks who call you non-stop to get you to pay.

High Balance/Maxed out Credit Lines - if you max out the Credit Line available to you, lenders would see you as a bigger risk and it will drag your score down. If you thought you could overcome this by using “Buy Now, Pay Later” EMI schemes, these are also being tracked by the Credit agencies now.

Bankruptcies/Foreclosures - This should be an obvious one, but sometimes, marks like this are accidentally left longer than they should. One other possibility is a mistake by the credit agencies or an identity theft - all of which could impact your score without you even knowing it. This is why its extremely important to review your credit report frequently.

800 and beyond!

Now that we know what goes into making up the credit score and what your current credit score is, we can explore the various ways in which we can improve it - that too for free!

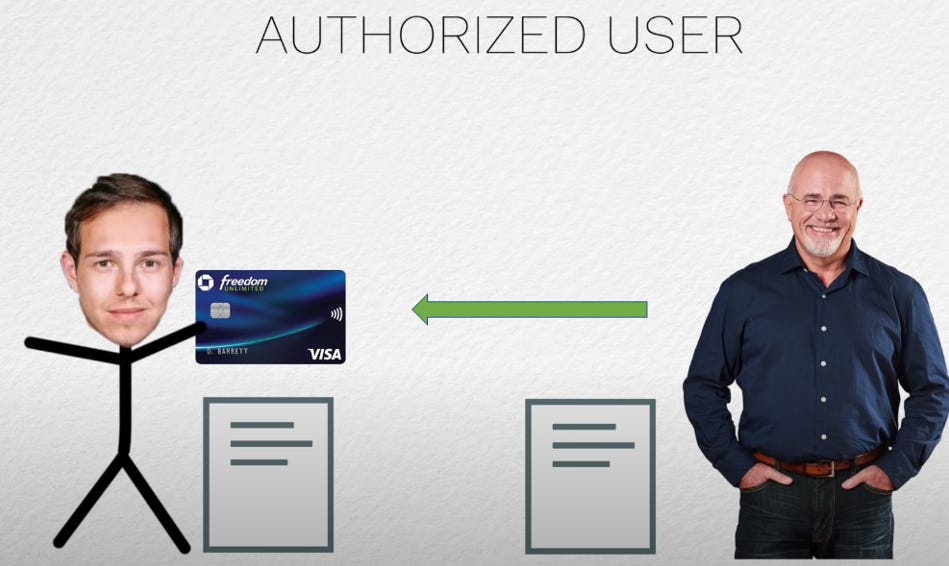

Authorized User

If you don’t have enough credit, and you want to increase your score immediately, the best method is to become what’s called as an ‘authorized user’.

This is when someone else with an extensive (and good) credit history adds you as an authorized user to their credit card. All of a sudden, their credit history shows up with your account. This is also known as “Credit Piggybacking” and is one of the fastest ways to improve your credit.

However, there are some ‘catches’ here that you should be aware of.

Some credit reporting agencies are catching up to this, and aren’t reporting the authorized accounts to all 3 credit bureaus. As of now, it appears as though Capital One, Discover, Bank of America, and Wells Fargo are the accounts that transfer over the entire past history while other credit cards will only show the history beginning at the time you became an authorized user. So make sure you do your research ahead of time so that you can transfer the entire history to your report.

It’s extremely important that you carefully choose the person who will add you as an authorized user as it’s not just the good parts that get transferred over. His/Her entire history will get transferred over to your account including late payments and maxed out credit cards if any! Make sure that the person who adds you is someone whom you trust and who has an excellent credit standing for the past 4-5 years.

Pay down your balances

Another quick-fire way to improve your credit is to pay off the existing balance so that your overall utilization comes down (Remember that Utilization contributes 30% to your score)! Ideally, you should be trying to keep your utilization under 10%. This will have the biggest impact on your credit score in the shortest period of time. If you pay down your credit card balance, the improvement in your score is reflected in just 2-4 weeks.

If you can’t pay off your card, another ‘hack’ here is just getting a new credit card. As we discussed in the beginning, utilization is based on the total limit, and adding a new card will improve your total limit bringing down your utilization %. This is why I recommend opening up as many no annual fee credit cards as you can so that the utilization is kept well below 10% (This might impact your average credit age, but utilization has a higher weightage in the credit score).

Experian Boost

As we saw, when calculating the credit score, a large portion of that score is calculated based on the number of on-time payments, your account history, and the type of loan that you have used. Obviously, this requires you to open multiple credit lines, pay them all off on time and keep the utilization low - all of this is pretty difficult to keep track of. Experian Boost aims to fix that and I feel most of you would qualify.

This isn’t sponsored, but Experian Boost is a totally free, opt-in service that tracks on-time phone and utility payments and adds them as a parameter for calculating your credit score. if you make your payments on time, Experian boost can help you boost up your credit score pretty fast.

Remove Late Payments and Delinquencies

First things first, if you have any kind of late payment now, minimize this window right now and pay it off if possible. The impact on your credit score gets worse as time goes on. A 90-day late payment will affect your credit score much worse than a 60-day late payment, and so on…

Any time you miss a payment or it gets sent to collections, it’s going to absolutely destroy your credit score. But, not all hope is lost if you work to resolve it. It’s always worth trying to negotiate the terms of the debt and see if you can get back your account to current.

This means reaching out to the lender to see if you can work out a repayment plan. The fact is that if the lender barely makes pennies on the dollar offloading the bad debt, they would rather negotiate with you to get something than nothing! Once you have paid off the debt, but the late payment is still on your credit report - just call them and ask (really really nicely) if they can remove it as a courtesy. I have to be clear though that they are not obligated to do this, but

If you don't ask, you don't get. - Mahatma Gandhi

Don’t close out any accounts

One of the biggest mistakes I have seen people making is closing out their old credit card because ‘they don’t use it anymore’. What you are really doing here is erasing your oldest trade line and that will bring down the average length of your credit history significantly.

So as a rule, don’t close out any credit cards, even if you are not using them. If they have no annual fee, keep them open and occasionally charge a $1 amazon gift card to show some activity and that’s it. If the card does have an annual fee, you can reach out to the bank for a downgrade to a free card so that you can keep the account open for free.

If you are able to follow these simple steps, a perfect credit score is absolutely achievable, for totally free and without paying any interest to credit card companies. It’s worth mentioning here that even though getting an 800 credit score comes with bragging rights, from a lender’s perspective, anything above 760 will get you the best possible rates. There is virtually no difference being a 780 or an 800 from the lender’s point of view.

Following these simple steps open up so many opportunities to save you money that wouldn’t be possible without a good score. All of this is something you can do yourself, in under an hour, for free and this can save you thousands of dollars down the line!

It took me hundreds of hours of research throughout my career to actually identify these tips and tricks that can help with the credit score. This information would easily be worth a few thousand dollars if you just follow along and actually do it! All I am asking in return is to just share it with one friend who is looking to improve his/her credit score. Just tell them Graham told you to do it. See you next time :)

And of course, smash that like button!

Thanks for sharing this information, I've seen your credit score video before but is good as a reminder and to have present in an article format, I will get that good and juicy credit score, take care :3

So what do you have to do to get 850?