What’s up you guys, it’s Graham here! If you want to join 17,200+ smart investors and never miss an update on the market, hit the subscribe button below. It only takes a second and it’s completely free.

Some of my newer viewers might not know this, but I started my career as a real estate agent right around the 2008 financial crisis. I saw, first-hand, the tremendous economic and human costs of job losses caused by a recession, and it has kept me grounded since then, no matter how well I am doing.

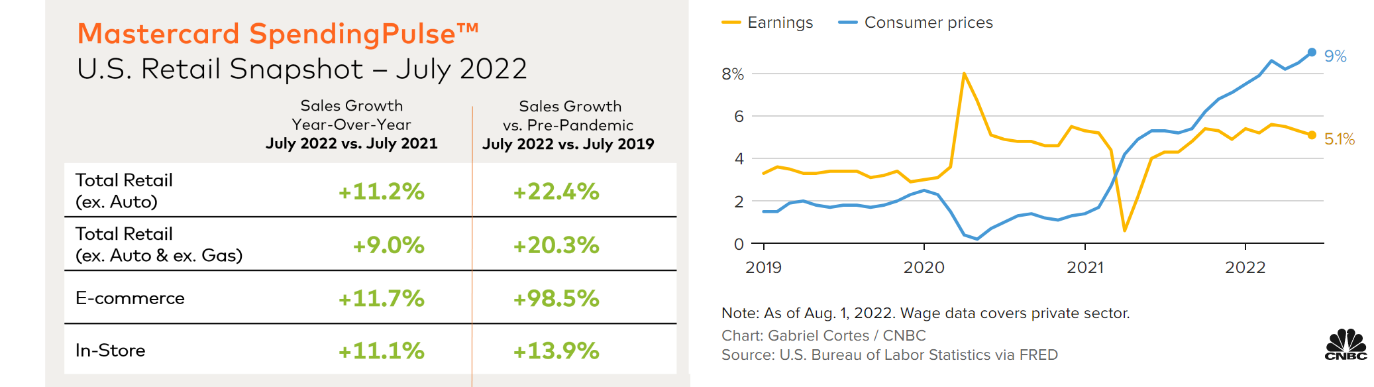

After the devastation of job markets by the Covid pandemic, 2022 has been a pretty good year for employees in the United States. The national unemployment rate is around 3.5%, the lowest it has been since 1960 and the wages have risen 6.2%, with the median American worker receiving an annual pay increase of around $3,500 dollars in comparison to 2021.

This is especially why the recent wave of layoffs caught me off guard and what makes this situation even more peculiar is that for many organizations, these downsizing operations are coming at a time when their profits are actually increasing! For example, Microsoft laid off a thousand staff members while reporting nearly 2% higher profits, while Ford announced plans to lay off around 10,000 employees when their net income was up by almost 20%.

So how can we make sense of the paradoxical news about the strong labor market coupled with increasing profits and the mass layoffs initiated at many organizations?

To answer this question, let’s take a step back in time to analyze the connection between inflation, interest rates, and unemployment, while also taking a closer look at the recent spending data to understand how staff restructuring in organizations is based on forward-looking data. The prospect of being laid off can be mentally taxing and I will provide some insight into how organizations decide whom to lay off and how you can avoid getting that pink slip.

Lessons from history

While recency bias can make us believe that the present 3.5% unemployment rate is normal, historic data shows that since the 1950s, the unemployment rate has never held below 3.5% for more than a year. Worse still, almost all stages of low unemployment were followed by a recession that bought substantial job losses.

In the 1950s, low unemployment and high inflation resulted in the Fed raising interest rates, which led to a recession. The recessions during the 1970s and 1980s were also preceded by spells of low unemployment. More recently, right before the dot-com recession of 2000 and the 2008 financial crisis, we saw unemployment dropping to nearly 4%.

The key thing to understand here is that low unemployment is almost always associated with high inflation which forces the Federal Reserve to raise interest rates, resulting in a slowing economy. With this in mind, what has the Fed been up to lately?

With the tight labor market and high inflation, the Fed is convinced that further rate hikes are required with the only debate being about how quickly to raise the rates. So how did we reach here?

As Covid ravaged the economy, the Fed reduced interest rates to spur economic growth, which allowed businesses to expand quickly and hire a lot of staff. With inflation still being around 8.5%, the Fed has decided to continue increasing interest rates. The increased cost of borrowing no longer presents the opportunity for businesses to over-expand and they want to improve revenue in anticipation of an economic slowdown. Due to this, despite increasing profits, they pre-emptively lay off some of their workforce to save cash and prepare for an economic slowdown.

Now, rising interest rates are not the only reason why companies are expecting an economic slowdown. The other reason becomes clear when we take a closer look at the recent spending data.

Devil in the details: Spending rate

An increasing spending rate is often touted along with the low unemployment data as a sign of a healthy economy and a cursory glance at the data does seem to conform to this notion. Retail sales rose 1% in the month of June, and it was 11.2% higher than the previous year. There is also abundant demand across various sectors with booked-out Airbnbs, Doordash sales beating estimates, and Amtrack having to contend with delays as demand rises. However, a closer look at the spending data reveals an unpleasant detail.

Consumer prices have increased at a rate far outpacing the wage increase and many sectors are more expensive than they were a year ago, which is likely the reason for increased spending. In fact, when adjusted for inflation, real spending across multiple industries has actually decreased! For example, although fuel spending is up by 32%, gas prices have increased by 40%, completely offsetting the idea of increased demand. Items like eggs have more than doubled in price alongside many other groceries, which explains the 1.8% increase in grocery spending.

The takeaway here is that even though people are spending more money, it is only because they are forced to spend more to purchase the exact same things that they bought a year ago. The latest wave of layoffs is most likely because many organizations are aware of this nuance in the spending rate and are preparing to save cash in anticipation of an economic slowdown.

Rocky Road Ahead

Overall, contextualizing the recent Fed rate increase and the associated waves of layoff with historic data suggests a rocky road ahead for the US economy. In terms of employment, many businesses are now realizing that they over-hired during the post-lockdown economic boom and are now ‘trimming the fat’, i.e., laying off employees who are dispensable. The CEO of Ford quite literally said ‘We have too many people’ and complaints about a ‘bloated workforce’ have been doing the rounds in Google. A recent survey showed that only 9% of tech workers are confident about keeping their job and I don’t think it would be very different across other industries.

So, if you are concerned about your job, now is the time to become absolutely indispensable to the organization that you are working in. Additionally, keep your resume up-to-date and ensure that you are picking up new skills that are relevant to your industry. We are no longer in an environment where people are rewarded for showing up and now is the time to double down to ensure long-term job security. So, stay sharp and ensure you have 3-6 months of saved income to get through tough times. Economic slowdowns won’t last forever and upskilling yourself now ensures that you are well positioned during sunnier days.

See you next week with another deep-dive!

And force of habit - Smash that like button to help others find this newsletter.

Great intel. Thanks Graham. Puts the numbers into perspective.

Thanks Graham! Makes a lot more sense to me now.