What’s up Graham, it’s guys here :-) If you would like to join more than 22,600+ members and never miss an update on the market, hit the subscribe button below. It only takes a second and is completely free.

All signs point to a coming recession - The Hill

I think there very well could be a recession or even worse - Carl Icahn

It’s time to address a topic that everyone’s worried about but that’s very hard to predict - The upcoming recession. More and more news articles are popping up every day highlighting that a recession is near.

From my perspective, the danger signals are all here, from rapidly increasing energy prices to a flattening yield curve, but it’s time to put all the pieces together to answer the questions:

What is a recession and how does one happen?

Are we heading into one right now?

What does that mean for the stock market… and how can you keep your money safe (or make more!)?

Let’s dive right into it.

What is a recession?

A recession, simply put, is a brake on the economy. A practical rule of thumb to identify a recession is to look for two consecutive quarters of declining GDP. This means that demand goes down, less money is spent and the economy contracts.

From a business point of view, a recession is a period when companies choose to save rather than invest. Saving isn’t bad from a retail consumer’s point of view, but for a company, saving means cutting down on growth and focusing on stability instead. This leads to lay-offs and increased unemployment. Growth takes a backseat as optimism is replaced by uncertainty.

How does a recession occur and are we heading into one?

Even though recessions can be caused by a myriad of factors, let’s focus on the most important ones and see if can identify any trends from them. After all, catching a recession early can pay dividends to your investment portfolio. This is exactly how Micheal Burry’s hedge fund Scion Capital was able to generate 489% returns. While we are not running our own hedge funds nor trying to beat the market, being aware of these signals can definitely improve our investing acumen.

Inverted yield curve

The first sign of a recession is an inverted yield curve. The yield curve is a measure of how treasury bills payout over different periods of time. Technically, investing over the short term is supposed to be less risky compared to investing over the long term when it comes to T-bills, and the 2-year rates are less than 10-year rates. An inverted yield curve happens when the 2-year payout is more than the 10-year one - Signalling that economic growth is slowing down and investing in the short term has become riskier!

Inverted yield curves have predicted recessions correctly 9 out of 10 times - The one false positive was in the 1960s when there was an economic slowdown but no recession. But coming to NOW - We are seeing a flattening yield curve, where the 2 year and 10 year rates are nearly the same, and it could invert at any time. On average, after the yield curve inverts for 10 or more days, it takes 311 days for a recession to start. The yield curve hasn’t actually inverted yet, but there are other factors to consider…

Inflation is at an all-time high

With commodity prices rising and no growth in income, households are being forced to spend a larger share of their earnings on food and gas. This means that there’s less to spend on other goods and services, leading to reduced demand. At the same time, higher interest rates also make credit expensive for both consumers and businesses. All this leads to less spending, and a decline in growth.

This ties back to what we saw in the beginning - When growth gets expensive, consumers and businesses alike go from investing mode to savings mode, and this leads to a ripple effect where reduced demand leads to reduced growth leading to more layoffs and unemployment, making production more expensive, and so on, leading to…

Slowing corporate profits

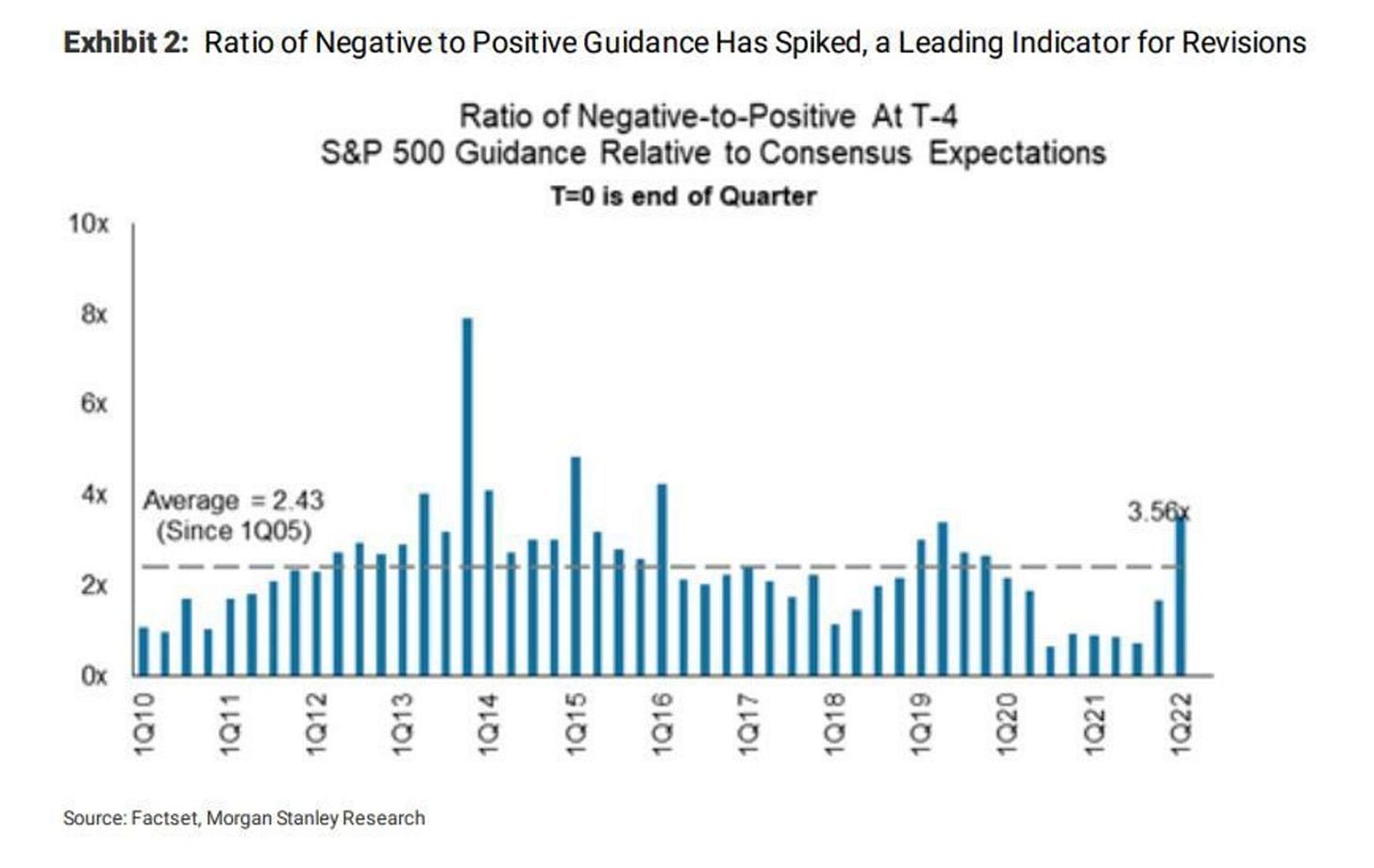

With lesser consumer spending and growth, the profits for companies are expected to decrease. This is already being reflected in the earnings guidance that companies issue to investors: The ratio of negative to positive guidance spiked above average for the first time since prior to the pandemic, and it wasn’t even this bad during the pandemic! We aren’t seeing a deflation yet, but the warning signs are all there.

Asset Bubbles

Recessions are scary - but some argue that recessions could even be healthy in a sense, by testing the profitability of businesses and weeding out the economically unsound companies. Ben Carlson of Commonsense Wealth thinks that recessions are inevitable, with one happening about every 4-10 years. They are like a reset mechanism in our boom and bust stock market cycle.

In my previous article about the changing world order, we saw how countries rose and fell, with the creation of bubbles. Something similar happens within the American economy as well: Many devastating recessions follow periods of prosperity after financial bubbles collapse, such as the Dot-com bubble or the subprime mortgage crisis, and some think that we are seeing such asset bubbles (Crypto, NFTs, Meme Stocks etc.) in the speculative parts of the market right now.

Sudden Economic Shocks

A drastic change in the market can also trigger a recession. Examples include the oil embargo issued by OAPEC in 1793, Covid’19 pandemic lockdowns etc. While we are nowhere near such a situation, the current Russia-Ukraine conflict have raised oil prices substantially which can drive up the already high inflation. Plus the uncertainty regarding a country having the largest Nuclear pile in the world is bound to keep the markets on the edge.

It does look like we have enough indicators that are flashing red to keep me up at night! But, before you get worried, let’s look into what happens to the stock market when a recession hits!

Recession and the market

Thanks to this excellent research from Market Sentiment, we now know how the stock market performs during a recession.

Surprisingly, recessions on average only lasted 10 months and the market lost value only half the time since the 1940s, with a positive average of 1.7%. In fact, going further back to 1869, we see that the market went up by 9.8% on average at a time when the GDP went down by 3%, and there was no significant correlation with lower stock values. This means that recession or not, the stock market is still one of the best investments around!

The cherry on top of the cake is how the market performed after the recession is over. Those who managed to hold on to their portfolio were well-rewarded post-recession. In 85% of the cases, there was a profit within a year, and after 3 years or more, there was a profit in 100% of the cases! In fact, the 5-year average is a whopping 120%.

Conclusion

A recession is an unsettling time for the economy, and looking at the warning signs, it seems like we might be heading into one soon. But one thing is for certain. The stock market has always come through in a recession and investing in the stock market is one of the best options regardless of whether there’s a recession or not. Buying into the S&P500 regularly without paying attention to the reaction of the market and holding on to your investments is the best strategy.

Just expect volatility to be the norm in the coming times, be mentally prepared, stay employed, and understand that no recession has lasted more than 18 months… At the end of it, you’ll be better off than where you started from. As the famous saying goes,

Far more money has been lost by investors trying to anticipate corrections, than lost in the corrections themselves - Peter Lynch

See you next week with another deep-dive!

If you found this insightful, please take a minute to subscribe to my newsletter :)

If you enjoyed this piece, smash that like button and share it! Thank you.

Do you have a source that shows FICO 10T and Vanage 4.0 use alternative data sources? My understanding is they use trended credit bureau data, but that is not considered alternative.

Greetings From Argentina! Thank you so much for the excelent information.