Recession Alert

Dread it, Run from it, Recession arrives all the same.

Well, what I thought was going to be a normal week turned out to be anything but that when I was hit with the news that GDP fell by 1.4% in the first quarter of 2022. This is massive, as we now have almost all the indicators of recession flashing red.

The yield curve inverted just 3 weeks ago

Inflation is breaking new records every week

The S&P 500 is down 13% and QQQ is down 22% from their respective ATHs

If we have just one more negative quarter of growth, we will be in a recession based on traditional definitions. So in this week’s deep dive, let’s break down what just happened and the potential impact not only for yourself - but also on the entire economy. This will enable us to be prepared, ahead of time, and to make the most out of the situation!

What is a Recession?

Even though it’s easy to imagine the stock market falling into the abyss, unemployment skyrocketing to a record high, and everyone losing their mind that the Fed won’t keep their money printer going - The reality is that recession isn’t always so catastrophically damaging.

Recessions are mainly based on one single metric - GDP (Gross Domestic Product). This is the entire market value of goods and services produced in the United States. So, if we are growing as a country overall, the number goes up. But, on the other hand, if the GDP decreases, it showcases that people are spending and producing less and usually this leads to a recession.

Technically, if we are going by the definition, a recession is defined as “Two Consecutive Quarters Of Declining GDP,” of which we are halfway there. But recessions are not as rare as you think they are. Since the 1940s, we have seen 12 recessions with the longest lasting 18 months and the shortest being 2 months during the Covid Lockdown.

Why did the GDP shrink?

For the first time since the pandemic, the GDP declined at an annualized rate of 1.4%. We have to understand why this happened to make sense of how this will play out in the near future.

Without boring you with all the complicated charts and data points, I am summarizing the main reasons for the drop:

Decreasing inventory investment

A decline in spending across State, Federal and Local governments

Declining Exports

A pullback in defense spending

There are a lot of arguments for and against each of these points but the biggest one is inventory investment. The argument here is that a lot of businesses bought a lot of extra inventory in the last quarter of 2021 expecting a supply chain bottleneck (I too did exactly this as a business owner of Bankroll Coffee) and the drop that we are seeing in 2022 Q1 is just due to these businesses cutting down their inventory spending since they have a lot of excess inventory on their hands.

The real worry is not the declining GDP but rather that the current scenario is a perfect situation for Stagflation - Something we haven’t seen in the last 50 years. For those who are unaware, stagflation refers to the perfect storm of slowing growth, high inflation, and rising unemployment — all occurring at the exact same time — and this is what happened in the 1970s. We are currently seeing rising inflation that has resulted in tightening of policies, rising raw material costs affecting companies, and businesses trying to scale back and lay off their workforce to reduce their expenses, and all of a sudden, stagflation is a real possibility.

In terms of how all of this is going to affect the stock market, this is where it gets extremely interesting. If you just read the following section carefully, it can end up saving or even making you a lot of money!

Stock Market & Recessions

From 1869 to 2018, there have been a total of 30 recessions out of which 16 recessions had a positive stock market return - The market went up an average of 9.8% during a time when the GDP declined by 3.0%. In other words, more than half the recessions had no correlation with the stock market. Going a step further, since 1869, the correlation between the stock market and GDP during a recession was negligible at 0.05%. The study found out that on average, the U.S Stock market peaks six months before the start of a recession - and this is where we get to the bad news :(

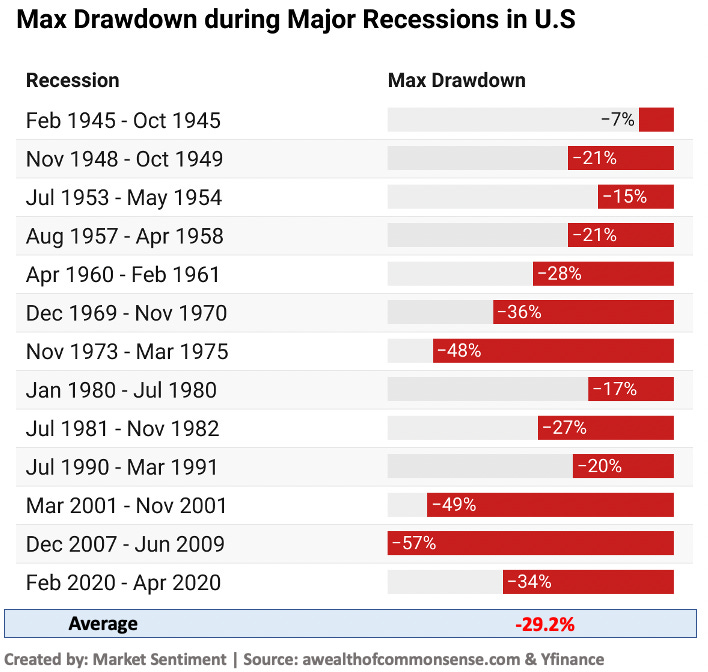

Throughout every single recession since 1945, the stock market at some point has seen a sell-off with the average drawdown coming in at a whopping 29.2%. However, the good news is that by the time the recession is over, the market actually recovers and posts an average gain of 1.7%.

The cherry on top is that following one year of recession, your portfolio would have gained 18% on average and you would be up 46% in just 3 years - This shows that the best time to invest is during a recession.

The rationale behind this is simple - The recession is a time of little hope and bleak prospects, but as investors start hearing news of the economy reopening and businesses growing once more, the optimism alone is sufficient to drive the market upwards. The economy can remain sluggish in the aftermath of a recession but the stock market may still be rocketing higher in anticipation of relative improvements.

However as Ben Carlson pointed out, it’s not easy as thinking - ‘oh perfect, I will just invest during a recession when the market drops’ because you don’t know whether you are in a recession until it’s too late. Technically, a recession is 2 periods of negative growth. We could be at the start of a recession right now with one-quarter of negative GDP change but we wouldn’t officially know it until the next few months. Bloomberg also notes that a bear market tends to be a better predictor of recession rather than a recession being a predictor of a bear market.

There are some other ‘interesting alternative indicators’ that are worth looking for in the search for a recession predictor such as the Skyscraper Index, Men’s Underwear Index, Lipstick Index, and Swiping Index all of which are hypothesized to predict a recession.

What now!

If we pay close attention to the stock market, we can observe that the worst drops come right before a recession and that usually coincides with the best time to buy. Now, that’s not to say that the prices can’t go any lower or that the recession could last way longer than anticipated, or finally, this might all just be a false alarm.

Whatever the case may be, the best course of action is to simply stay invested and to keep investing when times are bad which will pay dividends when the market inevitably turns around. It’s comforting to know that no recession has ever lasted more than 18 months - just expect the stock volatility to be slightly higher in the coming months - and it’s always a good idea to stay employed during the crisis.

Until next time…

If you enjoyed this piece, smash that like button and share it! Thank you.

Thanks Graham..... essentially, let's keep kalm :)

Great words of wisdom. Now if I could just find another job....