What’s up guys, it’s Graham here :-) If it’s your first time here, hit the subscribe button below to join 37,800+ smart investors and never miss an update on the market again. It only takes a second and is completely free.

Common currency, just like the world’s common language, tends to stay around because the habit of usage lasts longer than the strengths that made it so commonly used.

– Ray Dalio

Technology and capitalism go hand in hand. In fact, capitalism as we know it was invented because one country developed a technology that was so limitless in its possibility that everybody else wanted to invest in it. I’m not talking about computers or cars or weaponry or engines – way before these existed, the Dutch perfected shipbuilding. To finance it, they invented capitalism as we know it today.

The robust ships that the Dutch built enabled them to travel all around the world, and their military expanded their reach. These naval expeditions had the immense promise of conquest, trade, and riches from exotic lands but they were also expensive projects which carried the huge risk of complete failure – this risk-reward ratio was the basis for the world’s first stock market, and these projects were being financed by debt and investments from the public. As the reach of the Dutch expanded across the world, other countries trusted in their stability as well and began trading in the currency of the Netherlands. In the 17th and 18th centuries, the Dutch guilder was the de facto reserve currency of the Western World. It seemed like it was there to stay.

Yet, by the end of the 19th century, Britain had risen as the dominant superpower and the Dutch empire was in decline. The British pound, backed by the gold standard, was now the reserve currency. For a long time, the UK was the manufacturing hub for the world and the world traded in pound sterling. It stayed that way till World War I, when European countries took the most damage – and then the power shifted to America in the Bretton Woods Agreement. The countries of the world would peg their currencies to the US dollar, which was the most stable currency at the time.

And that’s where we are now. You might be seeing a pattern here. Empires rise, and empires fall, and the mantle of the reserve currency keeps being passed from one country to another. But it’s not a simple vanity metric: Controlling the reserve currency of the world comes with great advantages, and the transition brings a lot of changes for the economy and the people who hold the currency. Now, the world’s second-largest economy China has made a trade deal with Brazil ditching the dollar as the intermediary. This could be the signal for a shift in power.

What does the reserve currency status mean? Is the US dollar in decline? What does it mean for you as a consumer and investor? Let’s find out.

A beacon of stability

For the last 80 years, the US dollar has been the most powerful currency in the entire world, because it’s the reserve currency. To put this in perspective, consider this excerpt from the Fritz report in 2020:

Want to have a little fun? Take a €10.00 note to the local McDonald's! They won't have any clue what to do with it. Yet if you pulled out a $10.00 bill anywhere in Europe, they would accept it. Maybe not at a great exchange rate, but they would take it. Do you realize how meaningful that is?

The US dollar is accepted virtually everywhere in the world – because regardless of political instability and economic conditions, the dollar is seen as a safe-haven currency that provides stability and safety. And it’s not just from a consumer’s perspective. International trade between countries, especially in commodities like oil and gold, needs a common medium to denominate their value. If all trade happened in local currencies, countries would have to convert back and forth losing time, during which the value of the commodity would change. A reserve currency eliminates these problems and facilitates smooth and efficient trade.

Of course, the United States benefits a lot from this as well: By having the currency that’s in the highest demand, we have a lot of buying power. Control over the dollar infrastructure also grants the US the power to set rules and standards by which trade is to be done. But the problem with having wide reach is that it becomes difficult to maintain the empire. And that is what has happened historically…

The Rise and Fall of Nations

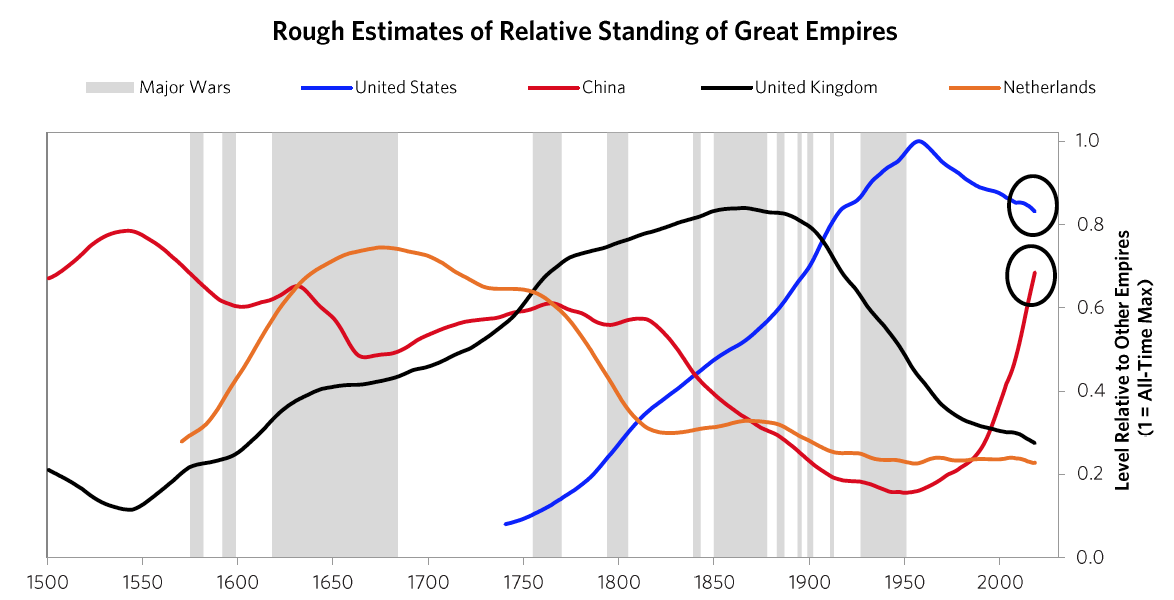

America now controls the reserve currency of the world. We saw that the United Kingdom and the Netherlands held this spot before the US – but these aren’t isolated occurrences. As Ray Dalio observes, reserve currencies change every 100 years or so in a transition period that lasts anywhere from 10-20 years. A reserve currency doesn’t exist in a vacuum – It’s a product of the geopolitical situation, trade relations, and alliances between countries. Though the exact circumstances change, the pattern itself is quite similar each time. Each superpower goes through these phases:

The Rise

The Top

The Decline

The Rise is when the country begins its ascent to power in a period of peace and prosperity. There is a spirit of optimism as people bet on the new system and the period is marked by investment in strong education systems, critical thinking, work ethic, and aspiration for a better life – The byproduct of this is innovation, new technology, and a rapid increase in productivity.

But to sustain the pace of productivity, more resources are needed and the economy cannot bootstrap itself. Two things happen: The leading country begins to expand its reach through trade and geopolitical control, and other countries begin to invest in the rising economy. A system is put in place to allow people from around the world to convert their currency into the reserve currency, and invest in its productivity.

This leads to The Top: As the leading country’s productivity rises and hits a peak, the value of the time of its people is worth more in relation to those from other countries. Other countries are willing to do the same work for less and they have a blueprint for the technology which they can imitate and make more cost-effective. So two things happen: The life of people in the leading country becomes more convenient because they can use the power of the reserve currency to buy services from outside, and they simultaneously become less competitive as other countries become more productive. As the new generation grows up in relative comfort, they tend to work less and values change across generations. A bubble starts to grow leading to a gap in wages between classes…

And that leads to The Decline. The excess spending and borrowing is great in the short term. But in the long term, it begins to weaken the economy and it becomes unprofitable to sustain. The country goes deeper into debt and potentially, begins to borrow from poorer countries who are able to save more. But this leads to a loss in the faith of the reserve currency, and at some point, people refuse to lend it more money. Instead they start selling their foreign reserves for profit.

If a situation occurs where the country can’t sustain its own debts, it needs to choose between defaulting or printing more money. And it’ll always choose to devalue its currency and raise inflation by printing more money. Since the 1990s, the US has already seen 3 occurrences where the Central Bank stepped in to finance an industry collapse: From the dot-com bubble, the mortgage crisis, and the Covid shutdown. Historically, it’s when a government has difficulty funding itself, during bad economic conditions and rising internal conflict, that the rich move their assets to places, investments, or currencies they feel safest in. With the loss of capital, innovation and productivity dries up further and gives way for a new reserve currency.

The three indicators

In the case of the dollar, we can look for signals to find out which phase we are in. The value of the dollar is indeed weakening, but to check if that’s really a problem, we can look at three metrics:

The foreign exchange rate

The demand for ten year treasury notes

Foreign currency reserves

The exchange rate to other currencies is measured by the US Dollar Index. Since 2020, the value of the US Dollar has been “gradually weakening”, but compared to the last 20 years, the dollar is still at a much stronger position than the recent drop indicates.

Second, 10-year treasury notes are essentially a 10-year loan to the government, and it’s a safe place to store people’s money and get a predictable return – as long as there’s still demand for it. In terms of the dollar, the rising interest rates are leading to a higher demand for higher yielding bonds, and we might be at the top of this dollar rally. On both counts, the dollar is quite strong.

But the third point is where it gets concerning. Foreign reserves are a measure of how much reserve currency is being held by other countries and reflects the trust they have in it. But the US dollar reserves have been steadily declining, and other currencies are beginning to take its place.

We are now at the lowest level in 25 years. And this is why the deal between China and Brazil is so important. Last year, they transacted around $150 Billion worth of trade, but on March 29th, they “struck a deal to trade in their own currencies, ditching the US dollar as an intermediary.” This isn’t the first time something like this has happened:

China has been shifting away from the US Dollar since 2010.

Russia and India both ditched the US Dollar a year ago.

Saudi Arabia said it was open to the idea of trading in Chinese Yuan.

Brazil, Russia, India, China, and South Africa (BRICS nations) have joined forces to transact in their own reserve currency to explicitly promote de-dollarization. They account for 24% of the world’s GDP and 16% of world trade, so this is not to be taken lightly.

Another event that turned out to be in China’s favor was the Russia-Ukraine war. The sanctions on Russia might have been a power move, but it allowed China to gain a larger share of the international trade. So in light of all this,

Is the dollar at risk?

Well, the future of the US dollar looks uncertain, but the reality is that there is nothing else close to taking its place. Despite China’s economy being poised to outpace the US by 2030, or the BRICS economies being some of the fastest growing nations, the US dollar still accounts for the vast majority of transactions.

Which country do you think is an underrated challenger for the reserve currency? Let me know in the comments.

In physics, there’s a phenomenon called the observer effect. The mere act of observing a process can change its path in the future. With something as complex as the path of world currencies, this is even more applicable: Now that we know the risks to the dollar, the government and US industries can act in a slightly different way to prevent history from repeating itself. But that doesn’t mean there’s no cause for concern. Even Elon Musk tweeted about the Brazil-China deal:

And with America’s internal problems being the current focus, its reserve currency role has been slightly out of the spotlight. With its money printing and policy changes and rate hikes having an impact throughout the globe, the currency war in the background is finally coming to the fore. There is a very real danger that other countries want to compete: With heavyweights like Saudi Arabia entering a new trade alliance, this puts more pressure on the United States.

At the end of the day, there’s something to remember – the position of the reserve currency is a crown of thorns in some sense. It comes with a lot of benefits, but by its very nature, it has an impossible agenda: Promote the local economy by making the currency weak and serve as a store of value by making the currency strong. This is called Triffin’s Dilemma. It’s not just the US, any country in the position of handling a reserve currency is going to have its hands full with the challenge.

Even though the US dollar is being traded less and there is more competition, the dollar has a strong advantage because of its position and flexible monetary policy. That isn’t going away anytime soon. This is definitely an issue to be aware about and keep on your radar, but there are issues closer to home that have a much bigger impact: Like how raising the impact of the debt ceiling on the markets.

My suggestion would be to focus on what you can control: Having a consistent stream of income, diversifying your investments, saving at least 15-20% of your income, and investing consistently. This will put you in the best possible position to keep your finances stable rather than worrying that the United States could one day lose its reserve status within our lifetimes.

Stay safe, stay invested, and I’ll see you next time – Graham Stephan.

Hours of effort and research went into making this ten-minute read. If you found it insightful, please help me out by clicking the like button and sharing this article.

Great article. One comment - stability of a currency also depends on that country’s legal system and whether most countries can trust that legal system to be fair.

Most of the other currencies while having power to challenge the dollar, their governments are not trusted because their legal infrastructure is obscure or corrupt. I think this will prevent currencies from China, India etc. to have parity with the dollar for a long time to come

Great article, very rare for the insights, I will make just one observation: I think that the real force behind a nation beeing a superpower and its currency a reserve is tecnology, and the leader is still the USA, the battle is in this field, and it has already started, just look at TSMC fabs in USA soil.