Retirement Blues

How inflation is affecting retirement plans

What’s up you guys, it’s Graham here! If you want to join 18,900+ smart investors and never miss an update on the market, hit the subscribe button below. It only takes a second and it’s completely free.

Buying the dip is not your only option*

Fundrise develops institutional-quality alternative investments for long-term investors obsessed with performance. The best investors are able to grow their portfolios in any macroeconomic environment. Today, many of the largest investors are turning to alternative investments like real estate.

Why? While the stock and crypto markets stumbled, Fundrise produced a resilient 5.5% net average client return through the first half of 2022.* That’s in addition to producing positive returns for the last 22 quarters in a row.

How? Fundrise has built a $6 billion+ portfolio of private market real estate, primarily made up of well-located residential (think: single-family rentals in Texas) and industrial (think: last-mile eCommerce distribution facilities) assets.

Fundrise is built for investors who expect outperformance and value transparency. You can start investing in just minutes with as little as $10.

*In partnership with Fundrise - For more information, including all relevant disclaimers, check out the Fundrise Mid-Year Investor Letter

Growing up, there were a few treats that pretty much defined my childhood. Sometimes it was a 99-cent Arizona Iced Tea or a $1.50 Hot Dog combo at Costco, at other times it was browsing through the dollar store with my allowance. Many such stores and products have become cultural phenomena primarily due to their unchanging price over the years. They signal value and stability even as the world changes around us. So, earlier this year, when I came across the news that Dollar Tree was increasing prices, it was a clear indicator of how much inflation was affecting our day-to-day life.

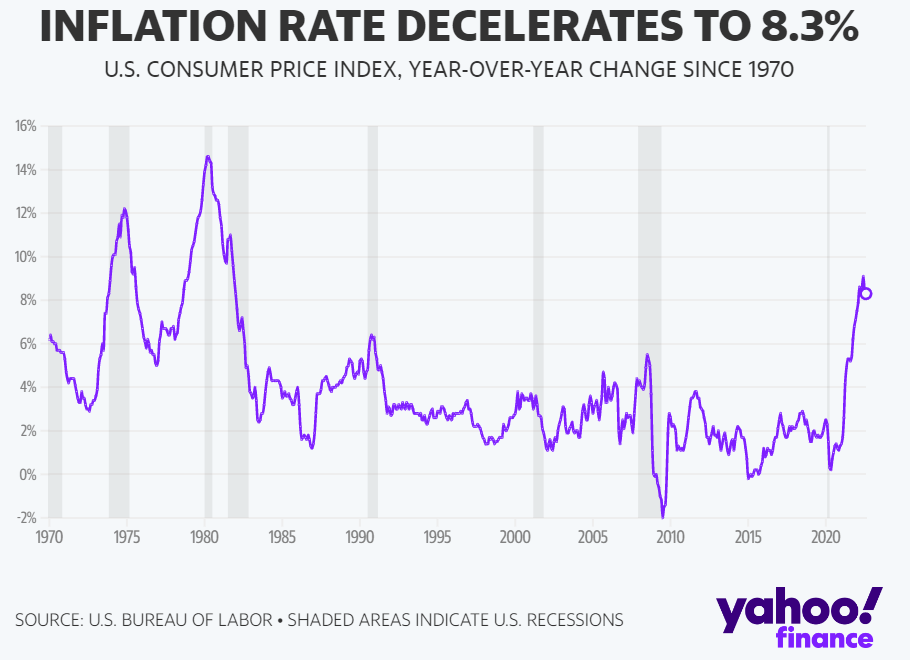

Now this news was from December 2021, but high inflation has been a constant theme throughout 2022. Despite the White House designating tackling inflation as their number one priority, the latest data shows inflation at 8.3%, much higher than analyst expectations. For some historical context, the last time inflation was this high was in 1982; so as far as millennials and GenZ are concerned, such a spell of high inflation is unprecedented.

Now, inflation certainly takes a toll in the short term, however, what concerns me more is its effect in the long term, particularly towards retirement. For decades, retirement planning was predicated on a delicate balance between stable inflation rates and steady returns from the market. But that has now changed in light of the rising cost of living and ongoing instability in equity markets.

As far as financial calculations go, retirement planning is the most consequential estimation that one has to do and it is extremely important to get it right. So, this week, let’s do a deep dive into how retirement savings are calculated, how inflation and stock market returns affect them, and how you should change your savings and investment strategy in this changing landscape.

The 4% Rule

Back in 1994, William P. Bengen, a financial advisor published a paper in which he backtested historical stock market performance and calculated how much money would be necessary to last a 30-year retirement period. Essentially, he found that to ensure that you can outlive your savings on a 30-year period, a retiree can withdraw 4% of their portfolio in the first year, and the inflation-adjusted amount from the next year onwards. For example, if you have $1.5 Million in retirement savings at the age of 65, you can withdraw $60,000 the first year, followed by the inflation-adjusted amount next year onwards till the age of 95 without having to worry about your savings running out.

The ‘Bengen rule’ of 4% became the holy grail of retirement planning and it was further reconfirmed in 1998 by the “Trinity study”. The popularity of the 4% rule is due to its simplicity and how well it works for pretty much everyone. However, there are a few nuances of the study that are often not discussed in this context.

First, the 4% rule assumes that your portfolio is a 50-50 (or 60-40 in some cases) split between stocks and bonds; the idea is that stocks will grow your portfolio, while bonds will protect it from volatility. However, with runaway inflation being the norm, these calculations are looking uncertain as of now. The key thing to understand here is that the Bengen 4% rule does not guarantee that you will be able to outlast your retirement savings.

Inflation Nation

One of the main assumptions of the 4% rule is that the inflation-adjusted returns on your retirement fund will be positive during the withdrawal period. In the last 120 years, the real returns of the stock market, i.e. after taxes and inflation, comes to ~5% per year on stocks and ~3.6% on bonds. However, as they say in mutual fund disclaimers, past performance is not indicative of future results. For example, right now, we are dealing with inflation of ~8.5%, which would mean that your withdrawal amount will have to increase by that much every year to maintain the same standard of living, which is likely unsustainable, given the expected rate of return on investments. However, there is a further nuance to the inflation rate that many folks miss.

While inflation as a single number is easy to absorb, it is important to understand its components and how much they individually increase. It is obvious that the prices of all goods and services won’t increase by exactly the inflation rate. Looking at the specifics reveals clear danger signs for those planning to retire. For example, in the latest inflation data, gas prices reduced, however, transportation only contributes ~18% to the consumer price index (CPI). The reduction in gas prices was completely offset by an increase in the prices of food, housing, and medical care.

For a retiree, an increase in gas prices might not directly affect their budget substantially since they no longer commute to work, but increases to other components are likely to extract a toll. For example, medical care services, which become more important as your age advances, increased 5.6% last year, while staples like bread and eggs are up 16% and 39% year on year. The inflation rate calculated from the overall CPI does not take into account the nuances of spending for retirees and some of them might end up having to withdraw even higher than the inflation-adjusted withdrawal amount. Now, this would not be an issue if your investments in the market were providing excellent returns, however, that is also looking less likely right now.

Uncertain returns

The other side of the 4% rule is the assumption that your investments will grow during your retirement. Assuming a withdrawal rate of 4%, over 30 years you would have withdrawn 120% of your initial retirement savings, so it is absolutely necessary that your investments generate inflation-beating returns during this withdrawal period for the 4% rule to work. Now, as we discussed earlier, in the 20th century, both equity and bond markets have returned inflation-beating returns, but that might not be the case in the 21st century. Many analysts are now predicting that the younger generation is expected to deal with a market that has higher unemployment, lower earnings, and higher taxes which will consequently result in lower returns.

There is also the additional issue of the Federal reserve printing money, further devaluing your savings. For example, during the COVID-19 pandemic, the Federal reserve started injecting money into the market to help businesses stay afloat by increasing its assets from $4 trillion in 2020 to $8 Trillion in 2022. Even Charlie Munger, the vice chairman of Berkshire Hathaway recently cautioned against this:

Nobody has gotten by with the kind of money printing now for a very extended period without some kind of trouble. We're very near the edge of playing with fire - Charlie Munger

He warns that the stock market may see lower-than-average growth over the next decade, simply because it has already risen so fast. Further, the period from 2012-2021 had an average annualized return of 12.62%, and based on past performance, the next 10 years are likely to give subpar returns. If you would like to further diversify your investments into real estate, check out the folks over at Fundrise, who have sponsored this article.

So, given the unprecedented inflation and headwinds in equity markets how can you prepare better for retirement? The first thing to do would be to cut down on expenses and maximize your investments. Further, it will be helpful to chart out a retirement plan specific to your conditions; how early you plan to retire, and whether your loved ones would need support from your post-retirement income.

MorningStar recently stated that if inflation remains at today’s levels for an extended period, the withdrawal rates would have to be reduced to around 3.3%. If you plan to spend more than that, then it’s a good idea to be flexible. For example, delay retirement by a few months, pick up a side job that supplements your income during retirement or reduce expenses when you see markets underperforming. A better understanding of how retirement savings work and anticipating uncertainty will ensure that you can live out your twilight years comfortably.

Although I tried to anticipate major expenses post-retirement (medical bills, rent, etc), let me know if I missed something. Also, how did you spend your allowance during childhood, and what were your favorite treats? Let me know in the comments!

See you next week with another deep-dive!

And force of habit - smash that like button and share this article to help others find the newsletter and grow our community.

Another piece of retirement savings is not withdrawing funds in real time.

If you have three years of expenses outside of the stock/bond markets and draw from that you can wait out market tantrums and restock your super-sized bucket of cash when the market regains its footing. It is true that this gets more expensive when inflation is running hot (a CD ladder isn’t going to keep up with inflation) but this way you have relatively predictable cash flow available without having to sell greatly depreciated assets to put food on the table.

In my opinion this trick plus the 4% rule is still a workable combination.

I especially enjoyed this newsletter! Very clear explanation of what’s going on with inflation right now👏

I would save up my allowance and birthday and Christmas gift money to buy American Girl doll accessories.