How to save $10,000 without sacrificing what you love

A step-by-step plan for building your savings

Leverage is the new hustle

Time is your most valuable asset — so stop wasting it on stuff you can outsource.

Upwork helps you hire skilled freelancers to do what you shouldn’t be doing: design, AI, marketing, websites, you name it.

No long-term contracts

Hire in hours, not weeks

Only pay for work you approve

Leverage > hustle. Build smart.

Let’s be honest. America has a savings problem.

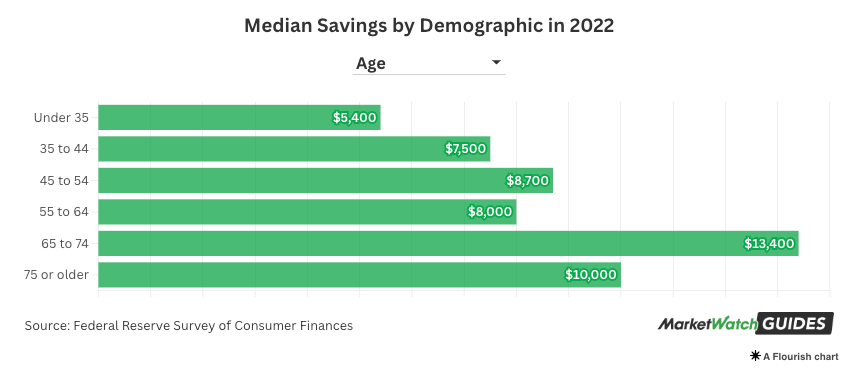

The numbers are bleak: the average American puts away just 4.6% of their income, and the median account balance for those under 35 is only $5,400. And now, almost half of Gen Z believes that saving for the future is pointless.

All of this is part of a much more disturbing trend. America’s savings rate has been sliding since the 1950s, and if it continues, we’re heading toward a future where “you’ll own nothing and be happy.”

The good news is, that slide can stop right now, and you don’t have to be a part of the decline. There are five simple strategies you can start today to build up $10,000 as quickly as possible. The best part is that it would cost you nothing – and contrary to popular belief, you don’t need to sacrifice your life to make it happen.

Step 1: Break It Down

“One day Alice came to a fork in the road and saw a Cheshire cat in a tree. ‘Which road do I take?’ she asked.

‘Where do you want to go?’ was his response.

‘I don’t know,’ Alice answered.

‘Then,’ said the cat, ‘it doesn’t matter.’”-- From Alice in Wonderland

If you don’t have a goal in mind, there’s nothing against which you can track your progress. The first step is to Get Specific. Deciding exactly how much you want to save and by when gives you a North Star to return to.

Parkinson’s Law tells us that the more time you give yourself to accomplish something, the more time it will take. So if you want to hit $10,000 fast, you need a firm (yet realistic) deadline and then you break it down into daily and weekly targets you can actually stick to. Let’s say you want to reach $10,000 in one year. That works out to:

$833 saved each month

$27.40 saved each day

$1.40 saved each hour

Or, if you want to really drill down, 2 cents saved every minute

Alright… you don’t have to go that far. But breaking a big goal into bite-sized, measurable steps makes it a lot less intimidating. $10,000 might sound overwhelming but $27.40 a day is doable.

If you hit that target consistently, you’ll reach your goal in no time. Once that’s decided…

Step 2: Start Immediately

I know this sounds like common sense, but you’d be surprised how differently it plays out in reality. People set a financial goal, get excited about it – and then nothing happens.

Maybe you forget about it because you get a text, or you think you’ll start tomorrow. Or you tell yourself, “Next week will be better because Bitcoin still hasn’t bottomed.” Whatever the excuse, the result is the same. You lose momentum before you even start.

The truth is, you have the most energy and motivation in the first 24 hours after deciding to take action. Let it sit, and that spark fades. It’s replaced by the same procrastination that’s kept you from hitting your goals in the past. Studies suggest that 86% of people who begin working on a goal right away are far more likely to hit their target in the timeframe they set for themselves.

If you’re serious about saving $10,000, you need to start immediately. Not tomorrow. Not after the weekend. Now. (I’ll wait till you get back, go ahead).

Step 3: Budget Like You Mean It

If you’re going to stash away an extra $27.40 every day, you need to know exactly where your money is going. Without a budget, you’re basically wandering into Costco on a Saturday without a shopping list.

The fix is simple: sign up for a free money-tracking platform like YouNeedABudget, RocketMoney, Monarch Money, or any similar tool. These pull all your accounts and credit cards into one dashboard so you can see every dollar flowing in and out, in real time. Keep in mind that these tools aren’t perfect. You might need to manually fix duplicate transactions or miscategorized expenses. But with 20 minutes of weekly upkeep, these tools can be game-changing. Why?

When you see where your money is actually going, you can spot the silent budget killers the average American falls victim to:

$18,000/year on non-essential purchases (USA Today)

$200/month on subscriptions – $133 more than you thought (CNBC)

$281/month on impulse buys (Capital One)

$100/month in credit card interest (WalletHub)

$100/month on fast food (The Barbecue Lab)

$91/month on coffee (Security Bank)

$82/month on alcohol (LendingTree)

$60/month on uneaten food (EPA)

$30/month on wasted home energy (LED One)

That’s $744 per month ($25 a day) that you could redirect to your savings goal, even without touching your core expenses. Track your spending for 30–60 days, and cut everything you don’t need. The magic happens when you finally pull back the curtain to see where your money has been hiding all along.

Step 4: Cut the Easy Stuff First

Sounds simple, right? That’s because it is. One survey found it was easiest for people to cut back in ten categories: eating out, alcohol, credit card interest, clothes, electricity, cigarettes, heating/AC, unreturned items, convenience, and the lottery.

Almost all of those are discretionary and directly under your control. Eat at home instead of dining out, and skip the alcohol. Prioritize paying down your credit cards to eliminate interest. Make coffee at home instead of going to Starbucks (I know, I know, I’ve been saying this forever, but it works). Turn off lights when you’re not using them. Bump the AC up two degrees. Return what you don’t use and cut down on “convenience” splurges. And yes, ditch the lottery.

If you don’t love the idea of cutting back, I understand. Fair enough. In that case, use my favorite filter for every expense: “How can I find the same thing… but cheaper?”

Car insurance: When’s the last time you shopped around for it? Thirty minutes of quotes can get you the same coverage for less.

Internet and cell phone: There are tons of lower-cost providers and plans.

Everything else: Sometimes a polite call asking for a discount works in minutes. I’ve done this on auto repairs, studio rentals, and hotel stays. You’d be surprised how often it works out. Most people don’t ask.

Here’s why this step is so powerful: saving beats earning at the margin. When you earn $1, you’ve got taxes, commuting costs, gas, wear-and-tear before you net ~$0.75. When you save $1, you get to keep the full $1 immediately. Put differently, if you spend $50 on a meal, you’d need to earn $67 before tax to pay for it. Skip the meal and eat the leftovers that were about to go to waste, and you’ve got $50 back in your pocket right now.

Step 5: Pay Yourself First

If you want to supercharge your savings, one of the most effective strategies you can use is simple: pay yourself first. But what I mean by “pay” is different. I mean paying yourself by saving a set amount first.

Most people spend their paycheck on housing, bills, entertainment, eating out, etc. and only save whatever’s left over. Paying yourself first flips that on its head: you automatically move a set amount into savings the moment you get paid, and then live on the rest. This works because most American households don’t have an income problem. They have a spending problem.

Expenses tend to rise right alongside income due to lifestyle inflation. That’s why almost half of Americans earning over $100,000 live paycheck to paycheck, and over a third of those making $200,000+ are in the same spot. Even a couple earning $500,000 a year in San Diego admits they’re living paycheck to paycheck!

Spending habits match your income unless you actively resist them. The only way out is to make saving non-negotiable. Automate the transfer, move it to an account you never touch, and keep it out of sight. Once it’s gone from your checking account, you’ll forget it was ever there. Now that your baseline is set, let’s move on to the tricks.

Step 6: Five Money-Saving “Life Hacks” That Actually Work

These are small mindset shifts that have personally had a massive impact on me over time:

1. The 24-Hour Rule

If you see something you want, wait at least 24 hours before buying. Most of the time, by the next day, the urge will fade. If it doesn’t, you’ll know you truly want it.

2. The 5-Minute Rule

Say you still want it after 24 hours, spend just five minutes shopping around for a deal. Sign up for a site’s mailing list can snag you a 10–20% discount. Little savings like this add up fast over time.

3. The 10X Rule

If you’re still doubtful, before you click “buy,” ask: Will this purchase still matter in 10 days, 10 months, or 10 years? If the answer is no, skip it.

4. Consider the Future Value

A $100 pair of shoes today could grow to $1,478 if invested at 8% for 35 years. A $500/month car lease translates to over $1.2 million in lost potential. The money you spend isn’t just an expenditure, it’s a lost opportunity to compound it. Every $1 spent today could be worth $14 in the future, so treat it that way.

5. The 10:1 Rule

If you really want something, have considered the cost, found the best price, and believe it will deliver at least 10 times its price in value or enjoyment, then go for it without guilt. That $90 Ninja Creami is worth it if it brings you $900 worth of happiness over time.

One thing my friend told me that changed my mindset is that certain experiences are only possible at certain times in your life – you might have the resources to travel or play adventure sports when you’re 50, but you’re likely to enjoy it more when you’re younger. If that’s your kind of thing, go for it. But budgeting for it in advance helps!

Step 7: How to Practically Save $27.40 a Day

If you’re aiming for $10,000 in savings over the next year, here’s how you can hit that number without extreme sacrifices.

1. Housing

Housing is the single largest expense in the average budget. If you can bring this down, you’re set. Your options include renting out a spare bedroom, negotiating a rent reduction, moving to a lower-cost area, or shopping around for home insurance. Even small changes help: adjusting the thermostat, lowering water usage, splitting property tax payments across credit cards for bonuses… these can free up at least $10/day.

2. Transportation

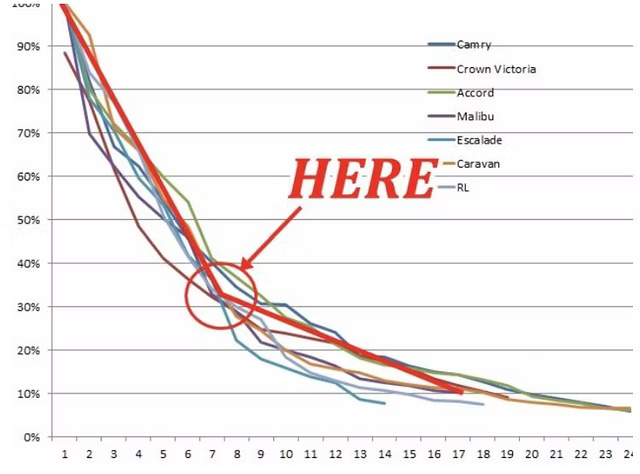

The average monthly car payment is now $745 (NerdWallet). Unless you need a high-end vehicle for work, opt for a reliable, fuel-efficient used car you can pay for in cash and drive into the ground. Cars lose the most value in years 6–7. If you buy then, you’ll maximize value.

Shop your insurance, adjust mileage, and you could save $5/day.

3. Taxes

Once you factor them in, taxes can rival housing to be your biggest cost. The average single U.S. worker pays 30.5% of their income in taxes. But if you learn the basics, claim every deduction, and hire a good accountant, the improvements could save $3/day.

4. Food

Americans now spend nearly $10,000/year on food – about 40% of that eating out! Stop “lazy spending” like $28 weekday lunches or daily Starbucks runs. Instead, you’ll get far more bang for buck if you save up for a premium experience instead of dining out regularly. Cutting back could free $3/day.

5. Debt Repayment

The average American carries $6,400 in credit card debt at 24% interest. That’s about $120/month wasted on interest alone. Follow the 24% Rule: Pay down the highest-interest balance first, and you’ll save roughly $4/day.

6. Apparel

We spend about $133/month on clothing. If most of your wardrobe goes unworn, cut that in half. That’s another $2/day in savings.

Add all of that up: housing ($10) + transportation ($5) + taxes ($3) + food ($3) + debt repayment ($4) + apparel ($2) = $27/day. That’s your $10,000 in a year, all from smarter budgeting, cutting unnecessary spending, and paying yourself first.

Step 8: The Other Path – Increase Your Income

But if you want the fastest route to an extra $10,000, here it is: make more money.

If you’re unwilling to cut spending, and you’re not interested in scraping together pennies over beans and rice, the solution is simply to earn more. That might mean a part-time job, extra hours, or even switching careers.

It doesn’t need to be glamorous. It doesn’t need to pay a fortune. Help a local business or pick up weekend shifts. Offer a service in your neighborhood. Check Craigslist, LinkedIn, ZipRecruiter, Facebook – and see what’s out there. Chances are, you’ll find solid opportunities. Over the last year or so, I’ve met fascinating people who’ve consistently utilized simple opportunities like window-cleaning and dog-sitting to save an incredible amount of money that they then leveraged.

Even at $15/hour after tax, just two extra hours a day adds up to $10,000 a year, without changing your existing spending habits. As your skills grow, so will your earnings. In fact, Americans who switch jobs are seeing pay gains nearly double those who stay put. Whether through a side hustle, overtime, or a better-paying role, more income gives you more flexibility and a faster track to your savings goal.

Once you’ve built up your savings, don’t let that money just sit there. Park it in a high-yield savings account or money market account.

Right now, plenty of options are offering 3%–4.5% interest, which means that once you’ve hit your $10,000 goal, you could earn an extra $400 a year, just for keeping your money in the right place without any extra work.

Follow the steps I’ve covered here: Set a clear goal, start immediately, budget, cut back on the easy stuff, pay yourself first, use money-saving rules, find daily savings opportunities, boost your income, and then optimize where you store your cash. You’ll be amazed how quickly the numbers add up.

This is a post that could help anyone working towards improving their financial status in 2025 – a savings fund of $10,000 is a solid base to start from. If there’s a friend or family member who needs to see this, please share it! Hit like and subscribe, if you haven’t done so already:

If you read this far, let me know what you thought by commenting: Great | Good | Meh | Terrible at the bottom. I read every single comment and email reply.

I’ll see you next week! Don’t forget to check out our sponsor, Upwork.

-Those median savings statistics always blow my mind. I don't understand such a large percentage of our population living paycheck to paycheck. Such a stressful way to live!

-No matter your income, there are so many creative ways to get your savings percentage significantly higher. Just need to find a way to get them all to read your blog posts!

Great Advise....I'm a fan of your newsletters and posts