The Blue Collar Fire Sale

Why Corporate America Is Buying Boring Businesses

Dan Schweber had what most people would consider a perfect resume.

He had navigated business school, landed a coveted role in health-tech consulting, and secured the kind of white-collar stability that parents dream of for their children. But the view from the corporate ladder didn’t look as promising as it used to. Instead of fighting for the next promotion or drowning in endless slide decks, Dan wanted to build something tangible.

So he quit.

He didn’t leave to launch a crypto token or an AI startup. He raised capital from investors and spent two grueling years hunting for a legacy business to buy. Ultimately, he bypassed Silicon Valley entirely and bought an air-duct cleaning company in Virginia.

But this wasn’t a passive bet. Dan didn’t just sign the check and retreat to a corner office. He took the wheel and expanded the fleet to 30 trucks, grew the team to over 60 employees, and set a target to hit $25 million in revenue by 2028. While his peers were worrying about tech layoffs, Dan was building the largest air duct cleaning operation on the East Coast. He proved that the “boring” path wasn’t just safer, it was smarter.

Dan is not an anomaly. He is part of a quiet but growing exodus.

A wave of highly educated professionals is currently trading high-status jobs on Wall Street for work boots and clipboards, using their capital to acquire plumbing fleets, car washes, and repair shops. They are betting their careers on a simple, contrarian thesis: The American Dream is under new management.

For thirty years, we told the next generation that success meant a university degree and a laptop, encouraging them to use their heads rather than their hands. They listened. They became lawyers, coders, and middle managers. But that shift has created a massive structural problem: The men and women who built the physical world – the shops, the repair yards, the local services – are ready to rest, and their children have long since left the building.

This demographic mismatch has triggered what I call the Blue Collar Fire Sale. It represents a once-in-a-generation opportunity to buy steady cash flow for a discount. But do not be fooled by the low price tag:

This isn’t free money. It is hard work disguised as an asset.

Join the 39,200+ investors who read this newsletter to spot the signal in the noise. Most financial media chases the headlines. I unpack the mechanics. If you want to understand where the money is actually moving, subscribe below:

The Silver Tsunami

The scale of this transition is massive:

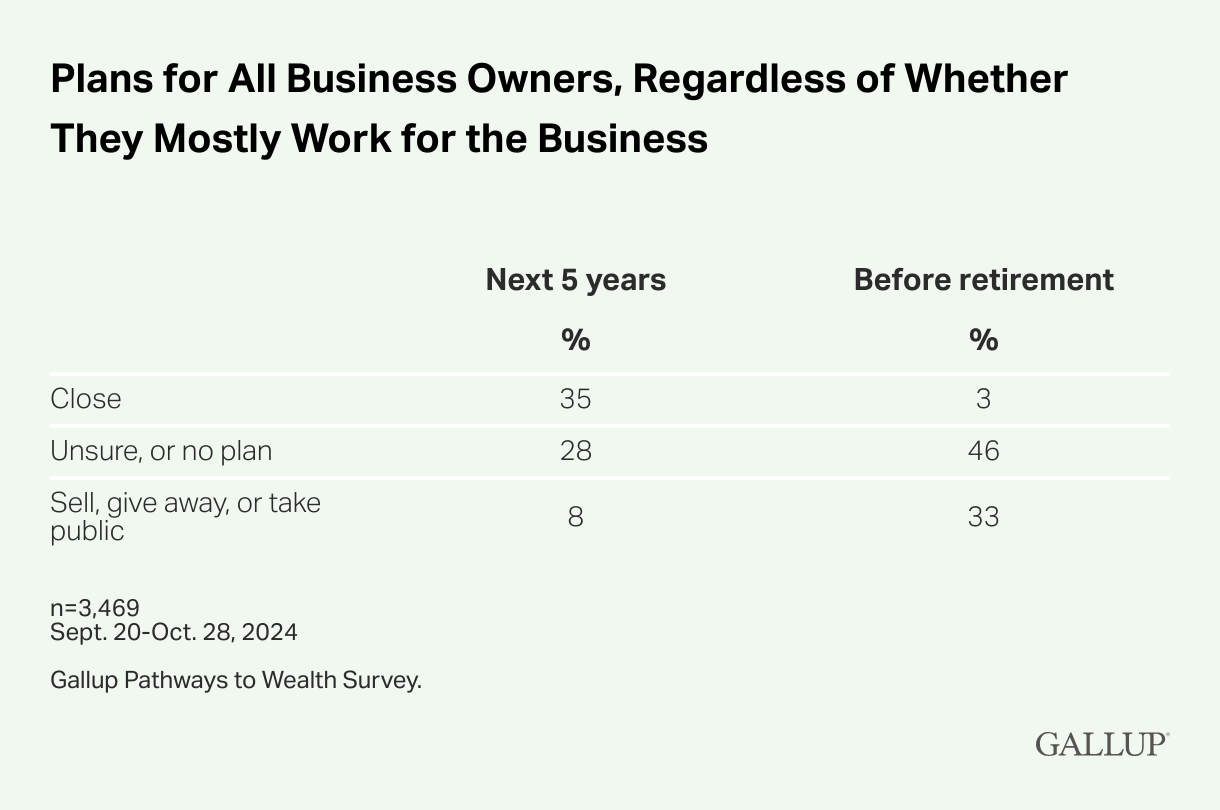

Gallup estimates that more than half of all private business owners in the US are now 55 or older.

JPMorgan Chase warns that millions of these owners are nearing retirement, with 75% of owners looking to exit within the next decade.

$10 Trillion in assets are expected to change hands.

The crisis lies in the lack of a plan. Most of these owners assumed their children would eventually take the keys, but the heirs have seen the reality of the lifestyle. They watched the business consume their parents’ weekends, and witnessed the stress that comes when a key employee quits or a lawsuit lands on the desk. If the heir has a stable corporate job or lives three states away, the choice is usually simple: they don’t want the overhead, they want the cash.

This dynamic creates a divided market. You have a massive wave of sellers who must exit due to age or health, pitted against a tiny pool of buyers who actually have what it takes to run a messy, real-world operation.

I want to hear from you. Is this a failure of the previous generation to make the work attractive, or is it just smart economics by the kids to walk away? If you are a business owner, do you have a succession plan?

The Price of Sweat

In the public stock market, you often pay a premium for hope. Investors will happily pay 50 times a company’s earnings because they are betting on future growth that hasn’t happened yet. On Main Street, however, the math is grounded in reality. These are not speculative startups: they have existing customers, proven models, and immediate cash flow.

Data from BizBuySell shows that service businesses, like HVAC or plumbing, often trade for 2-3x their cash flow. On average, these businesses bring in $100k-200k in cash flow and sell for $300k-$500k. Here’s an analogy that simplifies this:

Buying a tech stock is like betting on a racehorse. You pay a fortune hoping it becomes a champion, but if it breaks a leg, you lose everything.

Buying a small business, on the other hand, is like buying a farm. It smells like manure, you have to wake up at 4 AM to feed the animals, and you have to keep mending the fence. It’s backbreaking work. But that farm produces milk and wool every single day, regardless of what the racehorse does. Because so few people are willing to shovel the manure, you can acquire that reliable cash flow for a fraction of what you’d pay for a flashy asset.

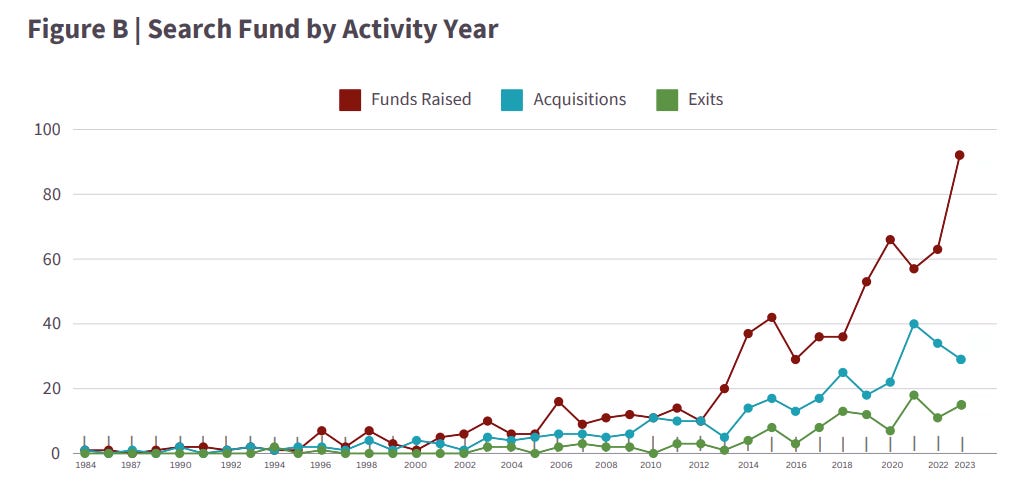

This is precisely why we are seeing record activity in “search funds”—pools of capital dedicated to buying these boring businesses. The smart money has realized that buying a job can be far more profitable than buying a stock, provided you are willing to do the work.

The Reality Check: “One Buyer Is No Buyer”

If you only read the headlines, you might assume you can simply walk into a bank, sign a paper, and become a millionaire. The truth, as always, is much messier. I spoke with brokers and experts in the field who warned that the market for the best businesses is actually a war zone.

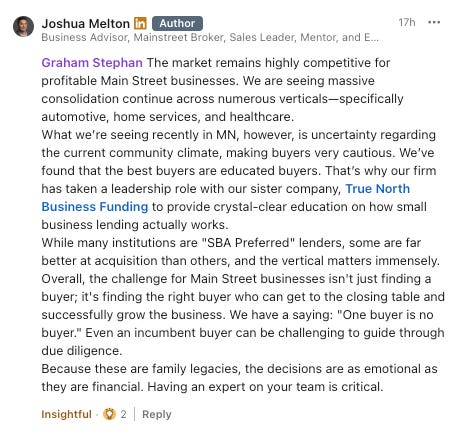

Private Equity firms are aggressively rolling up hundreds of plumbing and HVAC deals, bringing deep pockets and legal teams that individual buyers simply can’t match. One broker in Minnesota put it bluntly: “The challenge isn’t just finding a buyer; it’s finding the right buyer who can get to the closing table.”

He cited a common rule in the industry: “One buyer is no buyer.” Deals fall apart constantly because banks get cold feet or buyers panic during the audit. Furthermore, the financing landscape is a minefield. While many banks claim to be “SBA Preferred,” that doesn’t mean they understand your specific deal. If you bring an auto repair shop acquisition to a lender who only understands dental practices, you will likely get rejected. You need to find a specialist who knows the trade.

(If this sort of talk interests you, follow me on LinkedIn. I’m posting daily there).

The “Passive Income” Lie

There is a dangerous narrative on social media right now that suggests you can buy a laundromat or a pest control company, put a manager in place, and sip margaritas while the checks roll in. That is a lie.

The reality of running a Main Street service business is messy. If you have never run a real-world operation, it’s easy to romanticize it. But the day-to-day involves grit and process, rather than glamor. Here are some major risks:

1. The Inflation and Policy Squeeze

Small businesses are the first to feel macroeconomic pain. Unlike Google or Apple, a local plumbing company cannot easily absorb a 20% spike in insurance premiums or materials. BizBuySell’s Q3 2025 survey highlights this stress: 62% of owners said inflation was not easing, and 53% said tariffs increased business expenses. When policy gets uncertain, small operators suffer. If you buy a business with thin margins, one bad year of inflation can wipe out your ability to service your loan.

2. The “Key Man” Risk

In many of these deals, the owner is the business. They hold the relationships, the technical knowledge, and the employee loyalty in their head. A Reddit user recently described being overwhelmed by his father’s business, prompting a commenter to reply: “Sounds to me like your father didn’t have a business. He had a job.” Family expectations and drama can also make this decision complicated. (Like this man who is impatient waiting to take over his grandfather’s business – comments are gold)

A common nightmare scenario is buying a company only for the lead technician. the one person who understands the complex systems—to quit two weeks later. You aren’t just buying assets; you are buying a culture. If you don’t have a plan for retention, you are buying an empty shell.

3. The Systems Void

You might expect a company generating $1 million in revenue to have a CRM, standard operating procedures (SOPs), and clean books. Often, you will find a shoebox of receipts and a routing system that exists entirely in the owner’s memory. “Buying the business” usually means paying for the privilege of building the systems the founder never built.

The Operator’s Edge: Reinvention

So, who actually wins in this game? The winner isn’t just the person who buys the business; it’s the person who fixes it.

If you can take a plumbing company and implement digital booking, automatic billing, and modern routing software, you can potentially double the profit margins without finding a single new customer. You aren’t just buying cash flow – you are buying a platform to modernize.

The Due Diligence Checklist

If you are going to play this game, you need to treat it less like buying a stock and more like buying a job plus an asset. Here is your checklist to ensure you are on the right side of the trade:

Durability: Is the demand essential? HVAC breaks in a recession. Luxury landscaping does not. Look for repeat, local demand.

The “Bus Factor”: What happens if the best employee gets hit by a bus (or poached by a competitor)? If the answer is “the business dies,” walk away or negotiate a lower price.

Customer Concentration: Look at the P&L. Does one single client account for 30% of the revenue? If that contract blows up, will you survive?

Capex Reality: Look at the trucks and tools. Are they 15 years old? If you have to replace the entire fleet in year one, your cheap multiple just got very expensive.

For those ready to take the leap, the SBA 7(a) loan program remains the primary tool for financing these deals. It allows you to buy a business with as little as 10% down because the government guarantees a portion of the loan. This structure makes the “Fire Sale” accessible to regular people, provided they have good credit and a solid plan. But as the brokers warned, you must be educated on the terms.

The Verdict

The Blue Collar Fire Sale is real, driven by undeniable demographics: Boomers want out, and their heirs don’t want in. But this is not a get-rich-quick scheme. It is a career pivot.

If you are willing to leave the comfort of an air-conditioned office to learn how to run a real crew, you can build massive wealth and acquire the kind of leverage that most people spend a lifetime trying to build from scratch. But if you aren’t ready to sweat, stay in your cubicle. There’s no shame in it.

The farm is only for those who are willing to do the work.

If you’re interested in diving deeper, this video by Khe Hy is a great starting point. Khe interviewed Ben Jasper, a hedge fund exec who quit at 40 and started a second life building boring businesses.

If you enjoyed this article, please like and restack it. Share it with a friend. It helps the newsletter grow and reach more corporate refugees.

Stay safe, stay invested, and I will see you in the next one.

— Graham

Anyone buying these businesses should recognize it as a grind and not easy money. A blue sea strategy for differentiation should be the order of the day and not just an option. Avoid the sharks!!!!

for those that are willing to work, the promise of America is still there