What’s up guys, it’s Graham here :-) If you want to join 32,200+ smart investors and never miss an update on the market, hit the subscribe button below. It only takes a second and is completely free.

Arbitraging human nature is the last sustainable edge.

– Jim O’Shaughnessy

There’s so much talk about Artificial Intelligence these days that sometimes we lose sight of what it means to be human. It’s easy to be short-sighted when you’re so close to the screen, so let’s zoom out a little – and travel back into the mythical realm of Greece during the Trojan War.

The Greeks and the Trojans fought for a long time, and there were formidable forces on both sides. But the Greeks won because they had an edge. They had a master strategist on their side – Odysseus might have been the world’s first behavioral psychologist, because he understood how people’s minds worked and used it against them. His trick of using a decoy wooden horse to get into the enemy camp has become so famous that “Trojan Horse” is now a part of everyday speech. He used disguise and trickery to kill the one-eyed giant Cyclops. But Odysseus’s most important victory was against himself.

On his way back home, Odysseus sailed through the territory of the sirens – magical creatures who sang so irresistibly that passing sailors would turn their ships in their direction, collide with rocks, and die. Odysseus was warned about the power of the sirens’ song, so he commanded all his men to stuff their ears with beeswax. Yet, he was also curious to know what they sounded like – but instead of being overconfident in his own abilities, he asked his own men to tie him to the ship’s mast and not release him no matter how hard he rebelled.

When the ship passed through the sirens’ domain, the song reached Odysseus’s ears and drove him crazy. He struggled and protested and screamed, but luckily, his men did not heed him and they sailed through safely where everyone else had failed.

3,200 years later, a lot has changed but investors in the stock market are still the same humans – the call of rising stocks and market timing can sway us from our careful plans, and unless we tie ourselves up like Odysseus, we risk doing something brash and messing with our financial future. Veteran finance writer Jason Zweig even recommends creating an “Investment Owner’s contract” with yourself to make sure the future-you sticks to your original plan when times change!

The market has begun to shift, and this is one of those times when you are likely to be diverted by the siren song of the stock market. Let me take you through the dangers that you need to be aware of, why they aren’t worth it, and the strategy you need to follow to sail home safely.

The risk of picking stocks

Let me get right to the point – You’re probably not going to get rich by finding a winning multi-bagger among a universe of thousands. When you start out, there might be a bit of beginner’s luck, and rules of thumb like “sell when the money printer” is turned off and “buy when Ryan Cohen takes interest in a company” might sound delightfully simple. But when you look at the stats, it’s clear that maintaining a consistent edge in the markets is extraordinarily difficult – more than 90% of actively managed funds fail to outperform the S&P500 – and these are folks who spend all their working hours trying to beat the market!

Most stocks underperform the market. Four out of every seven stocks since 1926 have had buy-and-hold returns lesser than one-month treasuries – and only 4% of stocks have been responsible for all of the excess returns! 28,853 companies have traded on US markets since 1950, and 78% of them have died. The survival chances of a company don’t even depend on their age or size! 50% of all publicly traded companies disappear within ten years.

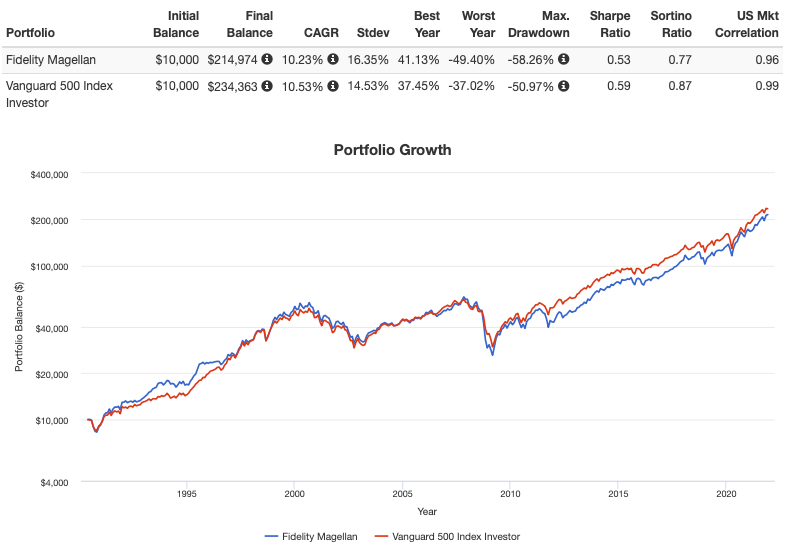

But that’s just talking about the losers. You might think that you have what it takes to pick the right stock or the right fund that beats the market. The surprising part is that you can invest in an extraordinary fund and still lag the market. Peter Lynch’s Magellan Fund has a stellar record of beating the market by for 15 years straight, with an average return of 29%. But the average investor in the fund would have lost money, not just underperformed the market. What’s worse is that you would have got nearly identical returns over the long term just by indexing and staying put!

Most investors buy in at the top after a fund reports a fantastic performance and panic-sell when the fund goes through a dip. Of course, it’s very difficult to foresee if “this fund is different” or “this time is different” when you’re in the middle of a dip, but if you can’t stomach a dip, you should never have bought the fund in the first place! This brings us to…

The perils of market timing

Ben Graham had a quote that he repeated throughout his writings: “The investor's chief problem – and even his worst enemy – is likely to be himself.” The feeling of knowing something that everyone else in the market is missing out on and trying to cash in on it is where market timing begins. And most people lose out by trying to beat the safe returns they would have got anyway.

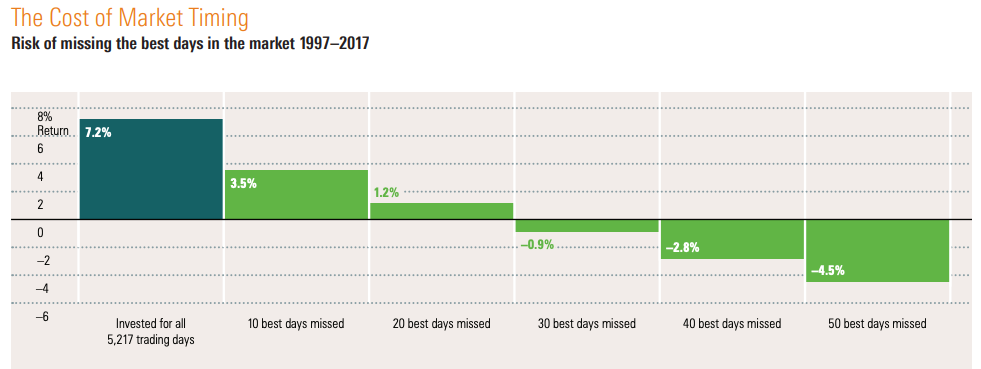

Morningstar studied the effects of timing the market – Investors who remained in the stock market between 1997 to 2017 generated a compound annual return of 7.2%. If you traded and missed just the 10 best days, your return would drop to 3.5%! And if you had missed the 50 best days, you would have had a loss of 4.5%. The more you trade, the more you stand to lose.

If you’re still not convinced, check out this excellent article called “Even God couldn’t beat dollar-cost averaging” – What chance does the average investor stand? Speaking of averages…

Average returns are a myth

Never try to walk across a river just because it has an average depth of four feet.

– Milton Friedman

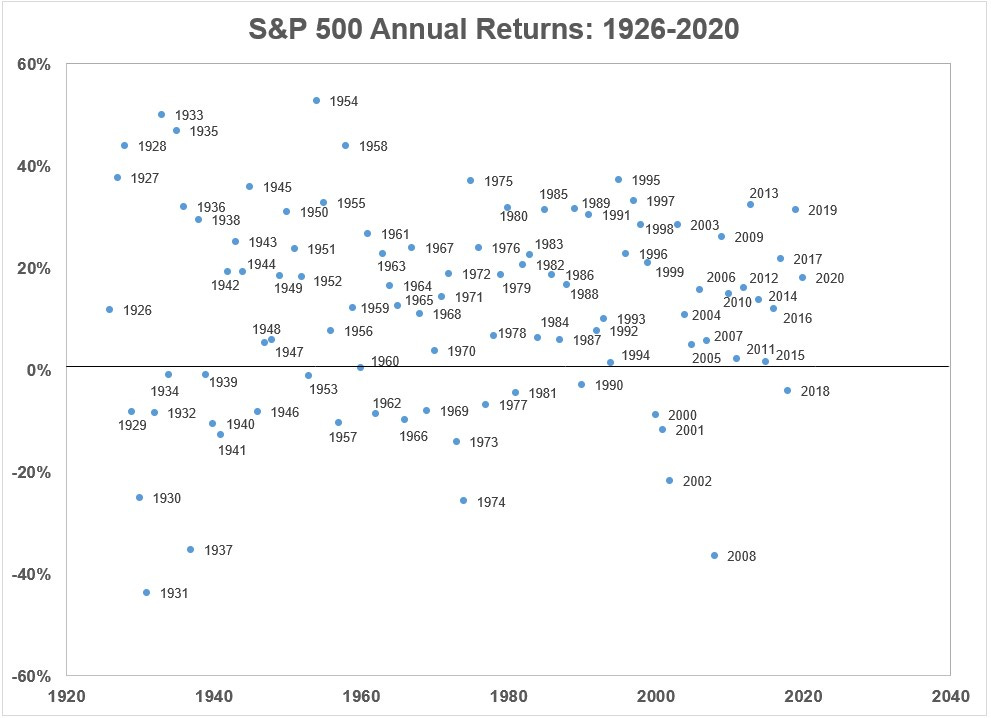

One of the factors that lure people into stock investing is the promise that the market generally has an average return of 10% per year. But actually earning 10% a year is a very rare event. The market could underperform by a lot in some years and compensate by doing extraordinarily well in others, but as Ben Carslon points out, the market has returned 8-12% in a year only 5 times since 1926! It was equally likely for the market to go up by 40% or dip by 15%.

Only 18% of returns have been between 5% to 15% in any given year. It’s more common to see a double-digit gain or even loss than to see the long-term average – so setting the wrong expectation can shake your confidence when you begin investing! That’s why it makes sense to have a long-term outlook over decades and not years. The longer the timespan you look over, the more the averages begin to normalize – and over a 30-year period, all investors in the past would have made 8% to 13.6% returns. That’s way more predictable.

What isn’t predictable is whether past returns guarantee future performance. And there’s a way you can make money regardless of that…

The Golden Butterfly

Investing always comes with trade-offs and people with different preferences will take on different risks. But one key factor that you would want in your portfolio is resilience: Tomorrow isn’t guaranteed to be like today, so how would you know what your returns would look like tomorrow? The golden butterfly portfolio is the answer to that.

You see, even though the future is uncertain, there are only a few different types of economic scenarios, and there are only four cycles that our portfolio needs to withstand:

Rising prices (inflation)

Falling prices (deflation)

Rising growth (bull markets)

Falling growth (bear markets)

In each of these four quadrants, there’s a best-performing asset that can be used to keep your portfolio green. In this case, it’s a mixture of stocks, bonds, and commodities. Equities perform best when the market goes up, commodities do well when inflation goes up, and bonds take care of the rest, when everything else falls.

Now, historically speaking, we have seen high-growth situations more than the other types of situations, so the portfolio doesn’t give equal importance to all assets. The portfolio is broken down into five segments:

20% US Large Cap

20% US Small Cap

20% Long-Term Treasuries

20% Short-Term Treasuries

20% Gold

The surprising aspect of this portfolio is that throughout the last 43 years, the golden butterfly had almost the same long-term compound annual growth as someone with 100% stocks, but with 60% less volatility. Even more impressive is that the worst year saw a loss of only 11% and the most severe drawdown period was just 2 years until you broke even. In comparison, buying into stocks during the 2007-08 financial crisis would have taken more than 5 years to break even!

The catch is that recently, the portfolio has been underperforming by quite a lot relative to the S&P 500, as gold has been almost completely flat through the last few years – but with gold now seeing a resurgence, only time will tell how this portfolio does! The golden butterfly portfolio works assuming that the past somewhat mirrors the future: but if you assume you have no idea how the future will be, the cockroach portfolio that Market Sentiment wrote about here is a better bet.

Five principles for safe investing

So, to sum up what we discussed:

Invest only for the long-term. Stock market returns are almost never the “average”, unless you look at it from a time horizon of at least 10-20 years. Short-term movements are completely unpredictable, so don’t go in expecting to make 30% in three years.

Do not go all in on one stock, no matter how attractive it seems. Companies like GE that were once giants are now on the sidelines, and the lifespan of companies in the S&P500 is dropping. Don’t be sure of your pick.

Do not blindly follow others. Like Peter Lynch said, “If you can’t explain a company’s business to a 10-year old in two minutes or less, don’t own it.” Don’t move with the herd following the excitement, because the most profitable investments tend to be the most boring ones.

Don’t time the market. Sticking to a regular plan only requires you to keep buying, and your chances of winning long-term are great. But if you time the market, you have to be right twice – when you buy, and when you sell.

Don’t invest if you can’t manage your emotions – and realize that you’re fallible. Like Odysseus in the siren story, have an external support system (friends, family, advisors, a community) that will keep you accountable and grounded, and be aware of your emotions. If you’re panicking over a 20% drop or losing sleep, the returns aren’t worth it.

Armed with these principles, you can now handle whatever 2023 throws at you with a more balanced mindset, and ignore the temporary excitement of the market to stick to your long-term wealth-building plan.

How do you keep yourself accountable for your long-term investing plan? Let me know in the comments.

Stay safe, stay invested and I will see you next week – Graham Stephan.

A lot of effort and research went into making this article, so if you found it insightful, please help me out by clicking the like button and sharing this article.

Approaches like the “Golden Butterfly” ignore macro issues like the consequences of the 1983 and later distortion of the bond market.

It took forty years to unwind the huge run up in bonds that resulted from Volcker’s moves to stomp out Stagflation, but stomp it out he did. During that forty year period owning bonds has been profitable, as the ever decreasing price of bonds meant your old bond was worth more than its face value.

What the Fed is doing now is minuscule relative to Volcker’s moves.

My point is that for now bonds are a no-person’s land until the Fed stops its current actions of increasing interest rates. Once it’s obvious that the coast is clear there will *eventually* be a long-term decline from whatever peak the Fed finally gets to, but the profitable period for owning bonds might start five or more years from now.