A storm on the horizon

While economic news improves at home, a storm brews on the other side of the world

What’s up you guys, it’s Graham here! If you want to join 15,000+ smart investors and never miss an update on the market, hit the subscribe button below. It only takes a second and it’s completely free.

Those of us who grew up with strict parents remember a recurring theme: “you had too much fun today, so you can’t have any tomorrow”. Unfortunately, this is what the past week’s economic news also felt like. Just as inflation appears to be coming under control with a 0% month-on-month increase and equity markets are surging to regain lost ground, there is a storm brewing on the other side of the world.

In the past year, there has been a steady drip of bad news from China: The authoritarian lockdowns in Shanghai, its precarious relationship with Taiwan, and the collapse of its second-largest property developer, Evergrande. Things have taken a turn for worse in the past week as reports are trickling in regarding mortgage defaults that are popping the real-estate bubble - Unfolding into a scary banking crisis. For folks who lived through the 2008 crisis this brings back, to put it mildly, unpleasant memories.

Based on my own research and from a recent video of Casgains academy, it appears that China might be at the edge of an economic catastrophe. And it might not stop there - The semiconductor shortages and the ensuing car market frenzy showed us how events across the world can impact our lives in the US.

China is responsible for manufacturing 20% of the products we use on a day-to-day basis. A financial collapse there will likely have severe ramifications back home. So, let’s take a deep dive into the recent news from China to see how bad the situation really is, the ways in which this could play out, and how it can impact America.

Blowing the bubble

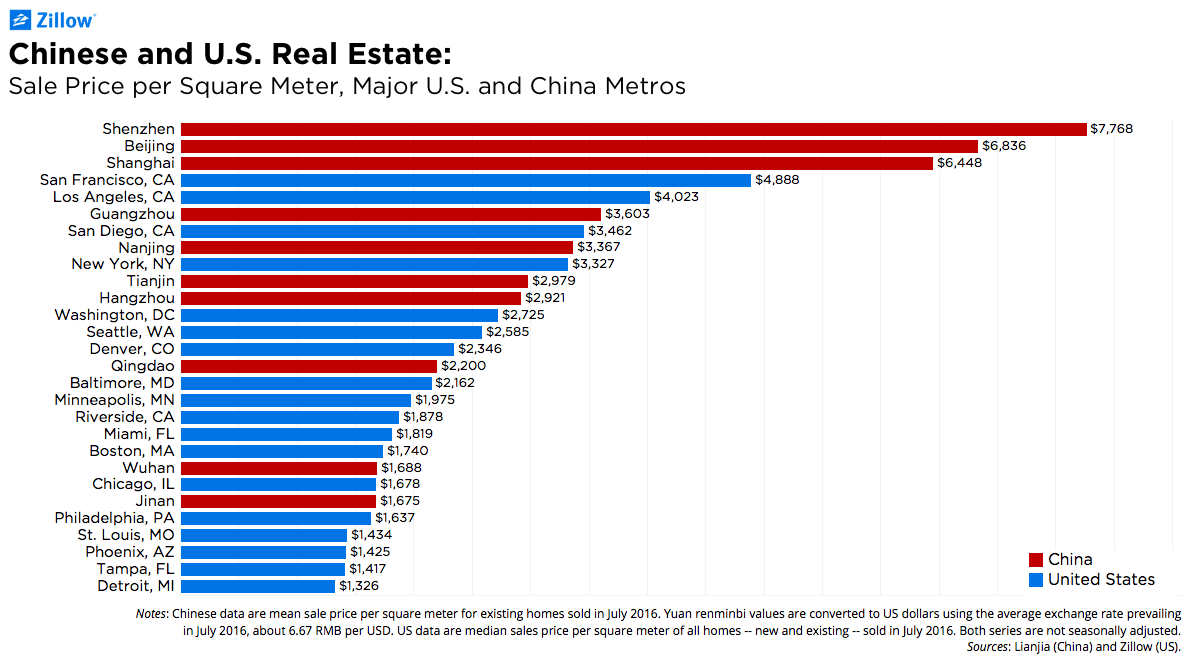

Much of the present issue originates from a topic close to my heart: Real Estate. If you thought the housing market in the US was crazy, you are in for a wild ride with what’s happening in China. While the median home price is around 10 times the median annual income in New York, this can be as high as 25 times in Beijing!

Unlike the United States, where personal wealth is in a combination of Equity Markets and home ownership, Chinese citizens prefer to invest almost exclusively in real estate. Why? It’s because the Chinese stock market is notoriously opaque and is not a reliable indicator of economic growth. For some context, the Shanghai Stock Exchange composite (equivalent to our S&P 500) has not yet recovered its 2008 peak, despite the Chinese GDP having tripled since then!

The lack of a reliable stock market combined with increasing urbanization and societal pressure to own a home resulted in the Chinese housing market growing at double digits. Burgeoning costs didn’t deter home buyers who would buy houses that cost 23 times their annual income with mortgage payments taking half their take-home pay, in addition to borrowing from family and friends. (Not-so-Fun fact: It’s almost impossible to own land in China - When you buy a house, you are technically leasing the land from the government for 50-70 years).

Despite this, the supply of housing couldn’t satisfy the demand with cities having to implement a lottery system with odds as high as 1 to 60 to allocate housing. Developers would often pre-sell units, where buyers would make payments even before the property was built, because by the time construction was completed, it would cost even more.

That was just the start of the problems. The insatiable demand for housing attracted several opportunists who saw this as a route to easy money. They would start the construction for one unit, collect the pre-sale money and then use that money to start construction on another unit - and collect pre-sale money there as well. Now if that sounds concerning, it is, because this is a classic Ponzi scheme. However, for many developers, the interest-free pre-sale deposits were too hard to resist.

Now like all Ponzi schemes, they continued working until one day, they suddenly didn’t. As the number of unfinished properties ballooned and faith in real estate plummeted, property developers struggled to raise funds to move forward and stopped construction. This eventually caused the Evergrande group, which was about $300 Billion in debt to default on their offshore bonds. This in turn caused disenchanted buyers of pre-sold properties to start mortgage boycotts in many provinces.

With nearly 96% of the Chinese population having exposure to real estate and about 70% of national wealth tied up in real estate, the crisis spread to the banking industry.

The Banks Creak

As home sales declined and construction halted, the credit market ballooned with developers borrowing at a staggering rate to keep themselves afloat. The banks, wanting to compete with pre-sale money, were luring in customers with high-interest rates and then lending almost all of it to housing developers.

As developers defaulted on their payments, banks were unable to pay back depositors’ money and two systemic issues in the Chinese banking system came to light

1. Fractional reserve Banking – As public faith in the banking system dropped, the biggest issue was that the banks were not holding enough cash to pay back depositors. China, like the United States, uses Fractional Reserve Banking (FRB), where banks are only required to keep 10% of their assets in cash. This assumes that not more than 10% of customers will want all their money at any given time. While FRB has been in operation in the United States since 1791 and has stood the test of time, this is not the case in China. Further, the Chinese government had also lowered this 10% limit even further during COVID to spur the economy, leaving many banks susceptible to dreaded bank runs.

2. Corruption – The crisis also highlighted questionable practices within the Chinese banking industry. Authorities claim that criminal gangs, who illegally transfer deposits to their privately owned organizations, have taken over some banks. There were also instances where developers took millions of dollars in loans, spent the bare minimum to collect pre-sales, and then transferred the rest of the money outside the country leaving depositors on the hook.

As frozen deposits mounted, protests erupted outside of People’s Bank of China, where investigators said they are looking into illegal financial activity with reports suggesting that over 400,000 customers have fallen victim to such activities. As public trust in the banking system plummeted, the government started to notice.

The government steps in

With money you are a dragon, with no money, a worm - Chinese Proverb

With all this happening, the Chinese government has stepped in to try and assuage fears. Overall, the government's idea is to stabilize the real estate market, restore people’s trust in banking, and break the negative feedback loop to avoid bank runs and liquidity crunches. However, the strategies they are employing towards this end seem questionable at best. Primarily, the Chinese government has chosen to give the impression that everything is fine.

To address the home vacancy rate, the government is buying surplus real estate and has tightened regulations by supervising customer funds to ensure timely delivery. Further, the government has agreed to pay up to $15,000 to compensate for lost deposits, but with a catch: If the banks were involved in “non-compliant” transactions, depositors could end up losing everything.

The worst part here is that the government strategy for overleveraged properties is to simply lend more money, much like telling a lottery addict to buy more tickets to recoup their losses. The Chinese government is also trying to raise around 300 billion Yuan to deal with the crisis. However, it remains to be seen whether this is sufficient to retrieve investor confidence or whether it’s simply delaying the inevitable.

How this affects us

As savvy investors, it would be imprudent of us to believe that if a financial crisis occurs in China, it will remain limited to that country. China is essentially the ‘factory of the world’ and our third-largest trading partner contributing to a substantial number of electronic imports. In fact, there is a high chance that the device you are reading this article on was assembled in China, as most of Apple’s phones and MacBooks are assembled there.

Additionally, although our total investment of around $118 Billion in the Chinese market is a drop in the bucket compared to the US economy, Chinese companies have investments in the US markets and in difficult times, they might have to sell off those assets to raise capital, thus affecting overall investor sentiment. As of now, things are looking grim, as China is expected to fall short of its targeted GDP growth rate of 5.5% with one in five Chinese citizens between the age of 16 to 24 being presently unemployed.

The Chinese government’s strategy appears to be to hold up the economy at all costs but given the presence of too many bad actors and systemic problems like corruption and unemployment, the question is whether this is a solution or a band-aid. Overall, I hope to see these issues amicably resolved and better regulations being put in place to protect citizens, but folks with relatively short investment horizons should keep an eye out for news coming out of China.

See you next week with another deep-dive!

And force of habit - Smash that like button to help others find this newsletter.

I’ve seen your video on the state of the Chinese economy, but I appreciate this thorough breakdown. Thank you Graham :)

Thank you for covering this topic Graham! Really informational and worth the read! <3