In today’s digital landscape, your personal information is more valuable than ever – and often, it’s being traded without your consent. Data brokers collect and sell your details to the highest bidder, exposing you to potential phishing scams and financial risks. I personally trust DeleteMe for its straightforward, dedicated approach to data privacy. By removing your data from hundreds of data broker websites, DeleteMe helps mitigate the risks associated with public personal information.

What distinguishes DeleteMe is its relentless focus on innovation and customer support. They continuously release updates to keep pace with the evolving tactics of data brokers. With automated removal opt-out monitoring and clear, transparent reporting, you can see exactly what data is discovered and removed. Their expert Privacy Advisors stand ready to assist with personalized support tailored to your needs.

Don’t let your personal data fall into the wrong hands. In a world where online details can be purchased by anyone, protecting your privacy is essential. Take control of your digital footprint today. Go to joindeleteme.com/GRAHAM and enter promo code GRAHAM to receive 20% off a consumer plan. Embrace security, embrace peace of mind – choose DeleteMe, and safeguard what matters most. Act now and secure your future:

Five days ago, this happened:

$2 Trillion worth of market cap was wiped out from the S&P 500 in 16 minutes. In the next few days, that number went up to $4 Trillion – more than the market cap of the Indian Stock Market. Fears of tariffs had put the market on edge over the last month, but there was always a chance that this was just a negotiating tactic that would be pulled back at the last moment. As tariffs started to take effect, chaos took hold in the markets. The economic policy uncertainty index is now at its highest ever — excluding the COVID pandemic — and trade policy uncertainty is at record levels.

We haven’t seen such tariffs since the 1800s, and I’ll be honest – we’re in for uncertain times, including the possibility of a recession. But if we’re looking to history for clues on how this could play out, we might as well study what’s the best strategy to protect your investments in a time like this, what assets are most likely to be affected, and what you can do to stay safe. First, let’s understand…

What are tariffs and why do they matter?

Tariffs are akin to a tax on imported goods. The idea is that because tariffs make imports more expensive, it encourages local manufacturing and competition. In the long run, this would generate more employment and revenue. But that’s not how it works in practice. Tariffs are not paid by foreign exporters — they’re paid by importers in the United States, who then pass those costs onto consumers, driving prices higher.

Tariffs have second-order effects too: while encouraging local alternatives might be the intention, these companies take time to scale. In the meantime, consumers pay higher prices (causing inflation) or cut back spending — and that reduction in demand increases the odds of a recession.

Countries that have long been stable trade partners with the US are alarmed at this move, which upends the globalized trading system that took decades to build. China has vowed retaliation unless tariffs are lifted, and Europe is preparing countermeasures.

So far, the US has been a net importer of services. As the US dollar is the world’s reserve currency, it's been cheaper to print money and buy goods abroad. But this has also weakened the dollar and led to the offshoring of major industries. Other countries also impose tariffs to protect their local industries based on trade imbalances. The Trump administration says this is unfair, claiming the US has been too lenient. His proposed tariffs are meant to pressure others into negotiating on better terms — but the rollout has been so abrupt that it’s sparked widespread retaliation.

Personally, I think that tariffs based on specific niches and targeted policy could be useful. But the proposed tariffs are broad and sweeping – consider Malaysia, for example. Their main export is palm oil which the US doesn’t even produce. So it makes no sense to tariff them. Similarly, Taiwan is a big supplier of chips to electronics manufacturers in the US (e.g TSMC makes all of Apple’s chips) – by imposing tariffs on them, we would just be raising the price of goods sold in the US and passing them onto the customer. The truth is that some countries are way more efficient and effective at making certain goods than us. For example, coffee grows better in tropical climates – imposing tariffs isn’t going to give us a competitive edge, but it will affect importers for sure. My two cents is that tariffs don’t really work.

But full credit to the

blog who have done excellent research on this. You can check out their full article here to understand this better:Are we heading into a recession?

Tariffs have been imposed at this scale twice before:

In 1828, leading to the Nullification Crisis, which laid the groundwork for the Civil War.

In 1930, under the Smoot-Hawley Tariff Act, which worsened the Great Depression as global trade collapsed due to retaliatory tariffs.

So… are we heading for a recession?

Hard to say in real-time. The NBER (National Bureau of Economic Research) takes over 7 months on average to officially declare a recession — meaning we may already be in one and not know it.

But the signs aren’t good. The odds of a 2025 recession have doubled to over 50%, according to Moody’s. First-quarter GDP has dropped to just 0.3%, with estimates for future quarters falling into negative territory. Add to that: U.S. companies cut 275,000 jobs in March, and economic uncertainty has spiked to its highest levels since 1995.

Your investments in a recession

Recessions typically last 10 months on average, though they can range from 2 months (COVID) to 18 months (early 1980s). Historically, stocks fall ~30% leading into a recession, but recover quickly. After a recession ends, the market has delivered positive returns in 85% of cases within a year, and 100% of the time within three years.

Even during recessions, half of the S&P 500’s strongest days occur during bear markets, and another 34% during the first two months of a bull market — meaning missing just a few rebound days can slash your returns dramatically. Even more interesting, some recessions have actually had positive market returns overall — from 1869 to 2018, there were 16 such cases with average gains of 9.8%, even though GDP was declining.

But what about real estate?

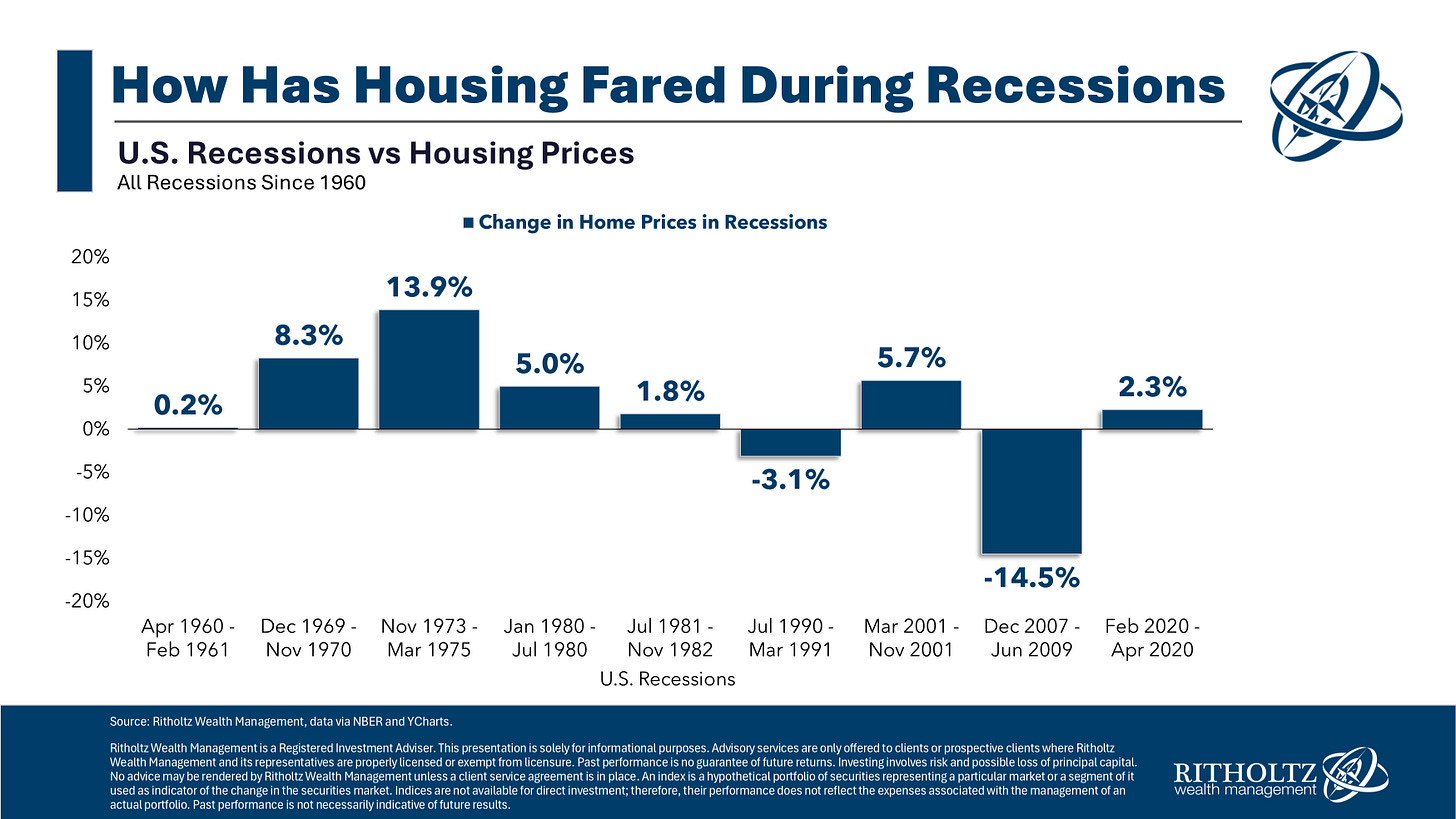

Housing often behaves differently. Aside from the 2008 financial crisis and a short dip in the early 1990s, home prices have risen in most recessions. That’s largely because interest rates usually fall, making mortgages cheaper, and homeowners are less likely to sell when uncertainty is high.

Today, over 40% of homeowners don’t have a mortgage at all, and most of the rest are locked into low rates. So there’s little incentive to sell — and without a surge in inventory, prices tend to stay steady or even rise. CoreLogic projects a 3.6% home price increase this year, with Zillow forecasting a 0.6% gain and Redfin projecting 4%.

So what should you do?

If there’s one lesson from all this, it’s that trying to time the market is a fool’s errand.

Yes, tariffs and recessions can wreak havoc in the short term — but missing just the top 10 best days in the market can dramatically reduce your returns. That’s why even when the headlines are scary, the best strategy is often to keep investing consistently and stay focused on the long term.

Even during the Trump tariff chaos, the advice remains the same: Avoid emotional decisions. Stick to your plan. In times of economic uncertainty, maintaining your income so that you can manage your expenses and invest consistently is the most important need – so focus on being indispensable in your career, keep expenses low, and dollar-cost average into assets you believe in.

If history is any indication, the people who stay the course — through the fear, the tariffs, the volatility — are the ones who come out ahead.

That’s it for this week. Though I read the news and scrub through as much data as I can find, I want to know whether you’re feeling the heat and how you are planning to handle the times ahead. Let me know in the comments.

If you read this far, please like the video and do share with someone who will find this helpful. I’ll see you next week!

Stay humble. Stack sats. I buy bitcoin, I buy MSTR. I am at peace with whatever happens.