In this world nothing can be said to be certain, except death and taxes - Benjamin Franklin

I normally don’t cover topics like these, and I do my best to stay out of topics that might get taken out of context or politicized, but just recently, there has been a lot of talk about a brand new tax plan that tries to

Increase the corporate income tax

Expand the definition of income to capture unrealized gains

Implement a minimum wealth tax on income above a certain limit

It’s very easy to think that whatever the changes being proposed to the tax plan are, they might not impact you. But the fact is that, no matter how much you make or what you do for a living, the proposed changes are going to impact you in one way or another.

So in this deep-dive, let’s try to understand the changes proposed, how this could alter the landscape of investing and why these changes are considered a big deal!

But before we jump in, somebody please explain to me the below logic in the comments. :P

A quick primer on the 2017 tax plan

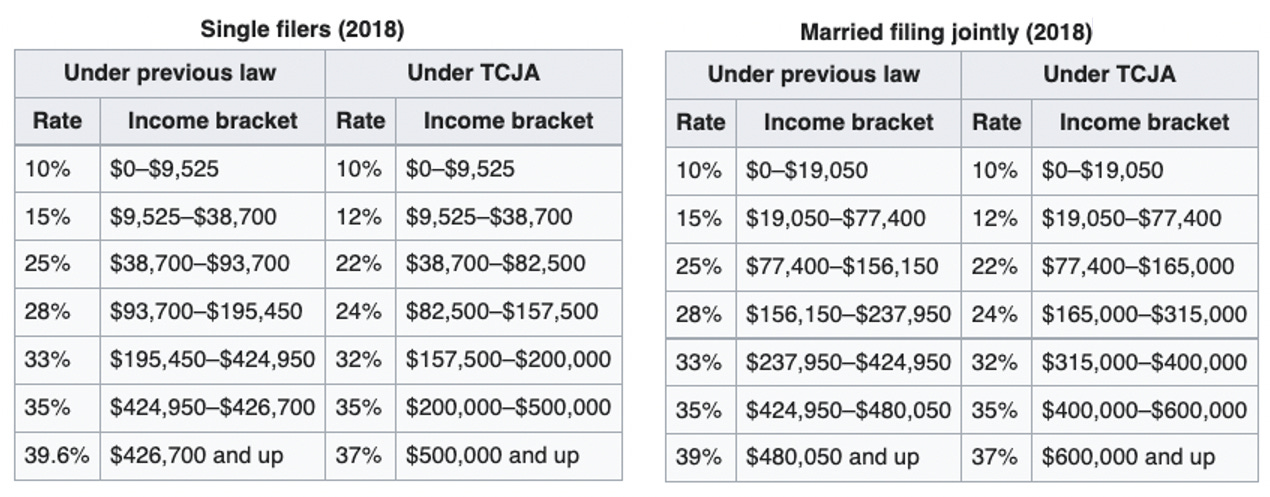

Before we get to the tax changes that are being proposed, it’s important to understand the background which led to this. In 2017, a new tax plan called the Tax Cuts and Jobs Act was introduced and it implemented a huge tax cut across the board for a lot of people!

Tax brackets for almost every income range were lowered, the standard deduction was increased, and corporate income tax was reduced from a maximum of 35% to 21%.

Under this reform, some people got crazy write-offs and saved a lot of money whereas others did not really see any significant change at all! What’s worse is that it imposed some limitations that caused the tax bills to go up for some folks - even though the bill was called ‘tax cuts’.

I mentioned this because it’s important to understand that in every tax plan, there will be ‘winners’ and ‘losers’. No matter what the proposed plan is, some people will benefit more than others and there is no way you can please everybody. So with that out of the way, let’s get into the details of the proposed tax plan and how it’s going to impact you!

Corporate Income Tax

The proposal in its current form aims to increase the corporate income tax rate from 21%, as it is right now, up to 28%. Prior to the 2017 tax cuts, corporations were paying tax rates as high as 35% (for income above $18MM) - so the current 28% proposal isn’t quite as radical as you think it might be.

The idea behind lowering the corporate income tax was that more companies would move their infrastructure back to the U.S, increasing the overall employment as well as infrastructure. But, even though more corporate money did flow back to the U.S, many economists have argued that the tax cut only fuelled corporate stock buybacks boosting the stock price. This would only be good for the top-level executives and investors but not very useful to the general public.

If the tax rate is increased as proposed to 28%, it’s unclear whether the cost is eventually just going to be passed back on to the consumers or if it will instead reduce corporate buybacks and profits - both of which can affect the future growth of the stock market!

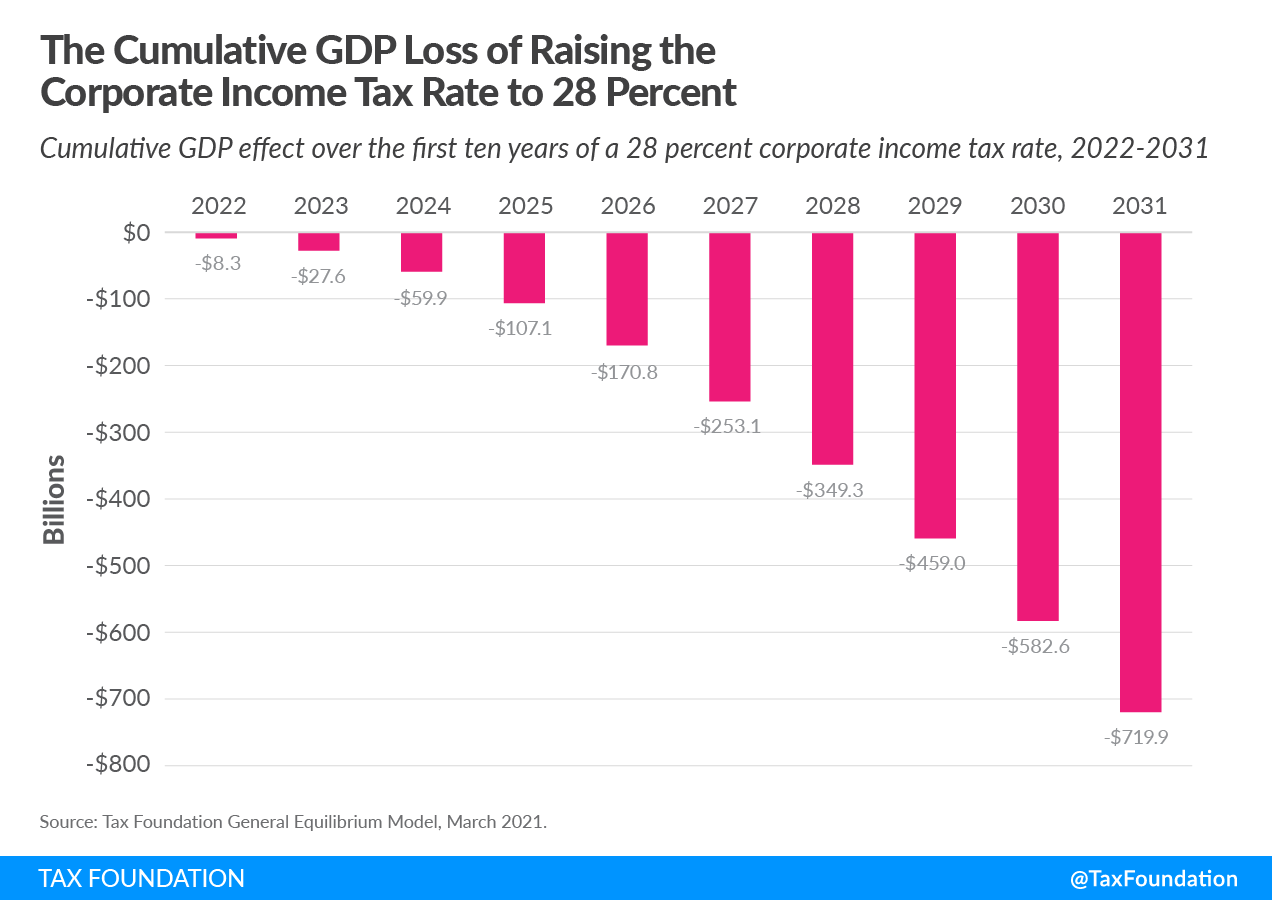

An interesting study done by Tax Foundation concluded that a 28% corporate tax rate would reduce GDP by 0.7% ($160 Billion) and wages would marginally decline. This is in addition to the 138K full-time jobs that would be lost due to the tax increase. The loss is expected to be gradual but the analysis shows that the GDP decline of $720 billion would be more than the $694 billion generated in additional tax revenue.

So as an armchair economist with a weird fascination for taxes, from what I can tell, a 28% corporate tax rate might not be the most effective at generating revenues over the long run.

The Billionaire Tax

The billionaire tax is the most controversial aspect of the proposed tax reforms. It’s not because we all love the billionaires :P, but it’s going to do something that has never been done before - i.e, taxing unrealized gains.

This is huge - Consider this example. If you make a $1,000 investment and over time it grows to $5,000, you don’t have to pay taxes on the $4,000 profit as you haven’t locked in the profit and realized those gains by selling. I can make a wager that almost everyone who is reading this now would have unrealized gains in one way or another, whether it be in the stock market, your retirement account, or your house! In its current form, these types of gains are not taxed as they are unrealized gains - i.e, you haven’t actually sold these assets to get the profit.

But the current tax reforms want to tax the unrealized profit on individuals who make more than $100MM!

All of this begins with the narrative that ‘Billionaires pay a lower tax rate than their secretaries’. This is true to a large extent and it's because most billionaires do not get there by working for a salary - but rather by having ownership in a company. If the business does well, the stock goes up in price and the person is able to grow his/her wealth tax-free (as all of the wealth is in unrealized gains).

As a thought experiment, let’s assume that we now have taxes on unrealized profit. There are multiple challenges that the Govt would have to overcome.

Taxing unrealized gains might be unconstitutional - In 1920, the U.S Supreme Court concluded that, under the 16th Amendment, there must be some actual transfer of rights before Congress can tax the appreciation as income - So from the very get-go… the bill in its current form is highly unlikely to ever pass.

Forced sale of ownership - The new rule would force business owners, who might not have the cash or the liquidity to pay the tax bill, to sell a portion of their ownership and potentially lose control of the company, or send the stock price into a nose-dive as more shares enter the market.

Dangerous Precedent - This sets up a precedent that unrealized gains can be taxed. The threshold right now might be very high, but it could be changed over time. After all, what’s stopping them from reducing the limit to $1MM and pretty soon everybody might have to pay some type of unrealized capital gain tax!

As we can see from all these issues, I would go as far as to say this is just political posturing and there is no chance of this passing in its current form.

My Take on the Tax Reforms

As someone who tends to fall within the income category of almost every single tax hike (besides the $100MM threshold), here’s my realistic and objective take on the matter.

First and foremost, I think the chances of these reforms actually passing is fairly slim - at least in the way they’re currently structured. I think most of these proposals pave the way to say: “at least we tried,” knowing that it’ll be a constant battle back and forth through congress - and likely winding up with a fraction of what was initially requested. Adding to this, enforcing these new tax codes would be a logistical nightmare and would require an immense and sustained effort from the IRS - which they are currently not equipped to launch.

Secondly, for those who are unaware, the 2017 Tax Cuts and Jobs Act is set to expire by the end of 2025. So in 3 more years, if nothing is done, we will eventually return to a higher corporate tax rate and higher individual tax brackets anyway. Realistically, by the time that happens, it will either be extended or something else will be put in its place - but the current tax code is not meant to last indefinitely and it will change, one way or another.

Finally, I am not against paying higher taxes, if the money gets put to good use. For example, I believe that the IRS needs more funding. The fact that only 3% of calls to them get answered is a huge issue. I have had numerous instances where my own documents were lost, information takes too long to get updated and refunds take months to process. What’s the point of higher tax increases if the IRS isn’t there to help people make sure that they are paying the correct amount they owe!

Personally, I would fully support a higher income tax rate, a progressive capital gains tax on profits above a certain threshold, and a slightly higher corporate tax rate. I don’t think this would be the end of the world and after the initial shock and outrage, most people wouldn’t even notice!

See you next week with another deep-dive!

If you enjoyed this piece, smash that like button and share it! Thank you.

A great and easy to process review of the tax plan. Helped me understand what's really going on, who it effects, and how it effects them. Thanks Graham, keep up the great work! It's appreciated!

SUPER easy to understand. Here in Argentina we are lost in some of the "changes" the US is trying to do. The state is always incrementing taxes to survive and printing more money so people can pay those higher interest rates. This is why we are a country with 50% Inflation (Every Year). We spent more than we produce and the system only works this way. We print money and we get poorer and poorer. Thanks Graham! You might come here and explain this to our blind people.