Struggling tenants, worried landlords

The elephant in the room

Smart money isn’t just about investing, it’s about leveraging your time.

Upwork makes it easy to offload tasks to expert freelancers in marketing, design, AI, and more. No cost to join. Only pay when you hire. Transparent, flexible, efficient.

Start building your team today with Upwork.

Whenever I hear a story where people are arguing about the same thing from different perspectives, I’m reminded of a parable. A group of blind men hear that a strange animal called an elephant has been brought into town, but none of them are able to imagine its form. They decide to inspect it by touch, and identify its form. The first person touches the trunk and thinks, “This is a flexible animal like a snake.” The second one grasps its ear and thinks it’s shaped like a fan. The third one finds its leg and thinks it resembles a tree trunk. Another one touches its belly and thinks the animal is a leathery wall. The last one catches its tusk and says, “It’s smooth and pointy, like a spear!” The five men argue that the others are wrong, without pausing to think that maybe they all had bits of information which could fit into a bigger picture.

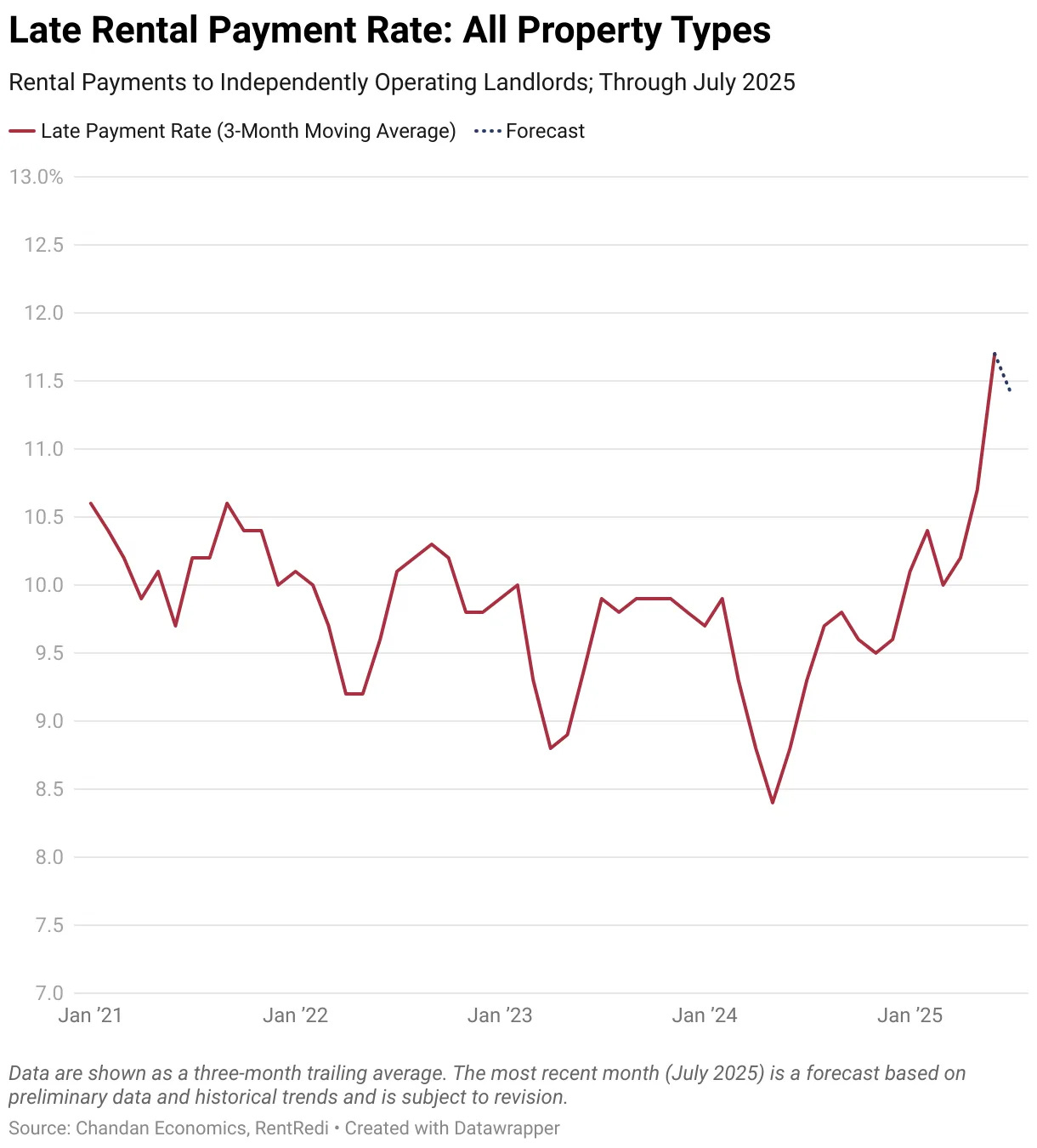

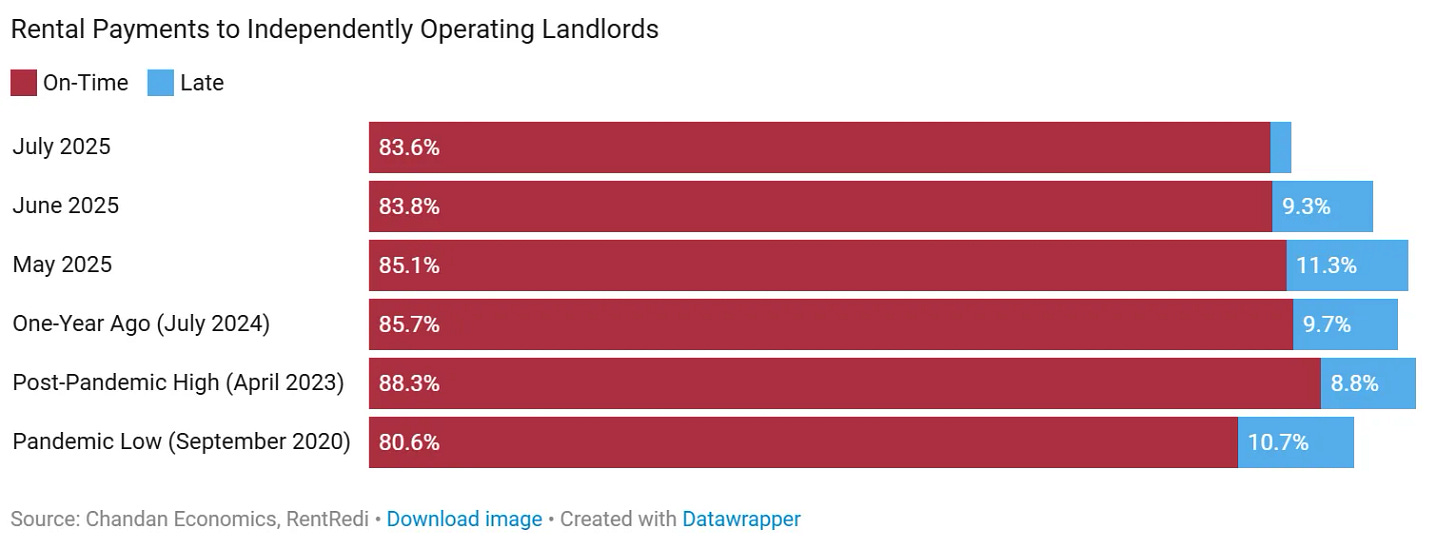

Now, the elephant in the room is this chart that’s going viral on X. It shows tenants falling behind on their rent. The argument is that this is an early warning sign of something much bigger breaking in the economy. Others think that this data is skewed and doesn’t cover the whole picture.

And honestly, I get why people are concerned. Real estate has been my full-time career since 2008. I own multiple rental properties. Even though most of my time is now spent begging for likes on YouTube, real estate was how I built everything. So this chart hits close to home. But to get the full picture, I wanted to dig into what’s actually happening, why so many tenants are struggling with rent, and what this really means for everyone watching. There’s a lot more going on beneath the surface than most people realize.

Oh, and before we start – if you like these breakdowns of just the facts, please hit subscribe to get every post in your inbox.

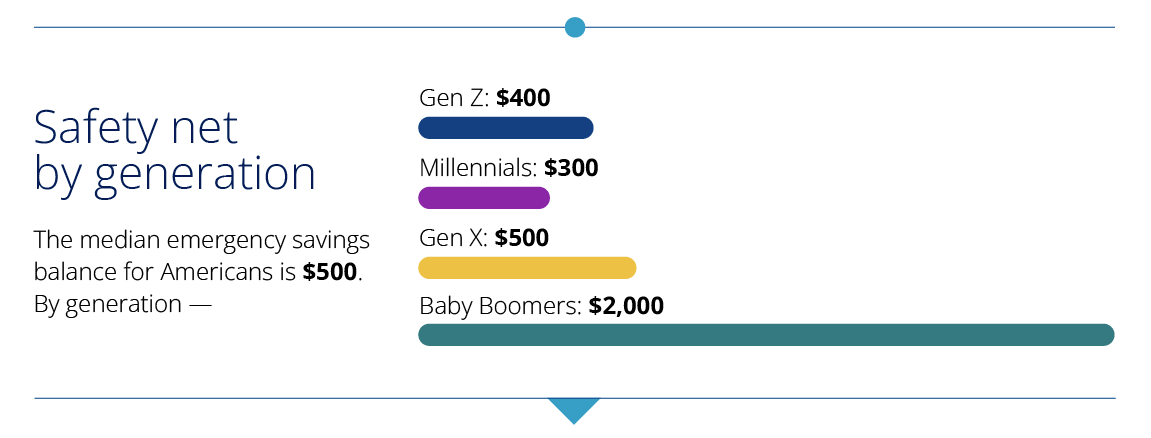

At first glance, that chart could make anyone panic. Renters worry about falling behind. Landlords worry about losing income. Investors start imagining ripple effects through the entire market if people stop paying. And it’s true: things aren’t looking great for the average household right now. About one in three Americans has no emergency savings, and the median savings is only $500. If you consider job losses on top of that, rent often slips down the priority list.

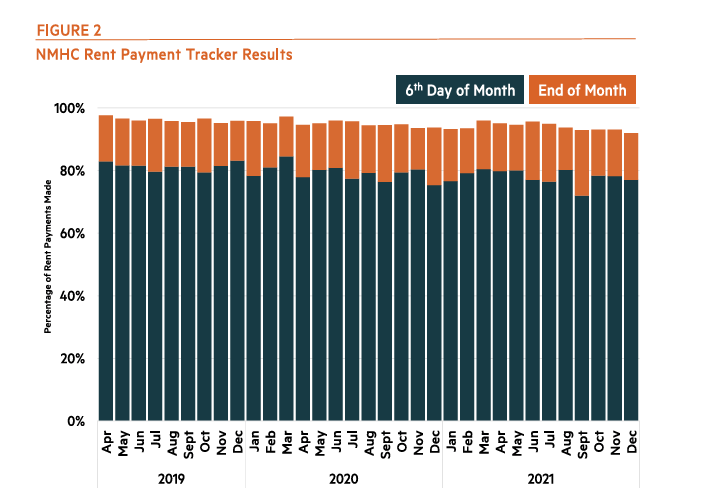

But here’s where I think the conversation is getting distorted. As someone who watches the rental market closely for both my own properties and nationally, I was skeptical when I saw this chart shared without context. Because it’s normal for nearly 20% of tenants not to pay rent on time, even in a healthy market. That’s just how the math looks.

So the real story isn’t just that late payments are ticking up. The full story involves understanding how those payments are happening, and that means looking at partial payments.

What the data misses

Here’s the thing most people miss: when you read the fine print of that chart, “rent paid” only counts if it’s paid in full, on the due date. But real life is rarely that convenient. As a landlord for over 15 years, I know that it’s common for something to go wrong. A payment doesn’t clear over the weekend. A tenant pays part upfront and the rest a week later. In all those cases, the chart still marks it as “unpaid,” though the payment could eventually come through.

Second, partial payments don’t count at all in the data. Even if the tenant puts down enough to cover the first couple of weeks, the data won’t recognize it until the full balance is in.

Third, late rent is far from unusual. At the pandemic low, only 80% of tenants paid on time. By 2023, that number climbed to 88%. In 2019, before the pandemic, it hovered around 83%. So even in normal times, 12–20% of renters are late.

And fourth, most tenants eventually catch up. By the end of the month, over 90% usually pay in full. That’s been consistent for years. What’s different now is that the delays are getting slightly worse – and that’s where things start to matter.

The ones who struggle are struggling more

Because yes, even if the majority eventually pay, the share of renters falling behind is rising. Since May 2025, the delinquency rate has climbed from 8.4% to 11.7%. That suggests more people are leaning on mid-month income just to catch up.

The Consumer Financial Protection Bureau backs this up. They found that late fees rose from 15.4% at the end of 2021 to 23% in early 2023, before falling back to 14% by late 2024. About half of those renters returned to paying on time, which implies most late payments are one-off situations. But here’s the twist: even though fewer people were getting hit with late fees in late 2024, the ones who were late owed a lot more in back rent.

In other words, the number of struggling renters is going down, but the renters struggling now are in much deeper trouble. And there’s a detail that changes how we interpret nearly all of this data.

Mom and Pop

So does this data mean it’s the end of the world? Not exactly. To get a clearer picture, you have to look at mom-and-pop landlords.

Not all landlords are created equal. Small landlords who own fewer than ten units consistently show the lowest rent collection rates, and this tilts the data a bit. In other words, a lot of these late payments are skewed by small-scale owners who are more likely to work out informal arrangements.

Part of this comes down to experience. Mom-and-pop landlords are less likely to enforce strict payment deadlines. They also tend to buy smaller buildings, which often attract lower-income tenants who are already more likely to pay late. Geography matters too. California renters historically have some of the highest on-time payment rates, while states like Georgia have the lowest. Washington DC tends to be more reliable than markets like Chicago or New York.

From my own experience, I’ll add this: mom-and-pop landlords are usually more compassionate and flexible than big corporate property managers. They’ll work with tenants on partial payments, late fees, or one-off issues. But that flexibility can cut both ways. Sometimes it’s a lifeline for tenants who’d otherwise be rejected by corporate screening. Other times, it just leads to tenants falling further and further behind because they know they can get away with it.

The other challenge is that small landlords often don’t have the same financial cushion that large companies do. A missed rent check can mean struggling to cover the mortgage, property taxes, or insurance. That makes them more willing to accept something rather than nothing, which is why late rent continues to pile up.

So we know which landlords are most affected, and where late rent is most common. But the bigger question remains: are renters actually falling further behind?

Putting it all together

Now let’s talk about the fine print on the original chart, because once you read it, the numbers start to look very different.

Units that haven’t paid anything in 60 days are removed from the sample. That means the chart only tracks tenants who eventually pay, even if it’s late. Anyone who falls more than two months behind and never catches up is excluded. So in reality, late payments may be higher than what we’re shown.

Rent charges below $500 and above $10,000 are excluded. The idea is to filter out subsidized housing and ultra-luxury rentals, but those markets matter too. They can tell us a lot about where financial stress is hitting hardest.

The data uses a three-month moving average. That helps smooth out short-term spikes, but it also hides sudden jumps. One really bad month might not even register.

With these caveats considered, I think the analysis is solid in the big picture. The data comes from more than 66,000 renters, and it paints a realistic picture of how things look today. But here’s the frustrating part: because rent payments are mostly private transactions, we don’t have a national “rent bureau” like we do for credit cards. There’s no central dataset telling us what percentage of renters are 30, 60, or 90 days behind, or how big the average balance is.

So instead, we’re stuck piecing this together from independent studies by rent collection companies. And while that’s useful, it means we’re always looking at a blurry picture.

So here’s where I land on this: in 2025, late rental payments are definitely higher than usual. But a one or two point increase above historical averages isn’t enough to call it a crisis – yet.

The reasons for this trend are simple to understand:

Americans have less disposable income than they did just a few years ago.

Rents are climbing across most major markets.

Nearly half of renters are cost-burdened, spending more than a third of their income just to keep a roof over their heads.

That leaves very little wiggle room if anything goes wrong. Meanwhile, other signs of financial stress are piling up:

Auto delinquencies among subprime borrowers are rising.

Credit scores just saw their biggest one-year drop since the Great Recession.

That tells us households are taking on more debt just to stay afloat. To me, the viral chart reflects the natural side effect of higher housing costs, higher interest rates, heavier debt loads, and the end of pandemic-era support programs. It’s not great, but we haven’t reached catastrophic levels either.

Here’s my advice:

For landlords: Work with your tenants whenever possible. Evictions are expensive, time-consuming, and should only be a last resort. From my experience, most tenants are honest and hardworking. A few bad actors might get the headlines, but most people just need some flexibility to get back on track.

For tenants: Remember that your landlord still has bills: mortgage payments, taxes, insurance, and repairs don’t stop just because your rent does. If you’re struggling, talk to them. A mom-and-pop landlord will usually try to work out a solution. If you’re renting from a corporate management company with lawyers on payroll… well, good luck.

If you’re a landlord or a tenant who’s being affected by this wave yourself, I’d like to hear from you. Reply to this email or drop a comment:

Overall, yes: Late payments are ticking up. But the jump is small, and even back in 2019, about 10% of renters weren’t paying on time. This isn’t the end of the world. It’s something to keep an eye on, and it isn’t something to panic about. And if you don’t feel like watching the numbers yourself, don’t worry – I’ll keep you updated.

That’s it for this week. If you found this useful, please like it and share it with one person. It’s a small action but it helps the newsletter a lot!

And don’t forget to check out today’s sponsor.

We're mom & pop with a triplex in L.A. near the harbor, just 3 blocks to the coast and a small beach. We've tried to get away from long term 1-year+ leases due to how toxic LA gov is towards rental property owners, and went all furnished mid-term, which means more DIY time for us managing things but also results in higher rents than unfurnished, long-term. One tenant we have we new had poor credit but seemed honest, hardworking - just had a divorce and was trying to get a better job and pay off debts. I asked him why not rent in a cheaper area, and he said he liked how our area was relatively safer and wanted the simplicity of furnished/utilities included. He put down 2 months' deposit (we usually just ask 1) and moved in 2-3 years ago. We had to stretch out payments and he's been late over half the times but has always come through. Last year he got a tech job he says paid over $120k so things are looking up. He still drives a beat up car, which I consider a very good sign.

It's tough because you want to help someone out by giving a little more time, but if they screw you, then the very long (many months) eviction process hasn't even started....all those months with no rent, paying their utilities, and tenants getting evicted may even decide to damage a few things on their way out just to F with you. I feel bad for someone forced to move because they no longer can afford, but I also feel it's their own fault for renting a place they can barely afford even when times are good, and have no emergency fund built up. These are people that don't watch Graham Stephan's channel, that's for sure !!!!!!!

The other 2 units have been guests staying an average of probably 2-4 months and all have consistently been on time.

I am concerned about selling the home I'm currently living in ( which is a duplex) and buying a new home. I thought about renting it out . I know I can create income from that. I guess my question is, do you think that it is wise to go forward with this when the buying market is not stable?