The Empire strikes back

Congress takes on inflation and new opportunities on the horizon

What’s up you guys, it’s Graham here! If you want to join 14,000+ smart investors and never miss an update on the market, hit the subscribe button below. It only takes a second and it’s completely free.

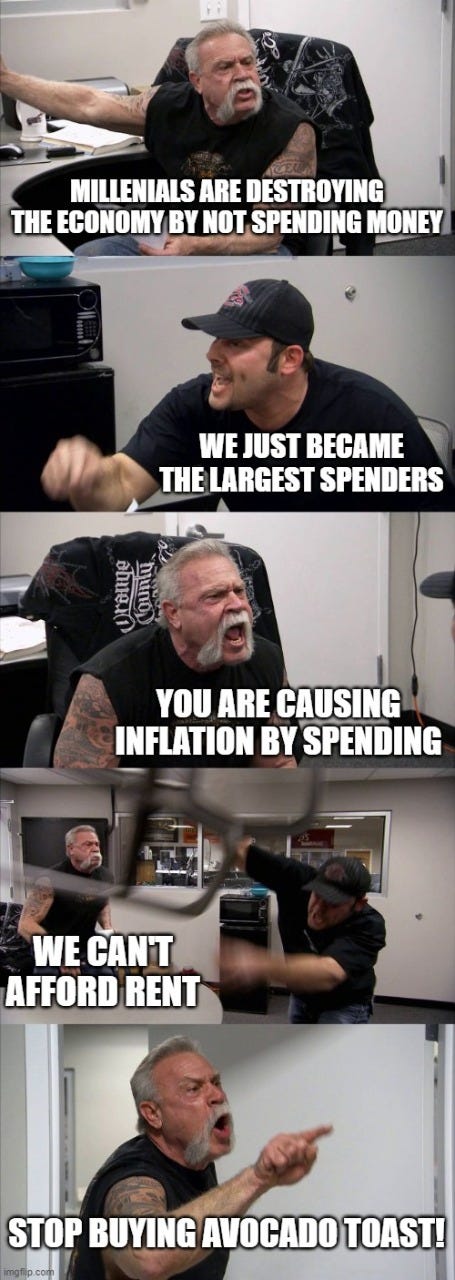

As a millennial, I have always felt that we were getting a raw deal. We are most likely entering the fourth recession of our lifetime, housing and college tuition remain unaffordable to most of us, wages haven’t kept up with inflation and there is an entire cottage industry making bank by blaming us for pretty much everything: destroying the wine industry, the golf industry, the diamond industry and most recently, inflation.

The situation room

Right now, the economy is reeling from the highest inflation since 1981 and the federal reserve, for its part has tried to control inflation using rate hikes. Now, as hard as it can be to believe, there is some merit to the claim that millennials are contributing to inflation. As the chief investment officer at Smead capital management explains, with a population of 92 million, Millennials have become the largest generation of the US population and are reaching an age group where they spend a lot of money. Known as ‘wolverine inflation’, this kind of inflation caused by a generational replacement that last occurred in the 1970s (when baby boomers replaced the silent generation) is very hard for policymakers to stop.

Nevertheless, Congress is attempting to ease the demand side of inflation using two new proposals: the Middle-Class Savings and Investment Act and the Inflation Relief Act, both of which are aimed at getting us to stop spending money and instead invest it to spur economic growth. So, let’s look at what these bills are, how you can maximize your potential savings and why it is necessary to stay invested during uncertain market conditions.

The Middle-class savings and investment act

This bill is intended towards giving more money back to middle-class families and to encourage investing in the market. Accordingly, the main opportunities are in

1. Capital gains tax: Capital gains in the stock market are taxed, which reduces your overall return. However, this bill proposes to essentially double the income limit for 0% capital gain tax from $83,000 to $160,000 per year. Additionally, this amount will also be indexed for a cost of living adjustment - meaning that these thresholds will increase with inflation. Because of this, a substantial portion of the population will pay no taxes on investment income, and this provides a major incentive to allocate more money into equity markets.

2. Interest/dividend income: This bill also makes the first $300 (600 if you are filing jointly) you earn in interest income (from a savings account) or dividend income (from a stock) to be completely tax-free. This is an additional motive to allocate some part of your portfolio to a savings account, as interest rates have gone up recently and the returns are essentially guaranteed. Further, if you do not own a dividend-paying stock, now would be a great time to buy, given the tax-free income and lower volatility of dividend stocks in uncertain market conditions.

3. Retirement contribution: The contribution to retirement is also incentivized as the ‘savers credit’ is increased from $1000 to $2500 and income limitations have been expanded to qualify more people. This is an amazing opportunity as tax credits are equivalent to their full value, while tax deductions only reduce your taxable income. For example, a $2500 tax deduction is worth $550 in savings if you are in the 22% income bracket, while a $2500 credit is literally worth the full $2500.

4. Surtax on investment income: Now, if you are wealthy (first of all, congratulations) but under this bill, the income limit for the additional 3.8% surtax on investment income would be doubled from $200,000 to $400,000. That is essentially a net saving of $7600! But maybe don’t YOLO it all into AMC just yet.

While these proposals incentivize investments, the second bill has a different function. It aims to provide relief to Americans who are affected by inflation and is called

The inflation relief act

Well, no marks for creativity in naming, but the bill does have some useful features. It attempts to lower the burden in a few key areas. They are

1. Child and dependent care - It should come as no surprise, but millennials are having fewer children than their previous generation and those already with children are struggling with skyrocketing childcare costs. The new bill will provide some relief in two sections.

Child Tax Credit - As of now, working Americans get up to 300$ per child per month, if they make up less than $150,000 as a couple. The bill proposes to index this to inflation, meaning that if prices rise by 10% in a year, then the credit amount will also go up accordingly.

Tax Credit for Childcare – The bill also indexes tax credit for childcare payments to inflation. Presently, it is between $1,050 and $2,100 per month.

2. Student loans - No, your student loans are not getting written off just yet, but the deduction for interest paid on student loans will be indexed to inflation under this bill. If inflation is 10%, the maximum deduction will increase from the present limit of $2,500 to $2,750.

3. Education after high school – This proposal aims to reduce the cost of the first 4 years of education after high school by indexing to inflation the American Opportunity Tax Credit (presently between $1,000 and $2,500) and lifetime learning credit for education after high school. The bill also increases the income thresholds that qualify for this credit.

4. Charitable mileage deduction – With rising gas and auto costs, this gives the authority to the IRS to change the charitable mileage deduction, presently at 14 cents per mile.

Even though Congress is providing an incentive to invest in the stock market with these bills and rising inflation is chipping away at your cash holdings, it is understandable if you are skeptical about investing right now. After all, things have not been rosy on the economic front, with a shrinking economy confirmed with a second consecutive quarter of GDP decline, news about layoffs in tech companies, and a debate about whether we are in a recession. The National Bureau of Economic Research, the official scorekeeper of recessions, hasn’t declared one yet and the White House has tried to allay fears by pointing to the unemployment rate.

Now, it could be some time before which the NBER officially declares a recession (or not declare one at all), however, it is clear that we are in a shrinking economy now and there is substantial uncertainty on the horizon. Given this scenario, it is pertinent to see how markets behaved during previous recessions. Conventional wisdom tells us that recessions are associated with stock market drawdowns, but a careful examination of previous data shows that there is more to it than a simple market drop.

Recessions and Investing

“Successful investing is about managing risk, not avoiding it”

– Benjamin Graham

First, the obvious. Recessions are almost always associated with a market selloff, and in every single recession since 1945, the stock market, at some point has seen an average dropdown of 29.2%. As of 9th August, the S&P 500 is 16% down from its all-time high, but at one point in June, we were nearly 30% down. The worst could well be behind us, but investors have reason to be skeptical, as bear markets are prone to the ‘dead cat bounce’ where every brief rally is followed by a new low.

Now, here is where it gets interesting. Despite the possibility of an abrupt selloff, markets have historically recovered well after every recession, with an average gain of 15.3% in the following year! Additionally, the maximum drawdown in the market occurs in the 6 months prior to the recession. Market Sentiment has done an excellent analysis about returns during and after recessions, but the gist here is that a recession provides one of the most profitable times to invest in equity. Folks with a long-term (>5 years) horizon, should continue their investment as historic analysis shows that in the 3 years following every recession, the market returns have been positive every single time.

Recessions also provide excellent opportunities to pick up high-quality stocks at a bargain as the broad market selloff brings down stock prices in general, i.e., the opposite of a rising ride lifting all boats. For example, Apple, which is considered a high-quality stock by Warren Buffet (40% of Berkshire Hathaway’s equity portfolio is Apple), was at one point in June around 30% down from its all-time high.

The Boston Globe pointed out that in the last 6 confirmed recessions, there is an average lag time of 7.3 months between a recession taking place and when it is officially declared by the NBER. For example, the 2008 recession, estimated to have started in December 2007, was officially declared by the NBER a full year later in December 2008! The takeaway here is that you shouldn’t wait for the official confirmation of a recession before deciding to invest, because by the time we know it, the opportunity to buy at the bottom is long gone.

Overall, my own thoughts regarding the proposed bills are that they do provide some relief to people struggling with high prices and incentivize long-term investments. While the effect of these bills on inflation remains to be seen, you should absolutely consider this opportunity to improve your tax credits and increase the allocation to your investment portfolio. After all, Dollar Cost Averaging the stock market is one of the proven ways toward inflation-beating returns and wealth generation. So, stay calm, stay invested and I will see you guys in the next week with another deep dive!

See you next week with another deep-dive!

And force of habit - Smash that like button to help others find this newsletter. Hit that subscribe button if you haven’t done so already!

Great Content. Thanks

Great Content! love having it in written form so I can read through it instead of watching it. I like your videos too, but this seemed a more professional product.