The Fed just turned on the Money Printer

What it means for your portfolio

Last year, Americans lost over $12 billion to fraud and scams. Many of these start when a scammer gets your personal data. But how?

They often just buy it. Data brokers legally collect your phone number, current address, and even your relatives’ names , then sell that data to virtually anyone. This makes it easier for criminals to target you with sophisticated phishing scams or attempt identity theft.

DeleteMe is a service that removes your personal information from hundreds of these data broker websites. Their experts find and remove your data , then monitor the sites all year to make sure it stays off. Removing your data will help you protect yourself from these financial risks.

Protect your assets. Get 20% off any DeleteMe plan at JoinDeleteMe.com/GRAHAM and use code GRAHAM.

The Federal Reserve just cut interest rates again after two meetings in a row.

Only this time, it’s not a one-off tweak to calm the economy. It’s the start of what could turn into a full-blown rate-cut cycle. If history is any guide, once that begins, there’s no going back.

The last time we saw this play out, easy money flooded the system. Asset prices spiked, debt piled up, and liquidity sloshed through every corner of the market. Now the same engine is starting to rev again, and if you’re not paying attention, you could miss the next big move.

In this breakdown, we’ll look at what Jerome Powell just announced, how rate cuts ripple through everything from your mortgage to your portfolio, and what this means for anyone trying to stay ahead while the money printer warms up again.

Why the Fed Hit the Panic Button

So why is the Fed rushing to lower rates even while stocks, real estate, gold, and crypto are brushing up against all-time highs? One word: shutdown.

The government shutdown dragged on way longer than anyone expected. More than a million federal workers were furloughed, and key economic reports were frozen in limbo. With official data missing, it’s getting harder to tell what’s really happening under the hood, but the early signs don’t look good. The economy looks like it’s slowing faster than expected.

Bank of America says small-business hiring is down 7%. Even Jerome Powell admitted that “both supply and demand in the labor market have come down so sharply, so quickly.” And since the usual reports on employment and inflation are delayed for the first time in over a decade, the Fed has been forced to rely on alternative data – real-time spending and unemployment filings – to guide its decisions. That data shows layoffs ticking up, job postings slowing, and consumer momentum fading.

Cutting rates, then, isn’t about juicing the market. It’s about keeping the slowdown from turning into something worse.

The Market’s on Fire: But for How Long?

Let’s be honest: the stock market’s been on an absolute tear.

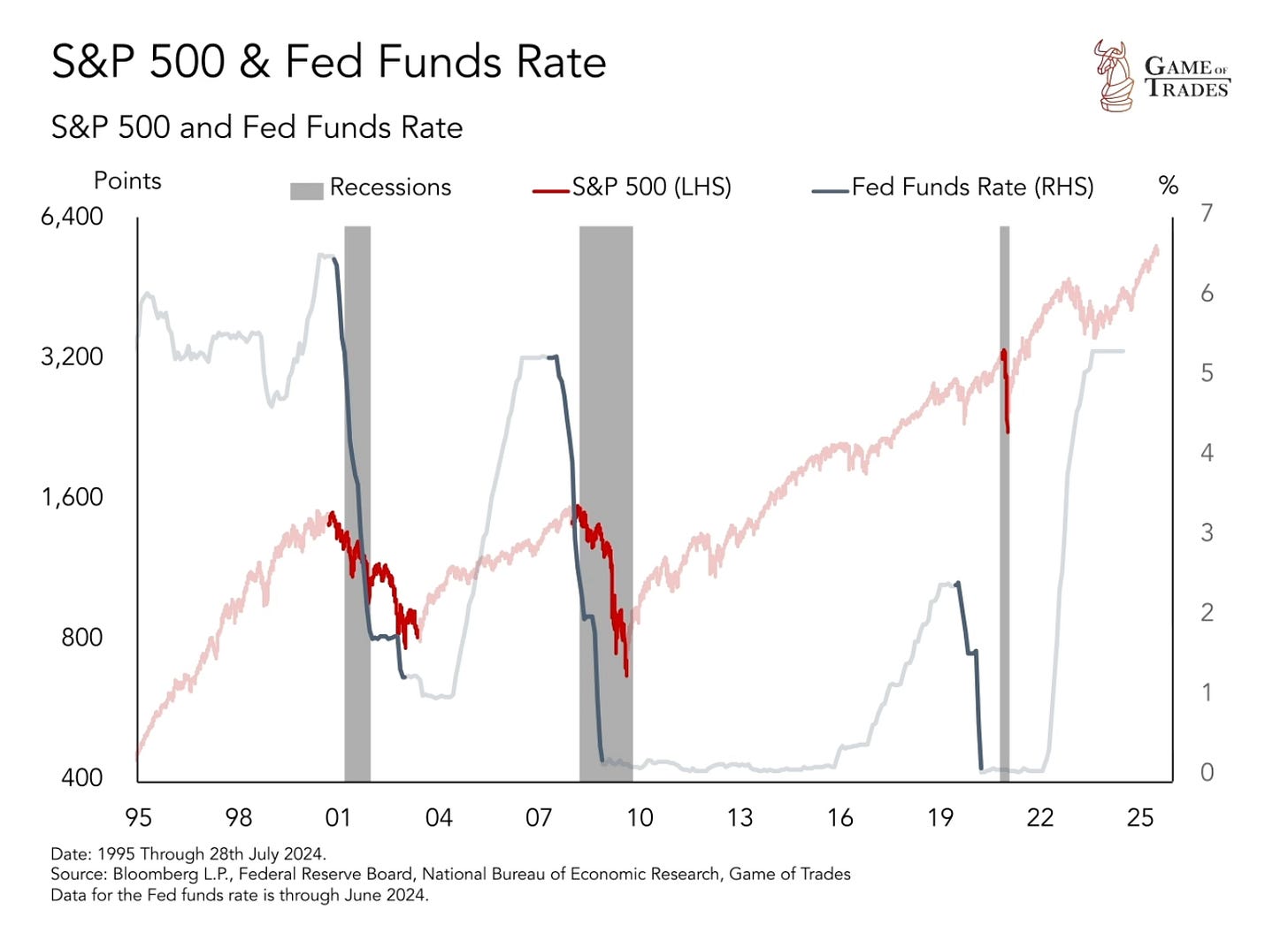

Despite every doomsday headline this year, the S&P 500 is up more than 30% from the April lows, and nearly doubled in five years. This is the kind of run that works out to a 15% annual return. That’s far from normal.

But the odd thing is that both Bank of America and Morgan Stanley think the rally still has room to run. Their latest forecasts call for another 8% climb in 2026, pushing the S&P toward 7,200, powered by record corporate earnings, broader adoption of AI, and higher productivity.

Others aren’t so optimistic. Goldman Sachs expects just a 3% annualized return over the next decade, while J.P. Morgan lands closer to 6%. And even that might feel generous if we’re entering a slower-growth era after years of easy money.

Still, a gloomy past doesn’t always mean a dark future. As DataTrek points out, the only periods with sub-3% returns followed major shocks like the Great Depression, the 1970s oil crisis, and 2008.

Unless we hit another event on that scale, it’s likely that we’ll continue to see positive returns especially now that leverage and AI-linked ETFs have poured jet fuel on an already overheated market.

But the key is not to mistake luck for pattern.

Gains of 15%–20% a year just aren’t sustainable. And while Morningstar notes that when the Fed cuts rates near record highs, markets still rise 13% on average over the next 12 months (with 93% of those periods positive), it doesn’t mean the road will be smooth. Volatility spikes in rate-cut cycles and 15% to 20% swings are common. And here’s the uncomfortable chart: every major market crash of the last two decades came more than a year after the Fed started cutting. This might not be because of the cuts themselves, but because of the cracks that forced those cuts in the first place.

So the bottom line is to expect the best and plan for the worst.

Even if the consensus says 2026 ends 13% higher, I’m still modeling a 4–6% annual return over the next decade. If it beats that, great. If not, I’m prepared anyway.

The New Reality of Housing Prices

Let’s talk about what’s happening to the one market that affects everyone: housing.

First, the good news: With more inventory coming online, home sales are expected to rise 10% in 2026, according to Real Estate News. More listings mean more activity, and a healthier turnover of buyers and sellers as mortgage rates start to drift lower.

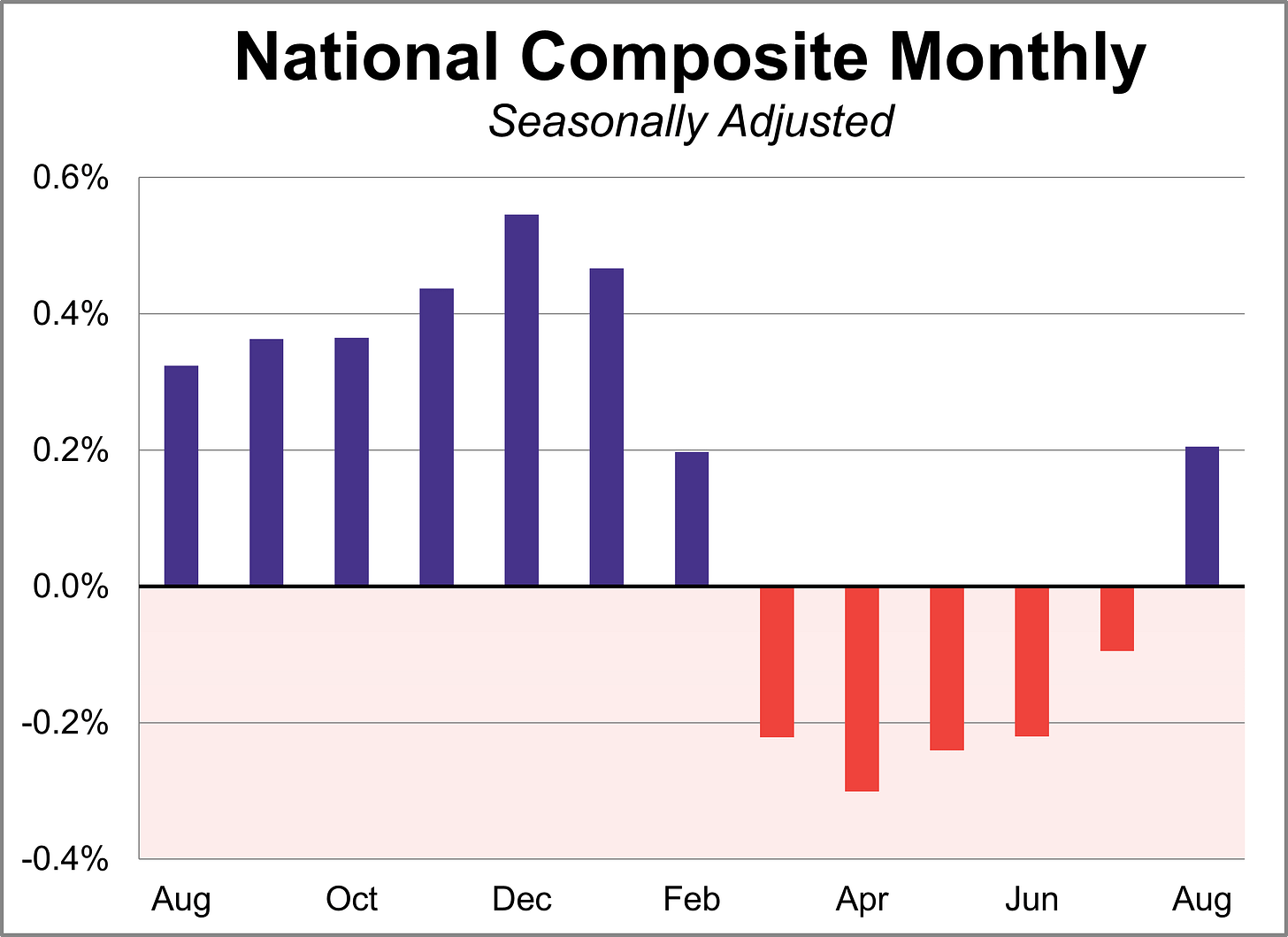

On the other hand, national prices are finally beginning to cool. S&P Global found that real estate values slipped 0.1% month over month and 1.7% year over year. That’s roughly a 2.3% decline after adjusting for inflation. It’s not a crash by any means, but it’s a shift in direction and that’s worth noting.

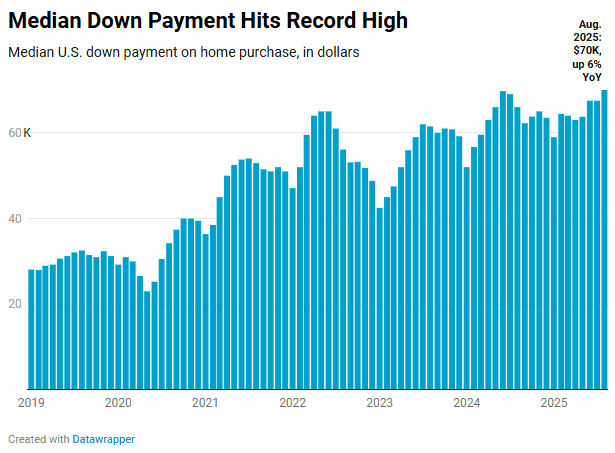

At the same time, almost 30% of buyers are paying in cash, and the average down payment just hit a record $70,000, per Redfin.

The market has split in two: high-end properties are simply waiting for the right offer, while mid-range homes are where most of the price cuts are happening. Realtor.com says reductions are most common between $350,000 and $500,000, and Redfin reports that about 15% of deals fall through, usually after home inspections.

From what I’ve seen firsthand, homes are still moving if they’re priced right. I recently sold my own place in Los Angeles: I priced it slightly below market, got multiple offers (several in cash), and closed in two weeks. The listings that sit are the ones chasing unrealistic numbers – people who bought for $800,000 in 2021 now asking $1.5 million and wondering why no one bites.

So if you’re buying, patience pays.

And if you’re selling, realism sells.

The market’s still active, but only for those who play it smart.

The Fed just opened the money tap

As of a few hours ago, the Federal Reserve cut interest rates by another 25 basis points, its second move in a row. It also hinted that more cuts are coming. Markets are already pricing in another cut of up to 50 basis points on December 10, with more likely throughout 2026.

Why now? Because the economy’s losing steam.

Companies are hiring less

AI-linked layoffs are rising,

Inflation threat from tariffs has cooled off.

For the first time in years, the Fed can start easing without worrying about reigniting runaway prices. But there’s also politics in the mix. Jerome Powell’s term ends in May 2026, which means Trump could soon appoint a new Fed chair, someone more aligned with his preference for lower rates. Reuters reports that shortlists are already forming. Translation: expect the “easy money” era to keep stretching.

Beyond the headline cut, Powell’s team also addressed two things: the banking crisis still rippling under the surface, and the growing “downside risks” to employment. But the biggest signal came in one phrase: the end of quantitative tightening.

Think of the economy as a swimming pool. When things go bad, the Fed fills it with water so everyone can stay afloat – cheap credit, liquidity, easy cash. When the recovery starts, they let some of that water evaporate via quantitative tightening.

Right now, they’re getting ready to top off the pool again.

In plain English: the money printer is humming back to life.

For your wallet, that means cheaper borrowing, easier credit, and if history repeats itself, a fresh wave of asset inflation. For investors, it’s both a blessing and a warning: the same liquidity that lifts prices can also set the stage for the next crash. So, buckle up. Rate-cut cycles don’t come often, and once they start, they tend to run hot.

What I’m Doing About It

Honestly, none of this should come as a surprise. Markets had already priced in this rate cut weeks ago. Futures are still pointing to at least one more 25-basis-point cut in December, which tells you the Fed sees an employment slowdown forming and wants to get ahead of it before it snowballs.

Still, not everyone’s cheering. Critics argue that the Fed is cutting rates while nearly every major asset – stocks, gold, Bitcoin – is already near record highs while the U.S. dollar keeps sliding. The worry is simple: are we adding fuel to the fire? On one hand, if inflation really is contained, cheaper money could help steady hiring, support asset prices, and smooth out the slowdown. On the other hand, it could just send everything back to the moon.

Here’s my take: If the Fed’s cutting now, it’s because they see fragility that most people don’t. They’re foreseeing a rough landing and easing early to cushion it. It’s also why gold is surging, investors are moving into safe-haven bonds, and there’s still over $7 trillion in cash sitting idle in money-market funds, waiting for direction (CNBC). As for me, I’m keeping things simple:

Roughly 20% of my net worth sits in cash through municipal bonds earning about 4.2% tax-free.

I dollar-cost average into the S&P 500, emerging markets, and international stocks. I do this every week, rain or shine.

A small slice of my portfolio goes to a Bitcoin ETF for diversification.

When markets dip, I buy more. When they rise, I still buy more.

Is it boring? Definitely. Is it consistent? Absolutely. And historically, it’s the approach with the highest odds of winning over a decade.

Because in the end, understanding the week-to-week chaos is useful, but sticking to a long-term plan is what actually builds wealth.

That’s it for this week! If you read this far, please like the post and share it with just one friend. It helps the newsletter to grow:

I’ll see you next week with another post!

The amount of work you put into these newsletters shows! I always enjoy reading through. Just want to say thank you Graham for doing what you do. You seem to work so hard, with little rest sometimes - I hope you do something nice for yourself this week to be refreshed and keep making a positive difference!