The Fed's last minute rate cut

What's in store over the next few months

How do you grow without the overhead? With Upwork.

Hire top freelance talent in:

AI

Marketing

Web & App Development

Design

Finance

…and thousands of other skills

Why Upwork works for smart founders:

✔ Hire in hours, not weeks

✔ No salaries or long-term contracts

✔ Pay only for approved work

✔ Access a global network of experts

Build faster. Spend smarter. Stay in control.

Imagine living in an era where brutal interest rates were the norm. Mortgages pushing 18% and businesses shutting down because they couldn’t borrow, unemployment climbing above 10%… That was daily life in the early 1980s, under Fed Chair Paul Volcker. The Volcker shock was controversial, with the Fed rate pushing 20%, with some praising the move and some criticizing it. But either way, people got used to the pain – it became the new normal.

Then one summer in 1982, the Fed quietly pivoted and rates began to fall. Stocks suddenly exploded higher, launching one of the most powerful bull markets in history. Meanwhile, housing lagged, unemployed stayed high, emerging markets suffered, and it took a long time to normalize – but things changed overnight for the average investor.

We aren’t living in 1982, but the parallel is striking. The Fed finally decided to cut rates a few days back, to revive a job market that has been beaten down in order to crush inflation. But today’s challenges are very different – tariffs, geopolitical tensions, and rising debt. The job market is poised at dangerous levels, and some people think that the Fed has waited far too long and this could lead to disastrous consequences.

What does this mean for the economy?

Will this lead to a bull run in the stock market or fix a divided housing market?

How does this affect your investments?

To understand that, let’s first start with why the pivot came now:

Too little, too late?

The Federal Reserve has officially cut interest rates for the first time since last year, marking the end of the most restrictive tightening cycle in U.S. history. The firehose is turning back on and the effect is going to ripple across everything: the stock market, housing, the national debt, even the value of the U.S. dollar. But why now? After all, the GDP grew at a 3.3% annual pace last quarter.

Even though the economy still looks “healthy” on the surface, Powell admitted that the risks are shifting. He said conditions now “allow us to proceed carefully as we consider changes to our policy stance.” In plain English: they’re worried.

Powell has flipped from “we won’t lower rates until tariff uncertainty is resolved” to “actually, the market is weakening faster than expected, and we need to get ahead of it.” The number one reason for this flip is: Jobs. Downside risks to employment are rising and if they materialize, they could hit quickly in the form of mass layoffs.

The shift comes after months of ugly data:

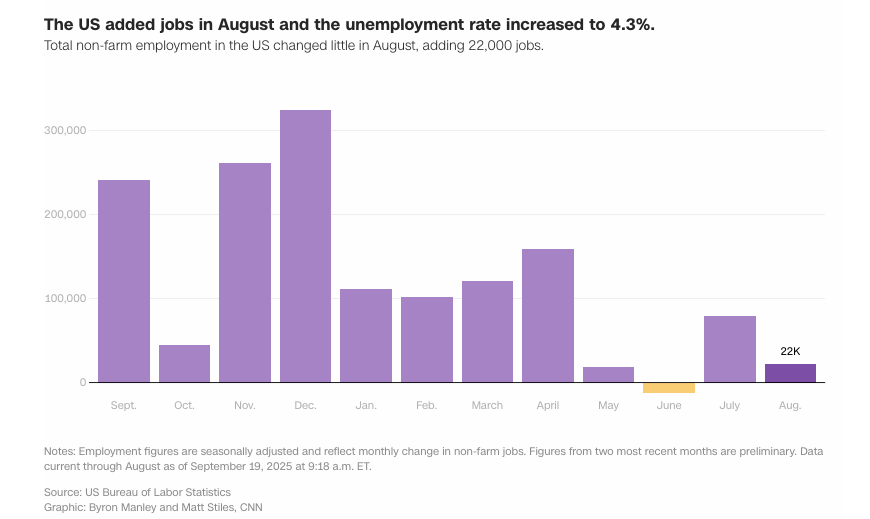

Just 78,000 jobs were added in July

Inflation is creeping back toward 3%

The dollar is off to its worst start in 50 years.

Source: US Bureau of Labor Statistics, CNN

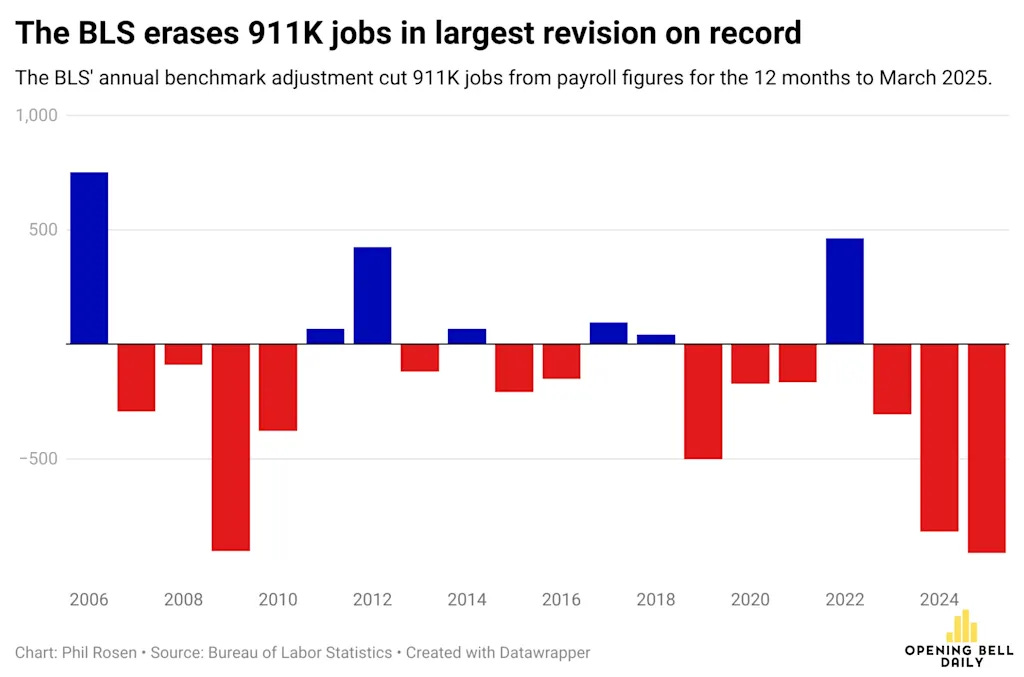

While the Federal Reserve’s mandate is to control inflation, it also has the big responsibility of maintaining policies that promote a healthy labor market. And right now, it turns out a lot more people are falling behind than we thought. The Bureau of Labor Statistics just revised its numbers by the largest amount ever recorded, showing a loss of one million more jobs than initially expected.

That revision was “more than 200,000 deeper than economists expected and worse than 2008 crisis levels.” Many economists are now arguing that the Fed is cutting rates too late, and that some of this damage could have been avoided if they had eased policy sooner.

But there’s something even more worrying. The cut might signal that the Fed has replaced its 2% inflation target with 3%, meaning that prices may never fully return to their old objective. But even with the pressure to keep cutting, there’s one major obstacle in the way of a revival: the 10-Year Treasury.

A rate for now, a rate for later

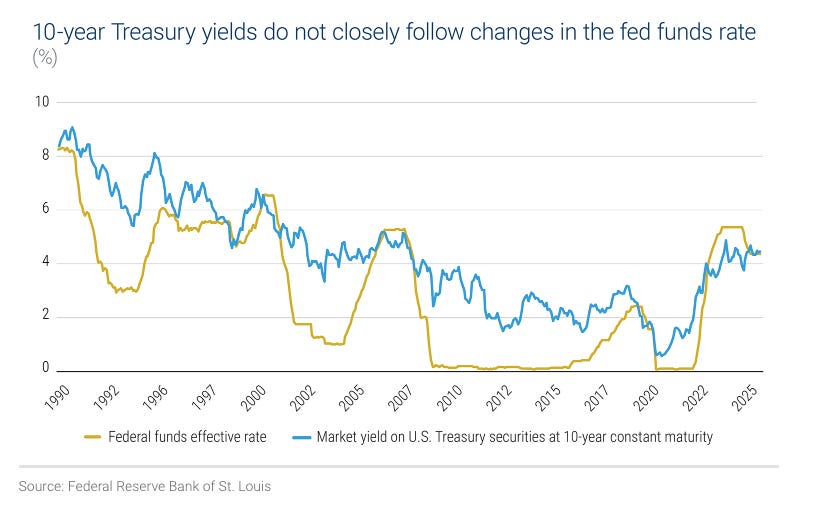

Here’s what most people don’t realize: The Fed controls one rate, but how it trickles down to the economy depends on other things.

The Fed directly controls the Federal Funds Rate which is basically the interest rate banks pay to borrow money from each other. This in turn influences short-term Treasury yields which ripple out into borrowing costs across the U.S. economy.

Think of Treasuries as government IOUs: the U.S. borrows money, promises to pay it back at a set date, and offers interest along the way. When the Fed cuts rates, short-term Treasuries don’t need to pay out as much, and those yields drop. That sounds like good news because it should ideally lead to cheaper mortgages, a stock market boost, and maybe a little relief for households.

But mortgages, business loans, and the rates that actually matter are tied much more closely to the 10-Year Treasury yield. And that number isn’t set by the Fed. It’s dictated by the bond market, by supply and demand from investors. How the bond market is doing is a measure of investor confidence in the country.

If investors believe inflation is coming down, bond prices go up and yields fall. But if they think inflation will stick around, or they lose confidence in U.S. credit, bond prices drop, and yields spike to entice investors. Borrowing gets more expensive. All this happens even as the Fed is cutting rates.

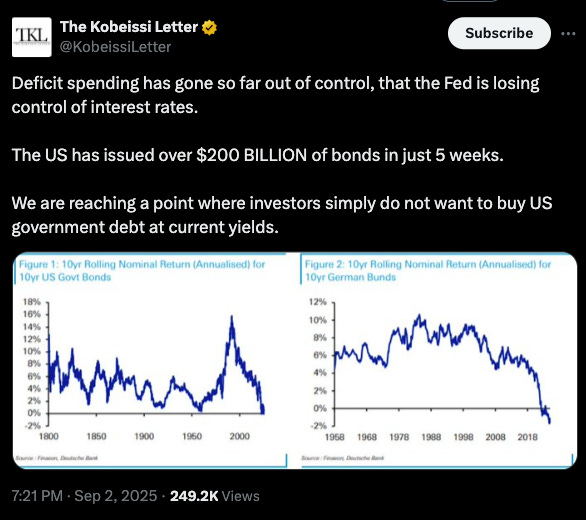

This isn’t just theory. We’ve seen it happen before. In 2024, despite repeated Fed cuts, mortgage rates barely budged. At times, they even went higher because investors feared inflation’s return. The same thing happened in the 2001 dot-com crash and in the early 1990s. And it gets worse. In May, Moody’s downgraded the U.S. credit outlook from AAA to Aa1, citing ballooning deficits and an inability to rein in debt. They warned that by 2035, interest payments alone could make up 30% of the federal budget!

The U.S. has never defaulted, and probably never will. But if fewer investors are willing to buy our debt, the 10-Year Treasury yield will stay elevated, causing a lot of problems…

Housing and rates

Let’s start with housing. For the first time in years, home prices are starting to slip. More inventory is hitting the market, and housing is now lagging inflation. As Fortune put it: “American housing wealth has actually declined in inflation-adjusted terms over the past year, which is a notable erosion that reflects the market’s new equilibrium.”

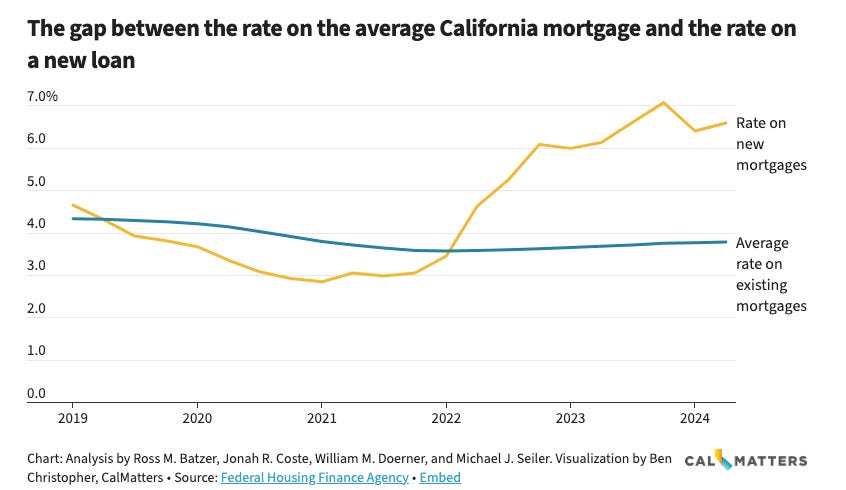

There’s a split in the housing market: homeowners who locked in record-low mortgages are sitting tight, while those who bought in the last two years are paying nearly double for the same house. In California, the average existing mortgage rate is just 3.8%, versus new mortgages at 6.6%.

That creates two markets in one. The “locked-in” group has no incentive to sell, while new buyers are hesitant to overpay. So when homes do hit the market, buyers have more leverage and room to negotiate.

Now, will lower Fed rates reshape the market? They might, but not directly. Powell controls the short-term federal funds rate, not the mortgage rates tied to the 10-Year Treasury. Right now, the 10-Year Treasury is tied to investor confidence. Unless the Fed actually steps in and starts buying long-term Treasuries, mortgage rates will likely stay sticky for a while. But the Fed stepping in this way would be a dire signal… this is what happened after the 2008 crash after all, and it’s an indicator that the market is really struggling and the Fed would be the last resort.

So barring some extraordinary intervention, housing is set to keep softening as inventory builds and buyer demand cools. National prices are holding up on paper, but the cracks are showing.

While that’s concerning enough, the real drama right now is in the stock market.

The stock market

Two forces are pulling on the stock market at once.

The first: Treasuries.

As mentioned earlier, the long-term Treasury yield is the economy’s benchmark, the “risk-free” rate of return that every other investment competes against. Put simply, if a 30-year Treasury offered a guaranteed 10% return, why risk stocks for 8% or real estate for 7%?

That’s why rising Treasury yields drag everything else down. Yields rise when investors start to lose confidence and want to be compensated for the higher risk. And right now, investors are worried about runaway deficits, inflation creeping back toward 3%, and the risk that global buyers lose faith in the U.S. dollar, all factors that push yields higher.

The second risk: market concentration.

Today, the top 10 companies make up 40% of the S&P 500. Nvidia alone now carries the biggest weight of any single stock in the index since its inception in 1981 (8% of the market). That’s eerily similar to the dot-com bubble, when the top 10 accounted for “just” 25% of the index, and even that was considered extreme.

To be fair, concentration by itself doesn’t predict a crash. Sometimes dominance is earned by companies that generate massive profits. Other times it reflects speculative mania. What matters is how fast the market concentrates. And with Nvidia’s rapid ascent, the risk of a pullback is rising. Here’s a disturbing stat: If you removed the top 7 stocks from the S&P500, the remaining 493 stocks have barely gone anywhere in a decade.

This is why diversification matters. No one knows if the current setup is the next bubble or the new normal. But if you can’t stomach the risk, it’s safer to spread your funds across multiple assets.

What does this mean for you?

Which brings us back to the Fed.

Three days ago, the Federal Reserve cut interest rates by 25 basis points. Why? Jobs. For the first time in four years, the U.S. has more unemployed workers than open positions. The Fed is hoping cheaper capital will encourage businesses to invest and hire again.

But there’s a twist. Even the Fed acknowledges that AI-heavy industries are seeing higher unemployment than those that don’t rely on automation. Powell struck a more cautious tone than in past meetings. He flagged tariffs as a continuing inflation risk, and said policy decisions will be made “meeting by meeting.”

Alongside the cut, the Fed released its summary of economic projections.

Another 50 basis points of cuts are expected by year-end

Inflation is expected to stay above 2% through 2028

A slower pace of easing is expected after 2025

Powell called this a “risk management cut,” admitting job growth has slipped below break-even. But that phrasing spooked investors and by the end of the day, markets were already selling off on fears the Fed had waited too long.

So where does that leave us?

The jobs numbers were ugly, and it’s no surprise the Fed felt pressure to step in. But here’s the catch: they’re doing this while asset prices hover near all-time highs and inflation is still elevated.

If they cut too aggressively, they risk reigniting inflation.

If they move too slowly, unemployment keeps rising.

That’s a tough balancing act that could easily tip in the wrong direction.

Personally, I wouldn’t be surprised to see another small cut in October, and maybe one more in December. My guess is that they’ll move slower than markets expect. But there’s another wrinkle: Jerome Powell’s term as Fed chair ends in May 2026. And if Trump gets to appoint a replacement who’s eager to slash rates, next year could look very different.

If you read this far, share it with a friend and drop a like. Every little bit helps :)

I’ll see you next week!

My Biggest Concern in the market right now is the Massive Consolidation of Capital around companies like NVDIA, which aren't seeing massive Jumps in the performance of their chips. It's just that they are selling a lot of Chips.

It's not innovation driving the investments, its more like they have the Keys to a resource everyone wants so everyone is forced to go to them. The Market is Ripe for Disruption IMO.

What happens when everyone has Chips but AI isn't getting smarter. How are these companies going to recoup the Hundreds of Billions they invested in these data centers???

How has "The Kobeissi Letter" become so widely referenced in finance circles.....?

It's run by a 27 year old by the name of Adam Kobeissi. He got a Bachelors in Biochemistry and in Business Administrations. So how on God Green Earth has he managed to amass such a large audience in such a "short" amount of time. And is it dangerous taking advice from just 1 source?

In regard to the interest rate cuts that are supposed to happen this year, it seems the Fed is still concerned about the short term, and not the pile of looming debt. Yes lowering the rate will allow for refinances so the interest doesn't stack up as fast but is that a solution. No, it seems like yet another band aid.