Mortgages are falling – but I'm selling everything

The great housing reset of 2026

If you thought the housing market couldn’t get any more distorted, welcome to 2026.

As of a few days ago, President Trump announced a plan to inject hundreds of billions of dollars into the housing market in an effort to lower monthly mortgage payments.

On the surface, this sounds like the relief homebuyers have been desperate for. If the government buys debt, rates go down, and affordability goes up.

Simple, right? Not exactly.

Historically, heavy-handed interventions like this don’t calm the market: they flip it into overdrive. The root cause of the affordability problem is low supply. By artificially suppressing rates without addressing the root cause, we risk making housing more expensive for the exact people this policy is supposed to help. Even worse, in the long run, it could change the very basis of the housing market even if prices keep rising.

This fundamental disconnection between “price” and “value” is exactly why I have started selling just about all the real estate I own. I am preparing to list another property in the next few months, and by the end of the year, my goal is to have sold all but one remaining home.

Let’s be clear: I am not doing this because I think the housing market is about to crash. I am doing it because the math that made real estate a “no-brainer” for the last decade has fundamentally broken. We are entering what Redfin is calling “The Great Housing Reset,” and the rules of the game have changed.

The $200 Billion Illusion

To understand why I’m exiting, you have to understand what’s propping up the market.

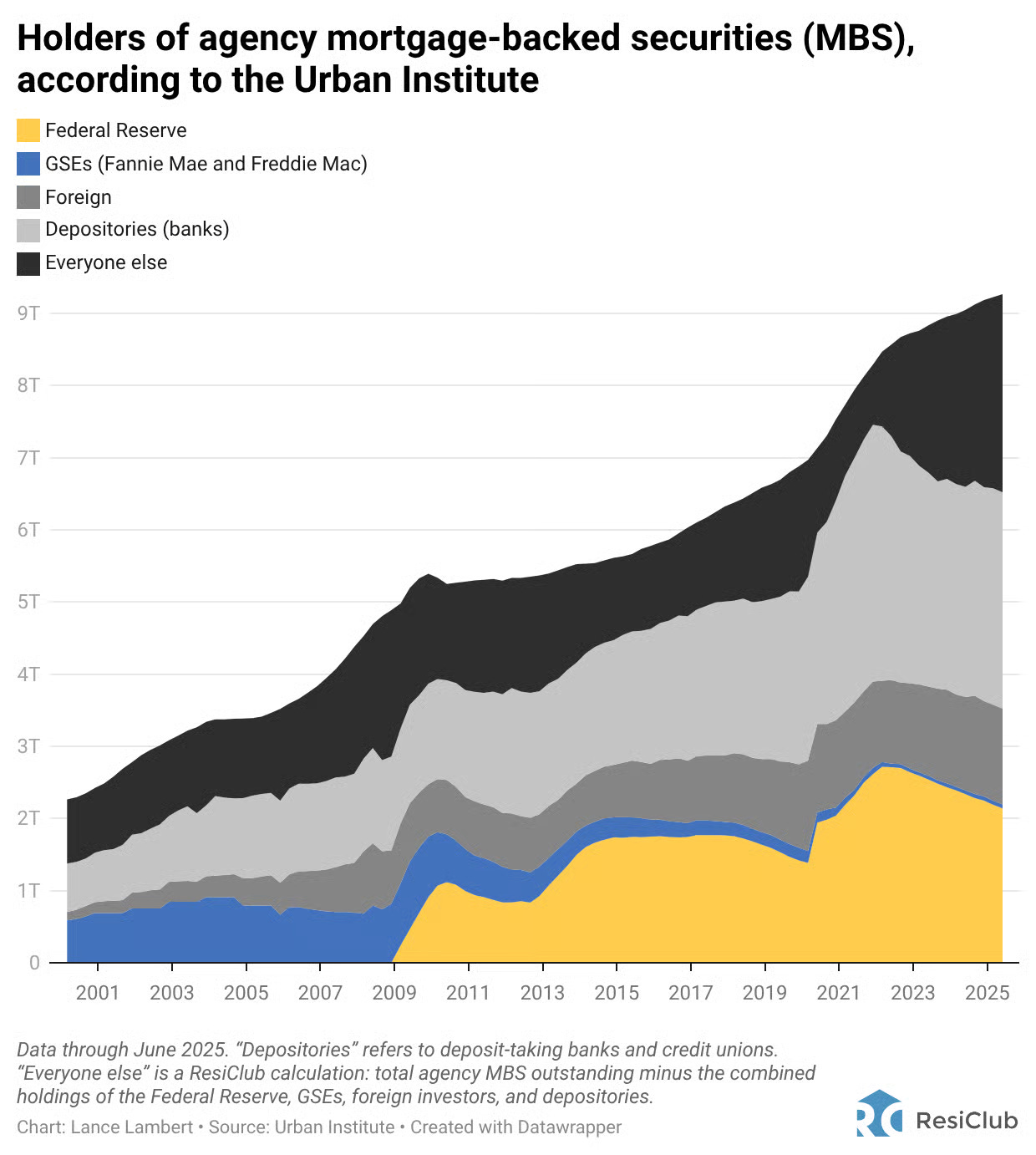

On January 8th, the administration announced it would drive down mortgage rates by purchasing $200 billion worth of Mortgage-Backed Securities (MBS). If you aren’t familiar with how the plumbing of the mortgage market works, here is the breakdown:

When you get a home loan, your bank rarely keeps that debt. They bundle your mortgage with thousands of others into a package (an MBS) and sell it to pension funds, insurance companies, or sovereign wealth funds. These investors buy them for a safe, steady yield.

Supply and Demand: When there are more sellers of bonds than buyers, yields (interest rates) go up.

The Injection: When a massive buyer, like the US Government, steps in with $200 billion, it creates artificial demand. The price of the bond goes up, and the yield goes down.

As a result: Mortgage rates drop.

Most analysts predict this move could drop rates by 0.25% to 0.50%. In theory, a 0.50% drop increases a buyer’s purchasing power by roughly 6%.

But here is the catch: The market is self-correcting.

When you inject liquidity into a supply-constrained market, the benefit rarely goes to the buyer. It goes to the seller. If a buyer can suddenly afford $3,000 a month instead of $2,800, sellers will simply price their homes higher to capture that difference. As the Chief Economist at Realtor.com noted, “The resulting boost to buyer demand could put upward pressure on home prices, offsetting some of the intended affordability relief.”

A one-time boost of $200 Billion will barely move the needle in the short-term – it’s barely 2% of the entire MBS market.

You see that thin blue line in the image? That’s the government’s holdings.

To make a meaningful difference, there has to be a steady purchase program of MBS-es to encourage builders to build more. That isn’t the plan right now.

This brings us to the real problem. It’s not the rates: it’s the inventory.

If you appreciate this kind of transparent breakdown of the numbers behind the headlines, consider subscribing. My goal for this year is to build a community of 100,000 smart investors, and I’d love for you to be one of them:

The Ghost of 2006 vs. The Crisis of 2026

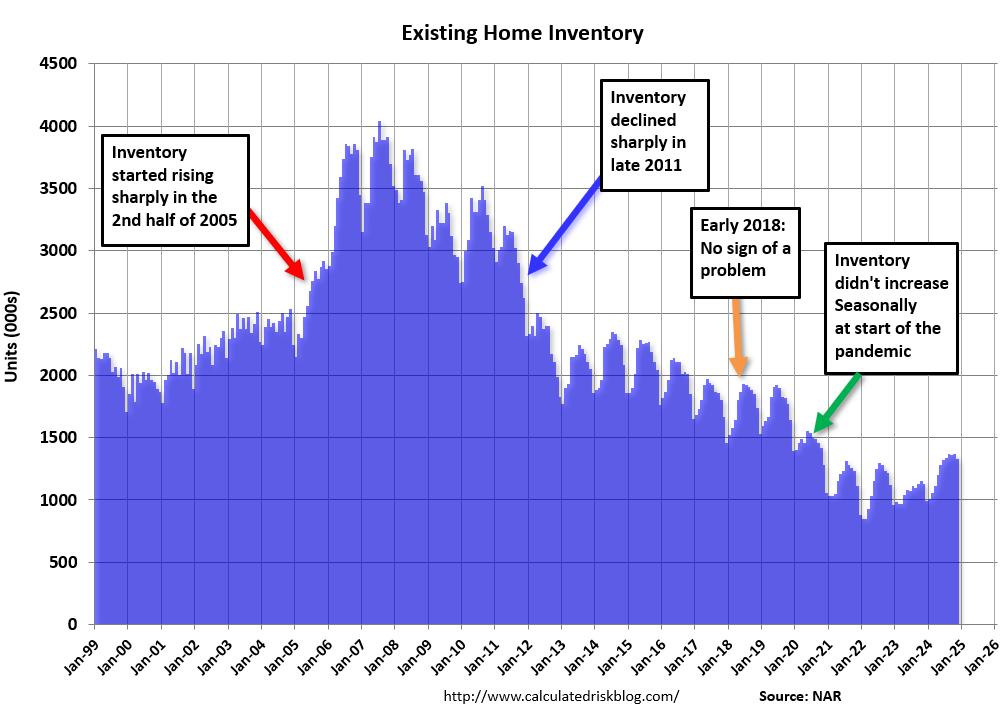

The biggest struggle for anyone looking to buy a home in the last five years stems from a misunderstanding of history. To understand why 2026 is so difficult, we have to look back at the 2005-2007 bubble.

Back then, homebuilders went into overdrive. Demand was artificial, fueled by no-income loans, so builders constructed more homes than the population actually needed. When the credit crunch hit, we had a massive oversupply, causing prices to collapse. It was a painful, but necessary, market correction that allowed people (like me) to buy their first homes at rock-bottom prices.

2026 is the exact opposite.

Since that crash, home construction never returned to its “pre-2006” levels. We have spent nearly two decades underbuilding relative to population growth.

We are now seeing the consequences of that gap, compounded by the “Lock-In Effect.” When rates hit historic lows in 2020/2021, millions of Americans refinanced. Now, even if they want to move, they refuse to trade a 3% mortgage for a 6% mortgage. This has paralyzed the resale market.

The data is startling:

We are finally nearing 2019 inventory levels, but the gap is still massive.

By the end of 2025, home sellers outnumbered home buyers by about 530,000 – the widest gap since 2013.

But perhaps the most worrying stat regarding affordability is the generational divide. Because prices have risen so much faster than wages, homebuyers over the age of 70 now outnumber those under 35. Think about that. The demographic that should be downsizing is out-buying the demographic that needs to start families, purely because they are the only ones with the capital to compete in this supply-starved environment.

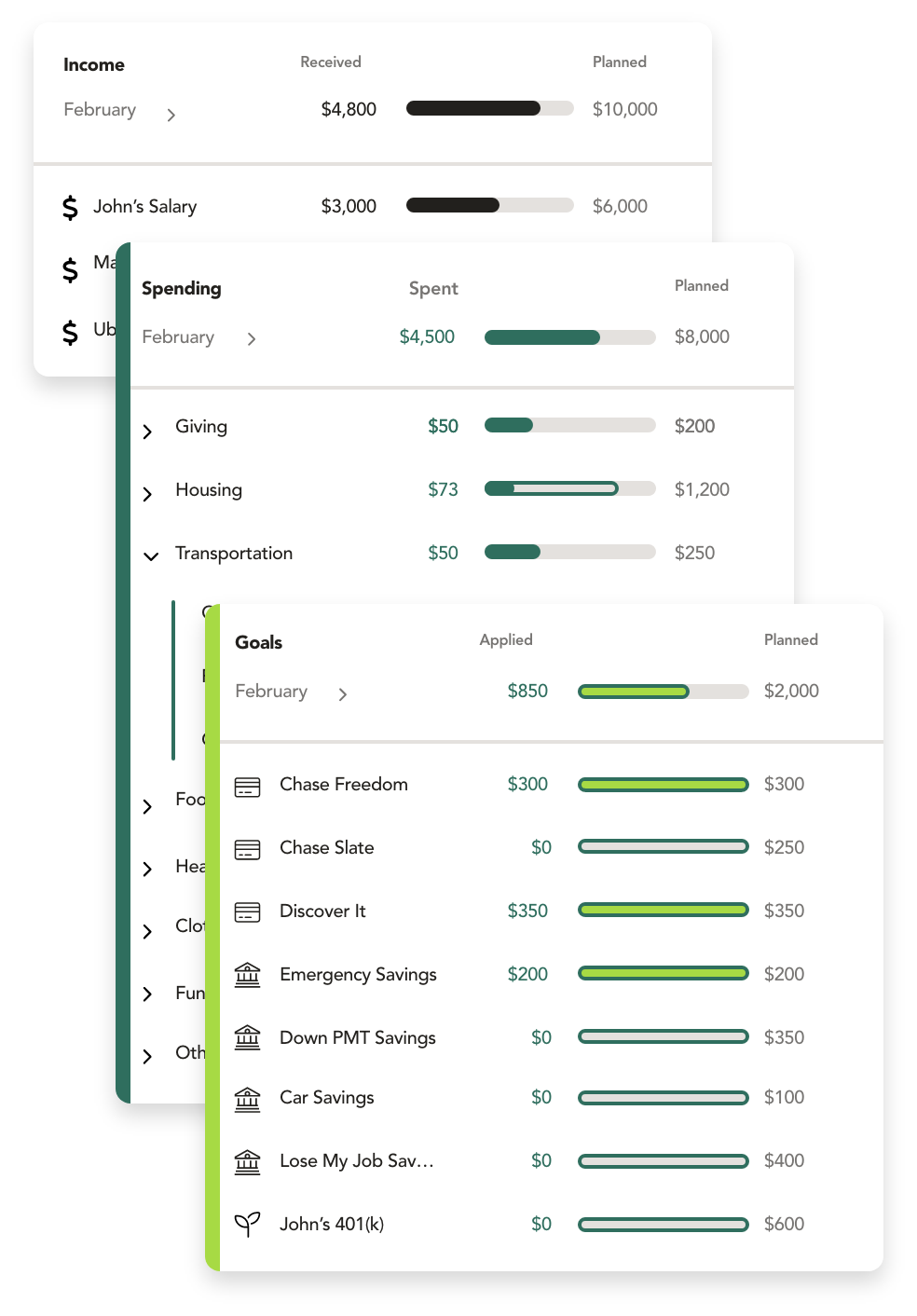

Taking Control of Your Cash Flow

This environment of rising costs highlights why it is critical to track every single dollar. You cannot control the housing market, but you can control your own burn rate.

For the last two years, I’ve been involved behind the scenes with a company called WizeFi, and the goal has always been simple: build a superior budgeting app that’s a real Mint.com replacement. We wanted to build something easier to use, more helpful, and actually enjoyable to stick with long-term.

This is one place for all of your accounts, where everything can be tracked, for FREE.

We just launched, and I’d genuinely love for you to be part of it early, try it out, and send feedback so we can keep improving it into the best budgeting tool possible. If you want to see exactly where your money is going before inflation eats it up, sign up and try it out here:

Growing prices, falling value: Inflation & Overhead

While the government tries to manipulate the top-line revenue (home prices) via mortgage rates, the bottom-line expenses are eating investors alive. This is the “Hidden Inflation” that nobody talks about.

In 2026, most forecasts predict home prices will rise nominally between 1% and 2%. But if inflation is running at 3%, and your asset appreciates by 2%, your real return is negative. You are technically losing purchasing power by holding that asset.

But it gets worse for landlords. The “CPI” (Consumer Price Index) might say inflation is 3%, but the “Landlord CPI” is significantly higher due to two specific line items: Insurance and Taxes.

Insurance: In states like California and Florida, insurance premiums have spiked as much as 50% year-over-year.

Taxes: In Texas, property tax appraisals have risen 20%.

As an investor, you are squeezed from both sides. Your asset is barely appreciating faster than inflation, and your holding costs are compounding at double-digit rates.

Pause for a second: Before we go further, I want to ask you: are you seeing this in your local market? Are older generations sweeping up the starter homes, or is inventory sitting longer in your neighborhood? Are you struggling with insurance and tax overheads?

Let me know. I read every comment to get a pulse on what the data isn’t showing:

The Return on Equity (ROE) Trap

This brings me to the definitive reason I am selling. It isn’t emotional. It’s a calculation called Return on Equity (ROE).

Many investors calculate their return based on what they bought the property for.

Example: “I bought a house for $500k. It makes $20k a year profit. That’s a 4% return.”

But that is the wrong math. You have to calculate your return based on the equity you have trapped in the deal today. I analyzed one of my properties recently. Thanks to the appreciation over the last few years, I have roughly $600,000 of equity sitting in that house.

However, after the rising insurance, taxes, and maintenance, that property only generates a net profit that equates to a 4.5% return on that $600,000. If I were to sell that house and take the $600,000 cash, could I beat a 4.5% return elsewhere?

Absolutely.

I could put that money into a high-yield savings account, a diversified index fund, or even short-term treasuries and likely match or beat that return with zero headaches.

No tenants calling at 2 AM.

No $10,000 roof repairs.

No risk of squatters (a growing issue in California).

No regulatory risk (Los Angeles capping rent increases below inflation).

When you combine a 4.5% ROE with the fact that maintenance costs are up 50% and local governments are making it harder to be a landlord, the “risk premium” creates a negative value. I am effectively paying to take on risk.

Advice for Buyers in 2026

Now, just because I am selling doesn’t mean you shouldn’t buy. Real estate is personal, especially if it’s your first home. But if you are entering this market, you need to understand that the leverage has shifted.

We are seeing softening. We are seeing inventory sit. And that means buyers are finally starting to gain the upper hand: if they know how to play it.

1. Don’t fear the “Stale” Listing: I’m seeing so many homes listed for months without offers. In 2021, a home sitting for 60 days meant something was wrong with it. In 2026, it often just means the seller priced it based on yesterday’s headlines. These sellers are losing momentum, and that is your opportunity to negotiate.

2. Ignore the List Price: Many sellers are “testing the market” with no intention of selling unless they get a dream number. Others are desperate but priced poorly. Don’t be afraid to offer a price that makes sense for you. The worst they can say is no.

3. Stick to your Range: Do not rush into a purchase out of fear that the $200 billion injection will cause prices to skyrocket. FOMO (Fear Of Missing Out) is the most expensive emotion in investing.

The Verdict

For the last decade, the winning strategy was “Buy and Hold.” For 2026, the winning strategy is “Calculate and Reallocate.”

The passive income era of real estate is being replaced by the active management era. The margins are thinner, the government is more involved, and the inflation is stickier.

For me, that means cashing out, simplifying, and reallocating capital where the risk-adjusted returns actually make sense. For you, that might mean slowing down, doing the math, and ensuring you aren’t confusing past performance with future results.

If you found this article helpful, please hit the like button ❤️ and share it with someone currently struggling with the housing market. It helps more people find this research.

I’ll see you next week, with another article.

–– Graham

Graham your article is accurate and well done. I have over 40 rental units outside of Columbus, OH. Due to the latest county reappraisals, my property taxes have increased 28% YOY. Spoke with my insurance agent last week and he is also expecting substantial increases coming my way.

Utility costs also should also be highlighted. I’m seeing 15-20% increases in utilities across the board.

Your common sense and knowledge are always impressive