You have 80,000 hours in your career.

That's a lot of time, meaning it's probably your best opportunity to have a positive impact on the world.

So how can you make the best use of that time?

80,000 Hours is a nonprofit that aims to help people find a fulfilling career that does good.

They've conducted over 10 years of research into what makes for a high-impact career. All that research is available on their site, plus a podcast, a job board with open job opportunities, and free 1-1 calls with their impartial advisors.

Everything they provide is free, forever — their only aim is to help people find more fulfilling careers that do good.

Get a free copy of their career guide here:

For much of the 20th century, the United States was the world’s manufacturing powerhouse. At its peak in 1953, America accounted for nearly 30% of global manufacturing output – a figure unmatched by any nation in modern history.

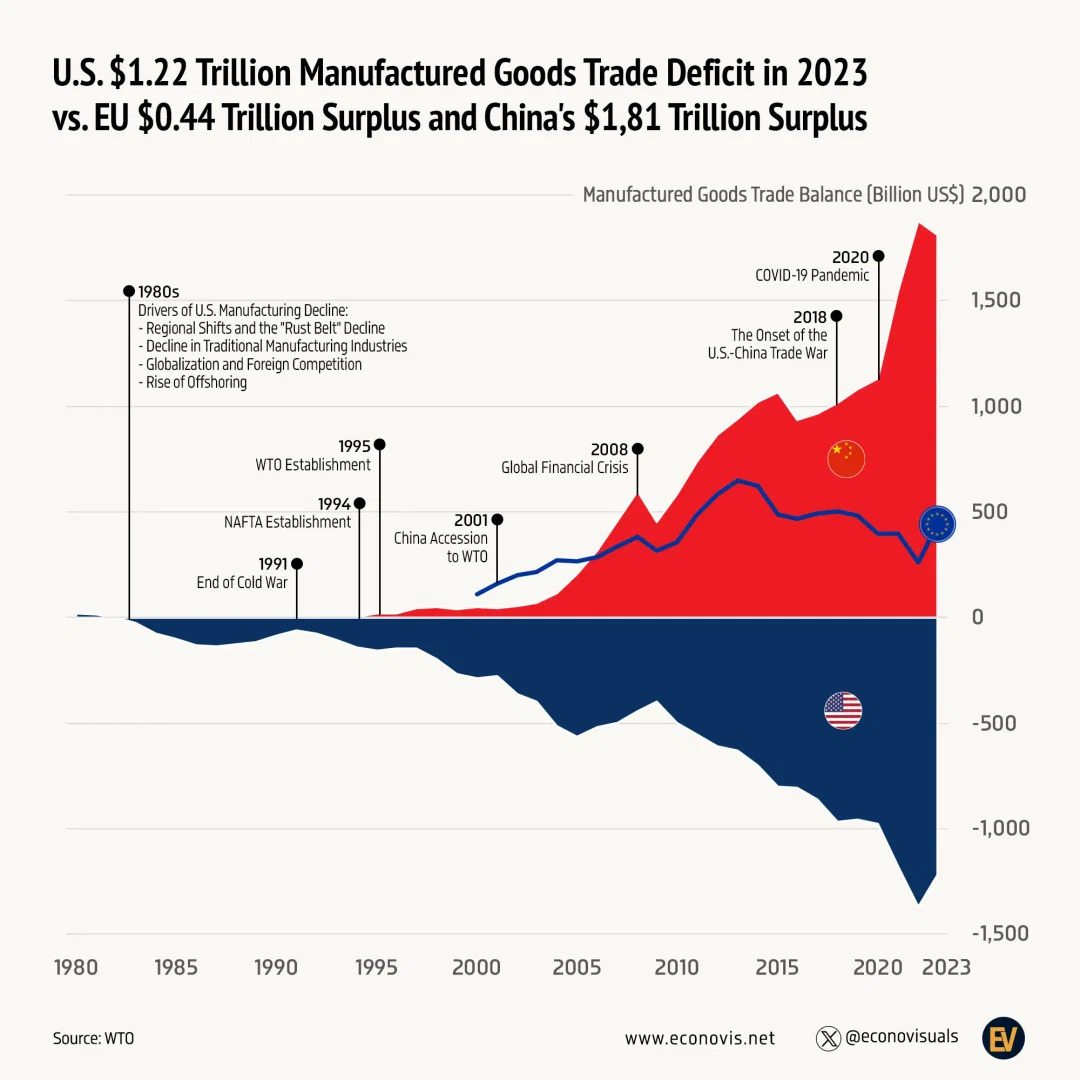

But over time, that dominance eroded. As China industrialized and integrated into global trade, the U.S. shifted toward a service-driven economy. China joined the WTO in 2001. Between then and 2024, America’s annual trade deficit with China ballooned from $83 billion to $295 billion, a symbol of deepening imbalance. The manufactured goods deficit was even higher:

This growing gap didn’t go unnoticed. Years of concern over intellectual property theft, supply chain dependency, and hollowed-out industrial towns culminated in a series of tariffs beginning in 2018, under the Trump administration, and continuing in 2025. The goal was straightforward: bring manufacturing back home. But it’s one thing to want that and another thing to pull it off.

As entrepreneur Molson Hart put it, America underestimates the difficulty of bringing manufacturing back. Costs are higher, the expertise gap is real, and long-established supply chains aren’t rerouted overnight. The uncertainty with changing policy is dissuading manufacturers from setting up shop in America. With all this uncertainty, markets have been chaotic.

Last week, after escalating tensions and reciprocal tariffs that shook global markets, the U.S. and China have announced a new deal – one the White House is calling a “total reset.” Tariffs are being paused. Markets are reacting, and both sides say this is just the beginning of a broader agreement.

So what does this mean – for trade, for inflation, and for your investments?

Let’s break it down.

Understanding the trade deficit

In terms of a trade agreement with China and the rest of the world, we should start here: the trade deficit.

We export $143 billion worth of our goods to China that they buy from us. But we import $438 billion worth of goods from China that we buy from them. In other words, we purchase three times more from China than China buys from the United States, leading to a trade deficit that the Trump administration wants to put an end to (or at least negotiate) so that more of our products could be manufactured locally.

But why is it so hard to pull off?

Since the 1980s, the US lost a significant portion of its manufacturing to factories in developing economies where labor was much cheaper (and arguably, better).

During the 1990s, globalization policies encouraged businesses to work together around the world.

Over time, this led to the US becoming less competitive and more expensive to manufacture everyday items.

Molson Hart had experience with manufacturing and working both in the US and in China – and his observation was that the knowhow to manufacture a lot of products might just be lost over multiple generations in the US because we have shifted to service jobs and have a different standard of life.

We face a similar challenge with agriculture: 70% of our oil imports come from Mexico and Canada, while Mexico also supplies 60% of our fresh vegetables. Sometimes it’s because these countries are able to produce crops for cheaper – but at other times, it’s just that some climates and terrains are better suited to certain crops.

Moreover, tariff revenue has always been in place to some degree, but over the last 70 years, revenue from tariffs has barely contributed to more than 2% of the government’s revenue.

The China situation

Now let’s talk about China. There has been a trade deficit with China pretty much since the very beginning. But this imbalance saw a sharp spike during the 2020 pandemic.

Why? Though this looks shocking, it’s mainly because:

Most of their country was on lockdown and unable to make any purchases

We imported a lot of medical equipment from China during the pandemic.

So while the charts are dramatic, the truth is more commonplace.

China is simply way more competitive today than it was 20-30 years back. It’s responsible for one-third of all manufactured products in the world. They occupy nearly every hotspot for mining raw minerals, and their factories produce batteries for 30% cheaper than Europe and 20% cheaper than the US. Even across other sectors like vitamins, pharma, household appliances, personal items, etc. China accounts for around 75% of the export market. The earlier round of tariffs since 2018 has made no difference for Chinese companies who wound up doing more business with Mexico and Vietnam – which brings us to the current phase of Trump Tariffs.

These were created to “level the playing field” between countries, encourage domestic manufacturing and bring back demand for U.S-made products. But things escalated fast. It started out with Trump proposing a 20% tariff on Chinese imports in March. China retaliated with a 15% tariff on U.S food products. Trump retaliated with a 54% tariff on China, which they responded by escalating to an 84% tariff.

On April 9, Trump announced a 90-day tariff pause for all countries – except for China – because they didn’t negotiate. Instead, he raised the tariff to 104% and China increased tariffs to 145%, sending the stock market into a panic — until there were hopes of woking out a potential agreement sooner than expected. A trade deal was announced with the UK last week to cap British cars at a 10% tariff on the first 100,000 imports and remove tariffs on planes, steel, aluminum, beef, and agriculture products. This was a hopeful sign that negotiations might start with China.

The agreement

As of last week, the United States and Chinese officials have agreed to pause most tariffs – and other trade barriers – for 90 days. The United States agreed to lower tariffs from 145% to 30%, and China would reduce their tariffs from 125% to just 10%. This is great progress, but remember that tariffs are still higher than they were before Liberation Day and this agreement holds only for the next 90 days. Tariffs might rise after that point, but it seems promising right now.

China did go on record to say that they hope the US would build on the foundation of this meeting and correct its unilateral tariff practices. Meanwhile, the U.S. Treasury Secretary said, “I would imagine that in the next few weeks, we will be meeting again to get rolling on a more fulsome agreement,” and that we could always return to April 2 levels, at 34%. Sigh.

The 90-day pause gives them time to construct a more comprehensive plan. But in terms of China, the worst is likely behind us. After the deal though, Trump said that the European Union is “nastier” than China, with the trade deficit in the automobile industry being too high. We trade about $1 Trillion a year with the EU making them one of our biggest trading partners – so round two could be a similar period of tension with Europe. Who knows.

Why is a trade agreement important?

According to the Market Sentiment blog, China makes up about 7% of total annual revenue in S&P 500 companies – which means that U.S companies made $1.2 trillion of revenue selling to Chinese consumers, four times higher than the trade deficit. If the US were to completely cut itself off from China, our largest companies would suffer, and that would trickle down to the economy.

On top of that, nearly 14% of everything we buy comes from China. They’re our second-largest trading partner, even above Canada, and they increased the annual purchasing power of the average U.S. household by $1,500 between 2000 and 2007.

Here in the United States, we have $163.8 trillion worth of wealth, with a savings rate of just 4.6%, compared to China’s $84.48 trillion of wealth and a 44% savings rate. Culturally, China is largely based on the mindset that money should be saved and not spent. As a result, they consume less, and that wealth disparity leads to an unequal balance of trade between countries.

In this case, it isn’t so much a trade deficit, but rather fundamental differences when it comes to consumption, savings, and priorities. And frankly, if you enjoy paying low prices for everyday items, that’s in part because of China’s ability to quickly produce certain products for real cheap. So yes, we are reliant on China for our goods and services, and the sooner a mutual agreement is reached, the better it will be for everyone – not just one side or the other.

Although, in terms of what I think about everything going on and my plan going forward, here you go:

Realistically, all this means is that tariffs are still remaining in place. They are lower than the worst-case scenario, and it’s a positive sign that both sides are openly communicating and coming to a general agreement. But it’s still not over.

Yes, the stock market is reacting quite positively to the news. But for my own strategy, I’m not letting this make a material impact. I just keep buying on a regular basis, and if things fall, I just buy a little more. Honestly, it worries me when markets are moving so much on a “buy the rumor, buy the news” mentality—that nearly any scenario gets instantly priced into the market, for better or worse, even as Trump reiterates that “China tariffs will go up without a deal.”

That’s why it’s probably best just to create a realistic plan, stick with it, and not get caught in the hype or fear either way. In the long term, I’m fairly confident that everything will eventually balance itself out. And over these 90 days, I’d say I’m cautiously optimistic.

Of course, the entire situation also changes by the minute. So if you want detailed updates on breaking news, feel free to subscribe and I’ll keep you updated every step of the way.

That’s it for today. Don’t forget to check out our sponsor!

If you enjoyed reading this, consider forwarding it or sharing it with a friend. Thanks!

Questions I will be looking into after reading this article:

---What products are we buying so much of from Canada? They don't have cheap labor so I am curious how this is possible.

---What have the tariffs been historically with China, including just 2 years ago?

---If Chinese save 44% of income, do they all retire at age 45???