Successful Investors Don’t DIY Their Numbers

You already know your time is capital. But so is your clarity. In this economy, guessing is expensive, and doing your own books is a liability.

BELAY matches leaders like you with Accounting Professionals who think like investors. They model risk, forecast cash flow, and translate your numbers into actual leverage — not noise.

Curious how they do it? BELAY is giving you a taste of the magic with their free resource 13-Week Cash Flow Forecast built for real decision-makers.

Download it today and start making smarter moves, faster.

J.P. Morgan was a titan of American finance when he watched the U.S. financial system unravel in the fall of 1907. An earthquake in San Francisco set off a chain reaction – the disaster drained insurers, leading to tightening credit. Depositors panicked and began pulling their money from the banks. By October, lines were running around the block in New York with depositors trying to withdraw their savings. One trust company had 11,000 customers show up in a single day.

There was no Federal Reserve. No FDIC. No circuit breakers. Just fear. In fact, this is the event that led to the creation of the Federal Reserve so that something like this wouldn’t happen again. The market dropped by more than 50% and it looked like capitalism itself might break. But what happened after the crisis? In the four years that followed, the market surged by 193%. Then it surged again after World War II. And again after the '70s inflation crisis, after the dot-com bust, and after the Great Recession. Every crash has been the waiting period for another rally.

Which brings us to now – because today, things are once again falling apart.

We just saw one of the fastest and deepest drops in stock market history. A steep 25% correction wiped out years of gains in days. It’s tempting to yell, “Everything’s on sale! Buy the dip!” But the hard truth is that if you lose your job, burn through your emergency fund, and don’t have a financial cushion, buying the dip is going to be the last thing on your mind. It’s a reminder that your first responsibility is to protect your money before growing it.

So, let’s break this down: What caused this? What might happen next? And most importantly, what should you do now to put yourself in the best possible situation?

What Triggered the Crash?

It all started with tariffs — again.

Trump informally announced sweeping worldwide tariffs, set to take effect on April 9th. Investors were bracing for impact, expecting something tough but manageable. Instead, the actual policy was far harsher than anticipated. There were two possible outcomes:

Scenario A: Other countries blink, America gets a deal, and stocks recover.

Scenario B: Other countries fight back leading to an escalating trade war that tanks the U.S. economy.

Now, the tariffs are on pause for most of the countries involved – except for China, which is one of our biggest trade partners and one of the largest markets in the world. Markets are reacting adversely:

Markets hate uncertainty, and this created the perfect storm.

This Isn’t the First Time

If this sounds apocalyptic, hold your breath. Let’s take a quick tour through history.

1907: The market fell 50%. Four years later, it was up 193%.

1929–1932: The market fell 83% during the Great Depression. Recovery took nearly two decades, but it led to a 14-year boom post–WWII with gains over 815%.

1973–74: Nixon ended the gold standard. Inflation surged. Markets fell 40%. Then they recovered by 845% over the next 13 years.

1987: Black Monday hit – a 22% crash in one day. Yet markets rebounded rapidly.

2000–2001: The dot-com bubble burst. Tech stocks imploded. Five years later, the market was back up 110%.

2008–2009: Housing crisis. Lehman collapsed. Stocks dropped 50%. But since then, we saw one of the longest uninterrupted bull markets in history.

2020: COVID crash. Markets fell 30% in weeks. Then, they rose another 120% over the next five years.

Here’s the takeaway: Every crash has felt catastrophic in the moment, but every single one was followed by growth if you had a long-term outlook of 10-15 years.

But what about the short term?

Here’s where things get tricky. History does favor optimism, but we can’t ignore the fact that the short term might still get worse. Stocks may drop another 10%, 20%, even 30%. The truth is, no one knows how deep this will go. But here’s the context that might calm you down a little:

Even now, the S&P 500 is still up over 70% over the last 5 years, and that’s without including dividends.

Major drawdowns have always been followed by recoveries.

Source: Macrotrends If you held through the worst days, you were there for the best ones too. Miss the top 10 days in the market and your returns get cut by more than half, which means that timing the market is a terrible idea.

So yes, short-term pain is real, but unless you’re retiring within the next few years, this isn’t any cause for immediate concern.

What you should focus on now

1. Stay employed and build cash

Before you think about investments, think about survival. Now is the time to increase your income, build an emergency fund, and stay as liquid as possible. If you’re concerned about hours getting cut or a job loss, this should be your #1 focus.

2. Keep Investing, but do it smartly

If you have a long time horizon of 10–20 years, this is one of the best times to invest. I’m not going all-in. I’m just dollar-cost averaging into a broad index fund, like I always do. This is the same strategy I used in 2011, in 2017, in 2020. It’s boring. It’s predictable. And it works. The temptation is strong to call the bottom of the market, but averaging out your investments is a much more reliable strategy.

3. Don’t try to time the bottom

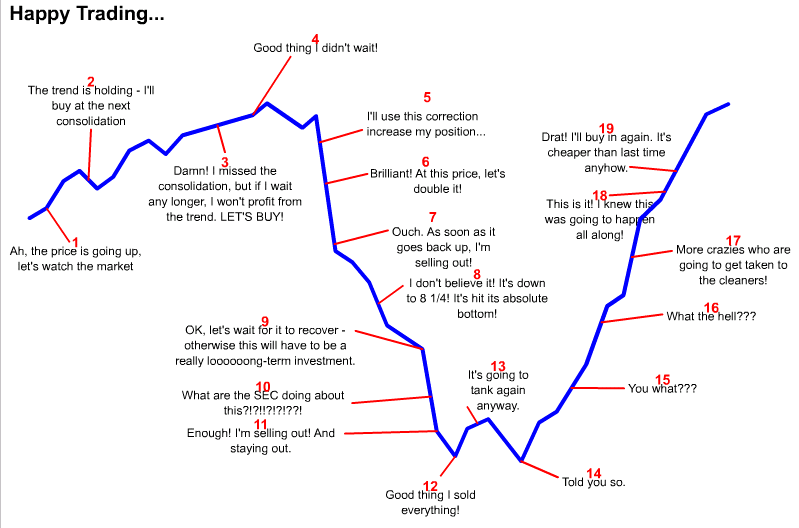

Here’s a chart of investor emotions I found online that sums it up:

You buy. It drops. You buy more. It drops again. You panic. You sell. It rebounds. You hesitate. Then finally, you buy back in — at the original price, but with fewer shares and more regret. Avoid that cycle. The less you react, the better you’ll do.

4. Reframe the dip

If you saw eggs at 50% off, you’d buy more instead of worrying about last week’s price. If there’s a Black Friday sale on the iPhone, you’d jump at that offer. So why treat stocks any differently? If you start approaching investments as owning a piece of a business, or a collection of businesses, then you’ll see it very differently from the rest who see it as a fluctuating ticker that they’re speculating on.

As Warren Buffet says: Be fearful when others are greedy. Be greedy when others are fearful.

Right now, fear is high.

Riches are built in recessions

The best investments I ever made were in 2009, when people were running scared. I bought houses for $70,000 in California. I bought Ford stock for $2 a share. That was possible only because I stayed calm when others didn’t. It’s not that I’m bragging, but it’s worth highlighting that such opportunities don’t come around often (especially like the 2009 housing market), and leveraging these makes the difference.

You don’t get rich chasing hype but instead, by making consistent decisions when everyone else is panicking. If you’re able to invest regularly, even in small amounts, during downturns like this, you’ll be in an incredibly strong position when the market recovers. And so far, it always has.

Let me end with a simple truth: The stock market is a fickle friend.

Sometimes it gives you amazing returns. Sometimes it takes money away. But over decades, it keeps showing up, and rewarding those who don’t bail when it gets emotional. So ignore the noise. Protect your income. Keep investing. And remember:

This too shall pass.

Useful Links for Context:

Market Sentiment on Tariffs:

That’s it for today. If you enjoyed reading, drop a like and forward this to a friend – it really helps in growing the newsletter and helping more folks. Also, do check out today’s sponsor, BELAY, if you haven’t already. Cheers!

I’m also looking to make this more pro-social and bring in more of what you’d like to see to the newsletter. If you have any topics or questions you’re thinking about, let me know in the comments.