What’s up you guys, it’s Graham here! If you want to join 13,500+ smart investors and never miss an update on the market, hit the subscribe button below. It only takes a second and it’s completely free.

Let’s face it, the money printer was on its last legs these past few months and the Fed might just have put it out of its misery last week by raising their benchmark interest rates by 75 basis points, taking us to the highest interest rates since early 2018.

We are most likely in the twilight era of a 40-year period of declining interest rates and essentially free money. These volatile market conditions present challenges and opportunities that most of us haven’t seen before.

So, let’s talk about why the Fed is raising their interest rates, the new changes that are about to go into effect, which of your investments will be affected, and finally, what you can do about this to make money!

Inflation

Unless you live under a rock, you have been feeling the effect of record-high inflation, the type we haven’t seen in the past 25 years. While a steady, consistent inflation rate is seen as an indicator of a healthy economy, uncontrolled inflation can quickly eat away the purchasing power of your wages and wealth.

To combat this, the federal reserve’s go-to tool is hiking interest rates. To put it simply, the higher the interest rate, the more expensive it is to borrow, fewer people spend, and in an ideal world, this results in lower inflation. The fed’s goal here is to achieve what is known as the ‘neutral rate’, which neither sparks nor hurts growth. With rising inflation gnawing away at middle-class wealth, some estimates say that the rates could reach up to 3.5-4.25 %, which is double what we have today.

If this happens, there are going to be winners and losers. After all, anticipating the winners and losers in this high-interest rate environment will put you in the best possible position to secure and grow your wealth.

The Losers

Real Estate

This one is personal for me, but the biggest casualty of high-interest rates will be Real Estate. Since January, mortgage rates have doubled from 2.8% to 5.6%, the highest since 2009. To put this in perspective, a $300,000 mortgage would have cost you $1265 per month at a 3% interest rate in January, but today, it is $1700 per month at a 5% interest rate => a 34% increase in your mortgage payment in just 6 months.

Moody’s Analytics believes that the housing market is about to enter a ‘deep freeze’ due to higher prices and rising interest rates. If you were considering renting as an alternative, well the median national rent just went above $2000 a month. Unfortunately, it appears that millennials’ housing worries are not waning any time soon and this just might be the wrong time to make a big investment.

However, if you have already bought one, the good news is that in the long term, home prices usually trend upwards and you can easily turn a profit if you keep it for at least 7-10 years.

Stock Market

The other asset class negatively affected by increasing rate hikes is the stock market. Higher interest rates are almost always associated with market corrections in the short term, and we should be prepared for strong market volatility in the coming months.

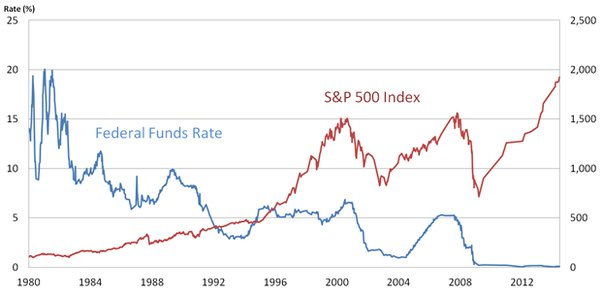

Blackrock explains that we should be looking at real rates, that is, current rates minus inflation, and high real rates can be positive for stock prices. Our interest rates are still negative when you account for inflation, but as long as the Federal Reserve slowly and effectively communicates its intentions and calms investor sentiment, rising rates shouldn’t be a complete disaster. This excellent analysis from Market Sentiment shows how the federal rates have affected the market historically.

However, the biggest impact on the economy and subsequently stocks due to rising interest rates are slowing growth and consequently, a recession.

THE R-WORD

The consequence of trying to control inflation with rate hikes is that every time the Fed rates matched inflation, a Recession followed (except in 1994 - mostly due to a productivity boom). In the United States, a recession is announced by the NBER - however, we have already seen two-quarters of declining GDP, and 10 out of the last 10 times the US economy shrank for two consecutive quarters, the US economy was declared to be in a recession.

Some estimates say that we have a 50% chance of confirming recession in the next 12 months, while JP Morgan, analyzing stock market data, reports an 85% chance of recession. Although it appears to be the only way to tame inflation, recessions are bad news. They almost always entail job losses, higher unemployment, declining wages, and less private investment as businesses scale back in anticipation of lower earnings and individuals look for safer investments.

Silver Linings

Remember when I said that there are winners in a high-interest rate environment? Despite the doom and gloom predictions, the stormy weather ahead also provides some silver linings.

Savings Accounts

The most obvious benefactor of the Fed raising interest rates is the savings account. For the last two years, most ‘High-interest accounts’ were paying you next to nothing, however, many of them are now paying a healthy amount. My top five picks for savings accounts with high-interest rates would be

Ally Bank (1.25%)

Marcus by Goldman Sachs (1.2%)

Sofi (1.5%)

CIT bank (1.65%)

Citizens Bank (1.75% ) - FYI - I do not have first-hand experience with them

Although a savings account can never match the return of equity markets nor even counteract depreciation due to inflation, the returns are essentially guaranteed.

Fixed Rate Loans

Fixed-rate loans do well in increasing interest rate scenarios because as long as the interest rate is locked in, your payment remains the same and with increasing inflation, the net impact of your debt goes down. For context, this would be like borrowing $1000 back in the 1990s and paying it off with today’s money. Now would be a perfect time to lock in a fixed-rate loan to insulate yourself against higher rates in the future and provide peace of mind knowing that your payment remains exactly the same.

Normalizing Markets

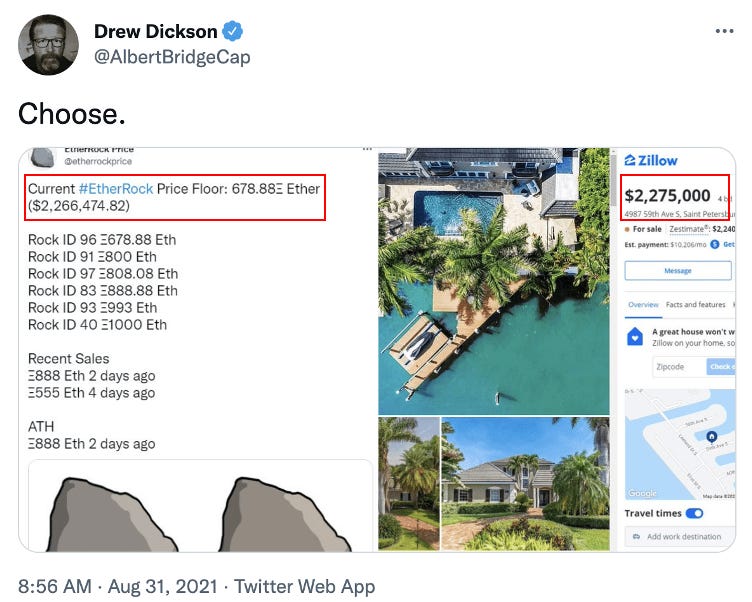

In the long term, recessions are required to value assets correctly. As hard as a recession might be, we really need a market reset since pretty much every single asset class was excessively valued. Remember when an image of a stone was equivalent to an actual waterfront house in Florida?

Even though it might not bring market prices down by 50%, a recession means that the fundamentals slowly retrace back to normal. The federal reserve has also noted that with the recent rate hikes, “indicators of spending and production have softened” and we could be looking at the start of a reversal of sky-high prices.

Riding the Rough Seas

A smooth sea never made a skilled sailor - Franklin D. Roosevelt

While what the FED decides to do is not in our control and we should expect more market volatility till September, you can do your best to pay down variable interest rate debt or get a fixed rate loan.

Layoffs and spells of low demand are also excellent opportunities to invest in yourself and hone your skills so that you are well positioned when market conditions improve. Upskilling yourself with education expands your knowledge and increases your leverage in finding new opportunities.

Volatile times also present opportunities to invest in high-quality stocks and real estate. Staying invested would be the best strategy as stocks and real estate tend to move up in the long term. I know it’s hard to stay positive when the news cycle is filled with talks of recession and economic collapse. But I believe that the experience of skilfully navigating a turbulent market is what makes an excellent investor.

See you next week with another deep-dive!

And force of habit - Smash that like button to help others find this newsletter. Hit that subscribe button if you haven’t done so already!

That was a stupid meme.

What does the WH have to do with this?