The true investment challenge is to perform well in difficult times - Seth Klarman

It’s always said that you will know how strong a business is only during bear markets. During bull markets, investors are exuberant, consumers are optimistic and capital is easily available. Having a business with a sketchy business model is easy to pull off in these conditions. But, when the market turns and easy money stops, all the skeletons come out of the closet!

The latest victim was Voyager Digital which filed for bankruptcy just 3 days back. Also, Peter Thiel backed crypto lender Vauld has suspended withdrawals and Genesis lost hundreds of millions of dollars due to the bankruptcy of Three Arrows Capital. Coinbase COIN 0.00%↑ stock has plunged 81% this year and has recently announced plans to lay off one-fifth of its staff. Given all of this, it’s important to talk about what’s going on in the crypto world and how to manage your risks effectively.

A warning for Crypto bros!

It’s becoming a recurring trend. We have to talk about the catastrophic state of the crypto market every week now! With the collapse of Terra Luna, Celsius, Voyager Digital, and Three Arrows Capital, and potentially many more in the coming months, I worry that most people are completely unprepared for what’s about to happen and could wind up losing a lot of money if they are not taking the right precautions ahead of time.

I cover various risks like bankruptcy, hacking, and freezes that you should be aware of while storing your Crypto and how to effectively hedge for those risks.

Housing Market Bubble Just Popped

Even though Housing Starts have declined to their lowest level since the beginning of the Pandemic, Mortgage demand has fallen to a 22-year low, and sales of the existing homes fell by 3.4%, the housing market still managed to increase in price! Due to all of these, the number 1 question I get asked these days is

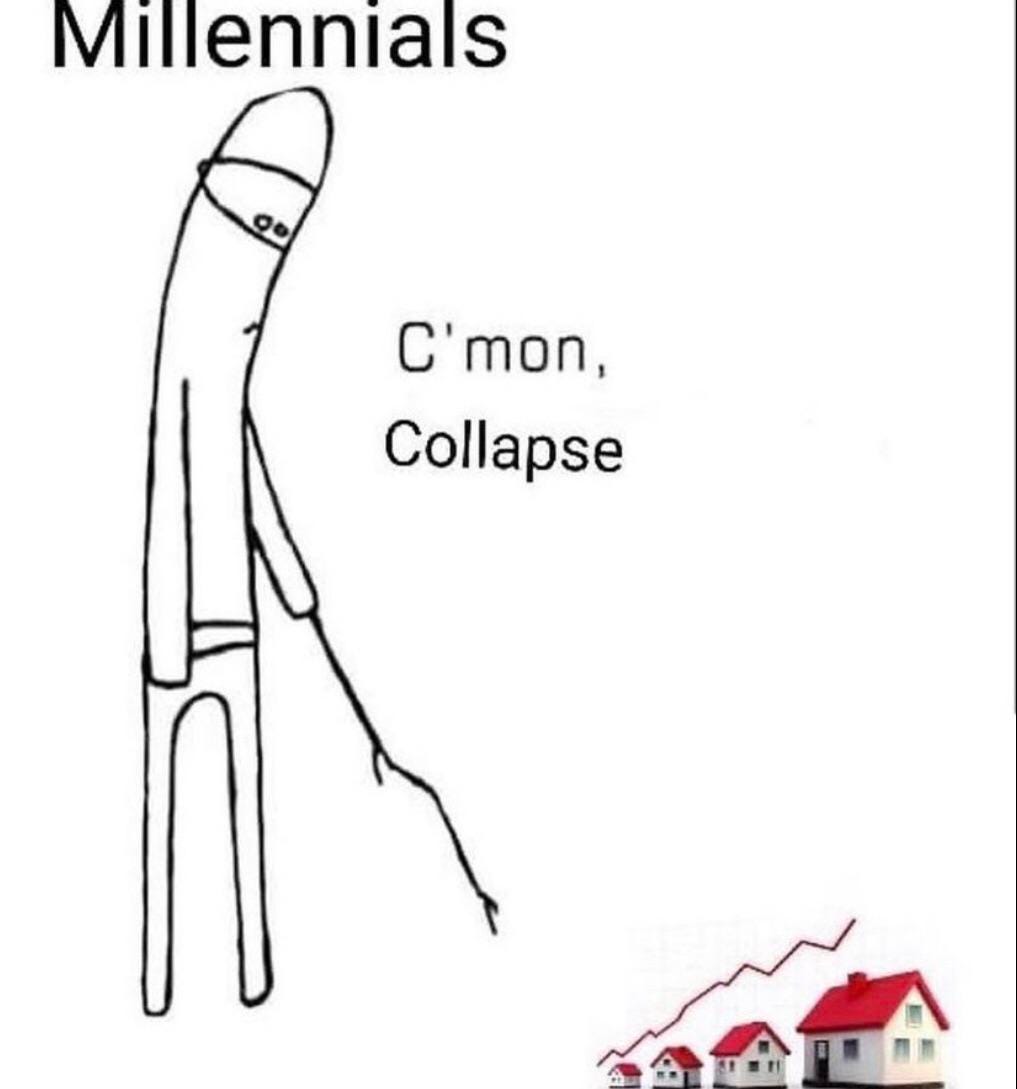

“When is the housing market going to collapse?” - Every Millennial right now

So, in this video, I talk about the current state of the housing industry, how much prices could possibly fall and if the housing market could head in the same direction as the stock market.

By the way, this week, I have a recommendation for you…

Checkout out The Bullpen.

Will Robinhood go bankrupt? Is PayPal a great buy at 15x PE? Is Spotify running out of money?

Find out by listening to former $100MM portfolio manager Genevieve Roch-Decter of GRIT Capital (the #1 FREE finance newsletter on Substack) and her co-host Robert Ross of TikStocks.

Subscribe on YouTube to watch the pair every Wednesday at 3 pm EST as they discuss what's happening in the stock market and how they plan to profit off it!

So that’s it for my Sunday round-up. For the new folks here, in this newsletter, I give a quick recap of whatever you may have missed over the week on Sunday, and on Wednesday, I will be doing my deep-dive article on one of these topics.

See you next week with another bunch of exciting videos!

And force of habit - Smash that like button to help others find this newsletter.

I'm here because of the squirrel on the inflation video

Excellent as always. Love the cartoon of the Millennial poking at the housing market.

When we bought our starter house in 1987 I had to pay five year’s salary for it.

Today the average starter house costs — 5 year’s salary. Sure, there are parts of the country where that number is higher, and parts where it’s lower. But that’s been pretty much a constant for a long, long time.