I usually stick with sharing the data while holding back on my personal opinions, but looking at everything that’s going on, it’s likely that Bitcoin has the potential to become the Global Reserve Currency at some point. It’s the best performing asset, not just in the last year, but in the last 10 years, averaging 102% annually after adjusting for inflation – beating the US stock market, gold, and real estate. If you had bought it last year, it would have already doubled in value. Meanwhile, public companies and national entities are starting to add more Bitcoin to their balance sheet.

Having said that, the biggest gains are still ahead of us. As are the biggest risks. In today’s article, let’s look at how far Bitcoin has come, why it’s getting popular with global investors, and how the future looks. And the most important thing: What does this mean for you as an investor, and how can you make the most money while protecting against the risks?

Bitcoin vs The Stock Market

In the last 10 years, the stock market has gained about 10% every year. But consider that the US has also increased its money supply by the same amount, and those gains seem less impressive.

Bitcoin on the other hand has a finite amount of coins to be mined – there will only be 21 million Bitcoin in existence, ever, and the first 19.9 million Bitcoin have already been mined. This leaves only 1.1 million to be mined over the coming decades, and this scarcity is what gives it its value. It has vastly outperformed the money supply in the last decade.

60% of people in America own stocks. 65% own homes. But only 14% own Bitcoin. This untapped market is what gives Bitcoin its potential for further growth in the future.

Since 2025, Bitcoin’s returns were over 100x the stock market’s returns. It has gone up by 20,000,000% since its inception, and its popularity is rising with both retail and institutional investors as a result. At the same time, Bitcoin has also lost 50 to 90% of its value multiple times which is less frequent with the stock market or any other asset for that matter.

Who are the biggest buyers?

ETFs and institutions hold the bulk of Bitcoin. Microstrategy owns 2.6% of the circulating supply. Tesla added Bitcoin to its reserve in 2021, and Blackrock’s Bitcoin ETF is one of the fastest growing funds of all time, zooming past $70 Billion in June. Pension funds have started to buy some Bitcoin to diversify their asset mix. But the real gamechanger could be that governments of countries are beginning to back part of their national reserves with Bitcoin.

265 entities have reserves of Bitcoin.

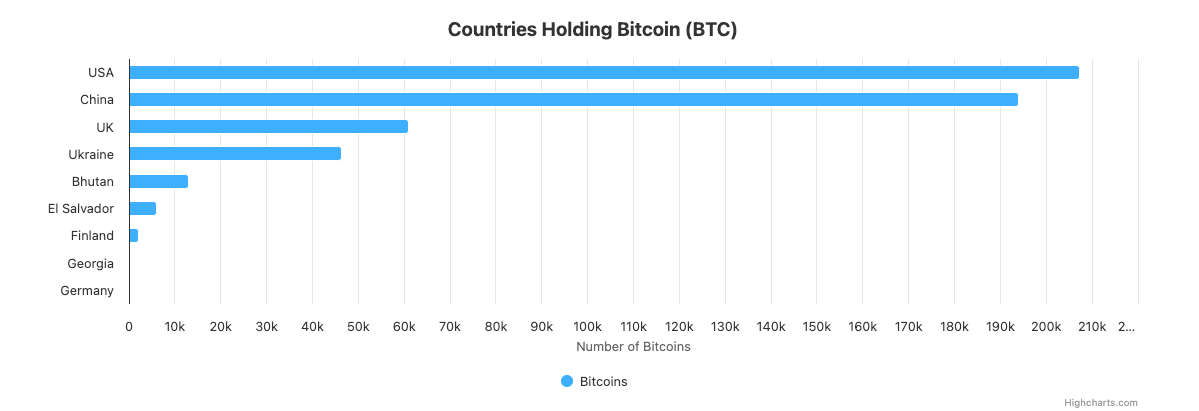

The US government has begun to stockpile Bitcoin in the tens of billions of dollars, while 8 other countries including China have also started to build up their reserves to not be left behind. The top 9 countries hold $64.65 Billion in Bitcoin.

One concern that institutional investors and analysts used to have is that national governments would never cede control by letting Bitcoin become more valuable than the reserve currency of the country. There was no way that Bitcoin could replace the US dollar as the global reserve currency.

But now that countries are beginning to buy Bitcoin themselves, institutions and retail investors are also gaining confidence in its potential. 65% of investors say they plan to invest in digital assets, and half of all financial advisors are planning to recommend crypto products to investors within the next 12 months.

How has Bitcoin compared to other assets?

Here’s a short summary of how different assets performed in the last ten years:

Inflation averaged 2.65%

The S&P500 has increased by 200%

Gold has increased by 181%

Home prices are up roughly 100%

The US Dollar has lost 26% of its value

Bitcoin is up 35,000% in the same timeframe!

Just $1,000 invested 10 years ago into Bitcoin would now be worth $400,000. One person on Twitter said that he had bought his house for $500,000 and it’s now worth $575,000 after 2 years. His home increased 15% in dollars, but it lost 76% in value next to Bitcoin! (This isn’t a recommendation to buy Bitcoin instead of a house – but the scale of the comparison is crazy to me)

Keeping all this in mind, most financial advisors recommend a 2% allocation into Bitcoin with almost 1 in 10 saying that 10-14% of a portfolio would be the ideal amount to invest in Bitcoin. But keeping historical performance aside,

What are the experts saying?

If it was all sunshine and roses, the entire world would have bought into Bitcoin by now. But there are some very experienced and wise investors who are vocally against Bitcoin. Chief among these is Warren Buffett, who warned that Bitcoin isn’t a value producing asset and that it was a gambling token. He also said that it’s illogical to think that the US government would let another currency exceed its importance. (But since then, the US government has already begun embracing Bitcoin)

Buffett’s friend Charlie Munger was even harsher in his last days. He called Bitcoin “rat poison” and went on to say – and I’m not making this up – that it’s like everybody is trading turds and you decide, “I can’t be left out.” Nobel-Prize winning analyst Eugene Fama said there’s a 100% chance of Bitcoin going to zero within the next decade. Jamie Dimon of JP Morgan, arguably one of the people with the best high-level views of the financial system, compared Bitcoin to smoking: The choice to own it was personal, but it would destroy their financial health.

However, some prominent people have also reversed their stance on Bitcoin.

Ray Dalio, for example, said that Bitcoin is a bubble, but he has since gone on to hail it as one hell of an invention and is considering investing in it. The same goes for Larry Fink of Blackrock who called Bitcoin an index of money-laundering – but now Blackrock runs the ETF with the biggest inflows into Bitcoin.

The truth is that in the grand scheme of things, Bitcoin is still very young and is a fledgling compared to stocks, gold, or the US dollar. So while experts are wise to point out the risk, their guess is as good as yours.

Price targets

I wanted to get the price predictions for the next few years, to see what we can expect. Depending on how far ahead we’re looking, the predictions are wildly different.

Currently, Bitcoin has breached the $120k mark for the first time. For the next 1 to 3 years, Bitcoin is expected to reach around $150k to $200k. Robert Kiyosaki thinks that by 2030, the bear case for Bitcoin would be $300k and in the bullish scenario, we might be looking at $1 million. Cathie Wood of Ark thinks that this figure could be much higher, as high as $2.4 Million.

Experts sometimes exaggerate because of the incentives they have, so if we look at what lay investors are estimating, many platforms set a more realistic estimate of $600k to $700k by 2030.

The further out we go in time, the crazier these predictions get. Analysts think that by 2035, Bitcoin could go as high as $1M to $2.1M. And by 2050, if Bitcoin could be used to settle 10% of the globe’s international trade and 5% of US domestic trade, $3 Million wouldn’t be a surprising price.

The highest prediction I’ve seen is $10 Million in the next decade, citing the limited supply that Bitcoin has. But keep in mind that all of these are crazy aspirational projections, and nobody knows for sure how high – or low – Bitcoin could go.

What are the risks?

As much as there is hype around Bitcoin, there are some very valid concerns about Bitcoin that many people are highlighting.

First, there’s the issue of centralization. A lot of the projections and potential of Bitcoin rely upon the assumption that it will grow as a currency when more and more people buy into it. But only 1.86% of wallets control the supply of 90% of Bitcoin. Many of these wallets are exchange wallets holding Bitcoin on the behalf of their customers – still, Bitcoin isn’t as decentralized as we think.

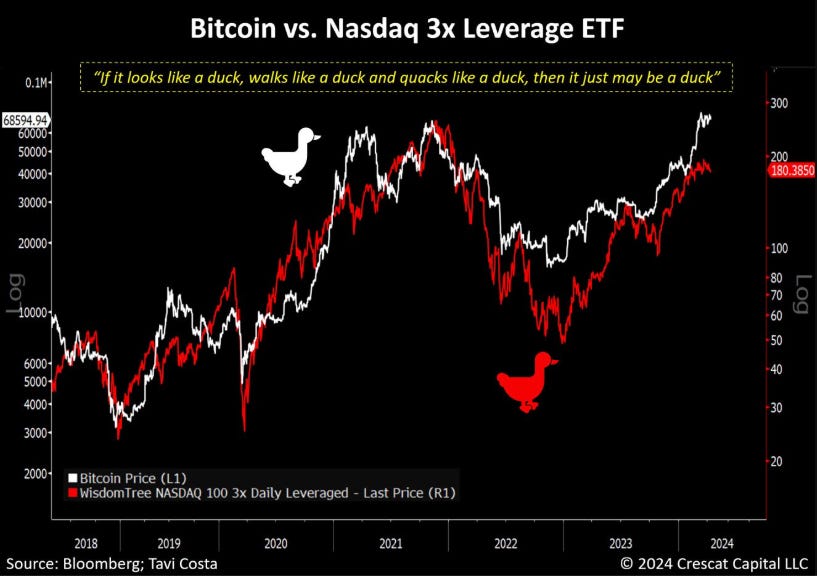

It’s also not as decoupled from the market as the theories suggest. Whenever there is an economic slowdown, Bitcoin slows down as well. For example, during the tariffs in April, there was a dip in Bitcoin’s price as well along with the stock market – and looking at the history of the market, it turns out that Bitcoin is heavily correlated to the Nasdaq.

Bitcoin’s risk of centralization could also be interpreted as “there’s so much room to grow, because not everybody is in on it yet.” But to make use of that fully and not lose money, here are some things you have to keep in mind:

Overconfidence is the biggest reason for losses. Attributing your gains to skill rather than luck can mess with your judgement.

Don’t get emotional. It’s normal to read stories of people who turned thousands into millions and wish you were one of those. But be aware that this could influence you to act in ways that are counterproductive. You could invest more than you can afford to lose or you could keep waiting for the right time to buy in and regret timing the market later.

Stay away from fast money and easy profits. The temptation to “make a killing” by trying out some strategy you came across on Tiktok is very tempting, but the chances of losing money are much higher. In the long term, buying and holding is the most reliable option to make money though it feels boring.

Keeping all this in mind, my strategy has always been to invest a small amount into a Bitcoin ETF, consistently, without paying attention to the market. It’s an amount that I can afford to lose, and if it fails, it would suck but it wouldn’t impact my life. But if it pays off, I get to reap the benefits of investing in the potential of Bitcoin. Either way, I’m in it for the long haul and I think that trying to ride the wave is a bad idea.

That’s the one piece of advice I’d want to leave you with at the end: Don’t buy the hype, and don’t sell the fear. Mistakes happen when you make emotional decisions. If you see Bitcoin rising in value and think that you’ll miss out if you don’t invest your life-savings in it immediately, or if you see Bitcoin crashing and panic-sell, those are the psychological weak points you need to address first.

FOMO killed more gains than market crashes ever did.

I’ll see you again next week with another article. I’d love to know what you think in the comments below.

If you reached the end of the article, just let me know what you thought with “Great | Good | Bad | Terrible” in the comments. Also reply to me with any feedback – I read every reply!

In 2010 I invested $100 in bitcoin because I was going teach a lesson on it to my class. Bitcoin was $1000 then. It initially went back down and I forgot about it until it hit 60,000 and I realized that my 1/10 bitcoin was worth 6,000. It took me a year to look through all my files to find the password to my account and by then it ran up to 80,000. Not a lot of money but an impressive return on investment and a fun story. I have since placed a few thousand in the bitcoin ETF, then withdrew half when it doubled. It has since almost doubled again. I feel the next run up will be when The GENIUS Act is signed into law. I wouldn't be surprised if soon after that we get the "rug pull" and bitcoin plumets but only after all the billionaires short their inventory :-)

Bitcoin has deviated from its original mission of serving as a currency to escape government-issued currencies and has become another speculative asset. The people who now own the majority of BTC are the very institutions Bitcoin was supposed to help people against (big banks, governments, and central banks).