Chain Reaction

A crisis of faith in China and the United Kingdom

What’s up Graham, it’s guys here :-) If you want to join 23,300+ smart investors and never miss an update on the market, hit the subscribe button below. It only takes a second and is completely free.

A butterfly can flap its wings in Peking, China and in Central Park, you get rain instead of sunshine - Jurrasic Park

On 16th January 1979, an aircraft left the Mehrabad Airport in Tehran, Iran for Egypt. On the aircraft was the Shah of Iran, Mohammad Reza Pahlavi, who went into exile following the Iranian Revolution, which effectively ended nearly 2,500 years of monarchy in the middle eastern state.

At the time, Iran accounted for less than 1% of the global GDP, but it was the fourth-largest producer of oil in the world. Unsurprisingly, the political instability following the revolution led to a sudden drop in oil production. Although the overall global supply of oil decreased by just 4%, the international reaction was drastic and the price of crude oil doubled in less than a year which lead to the 1979 oil crisis.

The effect was felt almost immediately in the United States. Suddenly, gas became scarce and long lines appeared at gas stations as folks had to wait more than an hour for their turn. States like California, Texas, and New York implemented odd-even rationing of gasoline, i.e. a car with a license tag ending in an odd number could buy gas only on odd-numbered weekdays.

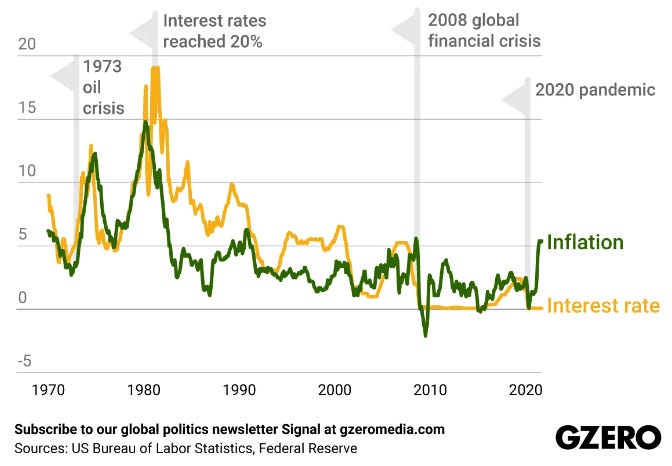

A cascading effect of the surging gas prices was skyrocketing inflation. Notice whenever present-day news reports inflation, it says ‘it’s the highest in 40 years’? That’s because, at a certain point in 1980, the inflation rate was a whopping 14%. Central banks across the world were forced to raise interest rates: right now, the federal funds rate is around 3.8% - back then, it reached 20%! As credit lines froze, the global economy went into the worst recession since World War 2.

As a nation, the most important lesson we learned from the crisis was how much our way of life can be affected by events across the globe. 42 years later, the US economy is more connected to the world than ever before. Our imports totaled nearly $290 Billion in 1980: now, it’s more than $3 Trillion. We are quite vulnerable to issues occurring in many parts of the world.

Right now, two major economies, the United Kingdom and China are experiencing severe economic uncertainty. They are also incredibly important trade partners to the US: we do nearly $270 Billion of trade with the UK and $615 Billion with China. A financial crisis in either of these countries will be invariably felt back home.

So this week, let’s do a deep dive into the issues occurring in these countries, how they can affect our way of life back home, and whether these events can lead to a chain reaction that jeopardizes the global economy.

Although, before we go into that - as most of you know, I've been a huge proponent of saving money, living frugally, and living below my means. By doing that, I was able to save enough money to buy my first rental property, which sparked my interest in real estate investing and set me up for financial independence.

However, I understand that real estate investing is capital-intensive. The median home price in the U.S now is $428K and it will take years of saving before you are able to buy a rental property. That’s exactly why I partnered up with Fundrise, where you can get started with real estate investing for as little as $10.

Fundrise’s $6B+ portfolio is well positioned to capture outperformance resulting from macroeconomic trends, like sky-high mortgage rates driving increased rental demand. Fundrise invests in built-for-rent communities, which means they’re adding brand new rental supply to the market. The cherry on top is that in the first half of 2022, Fundrise outperformed the S&P 500 by 25% with a steady return of 5.5%.

London Bridge is Falling

Much before the recent crisis, the UK economy was already on weary legs. It had the worst post covid recovery among big economies and the inflation rate was 10% in September. To make matters worse, the British Pound dropped in value compared to the dollar. A pound was worth $1.35 at the start of the year - Now, it’s worth $1.15.

However, the most recent crisis in the UK was related to pension funds. It began with what is known as a “Defined Benefits Scheme”, where employees are promised a portion of their salary throughout retirement. Now, your career prospects to become the manager of a pension fund are poor if you YOLO the portfolio into GME options. Instead, pension funds prefer stability, so they generally buy UK government-backed bonds (or gilts) which are considered safe and offer stable returns.

However, the returns from bonds are not sufficient to generate enough money to pay out the population, so pension funds started to buy slightly riskier assets. Further, they also borrowed money to purchase bonds, which works out well in a normal market. However, 2022 has been the worst year for bonds since 1949, and pension funds started bleeding money at an alarming rate.

Typically pension funds have sufficient cash to cover such emergencies, however, when the UK Chancellor announced a tax cut strategy, the bonds started collapsing in value all of a sudden. Because of this, the funds started to run out of cash reserves, which pushed them to the brink of insolvency.

Sensing the crisis, in an unprecedented move, the Bank of England stepped in and purchased bonds to stabilize their prices, to avoid what many described would have been another Lehman Moment.

While the timely action by the Bank of England avoided a catastrophe, the bigger issue here is the loss of credibility of the British Government. Due to the severe backlash, the UK’s finance minister ended up scrapping all the tax cuts and spending plans. With both the prime minister and the finance minister resigning soon afterward, the backpedaling has left a lot of investors worried about whether they can reliably invest in the UK.

With American investors lapping up opportunities to purchase UK businesses taking advantage of the strong dollar, the new prime minister, Rishi Sunak, and his team will have their work cut out for them.

Now, the United Kingdom isn’t the only country that is in a crisis of governance.

Beijing, We Have a Problem

In case you missed it, last week, Xi Jinping renewed his grip on power and packed the leadership with loyalists. Subsequently, the Chinese stock market, which was already teetering at the edge, fell off a cliff in the last few days. While the returns from the stock market have been unreliable in China, the recent drop was catastrophic even by those standards.

The Hang Seng Index dropped nearly 10% in value last week and is more than 50% down from its all-time high. For some context on how bad this is, the first time the index reached its current level was in 1999: almost an entire generation’s worth of wealth has been wiped out.

The lack of transparency is also making investors hesitant as the country censored references to the mainland listed equities on Weibo (the Chinese equivalent of Twitter). More importantly, China had delayed releasing its economic data before its party congress and later came around to announce higher-than-expected growth.

Transparency has long been a point of concern for Chinese companies and right now there is a high chance that Chinese Stocks could be de-listed from the US Stock exchange as they are unwilling to comply with US auditing standards. With nearly $1 Trillion dollars of Chinese investment in the US market, such a delisting could not come at a worse time for the Chinese companies which are already struggling with their stock prices in the mainland. With recent events like Luckin coffee having to reach a $175 Million settlement in a class action lawsuit over accounting fraud, auditors are likely to be extra careful in scrutinizing Chinese companies.

However, there is one more piece to this global economic puzzle and that is right here in the United States.

Dollar Crisis

The Dollar is our currency, but it is your problem – John Connolly, US Secretary to the Treasury in 1971

The third factor that drives in these complications deeper is the US Dollar crisis. Simply put, the American Greenback is the reserve currency for the entire world due to its stability, resiliency, and global acceptance. In times of global crisis and high inflation, everyone in the world is looking for a safe place to park their money and there is no better tool that is most likely to hold its value than the US Dollar. Because of this, the US Dollar is increasing in value compared to the rest of the world.

On one hand, this is beneficial as it makes US imports cheaper and further cements the Dollar as the reserve currency for decades to come. On the other hand, a strong dollar is clearly detrimental to American exports as it makes it difficult for other nations to pay for American Goods. For example, if a British company imported £1000 worth of goods in January 2022, they would now have to pay £1186 for the same goods, just to compensate for the rising dollar.

With companies in the S&P 500 making ~ 40% of their total revenue from non-domestic sales, a strong dollar could seriously affect our exporting prowess. A report from Credit Suisse pointed out that every 8 to 10% jump in the dollar results in a 1% hit to US companies’ profits. With global uncertainty still being the norm, it’s unlikely that the dollar will fall back to 2021 levels any time soon.

Uncertain Roads

As of now, it’s hard to not feel a sense of uneasiness about the present situation. As individual investors, there is little we can do to adjust our portfolios to international crises. Further, there is a substantial amount of information asymmetry when it comes to news from authoritarian countries. Very often, you hear about a crisis well after it happens.

Personally, I would be very cautious about making changes to an investment strategy based on the news. It would be far more prudent to stay the course and continue investing. With inflation showing no signs of abating and overall earnings being weak, it could take a while before things get better. When it gets better, and I believe it will eventually, your patience now will most likely pay off well.

So stay safe, stay invested and I will see you guys next week - Graham Stephan

Sidenote

A lot of effort and research went into making this article, so if you found it insightful, please help me out by clicking the like button and sharing this article.

International news is often very diverse and fast-changing. So let me know if I missed something! What do you think of the crises in UK and China? What is the worst manner in which it could affect us? Let me know in the comments below!

Great article…thanks for the information and advice!

Very informative article! Thanks for making it in an easy to digest format.