Chaos and Opportunity

An action plan to weather the oncoming storm

What’s up Graham, it’s guys here :-) If you want to join 23,800+ smart investors and never miss an update on the market, hit the subscribe button below. It only takes a second and is completely free.

A Crisis is an opportunity riding a dangerous wind - Chinese Proverb

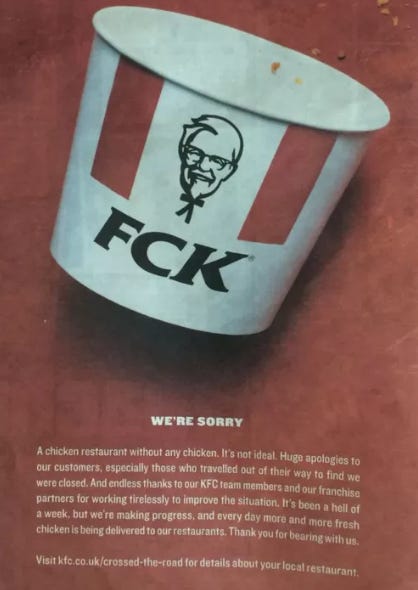

A few years ago, KFC in the United Kingdom faced a major crisis: they ran out of Chicken. How did a 70-year-old company with a 16 Billion dollar market cap run out of the most important ingredient of their product? Well, they had onboarded a new company to deliver chickens to their restaurant and that company couldn’t hold up their end of the deal. With more than 600 of the total 800 KFC restaurants having to close, folks in the UK were calling the police over not being able to get their hands on those 11 herbs and spices.

When your company’s main product is fried chicken, running out of chicken is quite possibly the biggest crisis you can have. Now, several fast-food chains have had to deal with a crisis at some point. Burger King had to deal with the horse meat hysteria, while Taco Bell was sued over its mystery meat. However, KFC’s handling of the chicken shortage was a masterclass.

They took out funny full-page advertisements apologizing for the store closures and thanked their staff for “working tirelessly to improve the situation”. The advertisement was incredibly well received and went viral on social media, which helped KFC recover its brand impression score. Considering that KFC’s word of mouth more than tripled during the same period, the brand is likely to have benefited from the crisis. Think about it for a moment: they were able to turn around a failure in their supply chain into something that resulted in a net positive for their brand.

Whether it’s at the scale of a Billion dollar business or at the level of an individual investor, the ability to identify opportunities during a crisis is one of the most critical skills that one can have. It helps in navigating stormy scenarios and emerging unscathed on the other side.

The economic landscape has been chaotic these past few months. 9 out of 10 CEOs are bracing for a recession and JP Morgan warned that the stock market could fall another 20% from current levels. Now, as much as we hate them, recessions occur fairly regularly: In fact, there have been 11 recessions in the United States since 1948 with recent data suggesting that we might be on the cusp of another one.

So this week, let’s take a look at what accompanies a recession, how it affects your investments, and what you can do to profit from this chaotic scenario.

Bad News

In the business world, bad news is usually good news - for somebody else. — James Surowiecki

If you’ve been following the news closely in the last few months, you know that even the definition of recession has become a contested topic. For the record, the National Bureau of Economic Research (NBER) is the bookkeeper of recessions and they define it as a “significant decline in economic activity that is spread across the economy and that lasts more than a few months”.

Pedantic arguments aside, recessions are in general, terrible news. They are accompanied by a significant rise in unemployment, a drop in wages, and a loss in consumer confidence. This past week, we saw several companies reporting weak earnings and bracing for slow or even negative growth. Coupled with weak earnings and decreasing consumer spending, companies are starting to scale back expenses by letting go of employees. Almost as if on cue, Bank of America has warned that the economy is about to start losing 175,000 jobs per month.

The other major impact of recessions is how they affect investments, and in particular, equities. Since 1946, the average bear market experienced a 30% drop from its all-time high, and when combined with a recession, it can go down by nearly 35%. As of now, the three major indexes, the S&P 500, NASDAQ, and Dow Jones are all down 20-30%. With JP morgan warning that markets are expected to go down even further, it might be a while before things start looking up.

Real estate investments also take a hit during times of recession, mostly due to a decrease in demand caused by rising interest rates coupled with prospects of layoffs. For many of us, the 2008 housing crisis has left terrible memories, but a large-scale reduction in home prices at the national level is incredibly rare. Even with the present uncertain circumstances, the wall-street consensus is that prices might fall only ~7% nationwide.

With the federal housing agency bringing in new laws to ease access to mortgages, we might not see anything more than a general cool-off in prices. However, that does not mean that prices might not drop locally. According to Moody’s Analytics, some vulnerable locations like Florida, Arizona, Idaho, etc could see a decline of more than 25% in home prices.

Opportunity Beckons

While the negative aspects of a recession are clear to pretty much everyone, recessions are also a time when a lot of money can be made, if you can identify the right opportunities. There are a few key reasons why they say riches are made during recessions.

Value purchases - A falling tide sinks all ships. When stock markets fall, they generally have a cascading effect as even valuable companies start trading at a lower price. Many folks who find success during recessions are those who seize the opportunity to buy those companies at a discount.

Cleansing effect - Recessions are the market’s way of “weeding out the weak”. When credit lines and venture capital dry up, only sustainable companies are able to hold their own. This is why we see absurdly high valuations in a bull market for companies that don’t even have a revenue model, but those same organizations fold at the beginning of a recession. Remember the phrase - “It's only when the tide goes out that you learn who has been swimming naked.”.

Bull Market - Some of the biggest gains are made during the bull markets that follow a recession. For example, Yahoo finance points out that even though markets have fallen an average of ~30% in a recession, the year following the bottom gave a return of 40% and within two years, it went up by 58%. For an example of someone who profited during recessions, look no further than Warren Buffet. His ‘buy American’ strategy generated a profit of more than $10 Billion during the 2008 recession.

Action plan

Given the oncoming storm, prudent investors should have a clear action plan that will keep them safe and help them take advantage of the opportunities. Here are a few things that everyone, irrespective of their financial status should keep in mind for the next 12-24 months.

Holding cash - Until very recently, the general consensus was that holding cash is equivalent to eroding your wealth via inflation. However, with every other asset falling in value, cash is emerging as one of the safest places to park your money for the short term. Additionally, holding some of your portfolio in cash will allow you to take advantage of opportunities to purchase high-value assets at a discount. Unsurprisingly, fund managers are holding the highest amount of cash since 2001.

Career protection - When the markets are down and employers are not hiring, one of the worst things that can happen is losing your job. Now is the time to improve yourself and learn new skills: the best hedge against any recession is the steady income from your job. Additionally, it will be helpful to scale back on your expenses by tracking your expenses and cutting back on unnecessary spending.

Investing - We are highly likely to see further market drops, and it is critical that one stays invested during these times. Look for value purchases that come at a discount and double down on them for the long term. Stock picking isn’t everyone’s forte and your best bet would be to invest in a diversified index fund that will not see a 20% drop overnight.

A recession is a scary prospect for many. I know that very well since I started my career as a real estate agent right out of high school at the peak of the 2008 crisis. At the time, I was one of the few remaining agents in the company who was willing to take on the lowest-paying deals just for the sake of gaining experience. I genuinely believe that if it weren’t for some of those experiences, I might not have done as well as I have today. The next 12 months won’t be easy, but rest assured - it will be incredibly rewarding for those who put in the work.

So stay safe, stay invested and I will see you guys next week - Graham Stephan.

What do you guys think is the best value investment opportunity right now? Let me know in the comments!

A lot of effort and research went into making this article, so if you found it insightful, please help me out by clicking the like button and sharing this article.

Those after recession return metrics give me peace if mind, thanks for sharing

Really valuable insights, keep up the good work!