What’s up Graham, it’s guys here :-) If you want to join 24,800+ smart investors and never miss an update on the market, hit the subscribe button below. It only takes a second and is completely free.

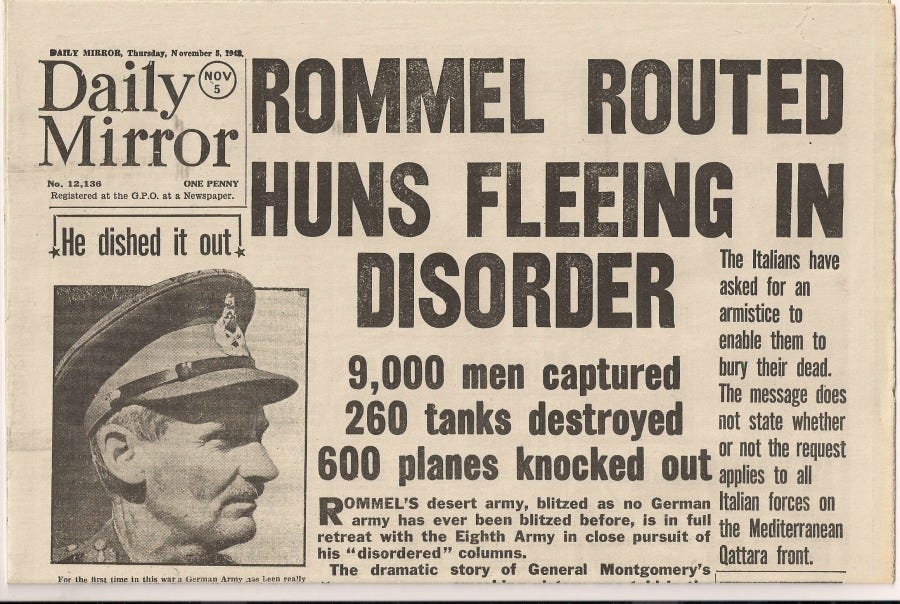

October 1942. Location: El Alamein - A quaint railway halt in Egypt, nearly 150 Miles west of Cairo. Europe and East Africa were at the peak of World War 2 and a key battle was brewing in the desert. The stakes were high: access to the Suez Canal and the Oil fields of the Middle East: a critical resource for maintaining an army. On one side was the German Army, led by the Afrika Korps Commander Erwin Rommel who had earned the moniker “The Desert Fox” for his prowess in desert warfare and apparent ability to outfox his opponents at every step. On the other side was the British Army, led by the “Spartan General” Field Marshal Bernard Montgomery.

Back in Britain, morale was low. In February, Singapore had fallen and in June, Axis forces had captured Tobruk, leading to the surrender of more than 100,000 allied forces. The British Prime minister, Winston Churchill survived a no-confidence vote. However, people were starting to lose faith in him. An opposition member of parliament remarked: “The prime minister wins debate after debate, but loses battle after battle”.

On 23rd October, at 9:40 pm, the battle of El-Alamein began with a four-hour bombardment by the allied forces. The progress through minefields was slow at first, but nearly 20 days later, the allies achieved a decisive victory and chased out the ‘desert fox’ from Africa. When one thinks of the major battles in World War 2, El-Alamein might not be at the top of their list. However, it represents a crucial moment in World War 2.

It’s when the tides started to turn.

Quite fittingly, after the victory, Winston Churchill famously said “Now, this is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning.”

For more than a year, the Federal Reserve (and the government) has been at war with inflation. The latest drop in inflation data has led many to believe that the tides of this battle may have turned. There is cause for jubilation: runaway inflation can be catastrophic to any nation and controlling it is one of the key duties of the Fed. However, there is also cause for concern as the price for controlling inflation is often a recession. Many companies have already cut their earning forecasts and others have started mass layoffs.

So this week, let’s take a closer look at the recent inflation report, its effect on the housing market, and how heavy a price we might end up paying for bringing inflation back to normal.

Inflation Cool-off

Last Thursday, CPI data showed that inflation had declined to 7.75% in October: a 0.5% reduction compared to last year. Now, under no normal circumstances would a 7.75% interest rate be considered a cause for celebration. But given that analysts were concerned about double-digit inflation nearly six months ago, the recent decline suggests that the Fed’s rate hikes are starting to take effect.

fully understand why analysts are feeling positive about the recent inflation data, we need to take a closer look at how it is calculated. Essentially, the Bureau of Labor Statistics tracks the price of a hypothetical basket of commonly used goods and services like rent, gas prices, groceries, and medical care. The increase in the price of this basket is typically reported as the headline inflation number.

However, the monthly changes in inflation data are often heavily skewed by food and energy prices, which fluctuate more frequently. Because of this, another measure, known as core inflation, which excludes the price of food and energy, is often used.

Along with the decline in headline inflation, core inflation has also dropped to 6.3%, pulling back from a 40-year high. In fact, Goldman Sachs now predicts that inflation will drop ‘significantly’ in 2023 due to improvements in supply chains, an increase in shelter vacancies, and slower wage growth as the labor market rebalances.

The decline in inflation has acted as a shot in the arm for the Fed, which has been raising interest rates at the fastest rate in its history. The president of the Philadelphia Federal Reserve came on record to say: “I would be okay with taking a brief pause from rate hikes”. The stock market also jumped nearly 5.54% in a single day: the largest rally in two years. We are now more than 10% up from October when the index was testing levels near 3,500.

While the stock market often reacts quickly to rate hikes, the effect on the housing market is often slow. However, it is also starting to show indications of a decline.

Housing Decline

Due to rising mortgage rates, the housing market has been feeling the heat of increasing interest rates for the past year. For some perspective on how badly this has affected homebuyers, on a $500,000 mortgage over thirty years, you end up paying nearly $438,000 extra at the present levels (7%) compared to the same mortgage taken in 2020 (at 3%)!

Understandably, home buyers are balking at the prospect of purchasing a home and many now believe that this is the worst time to buy real estate in the last 10 years! Goldman Sachs researchers now expect US home prices to decline between 5-10% with their official forecast model predicting a 7.6% drop.

Equally important is how the interest rates are affecting rent. When it comes to inflation, rent prices tend to be a lagging indicator. This is because once tenants sign a lease, they lock in their payments for 1-3 years, regardless of what is happening in the rest of the market. Within this context, rental prices have started to drop with some cities seeing a decline of 2-6%. Commercial real estate is also feeling the effects since it almost exclusively works on yields and so far, they have slid 13% from the peak.

Despite the positive news about inflation and housing prices, the Fed’s rate hikes will come at a price.

Heavy price

Quite bluntly, the side effect of trying to bring down inflation is the possibility of a recession. The Fed has been trying to walk the tightrope between inflation and recession for quite a while now. However, a large number of companies have cut their earnings forecasts and many are announcing layoffs.

An organization that tracks job cuts in the industry reported that more than 24,000 tech workers have been laid off this month, adding up to a total of 120,000 job losses in the tech industry alone. Amazon and Meta themselves are laying off nearly 20,000 workers. However, it’s not just cushy tech jobs that are facing the heat. Gap and Peloton have also announced nearly 500 layoffs each.

What’s more concerning is that an increasing number of analysts are warning about an ‘Earnings recession’, where corporate profits decline for two consecutive quarters. Goldman Sachs has trimmed the earnings-per-share forecast of the S&P 500 to 0% in 2023.

Overall, it appears that we’ve paid the price for bringing down inflation via reduced corporate growth, translating to layoffs and hiring freezes. A survey conducted in October found that 63% of economists expect a recession in the next 12 months. To revisit our earlier analogy, by winning the Battle of El-Alamein, Britain narrowly avoided having to surrender to the axis powers: an unthinkable catastrophe. However, despite turning the tide of the war, it would still take another 3 years for World War 2 to end. Similarly, it looks like we’ve avoided the catastrophe of hyperinflation, but it might be a while before inflation and the job market comes back to normal.

So stay safe, stay invested and I will see you guys next week - Graham Stephan.

A lot of effort and research went into making this article, so if you found it insightful, please help me out by clicking the like button and sharing this article. I want to know what you guys think about the current layoffs. Are they caused by problems in tech or is there an issue across industries? Let me know your thoughts!

Excellent article with a great analogy! Much appreciate you efforts.

Great analogy Graham. Thoroughly enjoyed reading your latest. Thank you.