What’s up Graham, it’s guys here :-) If you want to join 19,700+ smart investors and never miss an update on the market, hit the subscribe button below. It only takes a second and is completely free.

Many of my readers might not know this, but I am a huge Star Trek fan. The nerdy kid who quoted Spock was not popular in school, but there are several life lessons that I’ve learned from Star Trek. In particular, there is a specific moment from the series that remains imprinted in my mind. It is a simulation exercise designed to test the character of command class cadets at Starfleet academy.

The premise of the simulation is this: you are a captain commanding the crew of a starship - the USS Enterprise. Soon after you start, the USS Enterprise receives a distress call from a civilian freighter named Kobayashi Maru, which is disabled and stranded in enemy territory: the Klingon neutral zone. To rescue the civilian ship, you would have to violate the neutral zone treaty which would result in an attack on your ship and risk your crew’s life.

The simulation is programmed such that if the cadet chose to enter the neutral zone, the ensuing attack would destroy their ship but if the cadet chose not to respond to the call - they would face a mutiny from their crew. The eponymous Kobayashi Maru test appears to be a classic no-win scenario: there is no way to do all three - save the Kobayashi Maru, not get attacked by the Klingons, and escape with your crew unharmed. Well, the US economy is in a similar situation today.

Unfortunately, the Federal Reserve and other central banks across the world are facing a Kobayashi Maru test. There is a distress call from the general population about inflation - housing, groceries, and other living costs are becoming unbearable. If central banks choose to tackle inflation by raising interest rates, they risk causing a recession/depression that would make things far worse. If they choose not to act, inflation might quickly spiral out of control making money worthless.

Despite all the potshots we take at Jerome Powell, he is in an unenviable position right now. I also think we might be past the point where we take the Fed’s ‘soft-landing’ promise seriously.

So this week, let’s take a look at the role of the Federal Reserve, it’s efforts to fight inflation, the effect of interest rates on various asset classes, and how this global problem is likely to pan out in the near future.

Before we jump in, a quick word from my friends over at RentPrep*

Renting out an investment property is all about balance: You need to quickly place tenants to maintain steady rental income, but you also want to protect your assets by carefully vetting the applicants you’re considering. (Remember when my tenant trashed my place😔)

With RentPrep, you don’t have to choose between efficiency and accuracy. RentPrep streamlines the tenant screening process with its tech-driven approach and certified, in-house screeners authenticating results. As a result, data is delivered swiftly, accurately, and in compliance with the Fair Credit Reporting Act (FCRA) and other applicable laws. I would go as far as to say that its a must have for any real estate investor. Check them out and

*This is sponsored content

Now, back to it:

The Dual Mandate

“We owe you, and the public in general, clear explanations of what we are doing and why we are doing it. Monetary policy affects everyone and should be a mystery to no one” - Jerome Powell

Before we become armchair strategists for the Fed, it is important to understand what the role of the Federal Reserve is in the overall economy. To oversimplify things a bit, if capitalism is the accelerator for economic growth, the Fed’s role is to apply (or not apply) the brakes; i.e. the interest rates.

When interest rates are low, money is cheap and businesses have easy access to credit for expansion, which creates jobs and stimulates economic growth. When interest rates are high, businesses cut back, demand slows down and folks get laid off. So why not keep interest rates low forever? Well, we are living through that answer right now. When the Federal Reserve keeps interest rates low for an extended period, the economy overheats and people spend more, resulting in inflation.

The Federal Reserve is thus said to have a dual mandate: Pursue maximum employment, while maintaining stable prices. Right now, the employment part of the mandate is doing alright: we have a record high employment with a serious labor shortage. But, the other part of the mandate is a catastrophe.

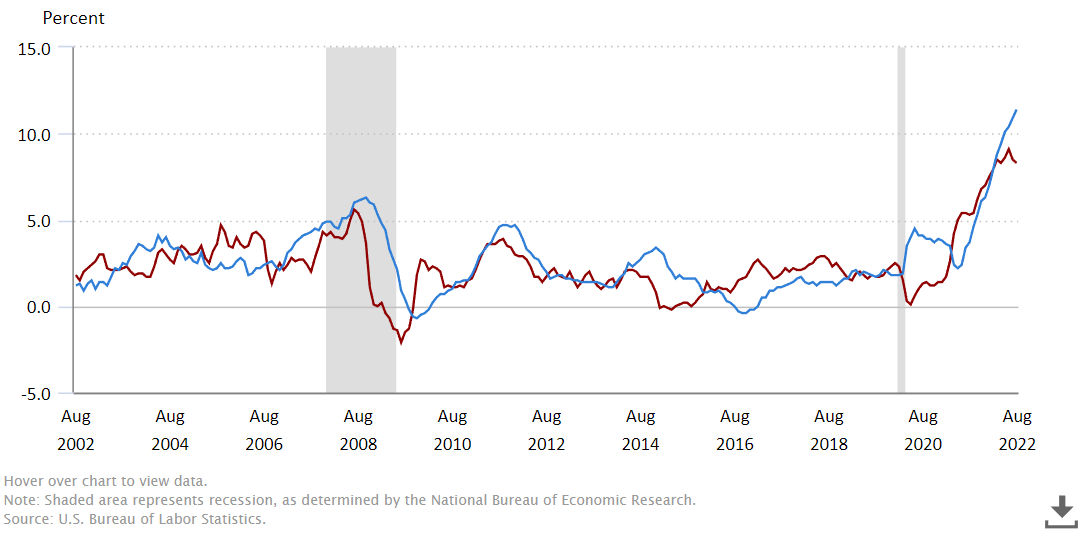

Despite concerted efforts by the White House and the Federal Reserve, the latest inflation data was an absolute disaster. Inflation increased to a nearly 40-year high of 8.3% and basic living expenses such as food have increased even further indicating that prices are quickly spiraling out of the Fed’s control.

The Fed has reiterated that they intend to continue the rate hikes to fight inflation until the job is done, i.e. reach the target 2% inflation rate. Jerome Powell also ominously remarked that the rate hikes will bring “some pain to households and businesses”. So far, it’s clear that every major asset class is likely to be affected by a high interest-rate environment.

Ripple Effects

Most of the American wealth is stored in one of these four asset classes: Bonds, equities, real estate, and cash. Let us see how each of them are affected by the rate hikes.

Bonds - Bonds are essentially the government’s way of borrowing money from you after paying interest. More importantly, treasury bonds are the most secure form of investment. They are backed by the full strength of the US government, which has never defaulted on its payments in its history.

Think about it for a minute: right now, in these uncertain market conditions, you can get a guaranteed 4% return on treasury bonds with absolutely no effort. Under such circumstances, many folks move their savings into bonds, which reduces cash flow into other assets.

With interest rates set to increase higher, the bond yields are likely to go up even further, which will strain other asset classes.

Stock Market - As a result of higher interest rates, less consumer spending, and overall reduced growth, stock markets have fallen substantially from their peak. Right now, the S&P 500 is well into bear market territory being ~25% down from its all-time high: something that has happened only four times in the last 20 years.

Further, analysts are expecting an “Earnings recession”- Where companies report lower profits than expected for the next few years. Goldman Sachs estimates that bear markets decline about 30% when combined with a recession, meaning that we might see further drops in the near future.Housing Market - The biggest impact of interest rate hikes is on housing mortgages: after all, why would banks lend you money at 4%, when that level of returns is guaranteed from treasury bonds? As a result, mortgage rates have now hit an astronomical level of ~7%, making home purchases unaffordable for many.

Jerome Powell himself said that the housing market needs to go through a correction to bring down costs. Although many key markets are seeing a decline, home prices are still nearly 40% up compared to last year: coupled with some of the highest mortgage rates we’ve ever seen, housing affordability remains a far-fetched dream for many middle-class Americans.

Cash - Right now, holding on to cash is undoubtedly a controversial position as inflation chips away at its value, but having no cash balance is also quite dangerous as it will put you in a precarious position, should you get laid off.

Now is a critical moment to make sure you have an emergency fund of 3-6 months that you can fall back on, in case of a layoff. You can also deploy that amount in case a stock or home that you were looking out for becomes cheaper.

With uncertainty looming over pretty much every asset class, it’s important to anticipate how things might play out.

New Horizons

Overall, I have to say that the economic outlook for the immediate future looks bleak. The Fed is likely to keep increasing interest rates to bring down inflation, and reports suggest that they expect next to no economic growth (below trend growth) in 2022. The message is clear: interest rates are going higher and will stay that way until inflation comes down

News from across the globe also doesn’t seem to be positive either. The war in Ukraine does not seem to be improving, and just yesterday the gas pipeline from Russia to the EU was sabotaged, worsening an already precarious situation. Additionally, Goldman Sachs now estimates that China will see zero growth in 2023. The European central bank is now discussing about the “Sacrifice ratio”, where they are weighing the effects of crashing the economy with the upside of reducing inflation.

Right now, there seems to be no clear path to reducing inflation without crashing the economy. Remember the Kobayashi Maru test from earlier? In Star Trek lore, only one person, Captain James T. Kirk has ‘succeeded’ in the test. How did he do it? He reprogrammed the simulation such that it made it possible for him to deter the Klingon attack and rescue the civilian ship. Whether this can be considered as ‘beating’ the test or outright cheating is a controversial discussion among Star trek fans, but for what it’s worth, the Starfleet academy commended him for ‘original thinking’.

“I don’t believe in no-win scenarios. As your teacher Mr. Spock is fond of saying, I'd like to think that there always are possibilities” - Captain James T. Kirk in Star Trek II: The Wrath of Khan

More importantly, the Kobayashi Maru test (and the present inflation vs recession dilemma) is a challenge in ethical decision-making for people in charge: to understand the limits of your authority and the consequences that your decisions bring. How long are you going to let inflation affect the lives of the people who put you in charge? Are you willing to inflict a recession to bring down inflation and stabilize the economy? How do you justify the deep humanitarian costs of such an action?

At the moment, there seems to be no perfect answer. To get us out of this no-win scenario, we would need a captain James T Kirk, but for now, all we have is Jerome Powell. It isn’t even clear that a correct decision would improve the situation, but I hope central banks across the world are able to reach a solution that improves living conditions. To quote Jean-Luc Picard “To say that you have no choice is a failure of imagination.”

Live Long and Prosper🖖 - Graham Stephan

A lot of effort and research went into making this article, so if you found it insightful, please help me out by clicking the like button and sharing this article. I am also curious to know what you guys think about the inflation vs recession dilemma and what you would have done if you were in charge of deciding the monetary policy. Let me know in the comments below!

Best Newsletter Yet! Well said on the state of the situation.

I love your articles and YouTube videos Graham! I appreciate and see the time and effort you put in to the research....

Thank you,

Vince