How I messed up

What got you here won't get you there

I’m going to be brutally honest with you.

Normally, I don’t write posts like this. I usually stick to market analysis, interest rates, or housing data. But this year has been a time of big change for me. As we head into 2026, I owe it to you to share what’s actually been going on behind the scenes.

If you’ve been following me for a while, you know exactly who I am. I’m the guy who made coffee at home for 20 cents instead of splurging on Starbucks. I tiptoed around spending money on anything unnecessary and treated my life like a spreadsheet, optimizing every single variable to maximize net worth.

And for a long time, that was my superpower. But I realized recently that the very mindset that built my wealth was actually destroying my life.

If this is your first time here, welcome! This is the unfiltered side of money we usually don’t talk about. Join 39,000+ readers to master your finances and build a healthy relationship with your money in 2026:

The “YES” trap

Almost two years ago, I made the decision to take a major step back. I started posting 3 times a month instead of 3 times a week. I cut down my ties with various projects. I shut down my coffee company, and I started selling off some real estate. But to understand why, you have to understand how I got here in the first place:

I spent my entire adult life saying “YES” to everything.

I said yes to shadowing a real estate agent for free when I was 18, and that taught me everything I know about real estate.

I said yes to working with a developer on foreclosed homes in 2011, and that helped me build and fix up my first home.

I said yes to starting a YouTube channel when I had no idea if it would work, and that taught me way more than waiting for the right moment.

It became a self-fulfilling prophecy: Say yes – Get a great outcome – Say yes even more.

And if you are 20 years old, you probably should be doing this. When you have nothing to lose and all the time in the world, saying “Yes” to learning opportunities and new ventures is the highest ROI activity you can do. But as I got older, I didn’t realize that the game had changed. I kept playing by the game with the Level 1 rules I’d learned, while trying to live a Level 10 life. Here’s what that meant practically:

Smart vs. Dumb Optimization

I had become so obsessed with optimizing that I lost sight of the bigger picture. I would spend hours manually calculating if an Uber was cheaper than walking, or hunting for coupon codes. I used to think “optimization” meant doing it all myself to ensure it was perfect. I treated it like a game and saw how far I could take it:

How cheap could I get my grocery bills by living on eggs, oatmeal, and leftovers?

Could I live for free by buying a duplex and renting out the other side?

Could I get a Tesla for $78 per month after tax write-offs and incentives?

From the age of 18 to 30, I literally budgeted every penny. And more than the money it saved, it built the habit of looking for the best deals and appreciating what I earned. It even got my cost of living down to $1,500 per month at one point. But here’s the problem:

Cutting down is a scarcity mindset.

Beyond a point, true wealth comes from using tools to remove your mental load.

Here is a perfect example:

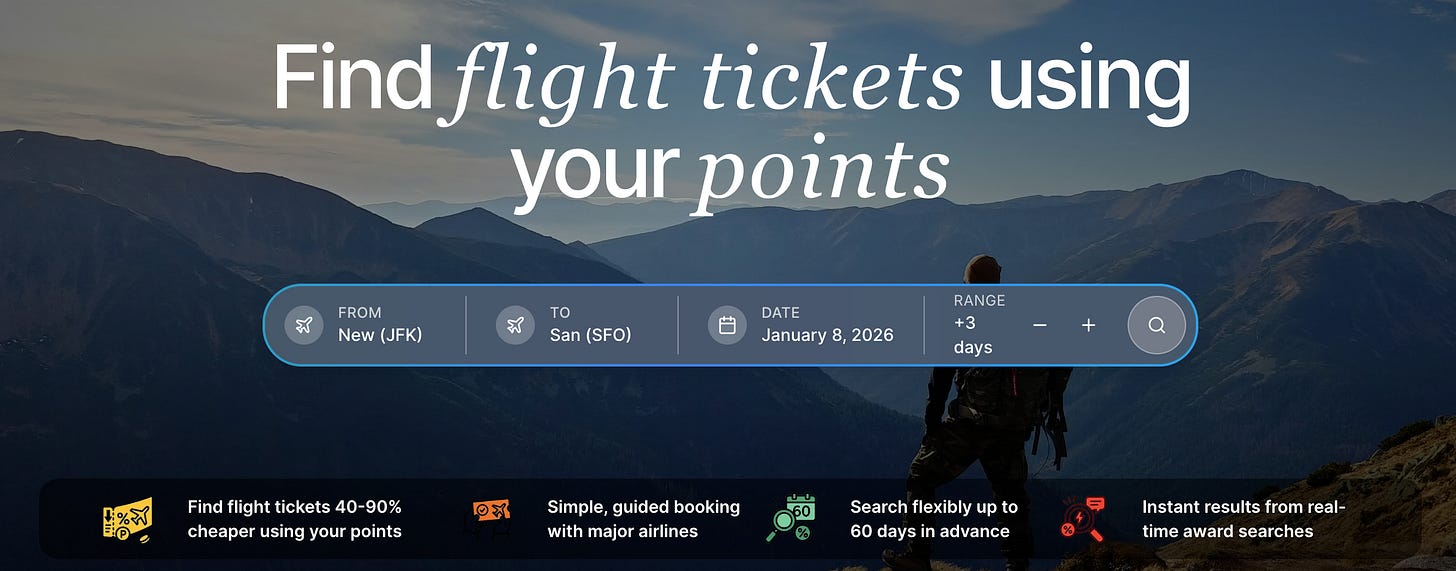

If you’re sitting on credit card points, the “Old Graham” would tell you to spend hours scouring portals to find the best redemption. The “New Graham” tells you that is a waste of your time. Instead, you should look for the tool that gets you the best deal in the least amount of time.

PointPal surfaces high-value award flights (including partner options) so you can stretch the same points much further without the manual headache. Before you book anything, check what your points can really do here: PointPal.ai

I recently booked myself a flight to NYC for just 12,000 points, and a first-class seat to Asia for 200,000 points, both round trip! The first class seat alone usually goes for more than $15,000!

Check out what’s available on PointPal.ai right here. Enjoy!

The Psychology of Doing Nothing

Beyond the money, I hit a psychological wall that I think a lot of entrepreneurs and high-performers hit, but rarely admit to.

I forgot how to relax.

For my entire life, my brain has been wired to be “productive.” If I went a whole day without working on a project, I genuinely felt bad. I felt like I was failing. Doing “nothing” on a weekend was actually terrifying to me. My self-worth was so tied to my output that silence felt like failure.

It took me months to accept that you don’t have to be constantly busy to make progress. In fact, being constantly busy was the very thing holding me back.

The “Life Energy” Wake-Up Call

There is a quote from Henry David Thoreau that changed my perspective:

“The cost of a thing is the amount of what I will call life which is required to be exchanged for it.”

I was exchanging my “Life Energy” – my stress, my time, my peace of mind – to save $5. Two events happened in 2025 that showed me how illogical this was:

The Market Drop: In April 2025, the market dipped on tariff fears. In one single day, my portfolio fluctuated more than the entirety of my “frugality savings” from the last five years. I realized all that stress over 20-cent coffee over days and months was nonsensical when one big event that was totally out of my control could cancel it out.

The Construction Nightmare: I tried to build an ADU in LA to “optimize” a property. It was supposed to take 3 months – but it ended up taking 9 months. I overshot my budget by $40,000. But the worst thing was the “hassle factor” which destroyed my peace of mind.

I realized I was spending 80% of my energy to get a 20% result. It was time to make a change. One of the great things about this community is that we have people from so many different stages in their life and we can all learn from each other. As one reader told me:

When you are young, it's all about saying yes.

As you get older, it becomes more and more about saying no.

I want to hear from you (I read every single comment). What is one habit that served you well in the past, but is holding you back right now?

The New Blueprint for 2026: Healthy Money

So, I’m changing. Building wealth and sharing my knowledge will always be my passion. But I want to build “Healthy Money” habits along with my wealth. Here is the 4-step blueprint I am following for 2026.

1. The 80/20 Rule is Law

I now have a screensaver on my phone that asks: Is this the 20% of effort that leads to 80% of the result? If the answer is no, I don’t do it. Even if it means making less money.

2. Audit the “Hassle Factor”

If a project adds complexity to my life, I’m out. I recently sold that property in LA. On paper, it was a great asset. In reality, the taxes, repairs, and city bureaucracy were draining my Life Energy and selling it lifted a weight off my shoulders. Peace of mind is an asset class I was undervaluing.

3. Spend Money to Buy Time

I am allowing myself to spend. I pay for parking to save 10 minutes. I pay the higher contractor bid for the guarantee of work done right. I pay in exchange for life experiences to create memories that I will cherish lifelong. If it buys me convenience and lowers my stress, I buy it without guilt.

4. Health is the Ultimate ROI

I finally got comprehensive bloodwork done. It turns out that “feeling tired” wasn’t just a lack of sleep. I had some thyroid and cholesterol issues to fix. I’m due for another test soon, but supplements and diet changes have already made me feel 10 years younger. You cannot enjoy wealth if your health is broken.

It’s possible to win the money game and lose the life game.

I spent the last couple of years learning that the hard way. 2026 will be about fixing it.

If you’re just starting out, keep grinding. Keep saying “Yes.” Build your foundation. This newsletter will still keep giving you the inside info that you’ll need to get ahead. But if you’ve already built that foundation, don’t be afraid to change the rules. Make your money work for you, not the other way around.

Here’s to a healthier, wealthier, and simpler 2026. Wish you all a Happy New Year!

– Graham

P.S. If you read this far, do me a favor and Like this post. And one more thing…

Help us grow and unlock my exclusive library: I’m giving away my best internal strategies including the The 800 Club Credit Score Guide and The Ultimate Homebuyer Blueprint to readers who share this newsletter.

It only takes 1 referral to start earning. Click here to see the proposal.

You’ve identified the next big trend, Graham: choosing wellbeing over financial optimisation! I’m looking forward to reading how you implement this in 2026. (Because I’ll be doing the exact same thing, but from a Gen X perspective. Yes, it’s time to plan a retirement that doesn’t just consist of rice and beans!)

My motto for the last few years has been to ‘choose comfort’. So I upgrade to the slightly better seat on the flight. I stay in a hotel to break up a long car or train journey. I check a bag rather than travel super-light. I walk, but I wear good shoes. And yes, I buy the coffee, occasionally. ☕️ There are so many small, simple luxuries that make a real difference to your sense of wellbeing. Choose comfort, and notice how your life changes for the better.

The conundrum is to balance this with the aforementioned retirement conundrum. Let’s see how things pan out!

(PS Greetings from Ireland!)

Retired teacher (2021) ....gathered 2.2 m..(includes house)..still putting into IRAs, driving two cars under 8k... I still haven't taken my wife to Europe, as promised. At 73, Maybe it's time.