What’s up Graham, it’s guys here :-) If you want to join 25,300+ smart investors and never miss an update on the market, hit the subscribe button below. It only takes a second and is completely free. I am also active on Linkedin, so connect with me over there!

There is an interesting paradox in economics known as the resource curse. It’s a situation where countries blessed with natural resources (often minerals or petroleum) are unable to take advantage of them and often have worse economic/development metrics compared to resource-poor nations. Angola and Congo (diamonds) or Venezuela and some nations in the middle east (Oil) are ongoing examples of this phenomenon.

When Norway found oil off its shores in the 1960s, there were concerns as to how this would impact its economy. At the time, several oil-rich nations in the middle east were going through political upheavals and other issues that arose from coupling the economy to a single, non-renewable resource.

However, Norway’s approach was a masterclass in handling the newfound resource. To start with, the government declared sovereignty over the Norwegian continental shelf and mandated a 50% state participation in each production license. More importantly, they established a sovereign wealth fund, in which the surplus income from the oil industry could be deposited. The fund was also prohibited from investing in Norwegian companies to decouple it from the Norwegian economy.

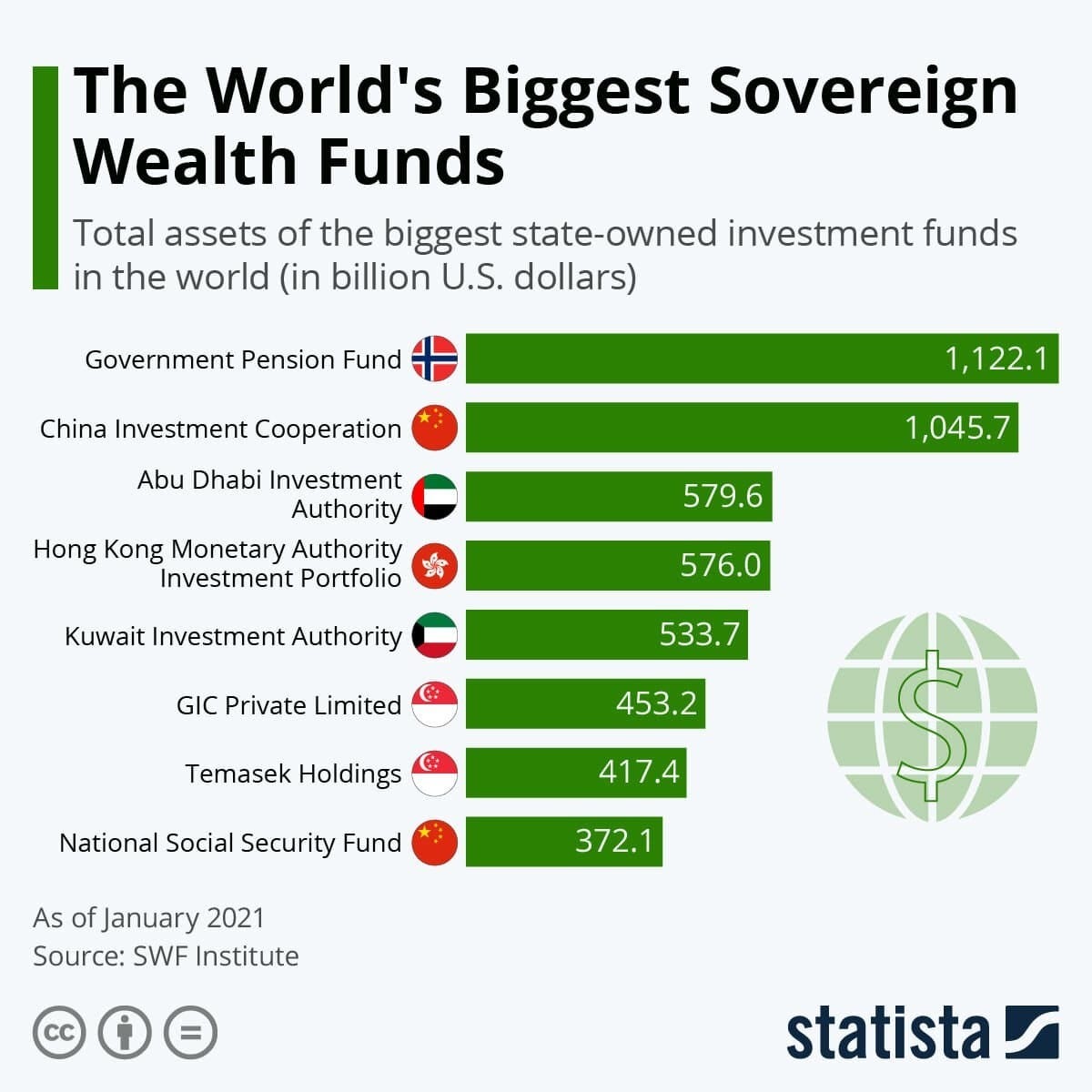

Today, the fund has more than $1.2 Trillion in assets holding nearly 1.3% of all shares of companies listed globally. It made the average Norwegian incredibly wealthy by holding the equivalent of nearly $250,000 per citizen. The funds have also helped the Norwegian welfare state, putting it at the apex of the global human development index metrics: the average Norwegian lives 5 years longer than the average American.

The way in which Norway avoided the resource curse by establishing a wealth fund is an excellent example of how anticipating crises and sticking to first principles can pay off in the long run. One could argue that Norway might not have faced the resource curse like other nations, however, it is clear that they have benefitted tremendously from their wealth fund. Preparing for a crisis is a key theme in Business schools as well. A study conducted by the Harvard Business Review found that companies that prepared for crises faced 36% fewer emergencies compared to companies that hadn't.

There is an almost universal consensus that we are in for tough times economically next year. Bloomberg economists forecasted a 100% probability of a recession by October 2023 and the Economist’s editor-in-chief recently wrote an article predicting that a global recession is ‘inevitable’ in 2023.

Now, there is very little that an individual investor can do to stop a recession from happening. Further, on an individual level, people face challenges like layoffs and wage declines. So this week, let’s take a look at the factors accompanying recession and how you can tailor your investment strategies by going back to the basics.

Understanding Recessions

The first step in preparing for recessions is to understand why they happen. At the risk of oversimplification, when companies can no longer access cheap credit (due to high-interest rates), they shelve plans for expansion, bring down wages and prepare for an eventual downturn. Further, when interest rates increase, people are encouraged to save money. Right now, the Federal Reserve has been raising interest rates at the fastest pace in history to combat inflation and due to this economists are anticipating a recession in the immediate future.

Now, irrespective of how they start, at least in the short term, recessions are terrible news for pretty much everyone. As companies anticipate lower earnings, they’ll seek to cut costs and lay off extra staff, which leads to higher unemployment. As unemployment rises, wages also start to decline: a 2009 study found that the average worker saw a 6-7% income loss for each percentage point increase in the unemployment rate. Finally, as businesses scale back, individual investors also tend to make smaller, safer investments, which further brings down the growth rate.

One of the most visible markers of a recession is a pullback in the stock market. While market corrections (~5% drop in price) occur as frequently as 3 times a year, in a bear market (which is often associated with a recession), market indices can drop by an average of ~33%. It can be nerve-wracking to see your wealth drop by 20% in a few months, however, this is precisely when you should go back to first principles.

First Principles

The key to navigating any market condition is to understand the basics. There is no dearth of complicated strategies that focus on maximizing returns, however, there are a few things that individual investors should always keep in mind.

Investing is not a game - If there is one thing that I would like you guys to take away today, it is that investing should be boring. Your retirement fund should not act as a source of entertainment. Whenever a new, fancy investment strategy comes up, keep one thing in mind: you are trying to beat the market average.

Unless you have spent quite a bit of time analyzing data and are taking a calculated risk, you are simply gambling.

Even after extensive analysis, there is no guarantee that you will do better than an index fund. Studies have found that 80% of fund managers fail to beat the S&P 500. Think about that for a second, 4 out of 5 people who make a living analyzing stocks as their day job (or night, investment banking is brutal) underperform a simple index fund. In fact, Warren Buffett had a famous million-dollar bet with Ted Seides that no set of actively managed funds could beat the S&P500 (Spoiler: Buffett won).

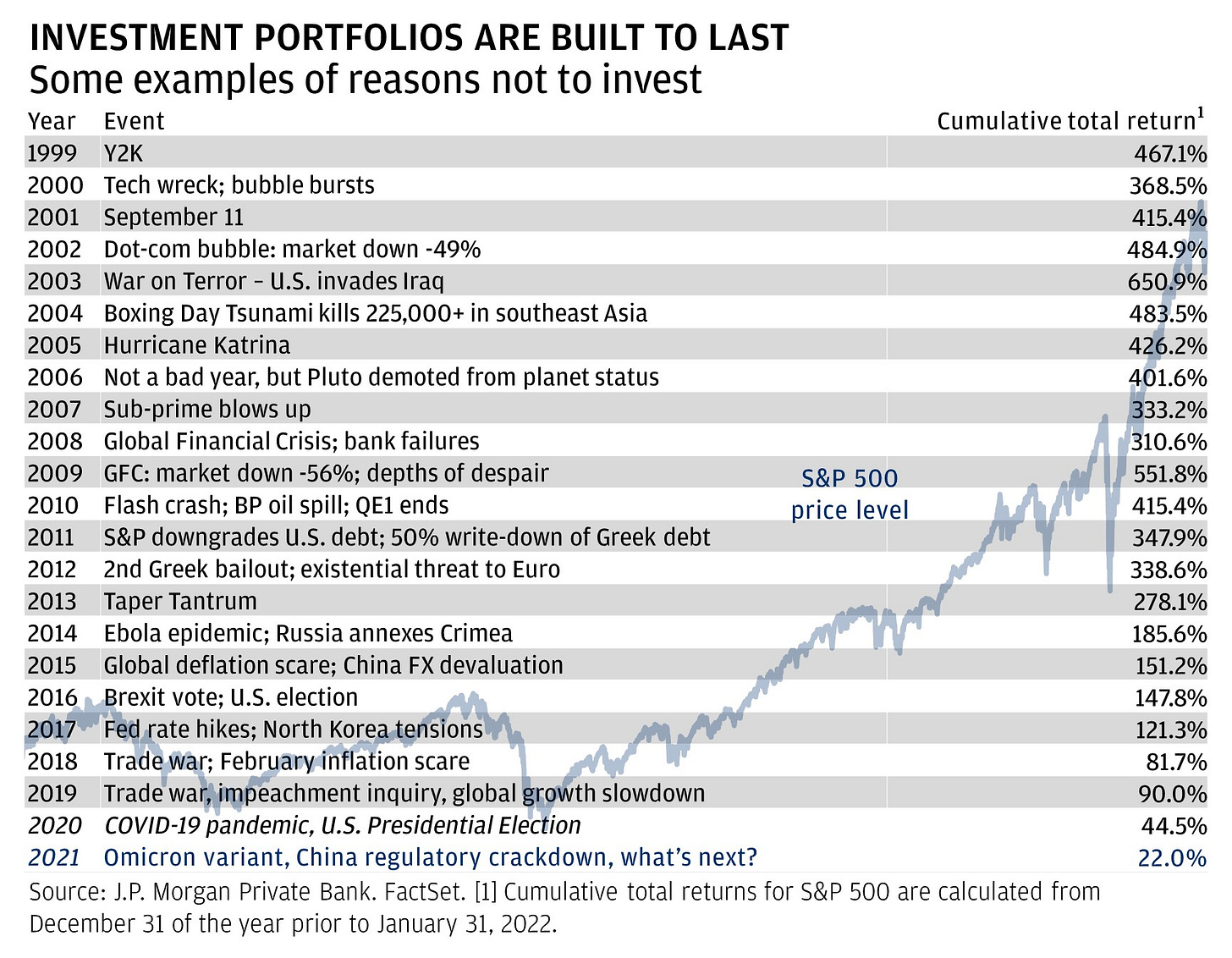

There is always going to be a reason not to invest - In an ever-changing global landscape, if you look hard enough, you are always going to find a reason not to stay invested: there is a reason why Perma bears are a thing. If you wait for the perfect time to invest, you will find that it has already passed.

Fundamentals remain unchanged - Right now, when the index is down ~20% from its all-time high, it’s an appropriate time to work some extra hours, cut back on spending, build up savings, and invest in the market. However, ideally, you should always be doing that regardless of how the stock or real estate market performs. In fact, half of the S&P 500’s strongest days occurred during a bear market and if you had missed out on just the 10 best days over 5 years, your overall return would drop from 15% to 3.75%!

Armed with this information, let’s see what we can do to ride out this storm.

Timeless Strategy

The biggest financial losses in any recession are for folks who get laid off. With Bank of America warning that the US economy will start losing 175,000 jobs every month, it is crucial that you try your best to stay employed. Further, polish your resume and stay updated on the latest skillsets valuable in your industry. Finally, having a 3-6 month emergency fund means that you won’t have to rely on high-interest debt or liquidate your investments in case of a layoff.

Finally, to grow your portfolio and take advantage of a recession, it is critical that you stay invested during down market conditions. There is a reason the average investor barely manages to outperform inflation: it’s because of the buy high sell low mentality. If history is any indicator, by the time the recession is over, the market actually recovers by posting a profit and gives a fantastic return of ~15% in the following year.

Ultimately, at the level of an individual investor, a recession is fundamentally a test of faith: when faced with uncertainty and difficult economic conditions, will you stick to the basic principles of investing? Based on previous market performance, those who do will likely emerge better positioned after the recession.

So stay safe, stay invested and I will see you guys next week - Graham Stephan

I want to know how (or if) you guys adjust your investment strategy based on prevailing economic news. Did that help you in the long run? Or are you a Boglehead who DCAs into VOO irrespective of what happens? Let me know in the comments!

A lot of effort and research went into making this article, so if you found it insightful, please help me out by clicking the like button and sharing this article.

Thanks for your research! I dca a handful of self picked stocks and do macro swing trades with a small percentage.

I buy 1 share of VOO almost every week. Once in a while I will skip a week if it has gone up too much too fast because of Fed news. But I’m right back at it the next week.